Answered step by step

Verified Expert Solution

Question

1 Approved Answer

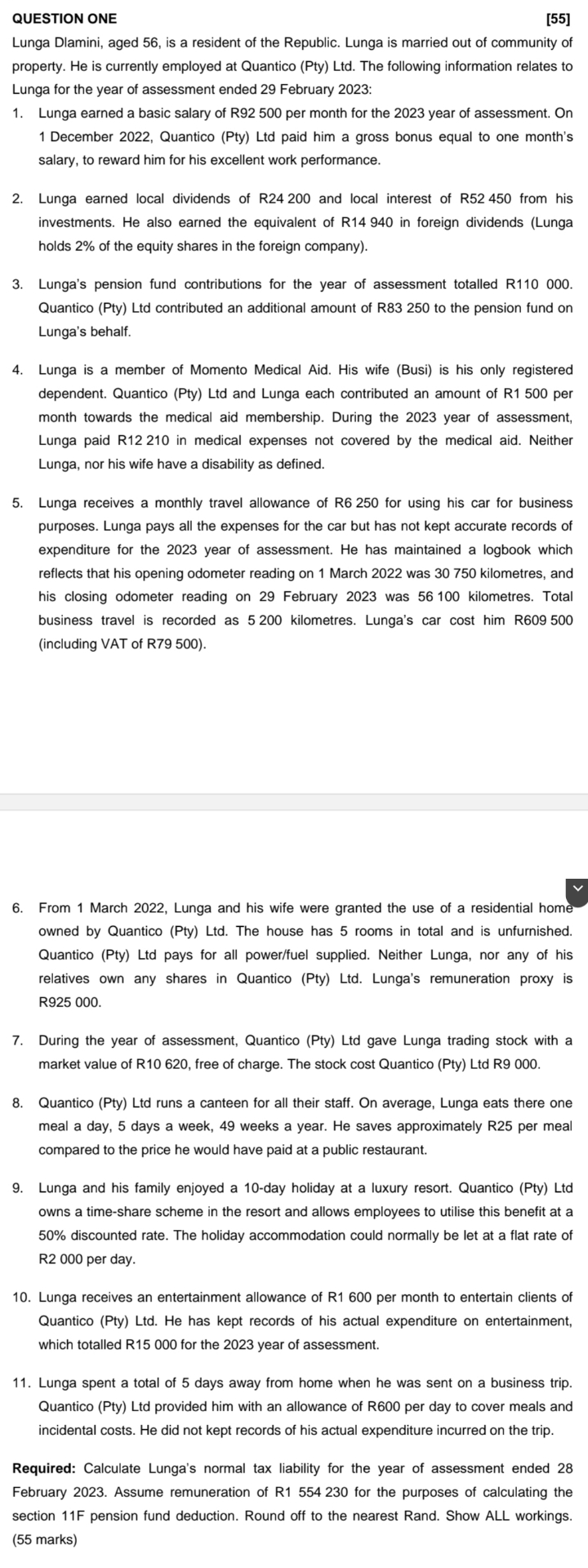

QUESTION ONE [ 5 5 ] Lunga Dlamini, aged 5 6 , is a resident of the Republic. Lunga is married out of community of

QUESTION ONE

Lunga Dlamini, aged is a resident of the Republic. Lunga is married out of community of property. He is currently employed at Quantico Pty Ltd The following information relates to Lunga for the year of assessment ended February :

Lunga earned a basic salary of R per month for the year of assessment. On December Quantico Pty Ltd paid him a gross bonus equal to one month's salary, to reward him for his excellent work performance.

Lunga earned local dividends of R and local interest of R from his investments. He also earned the equivalent of R in foreign dividends Lunga holds of the equity shares in the foreign company

Lunga's pension fund contributions for the year of assessment totalled R Quantico Pty Ltd contributed an additional amount of R to the pension fund on Lunga's behalf.

Lunga is a member of Momento Medical Aid. His wife Busi is his only registered dependent. Quantico Pty Ltd and Lunga each contributed an amount of R per month towards the medical aid membership. During the year of assessment, Lunga paid R in medical expenses not covered by the medical aid. Neither Lunga, nor his wife have a disability as defined.

Lunga receives a monthly travel allowance of R for using his car for business purposes. Lunga pays all the expenses for the car but has not kept accurate records of expenditure for the year of assessment. He has maintained a logbook which reflects that his opening odometer reading on March was kilometres, and his closing odometer reading on February was kilometres. Total business travel is recorded as kilometres. Lunga's car cost him Rincluding VAT of R

From March Lunga and his wife were granted the use of a residential home owned by Quantico Pty Ltd The house has rooms in total and is unfurnished. Quantico Pty Ltd pays for all powerfuel supplied. Neither Lunga, nor any of his relatives own any shares in Quantico Pty Ltd Lunga's remuneration proxy is R

During the year of assessment, Quantico Pty Ltd gave Lunga trading stock with a market value of R free of charge. The stock cost Quantico Pty Ltd R

Quantico Pty Ltd runs a canteen for all their staff. On average, Lunga eats there one meal a day, days a week, weeks a year. He saves approximately R per meal compared to the price he would have paid at a public restaurant.

Lunga and his family enjoyed a day holiday at a luxury resort. Quantico Pty Ltd owns a timeshare scheme in the resort and allows employees to utilise this benefit at a discounted rate. The holiday accommodation could normally be let at a flat rate of R per day.

Lunga receives an entertainment allowance of R per month to entertain clients of Quantico Pty Ltd He has kept records of his actual expenditure on entertainment, which totalled R for the year of assessment.

Lunga spent a total of days away from home when he was sent on a business trip. Quantico Pty Ltd provided him with an allowance of R per day to cover meals and incidental costs. He did not kept records of his actual expenditure incurred on the trip.

Required: Calculate Lunga's normal tax liability for the year of assessment ended February Assume remuneration of R for the purposes of calculating the section F pension fund deduction. Round off to the nearest Rand. Show ALL workings. marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started