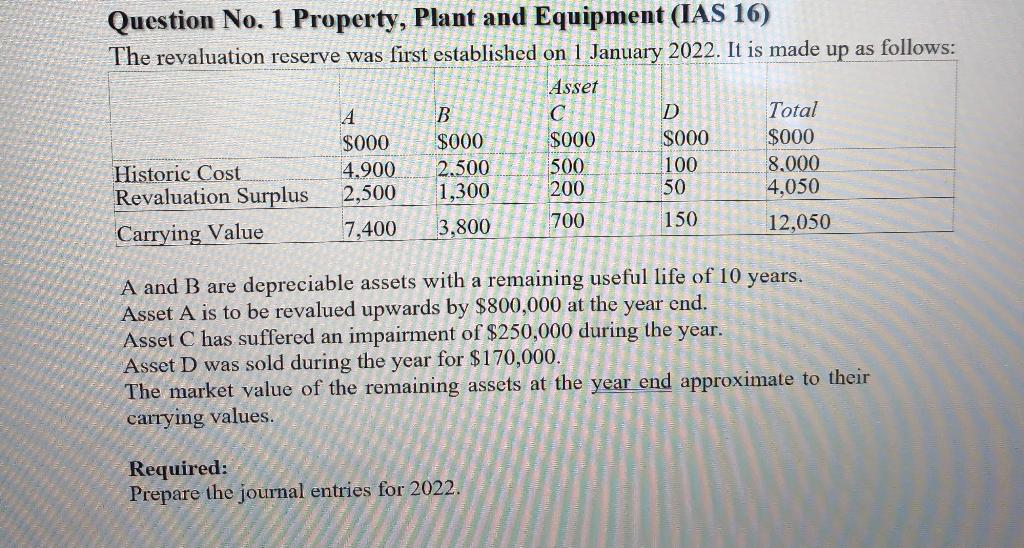

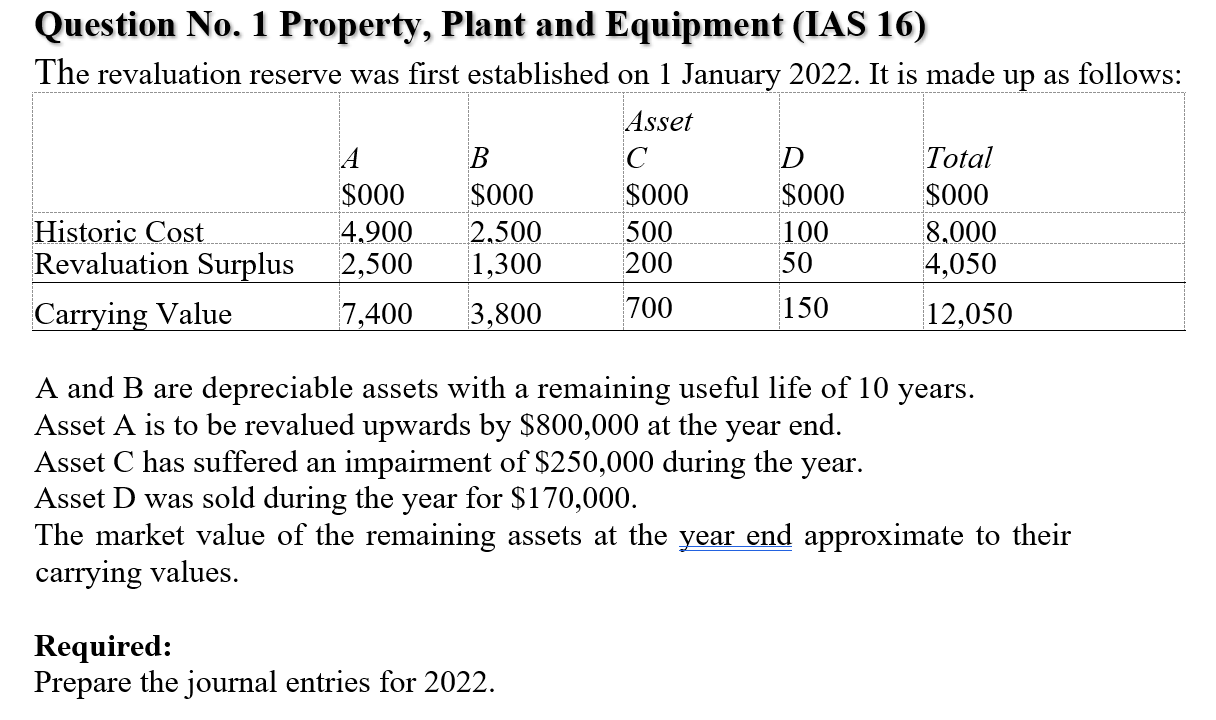

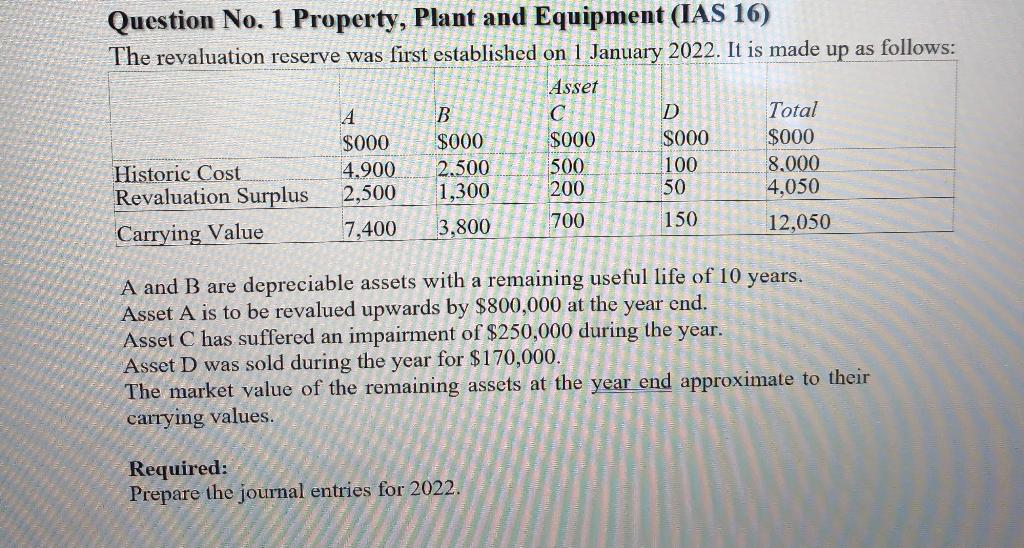

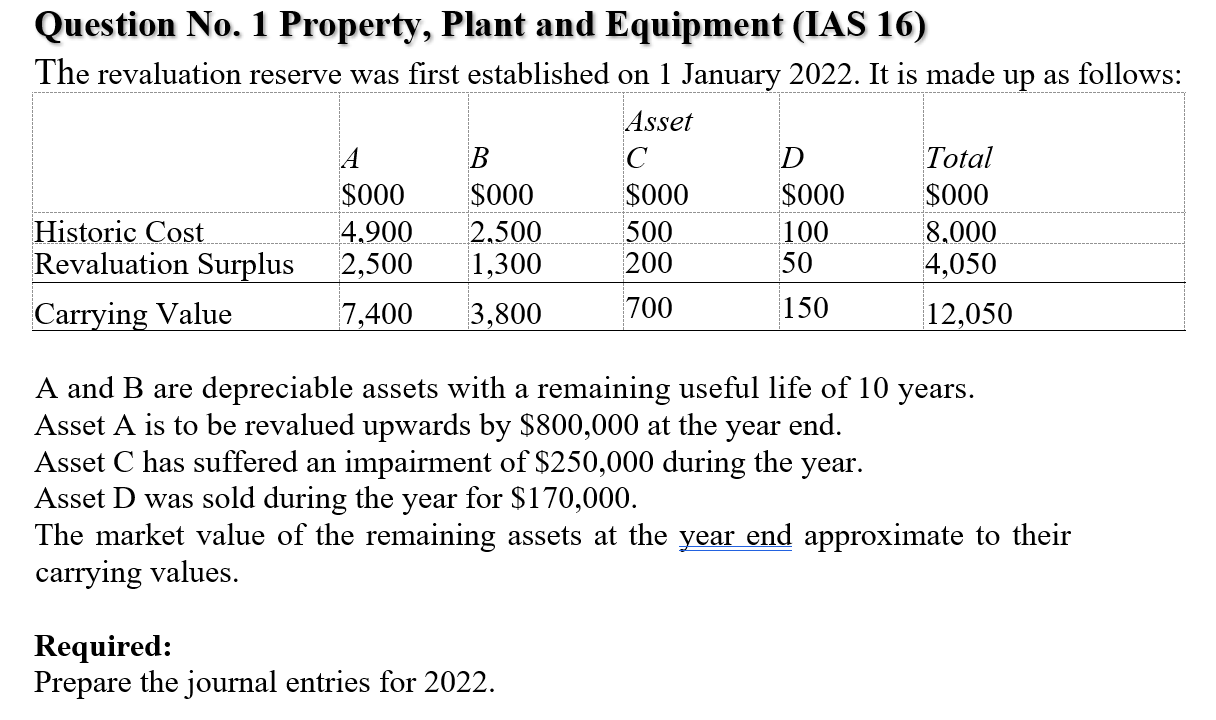

Question No. 1 Property, Plant and Equipment (IAS 16) The revaluation reserve was first established on 1 January 2022. It is made up as follows: A and B are depreciable assets with a remaining useful life of 10 years. Asset A is to be revalued upwards by $800,000 at the year end. Asset C has suffered an impairment of $250,000 during the year. Asset D was sold during the year for $170,000. The market value of the remaining assets at the year end approximate to their carrying values. Required: Prepare the journal entries for 2022. Question No. 1 Property, Plant and Equipment (IAS 16) The revaluation reserve was first established on 1 January 2022. It is made up as follows: A and B are depreciable assets with a remaining useful life of 10 years. Asset A is to be revalued upwards by $800,000 at the year end. Asset C has suffered an impairment of $250,000 during the year. Asset D was sold during the year for $170,000. The market value of the remaining assets at the year end approximate to their carrying values. Required: Prepare the journal entries for 2022. Question No. 1 Property, Plant and Equipment (IAS 16) The revaluation reserve was first established on 1 January 2022. It is made up as follows: A and B are depreciable assets with a remaining useful life of 10 years. Asset A is to be revalued upwards by $800,000 at the year end. Asset C has suffered an impairment of $250,000 during the year. Asset D was sold during the year for $170,000. The market value of the remaining assets at the year end approximate to their carrying values. Required: Prepare the journal entries for 2022. Question No. 1 Property, Plant and Equipment (IAS 16) The revaluation reserve was first established on 1 January 2022. It is made up as follows: A and B are depreciable assets with a remaining useful life of 10 years. Asset A is to be revalued upwards by $800,000 at the year end. Asset C has suffered an impairment of $250,000 during the year. Asset D was sold during the year for $170,000. The market value of the remaining assets at the year end approximate to their carrying values. Required: Prepare the journal entries for 2022