Question on image

Question on image

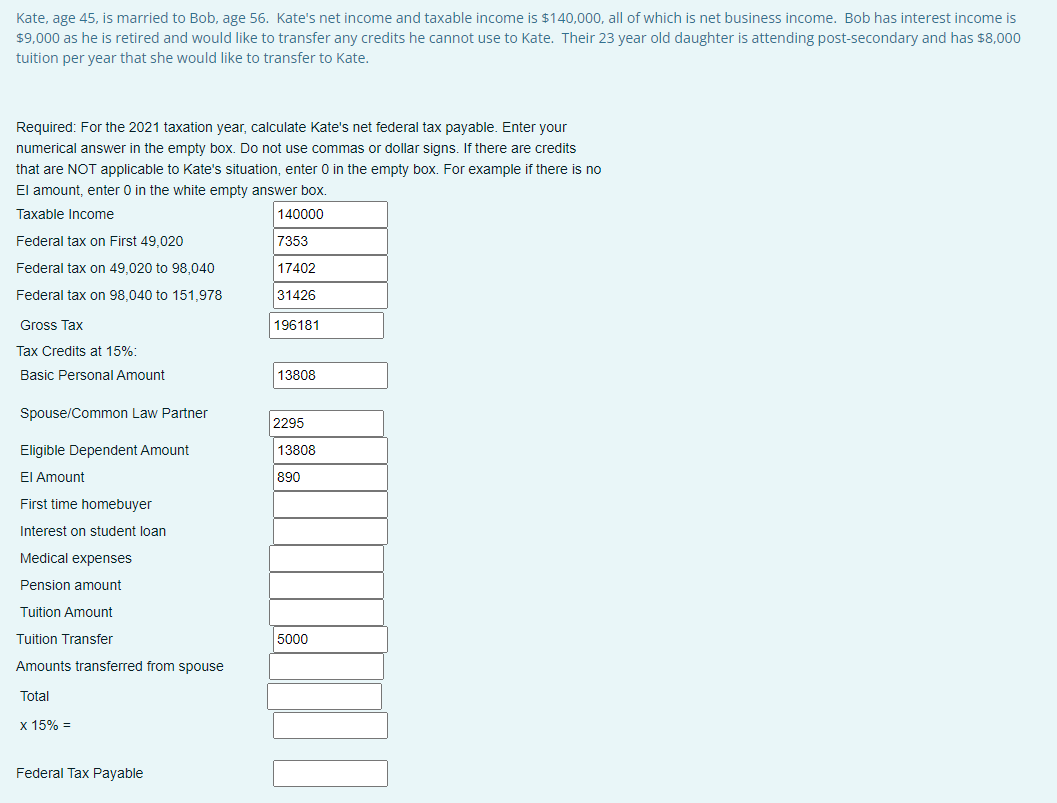

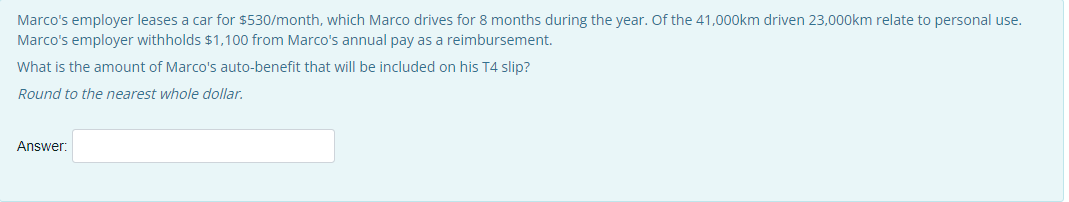

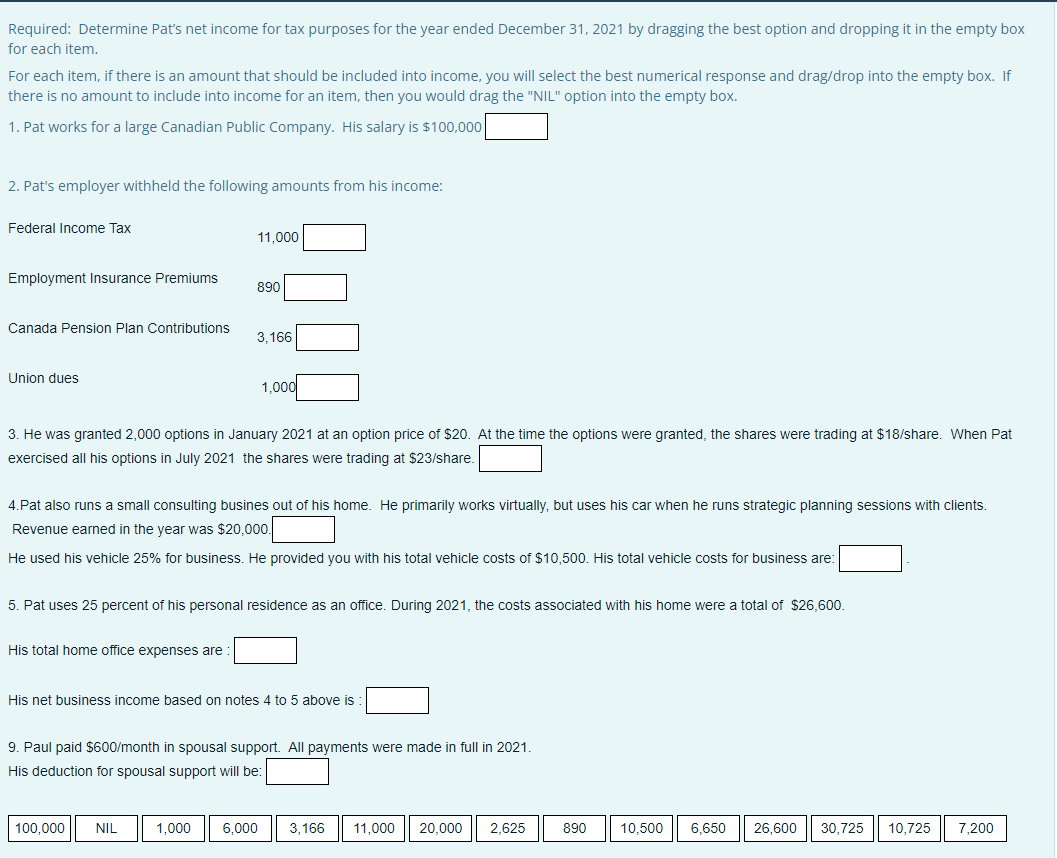

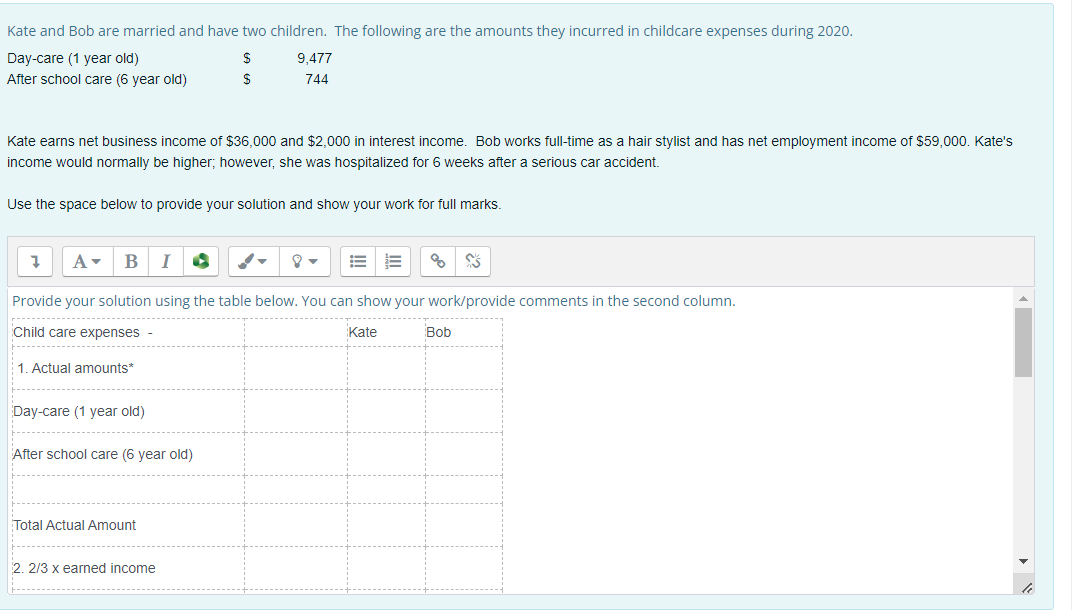

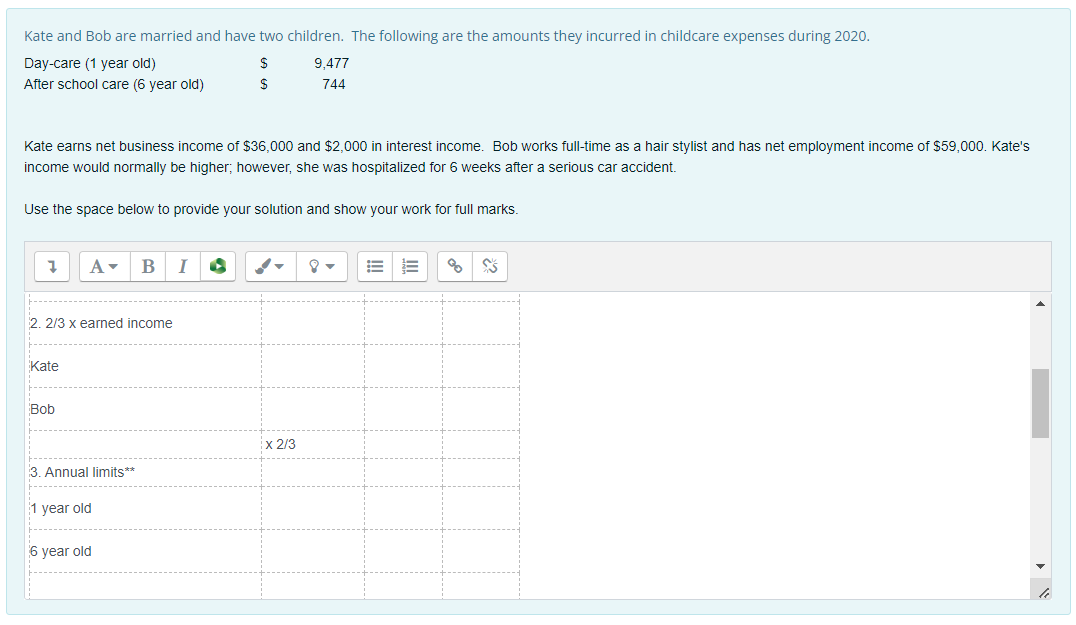

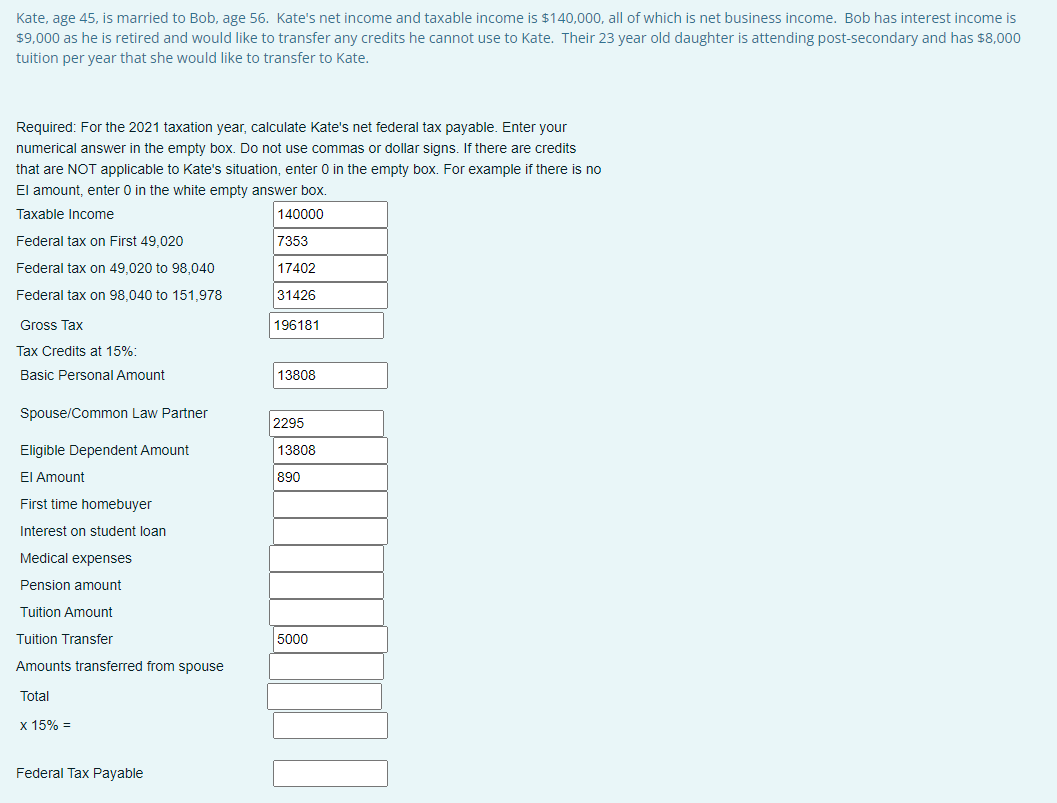

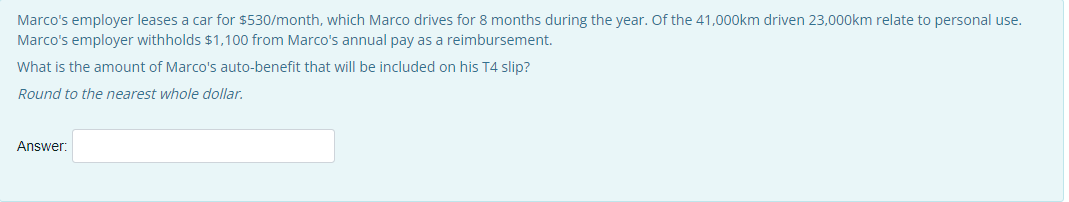

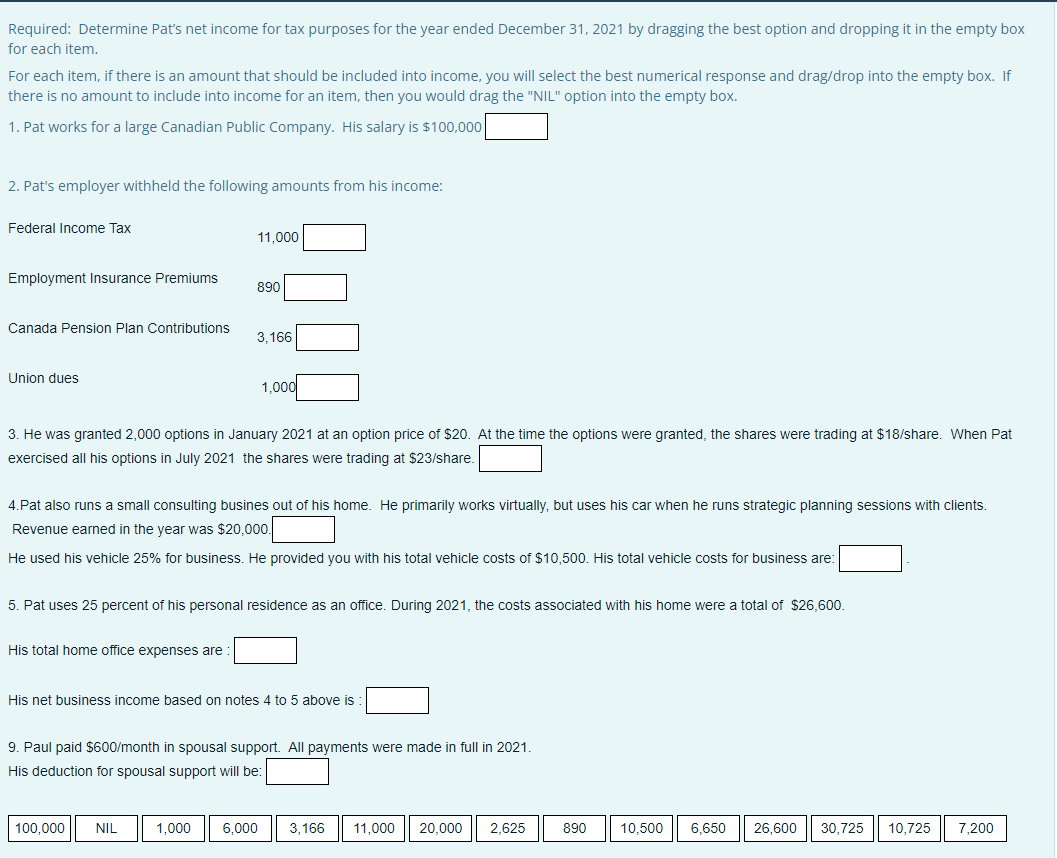

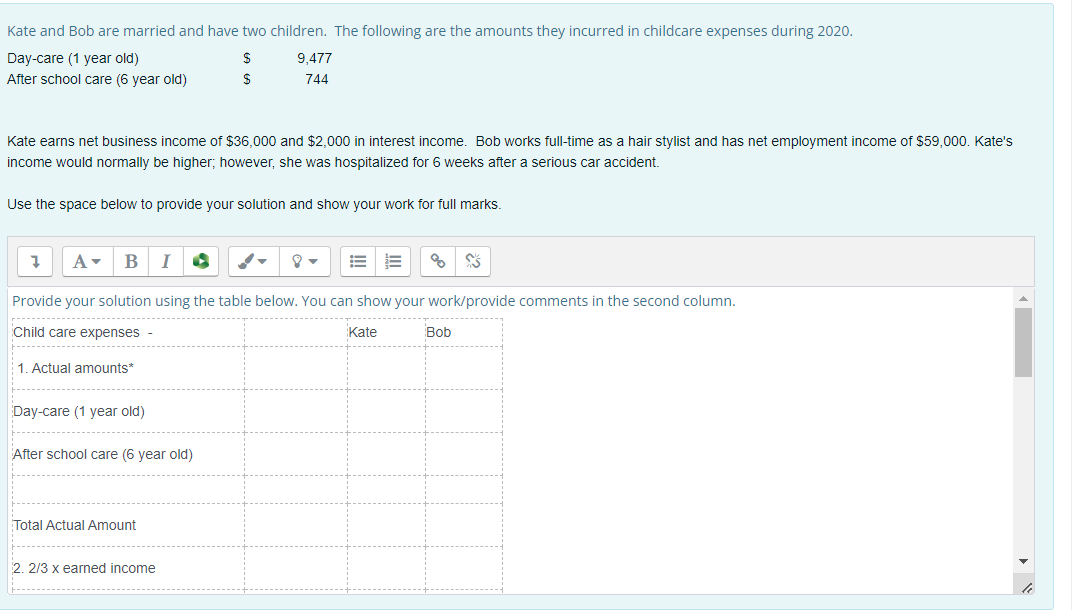

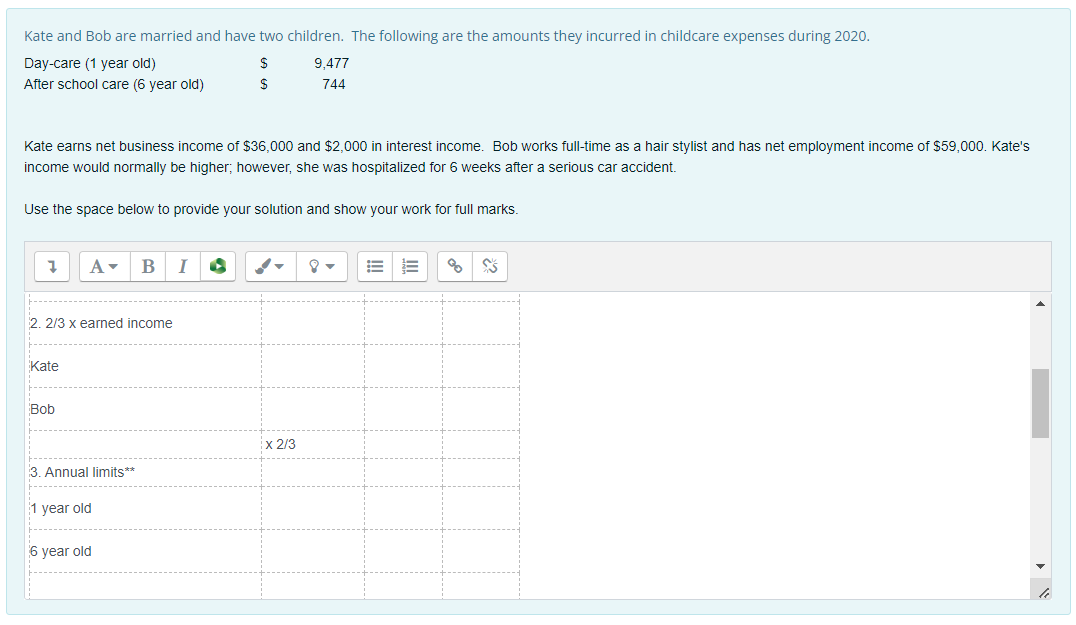

Kate, age 45 , is married to Bob, age 56 . Kate's net income and taxable income is $140,000, all of which is net business income. Bob has interest income is $9,000 as he is retired and would like to transfer any credits he cannot use to Kate. Their 23 year old daughter is attending post-secondary and has $8,000 tuition per year that she would like to transfer to Kate. Required: For the 2021 taxation year, calculate Kate's net federal tax payable. Enter your numerical answer in the empty box. Do not use commas or dollar