Answered step by step

Verified Expert Solution

Question

1 Approved Answer

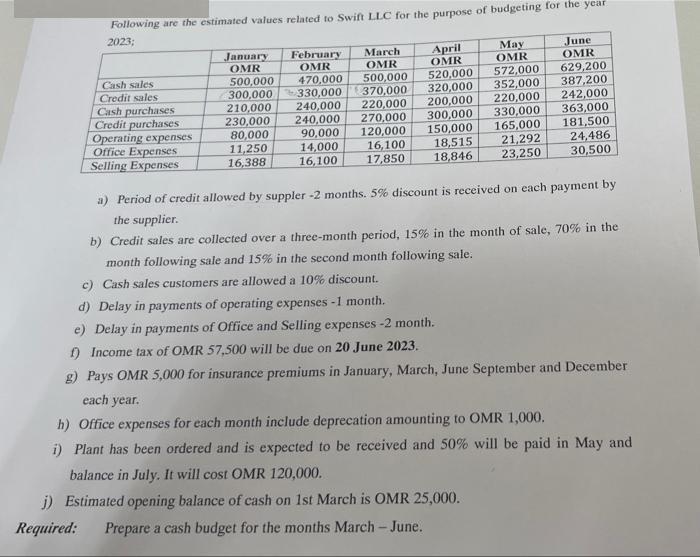

Following are the estimated values related to Swift LLC for the purpose of budgeting for the year 2023; January OMR April OMR OMR June

Following are the estimated values related to Swift LLC for the purpose of budgeting for the year 2023; January OMR April OMR OMR June OMR February March OMR 500,000 370,000 220,000 270,000 120,000 16,100 17,850 OMR 500,000 300,000 210,000 230,000 80,000 11,250 16,388 520,000 320,000 200,000 300,000 150,000 18,515 18,846 572,000 352,000 220,000 330,000 165,000 21,292 23,250 629,200 387,200 242,000 363,000 181,500 24,486 30,500 Cash sales 470,000 330,000 240,000 240,000 90,000 14,000 16,100 Credit sales Cash purchases Credit purchases Operating expenses Office Expenses Selling Expenses a) Period of credit allowed by suppler -2 months. 5% discount is received on each payment by the supplier. b) Credit sales are collected over a three-month period, 15% in the month of sale, 70% in the month following sale and 15% in the second month following sale. c) Cash sales customers are allowed a 10% discount. d) Delay in payments of operating expenses -1 month. e) Delay in payments of Office and Selling expenses -2 month. f) Income tax of OMR 57,500 will be due on 20 June 2023. g) Pays OMR 5,000 for insurance premiums in January, March, June September and December each year. h) Office expenses for each month include deprecation amounting to OMR 1,000. i) Plant has been ordered and is expected to be received and 50% will be paid in May and balance in July. It will cost OMR 120,000. i) Estimated opening balance of cash on 1st March is OMR 25,000. Required: Prepare a cash budget for the months March- June.

Step by Step Solution

★★★★★

3.21 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Step 1 Cash budget is the estimation of cash payments and receipts It is prepared to know the requir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started