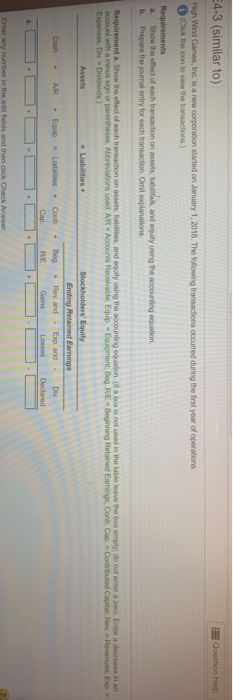

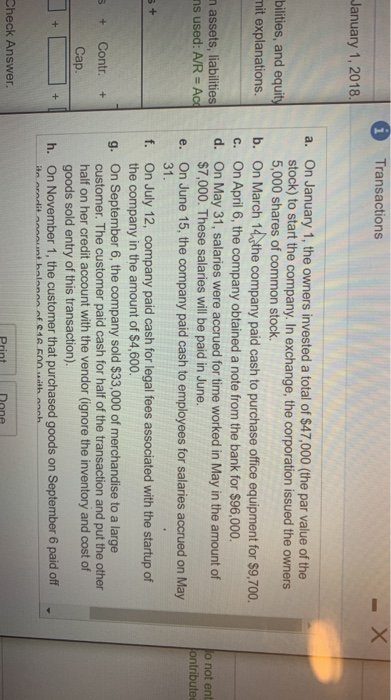

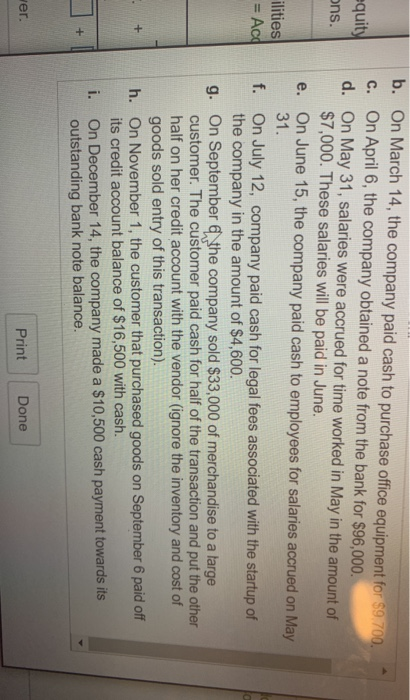

Question Help E4-3 (similar to) High Wind Games, Inc. is a new corporation started on January 1, 2018. The following transactions occurred during the first year of operations 1 Click the icon to wow the transactions Requirements a. Show the elect of each transaction on assets, labi , and equity using the accounting equation b. Prepare the journal entry for each transaction. Omit explanations Requirement a Snow the offect of each transaction on labs, and equity using the accounting on account who minus sign or parentheses. Abbreviations used AR Accounts Receivable Equip Equipment 1 Expenses: DW Dividonds) a box is not used in the lable loave the box amply do not entrar nor a decrease in an PL Beginning Retained a ng Contr. can contributed Capital Row Rovanos EAD Assets Liabilities - Stockholders' Equity Stockholders' Equity Ending Retained Earnings Rev. and Expand - Gain Loss Cash + AR + Equip -Liais + Conti Cap. Beg. RE Div. Declared Enter any number in the edit fields and then click Check Answer i Transactions January 1, 2018 bilities, and equity mit explanations. n assets, liabilities ns used: A/R = Aca Jo not ent Jontributed a. On January 1, the owners invested a total of $47,000 (the par value of the stock) to start the company. In exchange, the corporation issued the owners 5,000 shares of common stock. b. On March 14the company paid cash to purchase office equipment for $9,700. C. On April 6, the company obtained a note from the bank for $96,000. d. On May 31, salaries were accrued for time worked in May in the amount of $7,000. These salaries will be paid in June. e. On June 15, the company paid cash to employees for salaries accrued on May 31. f. On July 12, company paid cash for legal fees associated with the startup of the company in the amount of $4,600. g. On September 6, the company sold $33,000 of merchandise to a large customer. The customer paid cash for half of the transaction and put the other half on her credit account with the vendor (ignore the inventory and cost of goods sold entry of this transaction). h. On November 1, the customer that purchased goods on September 6 paid off ito andit cunt balonon of 16 600 with anch + Contr. Cap. Check Answer Print Done equity ons. ilities = Aca b. On March 14, the company paid cash to purchase office equipment for $9.700. c. On April 6, the company obtained a note from the bank for $96,000. d. On May 31, salaries were accrued for time worked in May in the amount of $7,000. These salaries will be paid in June. e. On June 15, the company paid cash to employees for salaries accrued on May 31. f. On July 12, company paid cash for legal fees associated with the startup of the company in the amount of $4,600. g. On September the company sold $33,000 of merchandise to a large customer. The customer paid cash for half of the transaction and put the other half on her credit account with the vendor (ignore the inventory and cost of goods sold entry of this transaction). h. On November 1, the customer that purchased goods on September 6 paid off its credit account balance of $16,500 with cash. On December 14, the company made a $10,500 cash payment towards its outstanding bank note balance. wer. Print Done