signs. If there are credits that are NOT applicable to Kate's situation, enter 0 in the empty box. For example if there is no Marco's employer leases a car for $530/month, which Marco drives for 8 months during the year. Of the 41,000km driven 23,000km relate to personal use. Marco's employer withholds $1,100 from Marco's annual pay as a reimbursement. What is the amount of Marco's auto-benefit that will be included on his T4 slip? Round to the nearest whole dollar. Answer: Required: Determine Pat's net income for tax purposes for the year ended December 31,2021 by dragging the best option and dropping it in the empty box for each item. For each item, if there is an amount that should be included into income, you will select the best numerical response and drag/drop into the empty box. If there is no amount to include into income for an item, then you would drag the "NIL" option into the empty box. 1. Pat works for a large Canadian Public Company. His salary is $100,000 2. Pat's employer withheld the following amounts from his income: 3. He was granted 2,000 options in January 2021 at an option price of $20. At the time the options were granted, the shares were trading at $18/ share. When Pat exercised all his options in July 2021 the shares were trading at $23/ share. 4.Pat also runs a small consulting busines out of his home. He primarily works virtually, but uses his car when he runs strategic planning sessions with clients. Revenue earned in the year was $20,000 He used his vehicle 25% for business. He provided you with his total vehicle costs of $10,500. His total vehicle costs for business are: 5. Pat uses 25 percent of his personal residence as an office. During 2021 , the costs associated with his home were a total of $26,600. His total home office expenses are : His net business income based on notes 4 to 5 above is: 9. Paul paid $600/ month in spousal support. All payments were made in full in 2021. His deduction for spousal