Question

Question number 1: Davy Company had a beginning work in process inventory balance of $32,000. During the year, $54,500 of direct materials was placed into

Question number 1:

Davy Company had a beginning work in process inventory balance of $32,000. During the year, $54,500 of direct materials was placed into production. Direct labor was $63,400, and indirect labor was $19,500. Manufacturing overhead is applied at 125% of direct labor costs. Actual manufacturing overhead was $86,500, and jobs costing $225,000 were completed during the year.

What is the ending work in process inventory balance?

- $172,000

- $ 11,400

- $ 4,150

- $ 79,250

Question number 2:

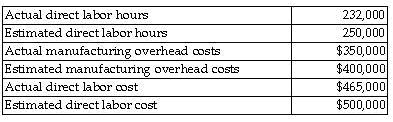

Nadal Company is debating the use of direct labor cost or direct labor hours as the cost allocation base for applying manufacturing overhead. The following information is available for the most recent year:

If Nadal Company uses direct labor hours as the allocation base, what would the applied manufacturing overhead be for the year?

- $324,800

- $350,000

- $400,000

- $371,200

Actual direct labor hours Estimated directlabor hours Actual manufacturing overhead costs Estimated manufacturing overhead costs Actual direct labor cost Estimated direct labor cost 232,000 250,000 $350,000 $400,000 $465,000 $500,000 Actual direct labor hours Estimated directlabor hours Actual manufacturing overhead costs Estimated manufacturing overhead costs Actual direct labor cost Estimated direct labor cost 232,000 250,000 $350,000 $400,000 $465,000 $500,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started