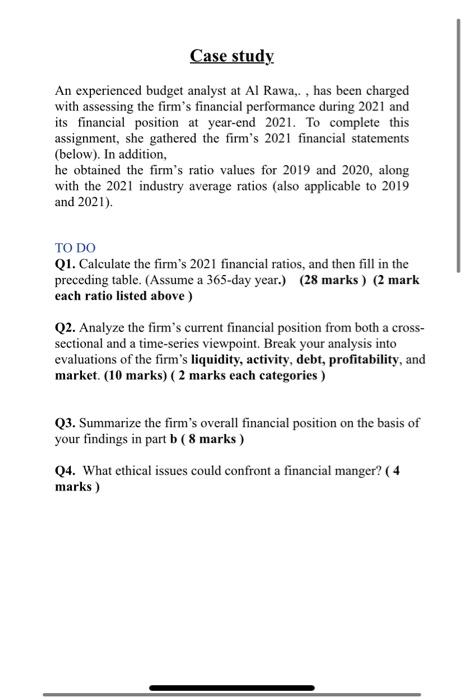

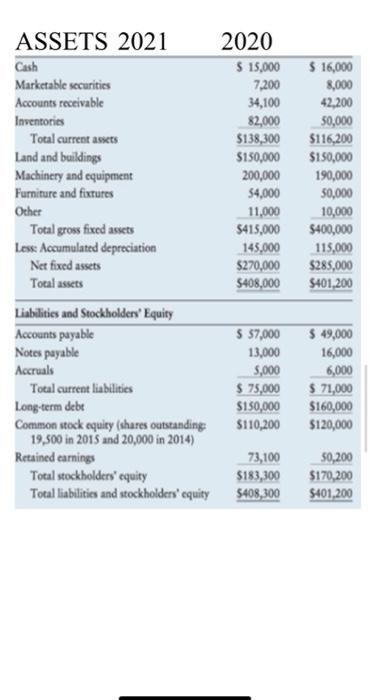

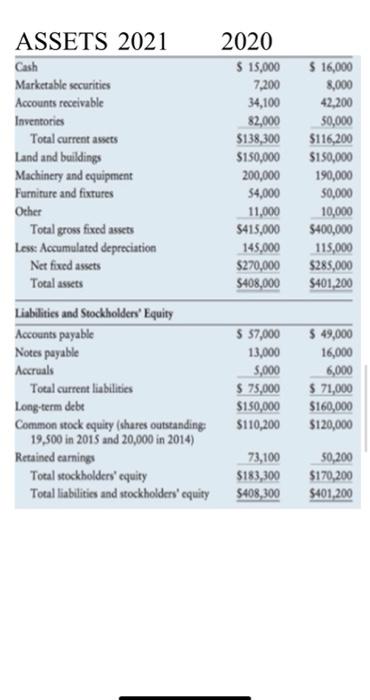

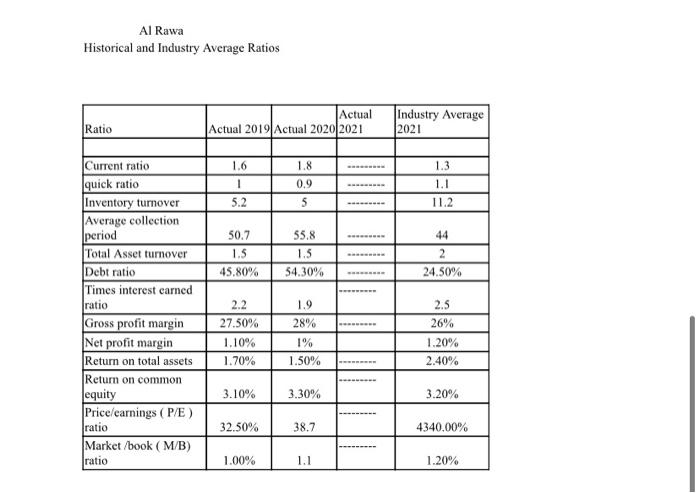

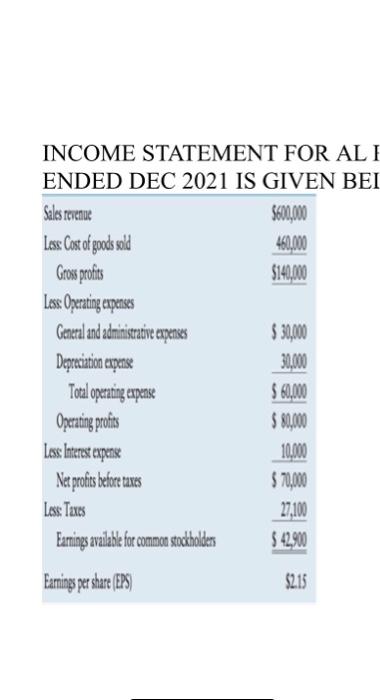

An experienced budget analyst at Al Rawa,. , has been charged with assessing the firm's financial performance during 2021 and its financial position at year-end 2021. To complete this assignment, she gathered the firm's 2021 financial statements (below). In addition, he obtained the firm's ratio values for 2019 and 2020, along with the 2021 industry average ratios (also applicable to 2019 and 2021). TO DO Q1. Calculate the firm's 2021 financial ratios, and then fill in the preceding table. (Assume a 365-day year.) (28 marks) (2 mark each ratio listed above) Q2. Analyze the firm's current financial position from both a crosssectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. (10 marks) ( 2 marks each categories) Q3. Summarize the firm's overall financial position on the basis of your findings in part b ( 8 marks) Q4. What ethical issues could confront a financial manger? ( 4 marks ) Al Rawa Historical and Industry Average Ratios INCOME STATEMENT FOR AL I An experienced budget analyst at Al Rawa,. , has been charged with assessing the firm's financial performance during 2021 and its financial position at year-end 2021. To complete this assignment, she gathered the firm's 2021 financial statements (below). In addition, he obtained the firm's ratio values for 2019 and 2020, along with the 2021 industry average ratios (also applicable to 2019 and 2021). TO DO Q1. Calculate the firm's 2021 financial ratios, and then fill in the preceding table. (Assume a 365-day year.) (28 marks) (2 mark each ratio listed above) Q2. Analyze the firm's current financial position from both a crosssectional and a time-series viewpoint. Break your analysis into evaluations of the firm's liquidity, activity, debt, profitability, and market. (10 marks) ( 2 marks each categories) Q3. Summarize the firm's overall financial position on the basis of your findings in part b ( 8 marks) Q4. What ethical issues could confront a financial manger? ( 4 marks ) Al Rawa Historical and Industry Average Ratios INCOME STATEMENT FOR AL