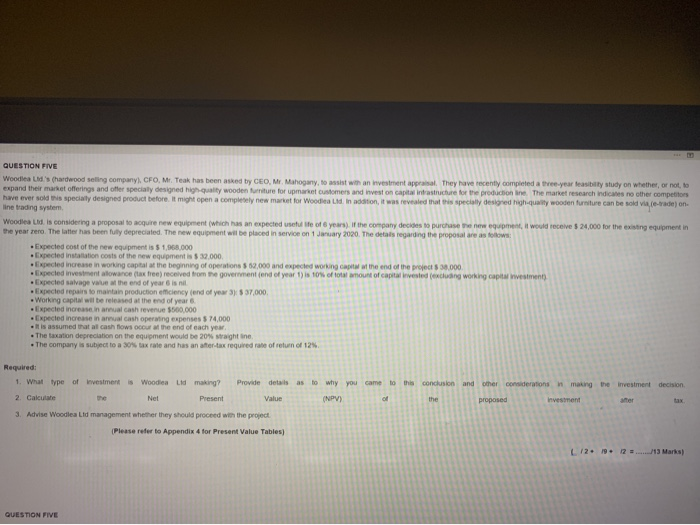

QUESTION FIVE Woodlea M's hardwood selling company CFO, M. Teak has been asked by CEO, Mr. Mahogany, to assist with an investment appraisal. They have recently completed a three year feasibility study on whether or not, to expand their market offerings and other specially designed high-quality wooden furniture for upmarket customers and investon capital indrastructure for the production in the market research indicas no other competitors have ever sold is specially designed product before it might open a completely new market for Woodlea Lid. In addition, it was revealed that this specially designed high-quality wooden furniture can be sold to-trade) on line trading system Woodlead is considering a proposal to acquire new equipment (which has an expected use of 6 years). If the company decides to purchase the new equipment, it would receive $ 24,000 for the existing equipment in the year rero. The latter has been fully depreciated. The new equipment wil be placed in service on 1 January 2020. The details regarding the proposal are as follows Expected cost of the new equipment is $ 1,068,000 Expected installation costs of the new equipment is $39.000 Expected increase in working capital at the beginning of operations $ 62,000 and expected working capit at the end of the projects 30.000 Expected investment alowance (tax free) received from the government end of year 1)is 10% of total amount of capital invested (excluding working capital investment) Expected salvage value at the end of year is ni Expected repairs to maintain production efficiency end of year 3 5 37,000 Working capital will be released at the end of year Expected increase in annual cash revenue $500.000 Expected increase in aualcash operating expenses $ 74,000 . It is assumed that al cash flows occur the end of each year, The taxation depreciation on the equipment would be 20% straight line. The company is subject to a 30% tax rate and has an after tax required rate of return of 12% Required: 1. What type of investment is Woodica Lid making? 2. Calculate Net Present and Provide details as to why you came to this conclusion Value (NPV) od the other considerations in making the investment decision proposed Investment ter 3. Advise Woodlea Lid management whether they should proceed win the project Please refer to Appendix 4 for Present Value Tables) 12. 9. 2...... Marks) QUESTION FIVE QUESTION FIVE Woodlea M's hardwood selling company CFO, M. Teak has been asked by CEO, Mr. Mahogany, to assist with an investment appraisal. They have recently completed a three year feasibility study on whether or not, to expand their market offerings and other specially designed high-quality wooden furniture for upmarket customers and investon capital indrastructure for the production in the market research indicas no other competitors have ever sold is specially designed product before it might open a completely new market for Woodlea Lid. In addition, it was revealed that this specially designed high-quality wooden furniture can be sold to-trade) on line trading system Woodlead is considering a proposal to acquire new equipment (which has an expected use of 6 years). If the company decides to purchase the new equipment, it would receive $ 24,000 for the existing equipment in the year rero. The latter has been fully depreciated. The new equipment wil be placed in service on 1 January 2020. The details regarding the proposal are as follows Expected cost of the new equipment is $ 1,068,000 Expected installation costs of the new equipment is $39.000 Expected increase in working capital at the beginning of operations $ 62,000 and expected working capit at the end of the projects 30.000 Expected investment alowance (tax free) received from the government end of year 1)is 10% of total amount of capital invested (excluding working capital investment) Expected salvage value at the end of year is ni Expected repairs to maintain production efficiency end of year 3 5 37,000 Working capital will be released at the end of year Expected increase in annual cash revenue $500.000 Expected increase in aualcash operating expenses $ 74,000 . It is assumed that al cash flows occur the end of each year, The taxation depreciation on the equipment would be 20% straight line. The company is subject to a 30% tax rate and has an after tax required rate of return of 12% Required: 1. What type of investment is Woodica Lid making? 2. Calculate Net Present and Provide details as to why you came to this conclusion Value (NPV) od the other considerations in making the investment decision proposed Investment ter 3. Advise Woodlea Lid management whether they should proceed win the project Please refer to Appendix 4 for Present Value Tables) 12. 9. 2...... Marks) QUESTION FIVE