Answered step by step

Verified Expert Solution

Question

1 Approved Answer

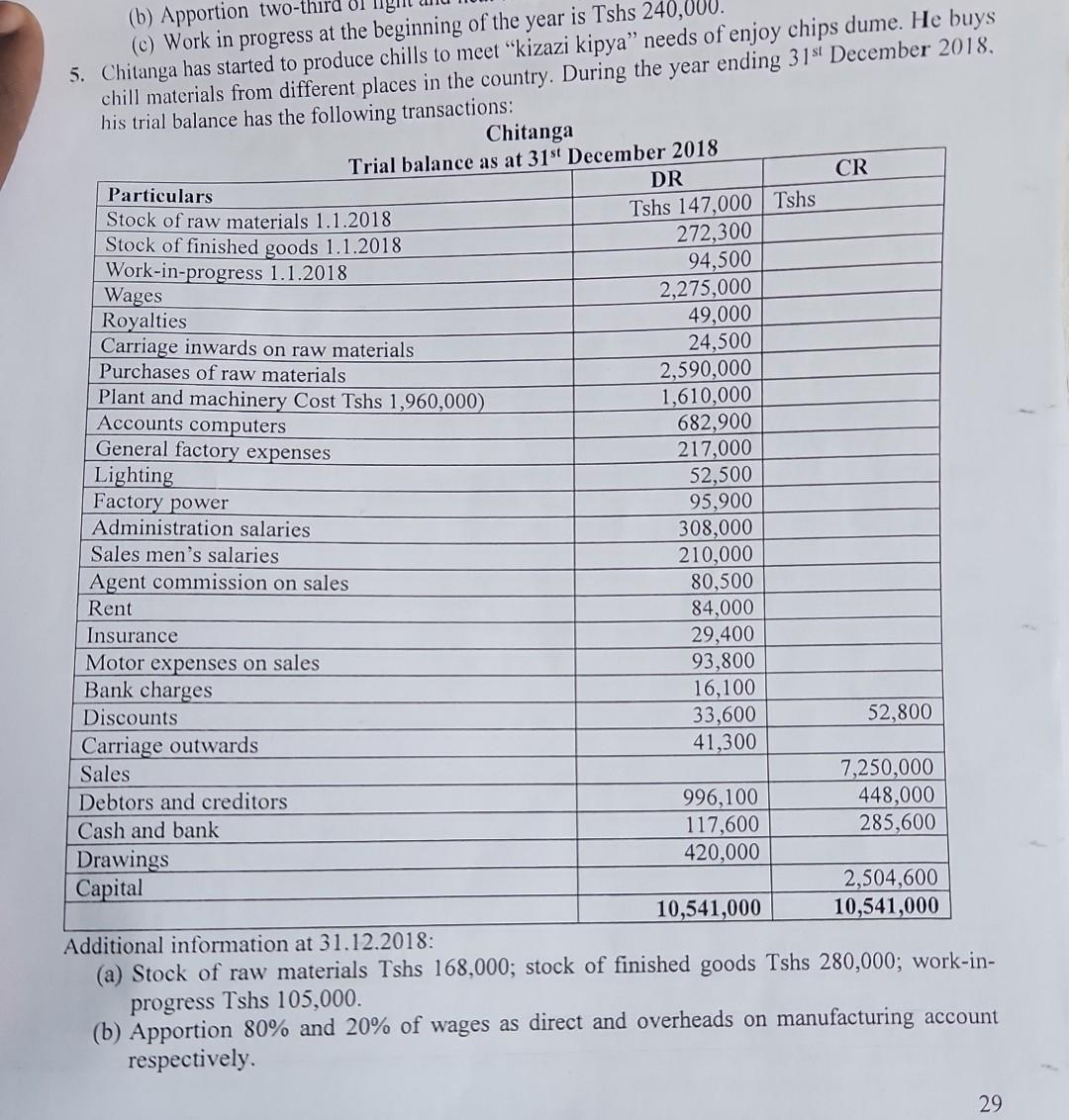

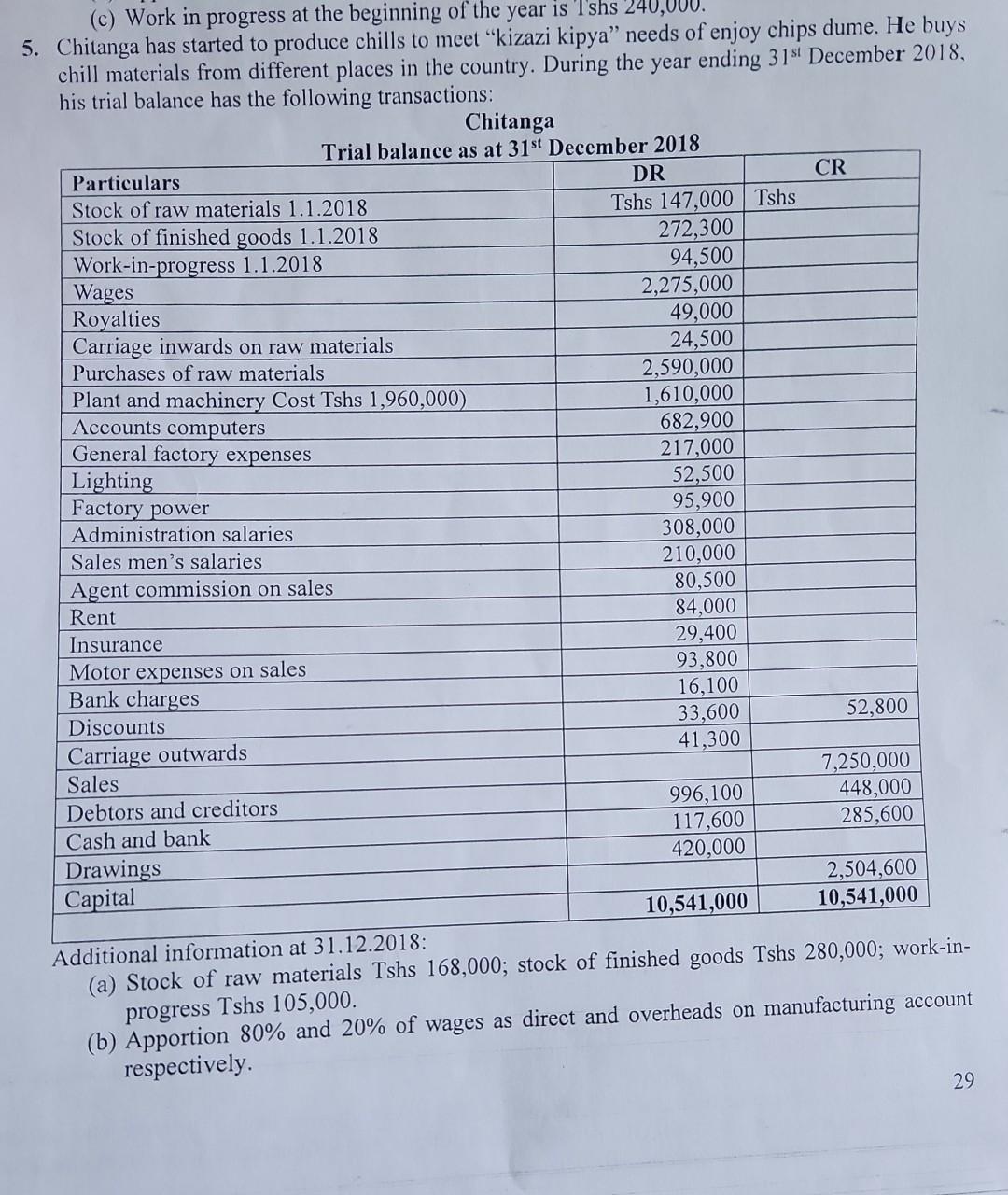

question no 5 (b) Apportion two-thrra ore beginning of the year is Tshs 240,000 . (c) Work in progress at the bey chips dume. He

