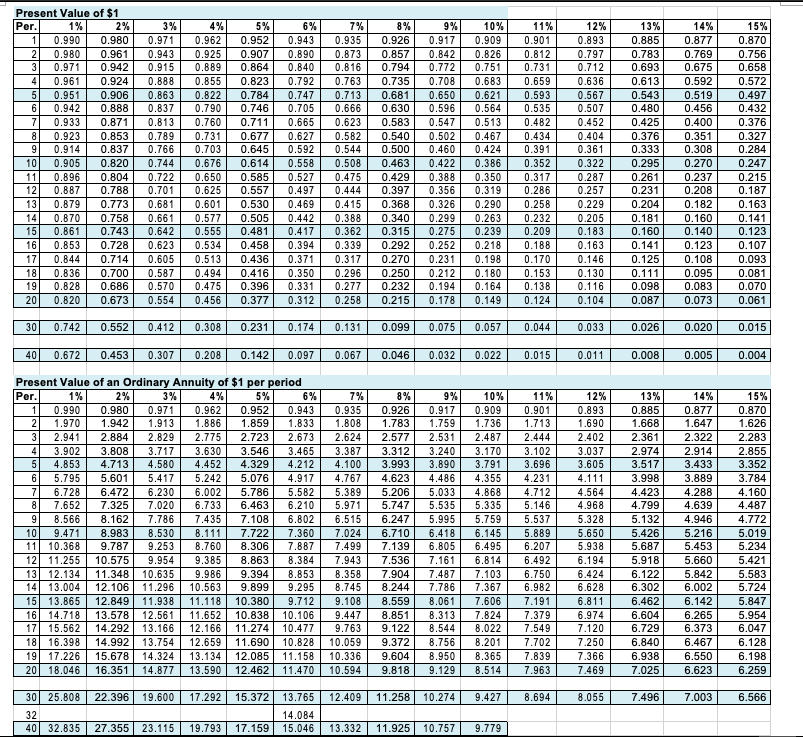

Question: Hazel Company has just purchased equipment that requires annual payments of $30,000 to be paid at the end of each of the next 4 years. The appropriate discount rate is 15%. What is the present value of the payments?

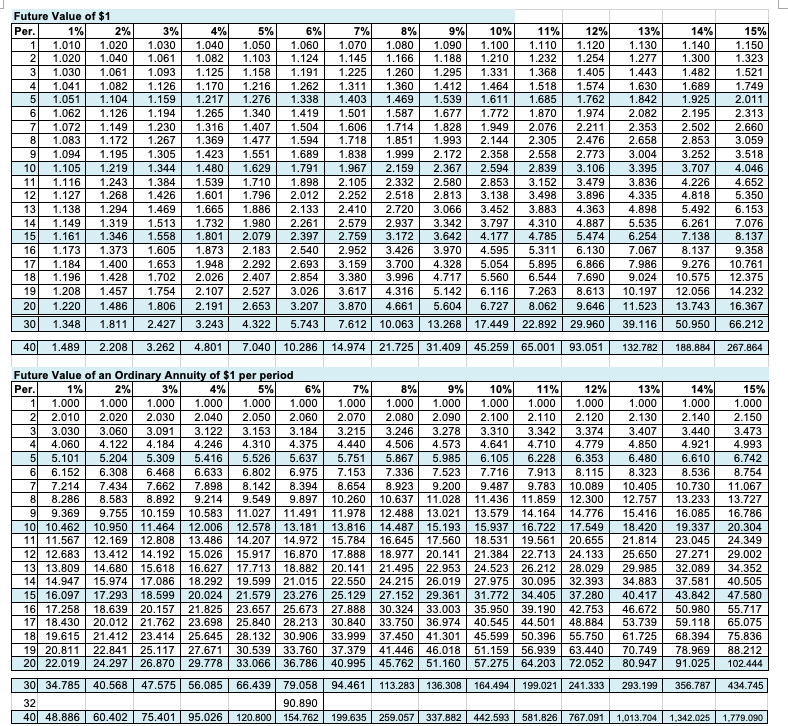

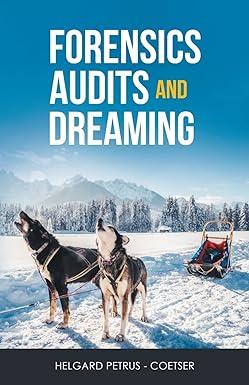

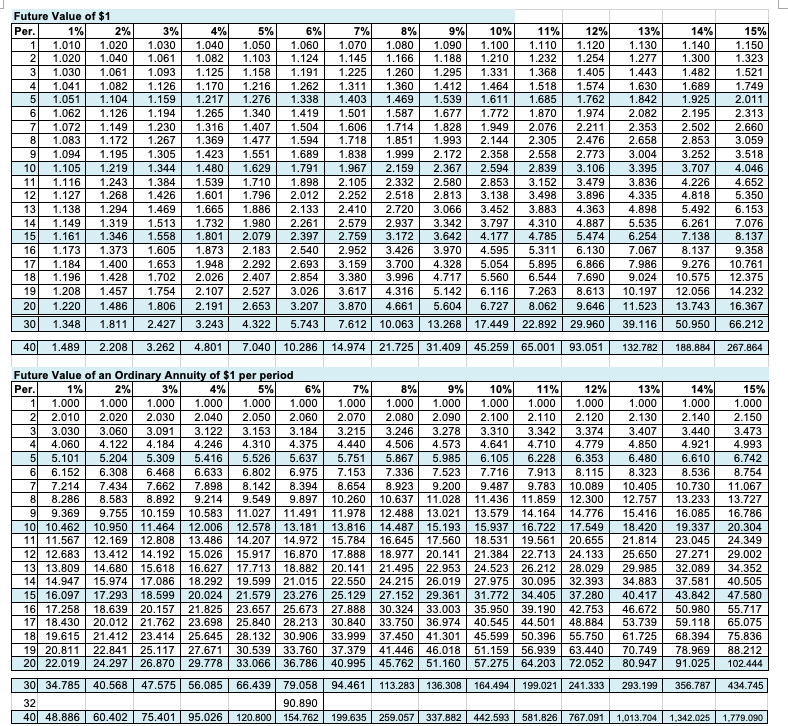

1 Future Value of $1 Per. 1% 2% 1.010 1.020 2 1.020 1.040 1.030 1.061 4 1.041 1.082 5 1.051 1.104 6 1.062 1.126 7 1.072 1.149 8 1.083 1.172 9 1.094 1.195 101 1.105 1.219 11 1.116 1.243 12 1.127 1.268 13 1.138 1.294 14 1.149 1.319 15 1.161 1.346 16 1.173 1.373 17 1.184 1.400 18 1.196 1.428 19 1.208 1.457 20 1.220 1.486 30 1.348 1.811 3% 1.030 1.061 1.093 1.126 1.159 1.194 1.230 1.267 1.305 1.344 1.384 1.426 1.469 1.513 1.558 1.605 1.653 1.702 1.754 1.806 2.427 4% 1.040 1.082 1.125 1.170 1.217 1.265 1.316 1.369 1.423 1.480 1.539 1.601 1.665 1.732 1.801 1.873 1.948 2.026 2.107 2.191 3.243 5% 1.050 1.103 1.158 1.216 1.276 1.340 1.407 1.477 1.551 1.629 1.710 1.796 1.886 1.980 2.079 2.183 2.292 2.407 2.527 2.653 4.322 6% 1.060 1.124 1.191 1.262 1.338 1.419 1.504 1.594 1.689 1.791 1.898 2.012 2.133 2.261 2.397 2.540 2.693 2.854 3.026 3.207 5.743 7% 8% 1.070 1.080 1.145 1.166 1.225 1.260 1.311 1.360 1.403 1.469 1.501 1.587 1.606 1.714 1.718 1.851 1.838 1.999 1.967 2.159 2.105 2.332 2.252 2.518 2.410 2.720 2.579 2.937 2.759 3.172 2.952 3.426 3.159 3.700 3.380 3.996 3.617 4.316 3.870 4.661 7.612 10.063 9% 1.090 1.188 1.295 1.412 1.539 1.677 1.828 1.993 2.172 2.367 2.580 2.813 3.066 3.342 3.642 3.970 4.328 4.717 5.142 5.604 13.268 10% 11% 12% 1.100 1.110 1.120 1.210 1.232 1.254 1.331 1.368 1.405 1.464 1.518 1.574 1.611 1.685 1.762 1.772 1.870 1.974 1.949 2.076 2.211 2.144 2.305 2.476 2.358 2.558 2.773 2.594 2.839 3.106 2.853 3.152 3.479 3.138 3.498 3.896 3.452 3.883 4.363 3.797 4.310 4.887 4.177 4.785 5.474 4.595 5.311 6.130 5.054 5.895 6.866 5.560 6.544 7.690 6.116 7.263 8.613 6.727 8.062 9.646 17.449 22.892 29.960 13% 1.130 1.277 1.443 1.630 1.842 2.082 2.353 2.658 3.004 3.395 3.836 4.335 4.898 5.535 6.254 7.067 7.986 9.024 10.197 11.523 