support will be: Kate earns net business income of $36,000 and $2,000 in interest income. Bob works full-time as a hair stylist and has net employment income of $59,000. Kate's income would normally be higher; however, she was hospitalized for 6 weeks after a serious car accident. Use the space below to provide your solution and show your work for full marks. Kate earns net business income of $36,000 and $2,000 in interest income. Bob works full-time as a hair stylist and has net employment income of $59,000. Kate's income would normally be higher; however, she was hospitalized for 6 weeks after a serious car accident. Use the space below to provide your solution and show your work for full marks. Kate, age 45 , is married to Bob, age 56 . Kate's net income and taxable income is $140,000, all of which is net business income. Bob has interest income is $9,000 as he is retired and would like to transfer any credits he cannot use to Kate. Their 23 year old daughter is attending post-secondary and has $8,000 tuition per year that she would like to transfer to Kate. Required: For the 2021 taxation year, calculate Kate's net federal tax payable. Enter your numerical answer in the empty box. Do not use commas or dollar signs. If there are credits that are NOT applicable to Kate's situation, enter 0 in the empty box. For example if there is no Marco's employer leases a car for $530/month, which Marco drives for 8 months during the year. Of the 41,000km driven 23,000km relate to personal use. Marco's employer withholds $1,100 from Marco's annual pay as a reimbursement. What is the amount of Marco's auto-benefit that will be included on his T4 slip? Round to the nearest whole dollar. Answer: Required: Determine Pat's net income for tax purposes for the year ended December 31,2021 by dragging the best option and dropping it in the empty box for each item. For each item, if there is an amount that should be included into income, you will select the best