question no 5

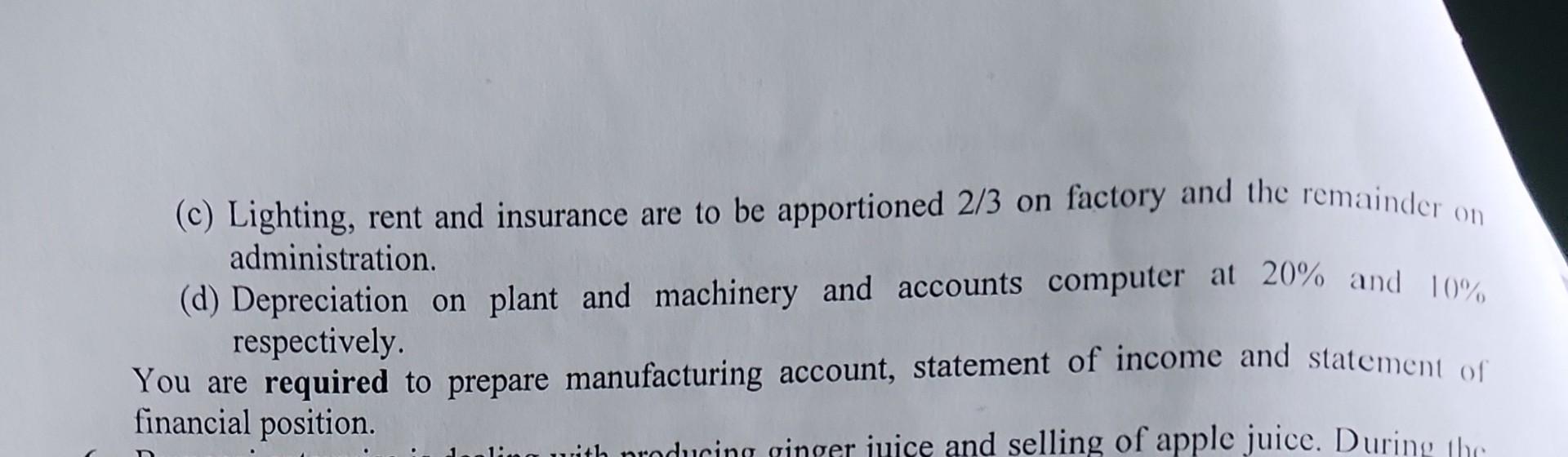

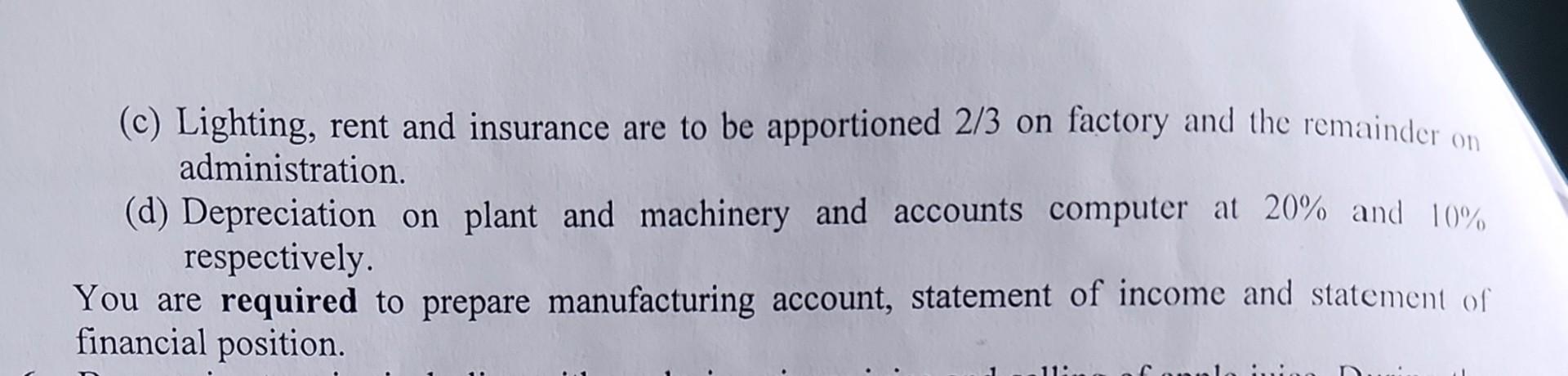

(b) Apportion two-thrra ore beginning of the year is Tshs 240,000 . (c) Work in progress at the bey chips dume. He buys 5. Chitanga has started to produce chills to meet "kizazi kipya" needs of enjoy chips dume. He buys 31 si December 2018. his trial balance has the following transactions: Additional information at 31.12.2018 : (a) Stock of raw materials Tshs 168,000; stock of finished goods Tshs 280,000; work-inprogress Tshs 105,000 (b) Apportion 80% and 20% of wages as direct and overheads on manufacturing account respectively. 5. Chitanga has started to produce chills to meet "kizazi kipya" needs of enjoy chips dume. He buys chill materials from different places in the country. During the year ending 31si December 2018. his trial balance has the following transactions: Additional information at 31.12.2018: (a) Stock of raw materials Tshs 168,000 ; stock of finished goods Tshs 280,000; work-inprogress the 105,000 . (b) Apportion 80% and 20% of wages as direct and overheads on manufacturing account respectively. (c) Lighting, rent and insurance are to be apportioned 2/3 on factory and the remainder on administration. (d) Depreciation on plant and machinery and accounts computer at 20% and 10% respectively. You are required to prepare manufacturing account, statement of income and statement of financial position. (c) Lighting, rent and insurance are to be apportioned 2/3 on factory and the remainder on administration. (d) Depreciation on plant and machinery and accounts computer at 20\% and 10\% respectively. You are required to prepare manufacturing account, statement of income and statement of financial position

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started