Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question: Members G,H and J form Residences at the National Gallery on January 1, 2024. Purpose of the LLC is to acquire an existing building

Question:

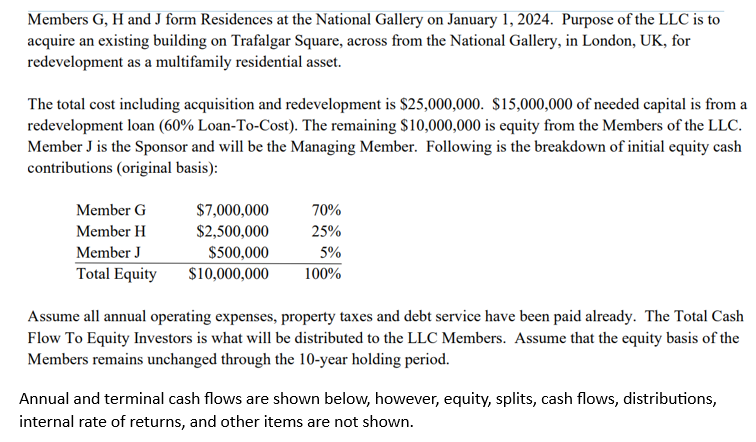

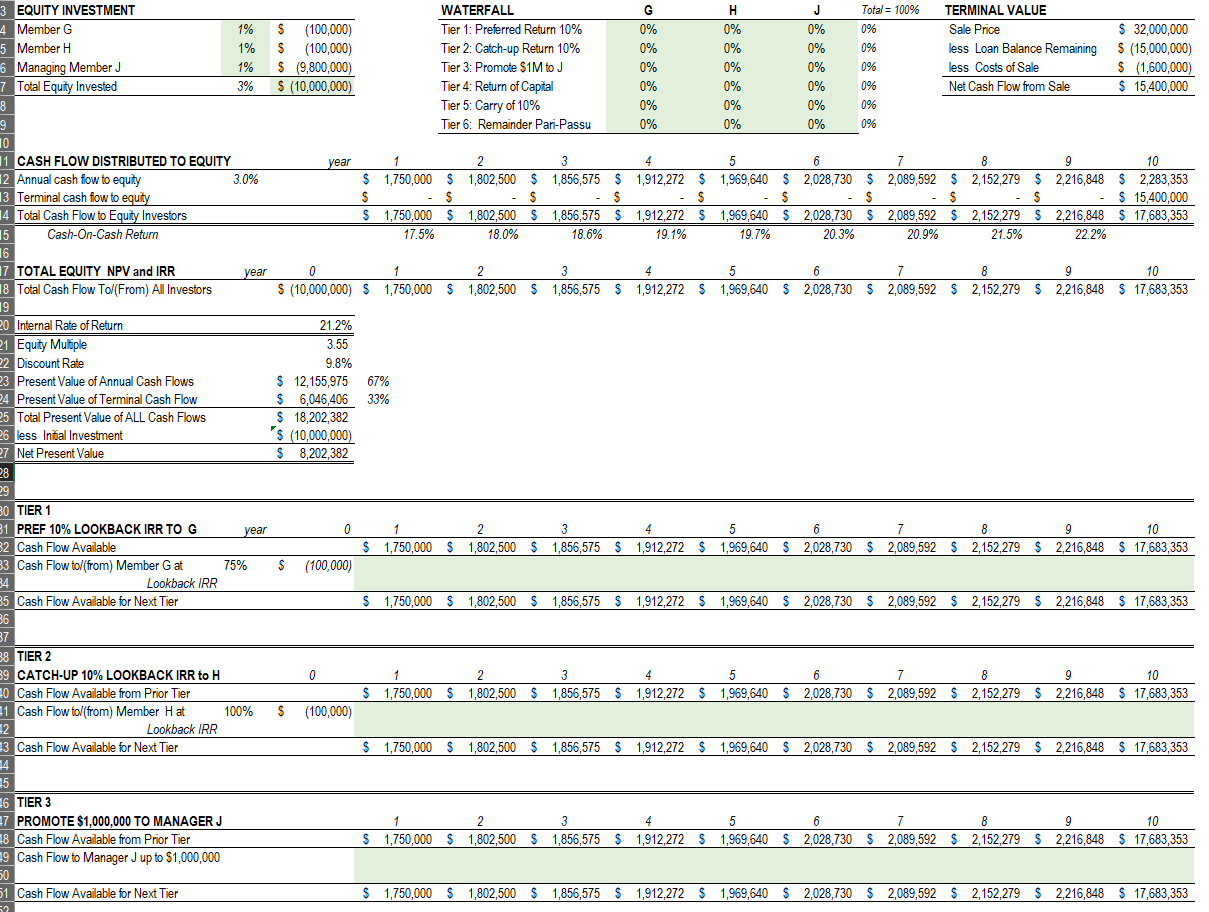

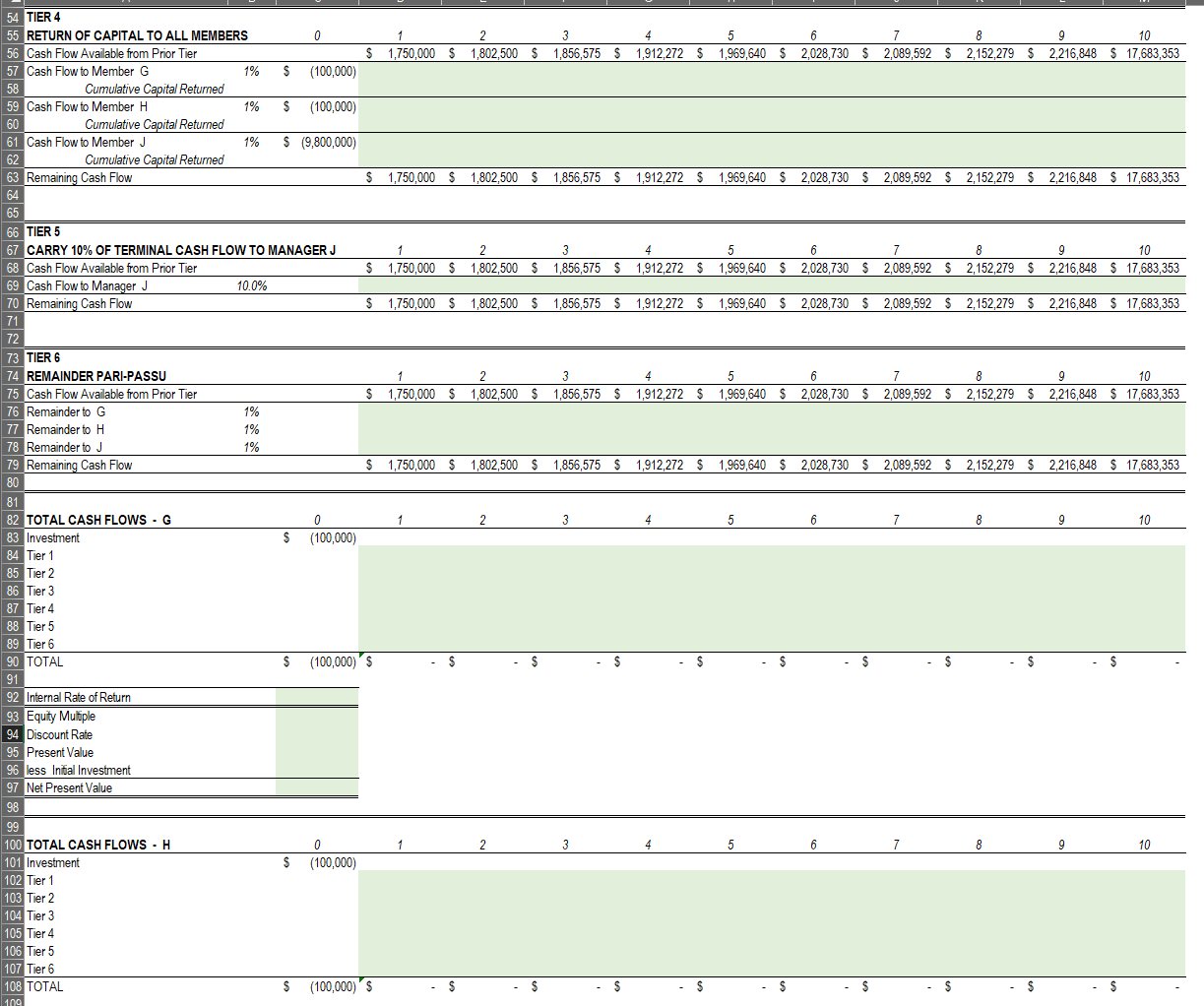

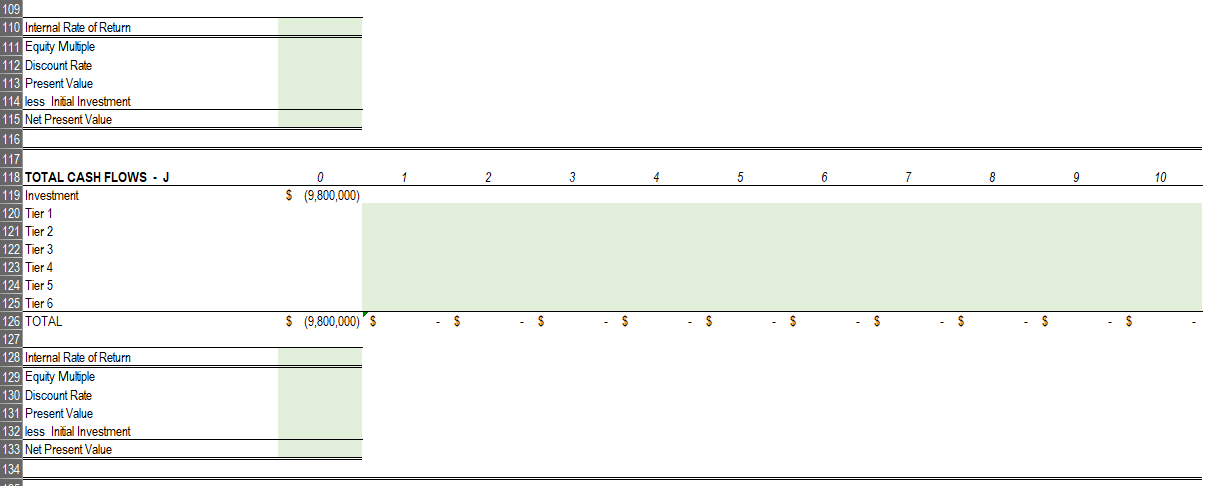

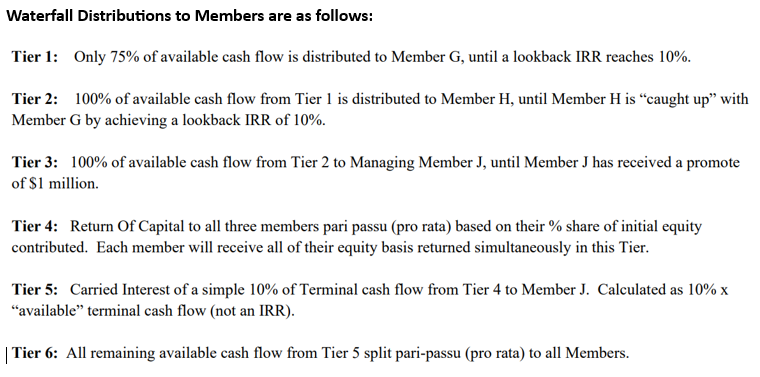

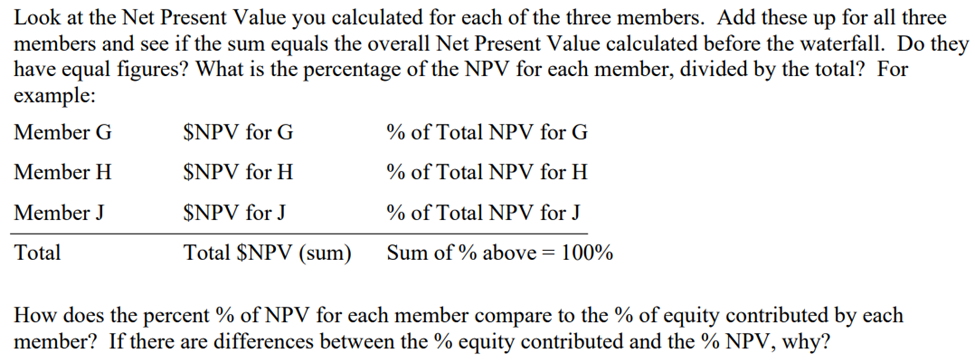

Members G,H and J form Residences at the National Gallery on January 1, 2024. Purpose of the LLC is to acquire an existing building on Trafalgar Square, across from the National Gallery, in London, UK, for redevelopment as a multifamily residential asset. The total cost including acquisition and redevelopment is $25,000,000. $15,000,000 of needed capital is from a redevelopment loan ( 60% Loan-To-Cost). The remaining $10,000,000 is equity from the Members of the LLC. Member J is the Sponsor and will be the Managing Member. Following is the breakdown of initial equity cash contributions (original basis): Assume all annual operating expenses, property taxes and debt service have been paid already. The Total Cash Flow To Equity Investors is what will be distributed to the LLC Members. Assume that the equity basis of the Members remains unchanged through the 10-year holding period. Annual and terminal cash flows are shown below, however, equity, splits, cash flows, distributions, internal rate of returns, and other items are not shown. EQUITY INVESTMENT Tier 5 : Carry of 10% Tier 6: Remainder Pari-Passu 0% 0% 0% TIER 4 RETURN OF CAPITAL TO ALL MEMBERS Cash Flow Avalable from Prior Tier Cash Flow to Member G Cumulative Capital Returned Cash Flow to Member H Cumulative Capital Returned Cumulative Capital Returned Remaining Cash Flow Investment $(100,000) Tier 2 Tier 3 Tier 4 Tier 5 TOTA T T T TOTA TOTA Internal Rate of Return Equity Mulfiple Discount Rate Present Value less Inffal Investment Net Present Value TOTAL CASH FLOWS - H 1 Investment 0 $(100,000) Tier 1 Tier 2 Tier 3 5 Tier 4 7 Tier 6 $(100,000)$ 8 TOTAL $(100,000)$ $ $ S $ $ $ 12 23 34 5 5 6 7 $ $ $ $ $ $ $ $ 9 10 109 \begin{tabular}{l} 110 Internal Rate of Return \\ 111 Equity Muffple \\ 112 Discount Rate \\ 113 Present Value \\ 114 less Inffal Investment \\ 115 Net Present Value \\ \hline \end{tabular} Waterfall Distributions to Members are as follows: Tier 1: Only 75% of available cash flow is distributed to Member G, until a lookback IRR reaches 10%. Tier 2: 100% of available cash flow from Tier 1 is distributed to Member H, until Member H is "caught up" with Member G by achieving a lookback IRR of 10%. Tier 3: 100% of available cash flow from Tier 2 to Managing Member J, until Member J has received a promote of \$1 million. Tier 4: Return Of Capital to all three members pari passu (pro rata) based on their % share of initial equity contributed. Each member will receive all of their equity basis returned simultaneously in this Tier. Tier 5: Carried Interest of a simple 10% of Terminal cash flow from Tier 4 to Member J. Calculated as 10%x "available" terminal cash flow (not an IRR). |Tier 6: All remaining available cash flow from Tier 5 split pari-passu (pro rata) to all Members. Look at the Net Present Value you calculated for each of the three members. Add these up for all three members and see if the sum equals the overall Net Present Value calculated before the waterfall. Do they have equal figures? What is the percentage of the NPV for each member, divided by the total? For example: How does the percent % of NPV for each member compare to the % of equity contributed by each member? If there are differences between the % equity contributed and the %NPV, why? Members G,H and J form Residences at the National Gallery on January 1, 2024. Purpose of the LLC is to acquire an existing building on Trafalgar Square, across from the National Gallery, in London, UK, for redevelopment as a multifamily residential asset. The total cost including acquisition and redevelopment is $25,000,000. $15,000,000 of needed capital is from a redevelopment loan ( 60% Loan-To-Cost). The remaining $10,000,000 is equity from the Members of the LLC. Member J is the Sponsor and will be the Managing Member. Following is the breakdown of initial equity cash contributions (original basis): Assume all annual operating expenses, property taxes and debt service have been paid already. The Total Cash Flow To Equity Investors is what will be distributed to the LLC Members. Assume that