Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question number 2 are written question 2. the sales tax requiremnets for business in quebec 3. the pay roll reporting requirements for business for quebec

question number 2 are written question

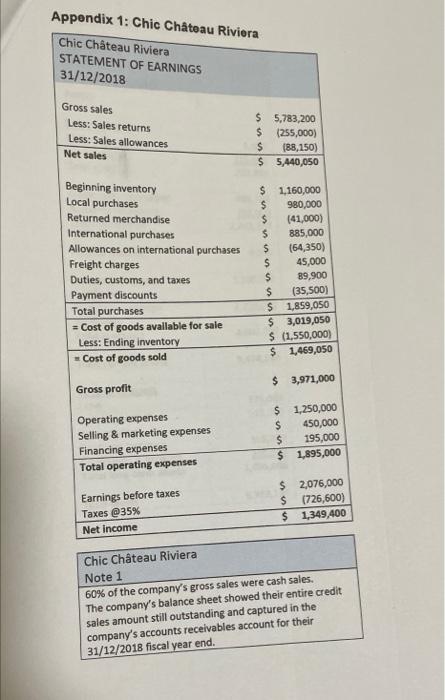

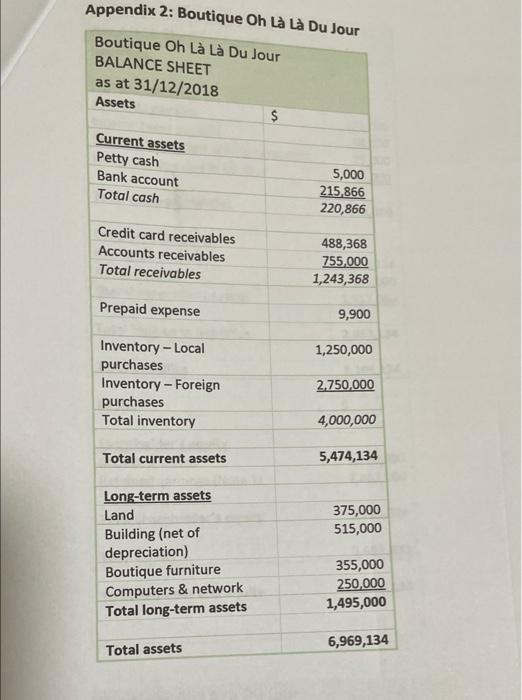

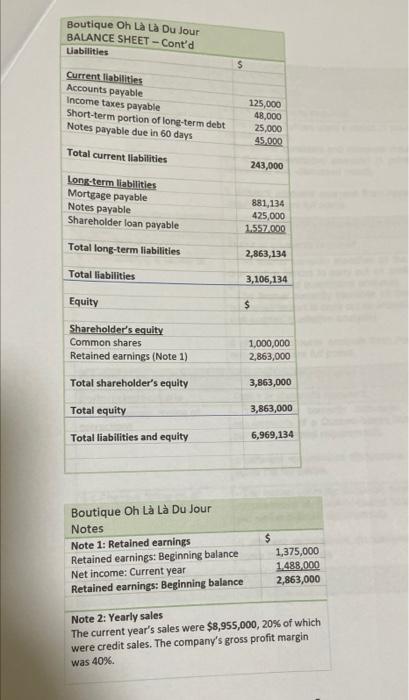

Scenario 1 After two decades working in various executive positions at medium and large apparel companies around the country, Mr. Yves St Germain has decided to purchase an existing retail clothing business. He intends to oversee the entire operation and grow the company to compete with other comparably sized retail establishments in North America. Mr. St. Germain wants to run a retail business that attracts as many customers as possible by carrying the trendiest inventory, providing impeccable customer service, and generating steady revenue, all while meeting its sales tax and payroll reporting requirements. Mr. St. Germain has come to you to help him with his investment in the retail business. He provides you with financial Information about the two companies he is interested in exploring as possible investment ventures, Appendix 1 contains information on Chic Chateau Riviera, based in the city of Quebec Appendix 2 contains information on Boutique Oh La La Du Jour, based in the city of Montreal. Instructions 1) Choose which company you would recommend to Mr. St. Germain, and explain your choice Provide detailed quantitative and qualitative analyses supporting your recommendation 2) Describe the sales tax reporting requirements for a Quebec-based business that your client must know (200-250 words) 3) Describe the key payroll reporting requirements for a Quebec-based business that your client must know (200-250 words). 2019/03/08 Appendix 1: Chic Chteau Riviera Chic Chteau Riviera STATEMENT OF EARNINGS 31/12/2018 Gross sales Less: Sales returns Less: Sales allowances Net sales $ 5,783,200 $ (255,000) $ (88,150) $ 5,440,050 Beginning inventory Local purchases Returned merchandise International purchases Allowances on international purchases Freight charges Duties, customs, and taxes Payment discounts Total purchases = Cost of goods avallable for sale Less: Ending inventory Cost of goods sold $ 1.160,000 $ 980,000 $ (41,000) $ 885,000 $ (64,350) $ 45,000 $ 89,900 $ (35,500) $ 1,859,050 $ 3,019,050 $ (1,550,000) $ 1,469,050 $ 3,971,000 Gross profit Operating expenses Selling & marketing expenses Financing expenses Total operating expenses $ 1,250,000 $ 450,000 $ 195,000 $ 1.895,000 Earnings before taxes Taxes @35% Net Income $ 2,076,000 $ (726,600) $ 1,349,400 Chic Chteau Riviera Note 1 60% of the company's gross sales were cash sales. The company's balance sheet showed their entire credit sales amount still outstanding and captured in the company's accounts receivables account for their 31/12/2018 fiscal year end. Appendix 2: Boutique Oh L L Du Jour Boutique Oh L L Du Jour BALANCE SHEET as at 31/12/2018 Assets Current assets Petty cash Bank account Total cash 5,000 215,866 220,866 Credit card receivables Accounts receivables Total receivables 488,368 755,000 1,243,368 Prepaid expense 9,900 1,250,000 Inventory - Local purchases Inventory - Foreign purchases Total inventory 2.750,000 4,000,000 Total current assets 5,474,134 375,000 515,000 Long-term assets Land Building (net of depreciation) Boutique furniture Computers & network Total long-term assets 355,000 250,000 1,495,000 Total assets 6,969,134 Boutique Oh La L Du Jour BALANCE SHEET - Cont'd Liabilities $ 125,000 48,000 25,000 45.000 Current liabilities Accounts payable Income taxes payable Short-term portion of long-term debt Notes payable due in 60 days Total current liabilities long-term liabilities Mortgage payable Notes payable Shareholder loan payable 243,000 881,134 425,000 1.557.000 Total long-term liabilities 2,863,134 3,106,134 Total liabilities Equity $ Shareholder's equity Common shares Retained earnings (Note 1) 1,000,000 2,863,000 3,863,000 Total shareholder's equity Total equity Total liabilities and equity 3,863,000 6,969,134 Boutique Oh L L Du Jour Notes Note 1: Retained earnings Retained earnings: Beginning balance Net income: Current year Retained earnings: Beginning balance $ 1,375,000 1.488.000 2,863,000 Note 2: Yearly sales The current year's sales were $8,955,000, 