39.116 14% 1.140 1.300 1.482 1.689 1.925 2.195 2.502 2.853 3.252 3.707 4.226 4.818 5.492 6.261 7.138 8.137 9.276 10.575 12.056 13.743 50.950 15% 1.150 1.323 1.521 1.749 2.011 2.313 2.660 3.059 3.518 4.046 4.652 5.350 6.153 7.076 8.137 9.358 10.761 12.375 14.232 16.367 66.212 40 1.489 2.208 3.262 4.801 7.040 10.286 14.974 | 21.725 31.409 45.259 | 65.001 93.051 132.782 188.884 267.864 1 Future Value of an Ordinary Annuity of $1 per period Per. 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 11% 12% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.110 2.120 3 3.030 3.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.342 3.374 4 4.060 4.122 4.184 4.246 4.310 4.375 4.440 4.506 4.573 4.641 4.710 4.779 5 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.228 6.353 6 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 7.523 7.716 7.913 8.115 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.923 9.200 9.487 9.783 10.089 8 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.637 11.028 11.436 11.859 12.300 9 9.369 9.755 10.159 10.583 11.027 11.491 11.978 12.488 13.021 13.579 14.164 14.776 10 10.462 10.950 11.464 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 17.549 11 11.567 12.169 12.808 13.486 14.207 14.972 15.784 16.645 17.560 18.531 19.561 20.655 12 12.683 13.412 14.192 15.026 15.917 16.870 17.888 18.977 20.141 21.384 22.713 24.133 13 13.809 14.680 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 28.029 14 14.947 15.974 17.086 18.292 19.599 | 21.015 22.550 24.215 | 26.019 27.975 30.095 32.393 15| 16.097 17.293 18.599 20.024 21.579 23.276 25.129 27.152 29.361 31.772 34.405 37.280 16 17.258 18.639 20.157 21.825 23.657 25.673 27.888 30.324 33.003 35.950 39.190 42.753 17 18.430 20.012 21.762 23.698 25.840 28.213 30.840 33.750 36.974 40.545 44.501 48.884 18 19.61521.412 23.414 25.645 28.132 30.906 33.999 37.450 41.301 45.599 50.396 55.750 19 20.811 22.841 25.117 27.671 30.539 33.760 37.379 41.446 46.018 51.159 56.939 63.440 20 22.019 | 24.297 26.870 29.778 33.066 36.786 40.995 45.762 51.160 57.275 64.203 72.052 30 34.785 40.568 47.575 56.085 66.439 79.058 94.461 113.283 136.306 164.494 199.021 