the equity basis of the Members remains unchanged through the 10-year holding period. Annual and terminal cash flows are shown below, however, equity, splits, cash flows, distributions, internal rate of returns, and other items are not shown. EQUITY INVESTMENT Tier 5 : Carry of 10% Tier 6: Remainder Pari-Passu 0% 0% 0% TIER 4 RETURN OF CAPITAL TO ALL MEMBERS Cash Flow Avalable from Prior Tier Cash Flow to Member G Cumulative Capital Returned Cash Flow to Member H Cumulative Capital Returned Cumulative Capital Returned Remaining Cash Flow Investment $(100,000) Tier 2 Tier 3 Tier 4 Tier 5 TOTA T T T TOTA TOTA Internal Rate of Return Equity Mulfiple Discount Rate Present Value less Inffal Investment Net Present Value TOTAL CASH FLOWS - H 1 Investment 0 $(100,000) Tier 1 Tier 2 Tier 3 5 Tier 4 7 Tier 6 $(100,000)$ 8 TOTAL $(100,000)$ $ $ S $ $ $ 12 23 34 5 5 6 7 $ $ $ $ $ $ $ $ 9 10 109 \begin{tabular}{l} 110 Internal Rate of Return \\ 111 Equity Muffple \\ 112 Discount Rate \\ 113 Present Value \\ 114 less Inffal Investment \\ 115 Net Present Value \\ \hline \end{tabular} Waterfall Distributions to Members are as follows: Tier 1: Only 75% of available cash flow is distributed to Member G, until a lookback IRR reaches 10%. Tier 2: 100% of available cash flow from Tier 1 is distributed to Member H, until Member H is "caught up" with Member G by achieving a lookback IRR of 10%. Tier 3: 100% of available cash flow from Tier 2 to Managing Member J, until Member J has received a promote of \$1 million. Tier 4: Return Of Capital to all three members pari passu (pro rata) based on their % share of initial equity contributed. Each member will receive all of their equity basis returned simultaneously in this Tier. Tier 5: Carried Interest of a simple 10% of Terminal cash flow from Tier 4 to Member J. Calculated as 10%x "available" terminal cash flow (not an IRR). |Tier 6: All remaining available cash flow from Tier 5 split pari-passu (pro rata) to all Members. Look at the Net Present Value you calculated for each of the three members. Add these up for all three members and see if the sum equals the overall Net Present Value calculated before the waterfall. Do they have equal figures? What is the percentage of the NPV for each member, divided by the total? For example: How does the percent % of NPV for each member compare to the % of equity contributed by each member? If there are differences between the % equity contributed and the %NPV, why

