Answered step by step

Verified Expert Solution

Question

1 Approved Answer

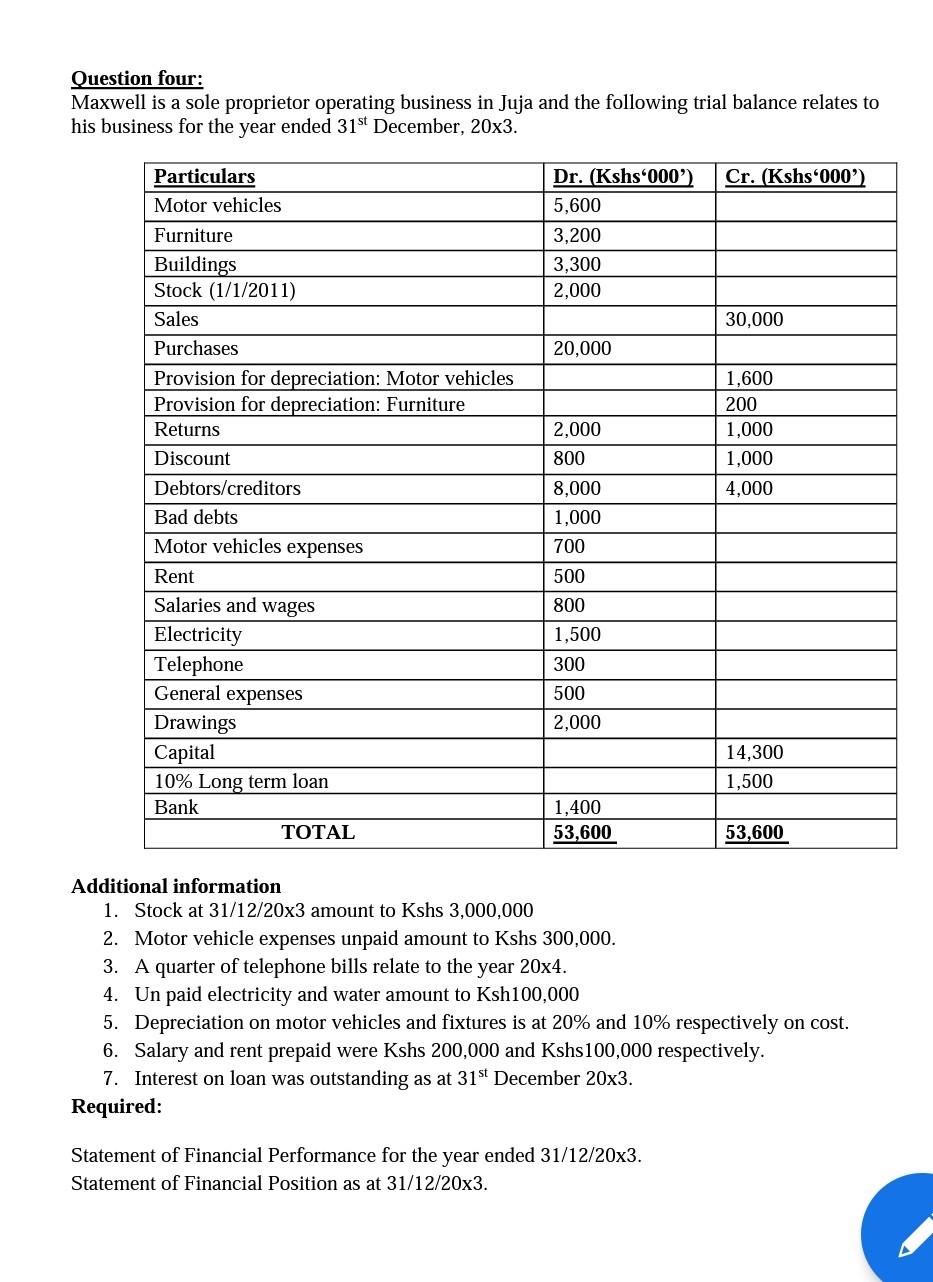

Question four: Maxwell is a sole proprietor operating business in Juja and the following trial balance relates to his business for the year ended 31st

Question four: Maxwell is a sole proprietor operating business in Juja and the following trial balance relates to his business for the year ended 31st December, 20x3. Cr. (Kshs'000') Dr. (Kshs'000') 5,600 3,200 3,300 2,000 30,000 20,000 Particulars Motor vehicles Furniture Buildings Stock (1/1/2011) Sales Purchases Provision for depreciation: Motor vehicles Provision for depreciation: Furniture Returns Discount Debtors/creditors Bad debts Motor vehicles expenses Rent Salaries and wages Electricity Telephone General expenses Drawings Capital 10% Long term loan Bank TOTAL 1,600 200 1,000 1,000 4.000 2,000 800 8,000 1,000 700 500 800 1,500 300 500 2,000 14,300 1,500 1,400 53,600 53,600 Additional information 1. Stock at 31/12/20x3 amount to Kshs 3,000,000 2. Motor vehicle expenses unpaid amount to Kshs 300,000. 3. A quarter of telephone bills relate to the year 20x4. 4. Un paid electricity and water amount to Ksh100,000 5. Depreciation on motor vehicles and fixtures is at 20% and 10% respectively on cost. 6. Salary and rent prepaid were Kshs 200,000 and Kshs100,000 respectively. 7. Interest on loan was outstanding as at 31st December 20x3. Required: Statement of Financial Performance for the year ended 31/12/20x3. Statement of Financial Position as at 31/12/20x3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started