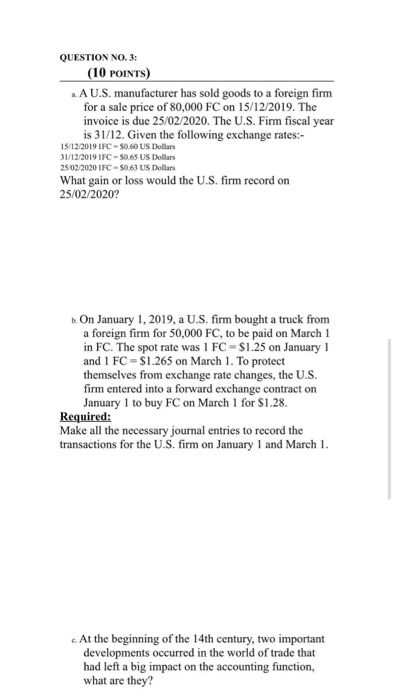

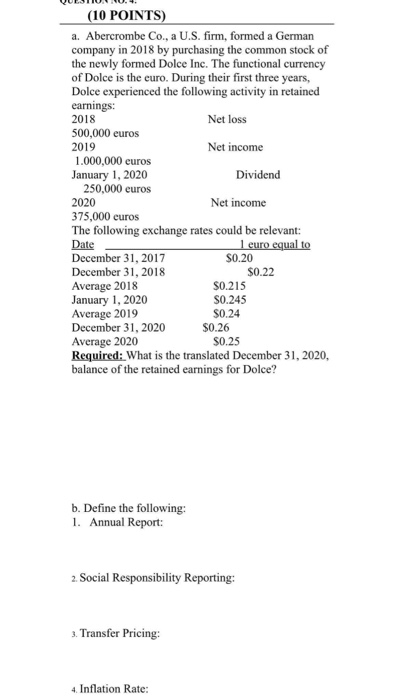

QUESTION NO. 2: MULTIPLE CHOICE STATEMENTS (10 POINTS) 1. What are the regulations suggested to improve the functioning of capital markets and alleviate the imperfect mechanism problem of communication between mangers and investors? 2. Equal treatment of foreign and domestic firms is a Principle of Operating Investor Oriented Markets, discuss? 3. What are the most important types of disclosures needed by users of financial statements around the world? QUESTION NO. 3: (10 POINTS) ..A U.S. manufacturer has sold goods to a foreign firm for a sale price of 80,000 FC on 15/12/2019. The invoice is due 25/02/2020. The U.S. Firm fiscal year is 31/12. Given the following exchange rates:- 15/12/2019 IFC -50.60 US Dollars 31/12/2019 1FC-50.65 US Dollars 25/02/2020 IFC -50,63 US Dollars What gain or loss would the U.S. firm record on 25/02/2020? b. On January 1, 2019, a U.S. firm bought a truck from a foreign firm for 50,000 FC, to be paid on March 1 in FC. The spot rate was 1 FC = $1.25 on January 1 and 1 FC - $1.265 on March 1. To protect themselves from exchange rate changes, the U.S. firm entered into a forward exchange contract on January 1 to buy FC on March 1 for $1.28. Required: Make all the necessary journal entries to record the transactions for the U.S. firm on January 1 and March 1. c. At the beginning of the 14th century, two important developments occurred in the world of trade that had left a big impact on the accounting function, what are they? (10 POINTS) a. Abercrombe Co., a U.S. firm, formed a German company in 2018 by purchasing the common stock of the newly formed Dolce Inc. The functional currency of Dolce is the euro. During their first three years, Dolce experienced the following activity in retained earnings: 2018 Net loss 500.000 euros 2019 Net income 1.000.000 euros January 1, 2020 Dividend 250.000 euros 2020 Net income 375,000 euros The following exchange rates could be relevant: Date 1 euro equal to December 31, 2017 $0.20 December 31, 2018 $0.22 Average 2018 $0.215 January 1, 2020 S0.245 Average 2019 $0.24 December 31, 2020 $0.26 Average 2020 $0.25 Required: What is the translated December 31, 2020, balance of the retained earnings for Dolce? b. Define the following: 1. Annual Report: 2. Social Responsibility Reporting: 3 3. Transfer Pricing: 4. Inflation Rate: QUESTION NO. 2: MULTIPLE CHOICE STATEMENTS (10 POINTS) 1. What are the regulations suggested to improve the functioning of capital markets and alleviate the imperfect mechanism problem of communication between mangers and investors? 2. Equal treatment of foreign and domestic firms is a Principle of Operating Investor Oriented Markets, discuss? 3. What are the most important types of disclosures needed by users of financial statements around the world? QUESTION NO. 3: (10 POINTS) ..A U.S. manufacturer has sold goods to a foreign firm for a sale price of 80,000 FC on 15/12/2019. The invoice is due 25/02/2020. The U.S. Firm fiscal year is 31/12. Given the following exchange rates:- 15/12/2019 IFC -50.60 US Dollars 31/12/2019 1FC-50.65 US Dollars 25/02/2020 IFC -50,63 US Dollars What gain or loss would the U.S. firm record on 25/02/2020? b. On January 1, 2019, a U.S. firm bought a truck from a foreign firm for 50,000 FC, to be paid on March 1 in FC. The spot rate was 1 FC = $1.25 on January 1 and 1 FC - $1.265 on March 1. To protect themselves from exchange rate changes, the U.S. firm entered into a forward exchange contract on January 1 to buy FC on March 1 for $1.28. Required: Make all the necessary journal entries to record the transactions for the U.S. firm on January 1 and March 1. c. At the beginning of the 14th century, two important developments occurred in the world of trade that had left a big impact on the accounting function, what are they? (10 POINTS) a. Abercrombe Co., a U.S. firm, formed a German company in 2018 by purchasing the common stock of the newly formed Dolce Inc. The functional currency of Dolce is the euro. During their first three years, Dolce experienced the following activity in retained earnings: 2018 Net loss 500.000 euros 2019 Net income 1.000.000 euros January 1, 2020 Dividend 250.000 euros 2020 Net income 375,000 euros The following exchange rates could be relevant: Date 1 euro equal to December 31, 2017 $0.20 December 31, 2018 $0.22 Average 2018 $0.215 January 1, 2020 S0.245 Average 2019 $0.24 December 31, 2020 $0.26 Average 2020 $0.25 Required: What is the translated December 31, 2020, balance of the retained earnings for Dolce? b. Define the following: 1. Annual Report: 2. Social Responsibility Reporting: 3 3. Transfer Pricing: 4. Inflation Rate