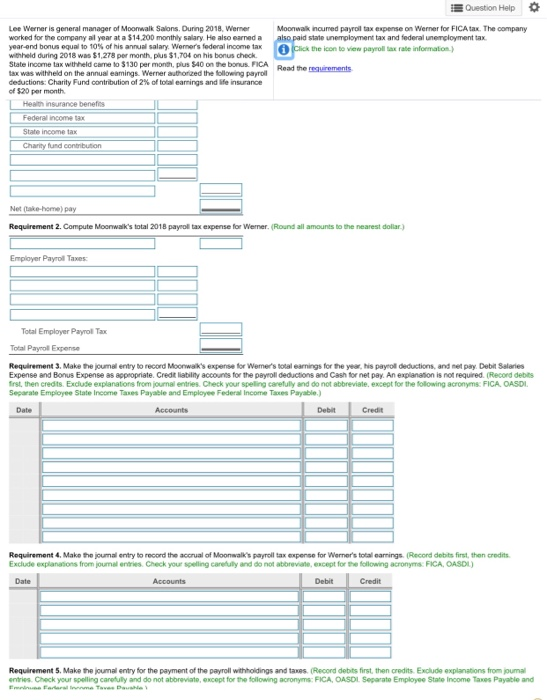

Question Help Moonwalk incured payroll tax expense on Werner for FICA tax. The company also paid state unemployment tax and federal nerployment tax A click the icon to view payroll tax rate information Read the requements Lee Werner is general manager of Moonwalk Salons. During 2018 Werner worked for the company al year at a $14.200 monthly salary He also earneda year-end bonus equal to 10% of his annual salary. Werner's federal income tax withheld during 2018 was $1,278 per month, plus $1,704 on his bonus check. State income tax withheld came to $130 per month, plus $40 on the bonus. FICA tax was withheld on the annualeamings. Werner authorized the following payroll deductions: Charity Fund contribution of 2% of total earnings and life insurance of $20 per month Health insurance benefits Federal income tax State income tax Charity fund contribution Not take-home) pay Requirement 2. Compute Moonwalk's total 2018 payroll tax expense for Womer (Round all amounts to the nearest dollar) Employer Payroll Taxes: Total Employer Payroll Tax Total Payrol Expense Requirement 3. Make the joumal entry to record Moonwalk's expense for Wemer's total earnings for the year, this payrol deductions, and net pay Debit Salaries Expense and Bonus Expense as appropriate. Credit liability accounts for the payroll deductions and Cash for net pay. An explanation is not required. (Record debits first, then credits. Exclude explanations from journal entries. Check your spelling carefully and do not abbreviate, except for the following acronymsFICA OASDI. Separate Employee State Income Taxes Payable and Employee Federal Income Taxes Payable) Accounts Debit Credit Requirement 4, Make the journal entry to record the accrual of Moonwalk's payroll tax expense for Werner's total warnings. Record debits first, then credits Exclude explanations from jouma entries. Check your spelling carefully and do not abbreviate, except for the following acronym FICA, OASOL) Requirement 5. Make the joumal entry for the payment of the payroll withholdings and taxes. Record debits first, then credits. Exclude explanations from ournal entries. Check your spelling carefully and do not abbreviate, except for the following acronyms: FICA, OASOL Separate Employee State Income Taxes Payable and artalma Tu Dawa t