question I will leave the biggest like ever thank you so much who ever does this!!

information for question

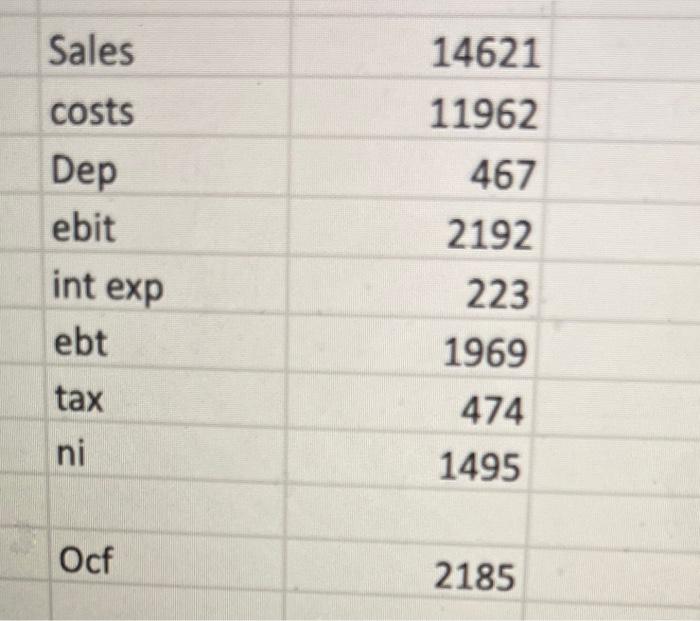

consoldiated statement of income

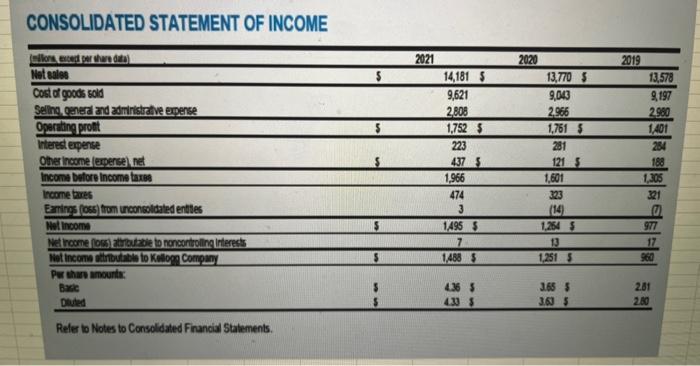

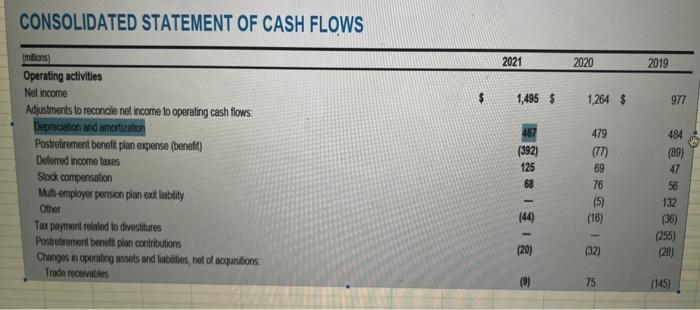

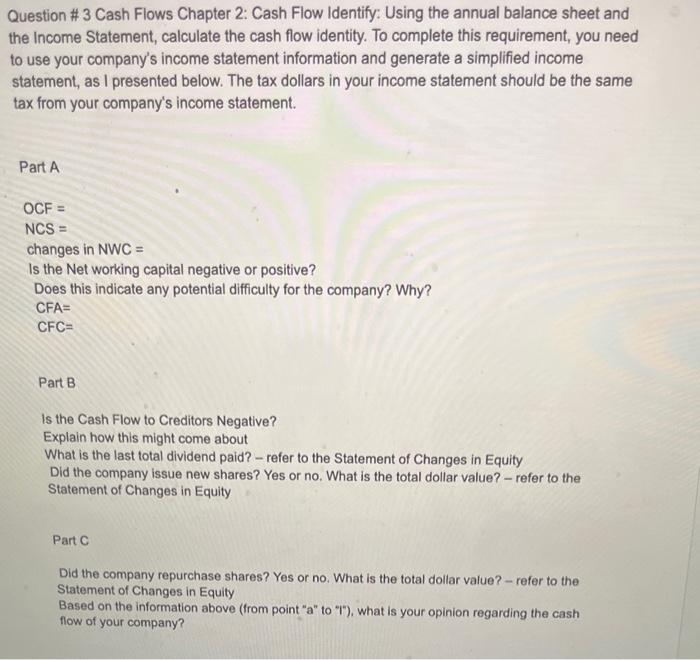

consolidated cash flows

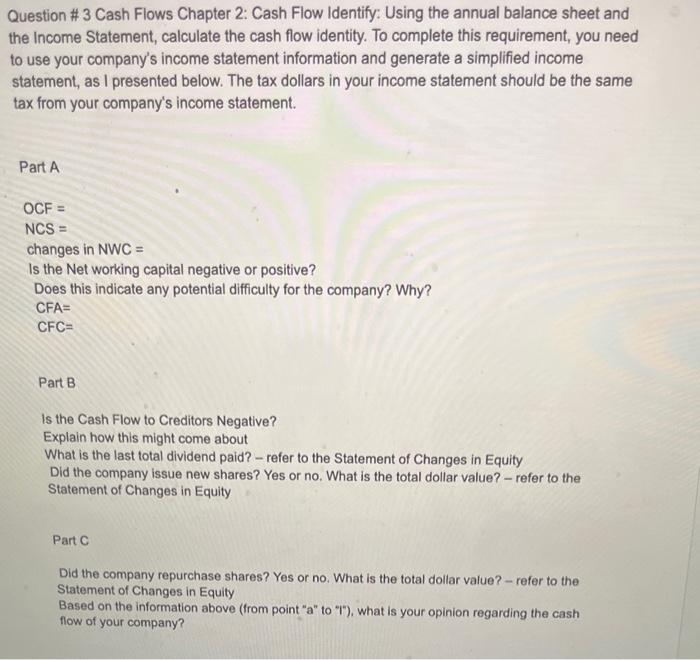

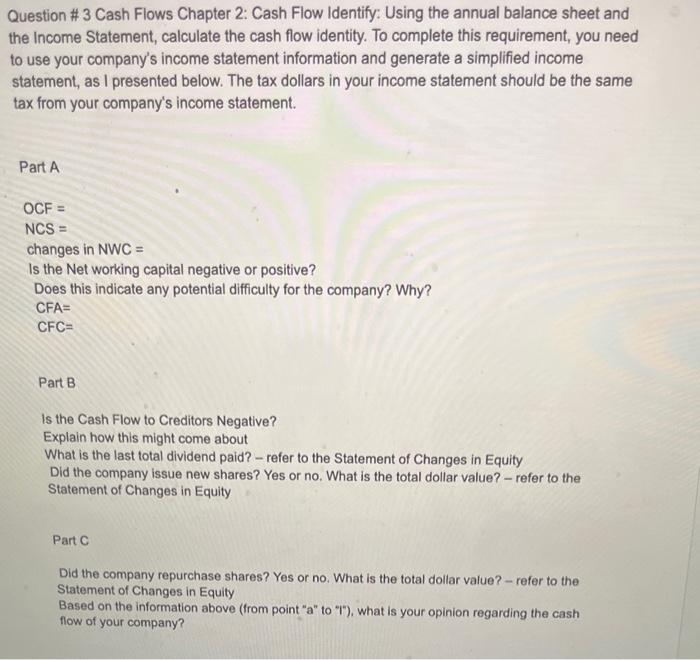

Question \# 3 Cash Flows Chapter 2: Cash Flow Identify: Using the annual balance sheet and the Income Statement, calculate the cash flow identity. To complete this requirement, you need to use your company's income statement information and generate a simplified income statement, as I presented below. The tax dollars in your income statement should be the same tax from your company's income statement. Part A OCF = NCS= changes in NWC = Is the Net working capital negative or positive? Does this indicate any potential difficulty for the company? Why? CFA= CFC= Part B Is the Cash Flow to Creditors Negative? Explain how this might come about What is the last total dividend paid? - refer to the Statement of Changes in Equity Did the company issue new shares? Yes or no. What is the total dollar value? - refer to the Statement of Changes in Equity Part C Did the company repurchase shares? Yes or no. What is the total dollar value? - refer to the Statement of Changes in Equily Based on the information above (from point "a" to "\%), what is your opinion regarding the cash flow of your company? \begin{tabular}{lr|} \hline Sales & 14621 \\ \hline costs & 11962 \\ \hline