Members G,H and J form Residences at the National Gallery on January 1, 2024. Purpose of the LLC is to acquire an existing building on Trafalgar Square, across from the National Gallery, in London, UK, for redevelopment as a multifamily residential asset. The total cost including acquisition and redevelopment is $25,000,000. $15,000,000 of needed capital is from a redevelopment loan ( 60% Loan-To-Cost). The remaining $10,000,000 is equity from the Members of the LLC. Member J is the Sponsor and will be the Managing Member. Following is the breakdown of initial equity cash contributions (original basis): Assume all annual operating expenses, property taxes and debt service have been paid already. The Total Cash Flow To Equity Investors is what will be distributed to the LLC Members. Assume that the equity basis of the Members remains unchanged through the 10-year holding period. Annual and terminal cash flows are shown below, however, equity, splits, cash flows, distributions, internal rate of returns, and other items are not shown. EQUITY INVESTMENT Tier 5 : Carry of 10% Tier 6: Remainder Pari-Passu 0% 0% 0% TIER 4 RETURN OF CAPITAL TO ALL MEMBERS Cash Flow Avalable from Prior Tier Cash Flow to Member G Cumulative Capital Returned Cash Flow to Member H Cumulative Capital Returned Cumulative Capital Returned Remaining Cash Flow Investment $(100,000) Tier 2 Tier 3 Tier 4 Tier 5 TOTA T T T TOTA TOTA Internal Rate of Return Equity Mulfiple Discount Rate Present Value less Inffal Investment Net Present Value TOTAL CASH FLOWS - H 1 Investment 0 $(100,000) Tier 1 Tier 2 Tier 3 5 Tier 4 7 Tier 6 $(100,000)$ 8 TOTAL $(100,000)$ $ $ S $ $ $ 12 23 34 5 5 6 7 $ $ $ $ $ $ $ $ 9 10 109 \begin{tabular}{l} 110 Internal Rate of Return \\ 111 Equity Muffple \\ 112 Discount Rate \\ 113 Present Value \\ 114 less Inffal Investment \\ 115 Net Present Value \\ \hline \end{tabular} Waterfall Distributions to Members are as follows: Tier 1: Only 75% of available cash flow is distributed to Member G, until a lookback IRR reaches 10%. Tier 2: 100% of available