241.333 32 90.890 40 48.886 60.402 75.401 | 95.026 120.800 154.762 199.635 259.057 337.882 442.593 581.826 767.091 13% 1.000 2.130 3.407 4.850 6.480 8.323 10.405 12.757 15.416 18.420 21.814 25.650 29.985 34.883 40.417 46.672 53.739 61.725 70.749 80.947 14% 1.000 2.140 3.440 4.921 6.610 8.536 10.730 13.233 16.085 19.337 23.045 27.271 32.089 37.581 43.842 50.980 59.118 68.394 78.969 91.025 15% 1.000 2.150 3.473 4.993 6.742 8.754 11.067 13.727 16.786 20.304 24.349 29.002 34.352 40.505 47.580 55.717 65.075 75.836 88.212 102.444 JU 293.199 356.787 434.745 1.013.704 1,342.025 1.779.090 2 Present Value of $1 Per. 1% 2% 1 0.990 0.980 0.980 0.961 3 0.971 0.942 4 0.961 0.924 5 0.951 0.906 0.942 0.888 7 0.933 0.871 8 0.923 0.853 9 0.914 0.837 10 0.905 0.820 11 0.896 0.804 12 0.887 0.788 13 0.879 0.773 14 0.870 0.758 15 0.861 0.743 16 0.853 0.728 17 0.844 0.714 18 0.836 0.700 19 0.828 0.686 20 0.820 0.673 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 0.661 0.642 0.623 0.605 0.587 0.570 0.554 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0.534 0.513 0.494 0.475 0.456 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 6% 0.943 0.890 0.840 0.792 0.747 0.705 0.665 0.627 0.592 0.558 0.527 0.497 0.469 0.442 0.417 0.394 0.371 0.350 0.331 0.312 7% 0.935 0.873 0.816 0.763 0.713 0.666 0.623 0.582 0.544 0.508 0.475 0.444 0.415 0.388 0.362 0.339 0.317 0.296 0.277 0.258 8% 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 9% 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 10% 0.909 0.826 0.751 0.683 0.621 0.564 0.513 0.467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.218 0.198 0.180 0.164 0.149 11% 0.901 0.812 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0.232 0.209 0.188 0.170 0.153 0.138 0.124 12% 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 13% 0.885 0.783 0.693 0.613 0.543 0.480 0.425 0.376 0.333 0.295 0.261 0.231 0.204 0.181 1.160 0.141 0.125 0.111 0.098 0.087 14% 0.877 0.769 0.675 0.592 0.519 0.456 0.400 0.351 0.308 0.270 0.237 0.208 0.182 0.160 0.140 0.123 0.108 0.095 0.083 0.073 15% 0.870 0.756 0.658 0.572 0.497 0.432 0.376 0.327 0.284 0.247 0.215 0.187 0.163 0.141 .123 0.107 0.093 0.081 