numerical response and drag/drop into the empty box. If there is no amount to include into income for an item, then you would drag the "NIL" option into the empty box. 1. Pat works for a large Canadian Public Company. His salary is $100,000 2. Pat's employer withheld the following amounts from his income: 3. He was granted 2,000 options in January 2021 at an option price of $20. At the time the options were granted, the shares were trading at $18/ share. When Pat exercised all his options in July 2021 the shares were trading at $23/ share. 4.Pat also runs a small consulting busines out of his home. He primarily works virtually, but uses his car when he runs strategic planning sessions with clients. Revenue earned in the year was $20,000 He used his vehicle 25% for business. He provided you with his total vehicle costs of $10,500. His total vehicle costs for business are: 5. Pat uses 25 percent of his personal residence as an office. During 2021 , the costs associated with his home were a total of $26,600. His total home office expenses are : His net business income based on notes 4 to 5 above is: 9. Paul paid $600/ month in spousal support. All payments were made in full in 2021. His deduction for spousal support will be: Kate earns net business income of $36,000 and $2,000 in interest income. Bob works full-time as a hair stylist and has net employment income of $59,000. Kate's income would normally be higher; however, she was hospitalized for 6 weeks after a serious car accident. Use the space below to provide your solution and show your work for full marks. Kate earns net business income of $36,000 and $2,000 in interest income. Bob works full-time as a hair stylist and has net employment income of $59,000. Kate's income would normally be higher; however, she was hospitalized for 6 weeks after a serious car accident. Use the space below to provide your solution and show your work for full marks

Question on image

Question on image