Dep & 467 \\ \hline ebit & 2192 \\ \hline int exp & 223 \\ \hline ebt & 1969 \\ \hline tax & 474 \\ \hline ni & 1495 \end{tabular} Ocf 2185 CONSOLIDATED STATEMENT OF INCOME CONSOLIDATED STATEMENT OF CASH FLOWS Question \# 3 Cash Flows Chapter 2: Cash Flow Identify: Using the annual balance sheet and the Income Statement, calculate the cash flow identity. To complete this requirement, you need to use your company's income statement information and generate a simplified income statement, as I presented below. The tax dollars in your income statement should be the same tax from your company's income statement. Part A OCF = NCS= changes in NWC = Is the Net working capital negative or positive? Does this indicate any potential difficulty for the company? Why? CFA= CFC= Part B Is the Cash Flow to Creditors Negative? Explain how this might come about What is the last total dividend paid? - refer to the Statement of Changes in Equity Did the company issue new shares? Yes or no. What is the total dollar value? - refer to the Statement of Changes in Equity Part C Did the company repurchase shares? Yes or no. What is the total dollar value? - refer to the Statement of Changes in Equily Based on the information above (from point "a" to "\%), what is your opinion regarding the cash flow of your company? \begin{tabular}{lr|} \hline Sales & 14621 \\ \hline costs & 11962 \\ \hline Dep & 467 \\ \hline ebit & 2192 \\ \hline int exp & 223 \\ \hline ebt & 1969 \\ \hline tax & 474 \\ \hline ni & 1495 \end{tabular} Ocf 2185 CONSOLIDATED STATEMENT OF INCOME CONSOLIDATED STATEMENT OF CASH FLOWS