cash flow from Tier 1 is distributed to Member H, until Member H is "caught up" with Member G by achieving a lookback IRR of 10%. Tier 3: 100% of available cash flow from Tier 2 to Managing Member J, until Member J has received a promote of \$1 million. Tier 4: Return Of Capital to all three members pari passu (pro rata) based on their % share of initial equity contributed. Each member will receive all of their equity basis returned simultaneously in this Tier. Tier 5: Carried Interest of a simple 10% of Terminal cash flow from Tier 4 to Member J. Calculated as 10%x "available" terminal cash flow (not an IRR). |Tier 6: All remaining available cash flow from Tier 5 split pari-passu (pro rata) to all Members. Look at the Net Present Value you calculated for each of the three members. Add these up for all three members and see if the sum equals the overall Net Present Value calculated before the waterfall. Do they have equal figures? What is the percentage of the NPV for each member, divided by the total? For example: How does the percent % of NPV for each member compare to the % of equity contributed by each member? If there are differences between the % equity contributed and the %NPV, why? Members G,H and J form Residences at the National Gallery on January 1, 2024. Purpose of the LLC is to acquire an existing building on Trafalgar Square, across from the National Gallery, in London, UK, for redevelopment as a multifamily residential asset. The total cost including acquisition and redevelopment is $25,000,000. $15,000,000 of needed capital is from a redevelopment loan ( 60% Loan-To-Cost). The remaining $10,000,000 is equity from the Members of the LLC. Member J is the Sponsor and will be the Managing Member. Following is the breakdown of initial equity cash contributions (original basis): Assume all annual operating expenses, property taxes and debt service have been paid already. The Total Cash Flow To Equity Investors is what will be distributed to the LLC Members. Assume that the equity basis of the Members remains unchanged through the 10-year holding period. Annual and terminal cash flows are shown below, however, equity, splits, cash flows, distributions, internal rate of returns, and other items are not shown. EQUITY INVESTMENT