20% of which were credit sales. The company's gross profit margin was 40% Scenario 1 After two decades working in various executive positions at medium and large apparel companies around the country, Mr. Yves St Germain has decided to purchase an existing retail clothing business. He intends to oversee the entire operation and grow the company to compete with other comparably sized retail establishments in North America. Mr. St. Germain wants to run a retail business that attracts as many customers as possible by carrying the trendiest inventory, providing impeccable customer service, and generating steady revenue, all while meeting its sales tax and payroll reporting requirements. Mr. St. Germain has come to you to help him with his investment in the retail business. He provides you with financial Information about the two companies he is interested in exploring as possible investment ventures, Appendix 1 contains information on Chic Chateau Riviera, based in the city of Quebec Appendix 2 contains information on Boutique Oh La La Du Jour, based in the city of Montreal. Instructions 1) Choose which company you would recommend to Mr. St. Germain, and explain your choice Provide detailed quantitative and qualitative analyses supporting your recommendation 2) Describe the sales tax reporting requirements for a Quebec-based business that your client must know (200-250 words) 3) Describe the key payroll reporting requirements for a Quebec-based business that your client must know (200-250 words). 2019/03/08 Appendix 1: Chic Chteau Riviera Chic Chteau Riviera STATEMENT OF EARNINGS 31/12/2018 Gross sales Less: Sales returns Less: Sales allowances Net sales $ 5,783,200 $ (255,000) $ (88,150) $ 5,440,050 Beginning inventory Local purchases Returned merchandise International purchases Allowances on international purchases Freight charges Duties, customs, and taxes Payment discounts Total purchases = Cost of goods avallable for sale Less: Ending inventory Cost of goods sold $ 1.160,000 $ 980,000 $ (41,000) $ 885,000 $ (64,350) $ 45,000 $ 89,900 $ (35,500) $ 1,859,050 $ 3,019,050 $ (1,550,000) $ 1,469,050 $ 3,971,000 Gross profit Operating expenses Selling & marketing expenses Financing expenses Total operating expenses $ 1,250,000 $ 450,000 $ 195,000 $ 1.895,000 Earnings before taxes Taxes @35% Net Income $ 2,076,000 $ (726,600) $ 1,349,400 Chic Chteau Riviera Note 1 60% of the company's gross sales were cash sales. The company's balance sheet showed their entire credit sales amount still outstanding and captured in the company's accounts receivables account for their 31/12/2018 fiscal year end. Appendix 2: Boutique Oh L L Du Jour Boutique Oh L L Du Jour BALANCE SHEET as at 31/12/2018 Assets Current assets Petty cash Bank account Total cash 5,000 215,866 220,866 Credit card receivables Accounts receivables Total receivables 488,368 755,000 1,243,368 Prepaid expense 9,900 1,250,000 Inventory - Local purchases Inventory - Foreign purchases Total inventory 2.750,000 4,000,000 Total current assets 5,474,134 375,000 515,000 Long-term assets Land Building (net of depreciation) Boutique furniture Computers & network Total long-term assets 355,000 250,000 1,495,000 Total assets 6,969,134 Boutique Oh La L Du Jour BALANCE SHEET - Cont'd Liabilities $ 125,000 48,000 25,000 45.000 Current liabilities Accounts payable Income taxes payable Short-term portion of long-term debt Notes payable due in 60 days Total current liabilities long-term liabilities Mortgage payable Notes payable Shareholder loan payable 243,000 881,134 425,000 1.557.000 Total long-term liabilities 2,863,134 3,106,134 Total liabilities Equity $ Shareholder's equity Common shares Retained earnings (Note 1) 1,000,000 2,863,000 3,863,000 Total shareholder's equity Total equity Total liabilities and equity 3,863,000 6,969,134 Boutique Oh L L Du Jour Notes Note 1: Retained earnings Retained earnings: Beginning balance Net income: Current year Retained earnings: Beginning balance $ 1,375,000 1.488.000 2,863,000 Note 2: Yearly sales The current year's sales were $8,955,000, 20% of which were credit sales. The company's gross profit margin was 40% 2. the sales tax requiremnets for business in quebec

3. the pay roll reporting requirements for business for quebec

and question 1 included in all apendix

thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started