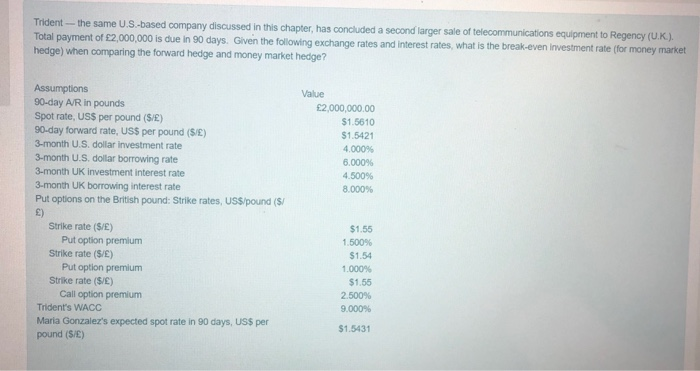

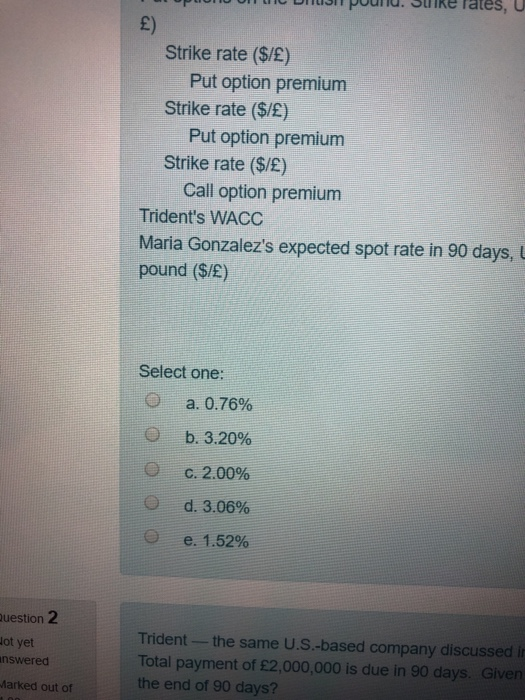

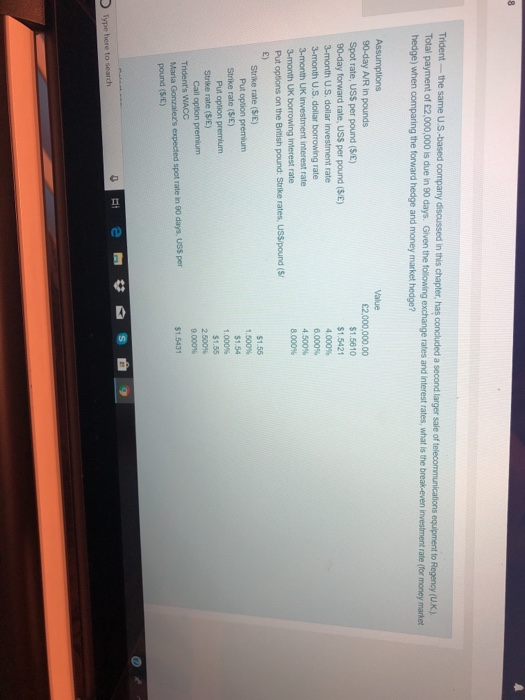

Trident--the same U.S.-based company discussed in this chapter, has concluded a second larger sale of telecommunications equipment to Regency (UK). Total payment of 2,000,000 is due in 90 days. Given the following exchange rates and interest rates, what is the break-even Investment rate (for money market hedge) when comparing the forward hedge and money market hedge? Assumptions 90-day A/R in pounds Spot rate, US$ per pound (S/) 90-day forward rate, US$ per pound (S/E) 3-month U.S. dollar investment rate 3-month US dollar borrowing rate 3-month UK investment interest rate 3-month UK borrowing interest rate Put options on the British pound: Strike rates, US$/pound ($/ Value 2,000,000.00 $1.5610 $1.5421 4.0009 6.000% 4.500% 8.000% Strike rate ($/E) Put option premium Strike rate ($/E) Put option premium Strike rate ($/E) Call option premium Trident's WACC Maria Gonzalez's expected spot rate in 90 days, US$ per pound (S/E) $1.55 1.500% $1.54 1.000% $1.55 2.500% 9.000 $1.5431 pum Om U DIJIT puuiiu. Sulke rates, U Strike rate ($/) Put option premium Strike rate ($/) Put option premium Strike rate ($/) Call option premium Trident's WACC Maria Gonzalez's expected spot rate in 90 days, pound ($/) Select one: O a. 0.76% b. 3.20% c. 2.00% O d. 3.06% o e. 1.52% Question 2 Hot yet answered Marked out of Trident--the same U.S.-based company discussed in Total payment of 2,000,000 is due in 90 days. Given the end of 90 days? Trident- the same US-based company discussed in this chapter, has concluded a second larger sale of telecommunications equipment to Regency (UK) Total payment of 2,000,000 is due in 90 days. Given the following exchange rates and interest rates, what is the break-even investment rate (for money market hedge) when comparing the forward hedge and money market hedge? Assumptions 90-day AR in pounds Spot rate, USS per pound (S/E) 90-day forward rate, USS per pound (S/E) 3-month U.S. dollar investment rate 3-month U.S. dollar borrowing rate 3-month UK Investment interest rate 3-month UK borrowing interest rate Put options on the British pound: Strike rates, USS pound (S! Value 2,000,000.00 $1.5610 $1.5421 4.000 6.000 4.500% 8.000% Strike rate (SE) Put option premium Strike rate (SE) Put option premium Strike rate (S/E) Call option premium Trident's WACC Maria Gonzalez's expected spot rate in 90 days. US5 per pound (SE) $1.55 1.500% $1.54 1.000 $1.55 2.500% $1 5431 Type here to search