Tier 5 : Carry of 10% Tier 6: Remainder Pari-Passu 0% 0% 0% TIER 4 RETURN OF CAPITAL TO ALL MEMBERS Cash Flow Avalable from Prior Tier Cash Flow to Member G Cumulative Capital Returned Cash Flow to Member H Cumulative Capital Returned Cumulative Capital Returned Remaining Cash Flow Investment $(100,000) Tier 2 Tier 3 Tier 4 Tier 5 TOTA T T T TOTA TOTA Internal Rate of Return Equity Mulfiple Discount Rate Present Value less Inffal Investment Net Present Value TOTAL CASH FLOWS - H 1 Investment 0 $(100,000) Tier 1 Tier 2 Tier 3 5 Tier 4 7 Tier 6 $(100,000)$ 8 TOTAL $(100,000)$ $ $ S $ $ $ 12 23 34 5 5 6 7 $ $ $ $ $ $ $ $ 9 10 109 \begin{tabular}{l} 110 Internal Rate of Return \\ 111 Equity Muffple \\ 112 Discount Rate \\ 113 Present Value \\ 114 less Inffal Investment \\ 115 Net Present Value \\ \hline \end{tabular} Waterfall Distributions to Members are as follows: Tier 1: Only 75% of available cash flow is distributed to Member G, until a lookback IRR reaches 10%. Tier 2: 100% of available cash flow from Tier 1 is distributed to Member H, until Member H is "caught up" with Member G by achieving a lookback IRR of 10%. Tier 3: 100% of available cash flow from Tier 2 to Managing Member J, until Member J has received a promote of \$1 million. Tier 4: Return Of Capital to all three members pari passu (pro rata) based on their % share of initial equity contributed. Each member will receive all of their equity basis returned simultaneously in this Tier. Tier 5: Carried Interest of a simple 10% of Terminal cash flow from Tier 4 to Member J. Calculated as 10%x "available" terminal cash flow (not an IRR). |Tier 6: All remaining available cash flow from Tier 5 split pari-passu (pro rata) to all Members. Look at the Net Present Value you calculated for each of the three members. Add these up for all three members and see if the sum equals the overall Net Present Value calculated before the waterfall. Do they have equal figures? What is the percentage of the NPV for each member, divided by the total? For example: How does the percent % of NPV for each member compare to the % of equity contributed by each member? If there are differences between the % equity contributed and the %NPV, why Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started