Answered step by step

Verified Expert Solution

Question

1 Approved Answer

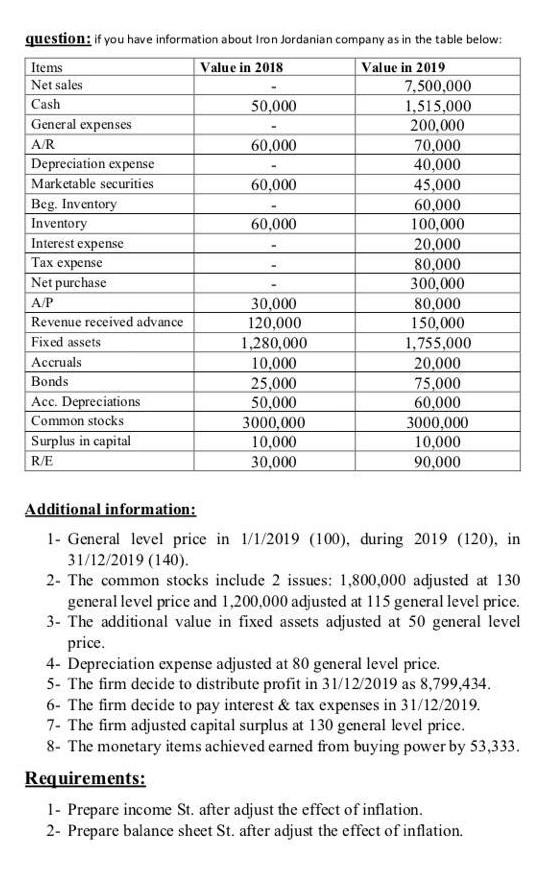

question: If you have information about Iron Jordanian company as in the table below: Items Value in 2018 Net sales Cash 50,000 60,000 60,000 General

question: If you have information about Iron Jordanian company as in the table below: Items Value in 2018 Net sales Cash 50,000 60,000 60,000 General expenses A/R Depreciation expense Marketable securities Beg. Inventory Inventory Interest expense Tax expense Net purchase 60,000 Value in 2019 7,500,000 1,515,000 200,000 70,000 40,000 45,000 60,000 100,000 20,000 80,000 300.000 80,000 150,000 1,755,000 20,000 75,000 60,000 3000,000 10,000 90,000 A/P Revenue received advance Fixed assets Accruals Bonds Acc. Depreciations Common stocks Surplus in capital R/E 30,000 120,000 1,280,000 10.000 25,000 50,000 3000,000 10,000 30,000 Additional information: 1- General level price in 1/1/2019 (100), during 2019 (120), in 31/12/2019 (140). 2. The common stocks include 2 issues: 1,800,000 adjusted at 130 general level price and 1,200,000 adjusted at 115 general level price. 3- The additional value in fixed assets adjusted at 50 general level price. 4. Depreciation expense adjusted at 80 general level price. 5- The firm decide to distribute profit in 31/12/2019 as 8,799,434. 6- The firm decide to pay interest & tax expenses in 31/12/2019. 7- The firm adjusted capital surplus at 130 general level price. 8- The monetary items achieved earned from buying power by 53,333. Requirements: 1- Prepare income St. after adjust the effect of inflation. 2- Prepare balance sheet St. after adjust the effect of inflation. question: If you have information about Iron Jordanian company as in the table below: Items Value in 2018 Net sales Cash 50,000 60,000 60,000 General expenses A/R Depreciation expense Marketable securities Beg. Inventory Inventory Interest expense Tax expense Net purchase 60,000 Value in 2019 7,500,000 1,515,000 200,000 70,000 40,000 45,000 60,000 100,000 20,000 80,000 300.000 80,000 150,000 1,755,000 20,000 75,000 60,000 3000,000 10,000 90,000 A/P Revenue received advance Fixed assets Accruals Bonds Acc. Depreciations Common stocks Surplus in capital R/E 30,000 120,000 1,280,000 10.000 25,000 50,000 3000,000 10,000 30,000 Additional information: 1- General level price in 1/1/2019 (100), during 2019 (120), in 31/12/2019 (140). 2. The common stocks include 2 issues: 1,800,000 adjusted at 130 general level price and 1,200,000 adjusted at 115 general level price. 3- The additional value in fixed assets adjusted at 50 general level price. 4. Depreciation expense adjusted at 80 general level price. 5- The firm decide to distribute profit in 31/12/2019 as 8,799,434. 6- The firm decide to pay interest & tax expenses in 31/12/2019. 7- The firm adjusted capital surplus at 130 general level price. 8- The monetary items achieved earned from buying power by 53,333. Requirements: 1- Prepare income St. after adjust the effect of inflation. 2- Prepare balance sheet St. after adjust the effect of inflation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started