Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question Information Submission Format: Please answer the question in the submission format and fill out all sections. Thank you! E3-17 Subsidiary Acquired at Net Book

Question Information

Submission Format:

Please answer the question in the submission format and fill out all sections. Thank you!

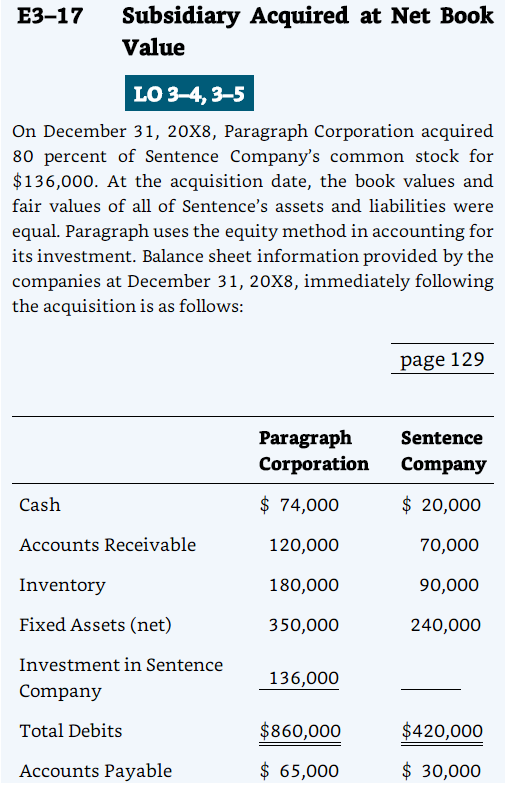

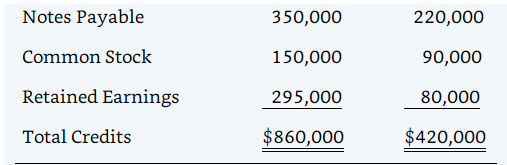

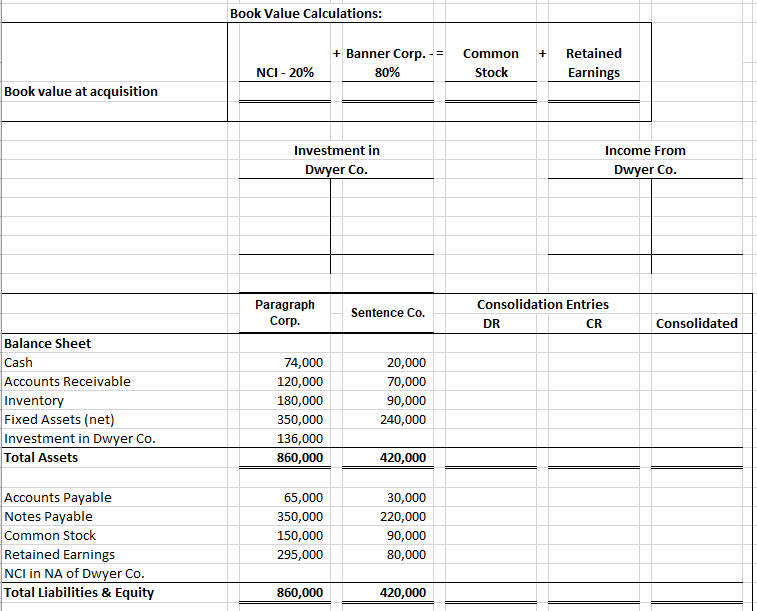

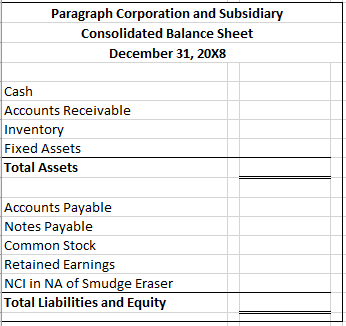

E3-17 Subsidiary Acquired at Net Book Value LO 3-4, 3-5 On December 31, 20X8, Paragraph Corporation acquired 80 percent of Sentence Company's common stock for $136,000. At the acquisition date, the book values and fair values of all of Sentence's assets and liabilities were equal. Paragraph uses the equity method in accounting for its investment. Balance sheet information provided by the companies at December 31, 20X8, immediately following the acquisition is as follows: page 129 Paragraph Corporation Sentence Company Cash $ 74,000 $ 20,000 Accounts Receivable 120,000 70,000 Inventory 180,000 90,000 Fixed Assets (net) 350,000 240,000 Investment in Sentence Company 136,000 Total Debits $860,000 $420,000 Accounts Payable $ 65,000 $ 30,000 Notes Payable 350,000 220,000 Common Stock 150,000 90,000 Retained Earnings 295,000 80,000 Total Credits $860,000 $420,000 Book Value Calculations: + + Banner Corp. - = 80% Common Stock Retained Earnings NCI - 20% Book value at acquisition Investment in Dwyer Co. Income From Dwyer Co. Paragraph Corp. Sentence Co. Consolidation Entries DR CR Consolidated 20,000 Balance Sheet Cash Accounts Receivable Inventory Fixed Assets (net) Investment in Dwyer Co. Total Assets 74,000 120,000 180,000 350,000 136,000 860,000 70,000 90,000 240,000 420,000 Accounts Payable Notes Payable Common Stock Retained Earnings NCI in NA of Dwyer Co. Total Liabilities & Equity 65,000 350,000 150,000 295,000 30,000 220,000 90,000 80,000 860,000 420,000 Paragraph Corporation and Subsidiary Consolidated Balance Sheet December 31, 20x8 Cash Accounts Receivable Inventory Fixed Assets Total Assets Accounts Payable Notes Payable Common Stock Retained Earnings NCI in NA of Smudge Eraser Total Liabilities and EquityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started