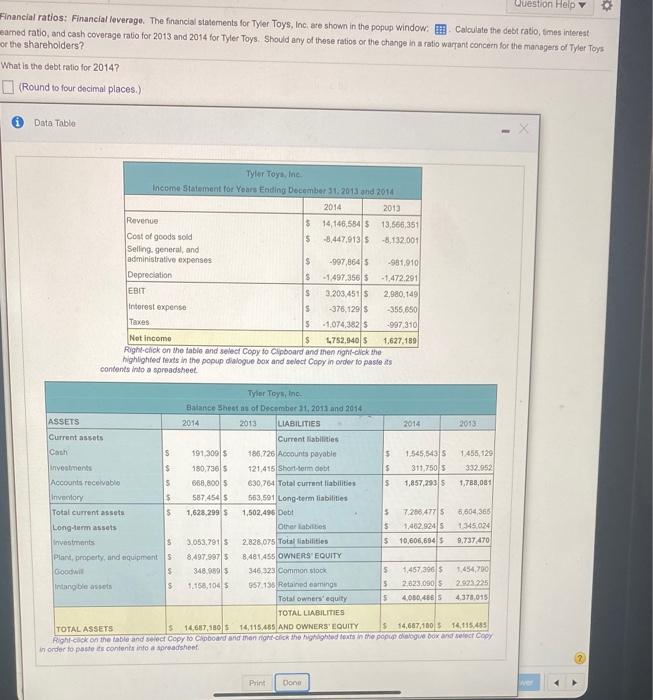

Question Help Financial ratios: Financial leverage. The financial statements for Tyler Toys, Inc. are shown in the popup window. Calculate the debt ratio, times interest earned ratio, and cash coverage ratio for 2013 and 2014 for Tyler Toys Should any of those ratios or the change in a ratio warrant concern for the managers of Tyler Toys or the shareholders? What is the debt ratio for 2014? (Round to four decimal places.) Data Table - Tyler Toys, Inc Income Statement for Years Ending December 31, 2013 and 2014 2014 2013 Revenue $ 14,146,584 $ 13,566,351 Cost of goods sold 5 -3.447,9135 -8,132,001 Selling general, and administrative expenses $ -997,86415 -981,910 Depreciation S -1.497,356 $ -1,472.291 $ 3.203.451 5 2,980,149 Interest expense S -376,129 $ -355 650 Taxes S -1074.382 $ -997.3101 Not income $ 1.752,940 $ 1.627.189 Right click on the table and select Copy to clipboard and inen ngnt-click the highlighted texts in the popup dialogue box and select Copy in order to pastats contents into a spreadsheet. EBIT 2014 S 5 $ 5 S Tyler Toys, Inc Balance Sheets of December 31, 2013 and 2014 ASSETS 2014 2013 LIABILITIES 2013 Current assets Current abilities Cath 191 30015 186.725 Accounts payable 1.545,54315 1,455,129 Investments $ 180,7305 121.415 Short-term obt 311,7505 332.952 Accounts receivable 668.80015 630,764 Total current liabilities 1,857.2935 1,788,081 Inventory 5 587.4545 563.591 Long-term liabilities Total current assets $ 1,628,299 1,502,496 Debt S 7280.47715 5,604 365 Long-term assets Other labios 5 1,462.9245 1345024 Investments 3.053.7915 2,828,075 Total liabilities 10,606,6945 9,737.470 Plant, property, and equipment S 8.497.9975 8.481.455 OWNERS' EQUITY Good S 348.9895 346 323 Common slock 1,457,300 $ 1.454,790 Intang beses $ 1.158,10415 957.156 Retained emings 2.833,0905 2993225 Total owners' equity 4,080,46 5 4.378,015 TOTAL LIABILITIES TOTAL ASSETS 14,687,1805 14.115.455 AND OWNERS' EQUITY $ 14,667,100 $ 14, 15:485 Right-cook on the table and select Copy to Cipboard and on right click the highlighted out in the populogue box and select Copy in order to post contents into a roadsheet $ 5 5 5 5 Print Done