0.070 0.061 PIT 30 0.742 0.552 0.412 0.308 0.231 0.174 0.131 0.099 0.075 0.057 0.044 0.033 0.026 0.020 0.015 40 0.672 0.453 0.307 0.208 0.142 0.097 0.067 0.046 0.032 0.022 0.015 0.011 0.008 0.005 0.004 2 Present Value of an ordinary Annuity of $1 per period Per. 1% 2% 3% 4% 5% 6% 1 0.990 0.980 0.971 0.962 0.952 0.943 1.970 1.942 1.913 1.886 1.859 1.833 3 2.941 2.884 829 2.775 2.723 2.673 4 3.902 3.808 3.717 3.630 3.546 3.465 5 4.853 4.713 4.580 4.452 4.329 4.212 6 5.795 5.601 5.417 5.242 5.076 4.917 7 6.728 6.472 6.230 6.002 5.786 5.582 8 7.652 7.325 7.020 6.733 6.463 6.210 9 8.566 8.162 7.786 7.435 7.108 6.802 10 9.471 8.983 8.530 8.111 7.722 7.360 11 10.368 9.787 9.253 8.760 8.306 7.887 12 11.255 10.575 9.954 9.385 8.863 8.384 13 12.134 11.348 10.635 9.986 9.394 8.853 14 13.004 12.106 11.296 10.563 9.899 9.295 15 13.865 12.849 11.938 11.118 10.380 9.712 16 14.718 13.578 12.561 11.652 10.838 10.106 17| 15.562 14.292 13.166 12.166 11.274 10.477 18 16.398 14.992 13.754 12.659 11.690 10.828 19 17.226 15.678 14.324 13.134 12.085 11.158 2018.046 16.351 14.877 13.590 12.462 11.470 7% 0.935 1.808 2.624 3.387 4.100 4.767 5.389 5.971 6.515 7.024 7.499 7.943 8.358 8.745 9.108 9.447 9.763 10.059 10.336 10.594 int- 8% 0.926 1.783 2.577 3.312 3.993 4.623 5.206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7.786 8.061 8.313 8.544 8.756 8.950 9.129 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8.514 11% 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7.379 7.549 7.702 7.839 7.963 12% 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6.811 6.974 7.120 7.250 7.366 7.469 13% 0.885 1.668 2.361 2.974 3.517 3.998 4.423 4.799 5.132 5.426 5.687 5.918 6.122 6.302 6.462 6.604 6.729 6.840 6.938 7.025 14% 0.877 1.647 2.322 2.914 3.433 3.889 4.288 4.639 4.946 5.216 5.453 5.660 5.842 6.002 6.142 6.265 6.373 6.467 6.550 6.623 15% 0.870 1.626 .283 2.855 3.352 3.784 4.160 4.487 4.772 5.019 5.234 5.421 5.583 5.724 5.847 5.954 6.047 6.128 6.198 6.259 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 9.427 8.694 8.055 7.496 7.003 6.566 30 25.808 32 40 32.835 14.084 15.046 27.355 23.115 19.793 17.159 13.332 11.925 10.757 9.779