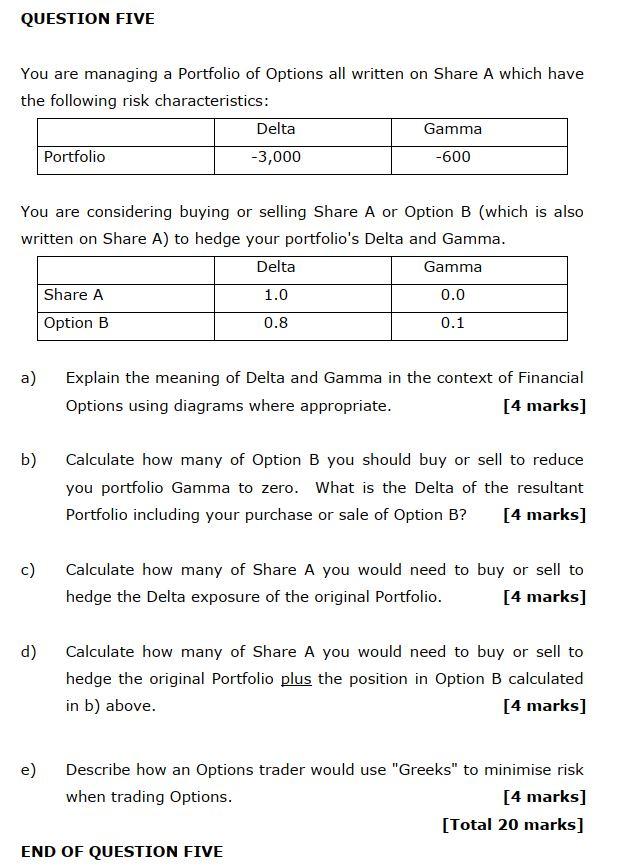

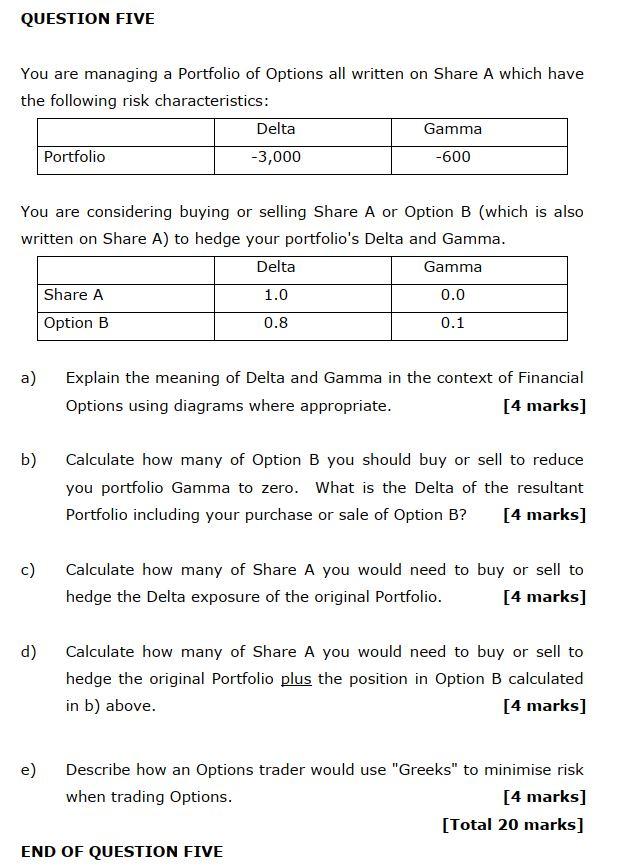

QUESTION FIVE You are managing a Portfolio of Options all written on Share A which have the following risk characteristics: Delta Gamma Portfolio -3,000 -600 You are considering buying or selling Share A or Option B (which is also written on Share A) to hedge your portfolio's Delta and Gamma. Delta Gamma Share A 1.0 0.0 Option B 0.8 0.1 a) Explain the meaning of Delta and Gamma in the context of Financial Options using diagrams where appropriate. [4 marks] b) Calculate how many of Option B you should buy or sell to reduce you portfolio Gamma to zero. What is the Delta of the resultant Portfolio including your purchase or sale of Option B? [4 marks] c) Calculate how many of Share A you would need to buy or sell to hedge the Delta exposure of the original Portfolio. [4 marks] d) Calculate how many of Share A you would need to buy or sell to hedge the original Portfolio plus the position in Option B calculated in b) above. [4 marks] e) Describe how an Options trader would use "Greeks" to minimise risk when trading Options. [4 marks] [Total 20 marks] END OF QUESTION FIVE QUESTION FIVE You are managing a Portfolio of Options all written on Share A which have the following risk characteristics: Delta Gamma Portfolio -3,000 -600 You are considering buying or selling Share A or Option B (which is also written on Share A) to hedge your portfolio's Delta and Gamma. Delta Gamma Share A 1.0 0.0 Option B 0.8 0.1 a) Explain the meaning of Delta and Gamma in the context of Financial Options using diagrams where appropriate. [4 marks] b) Calculate how many of Option B you should buy or sell to reduce you portfolio Gamma to zero. What is the Delta of the resultant Portfolio including your purchase or sale of Option B? [4 marks] c) Calculate how many of Share A you would need to buy or sell to hedge the Delta exposure of the original Portfolio. [4 marks] d) Calculate how many of Share A you would need to buy or sell to hedge the original Portfolio plus the position in Option B calculated in b) above. [4 marks] e) Describe how an Options trader would use "Greeks" to minimise risk when trading Options. [4 marks] [Total 20 marks] END OF QUESTION FIVE