Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Attorney, a cash method unincorporated sole practitioner, joins a cash method partnership of three other attorneys all of whom own an equal onequarter interest in

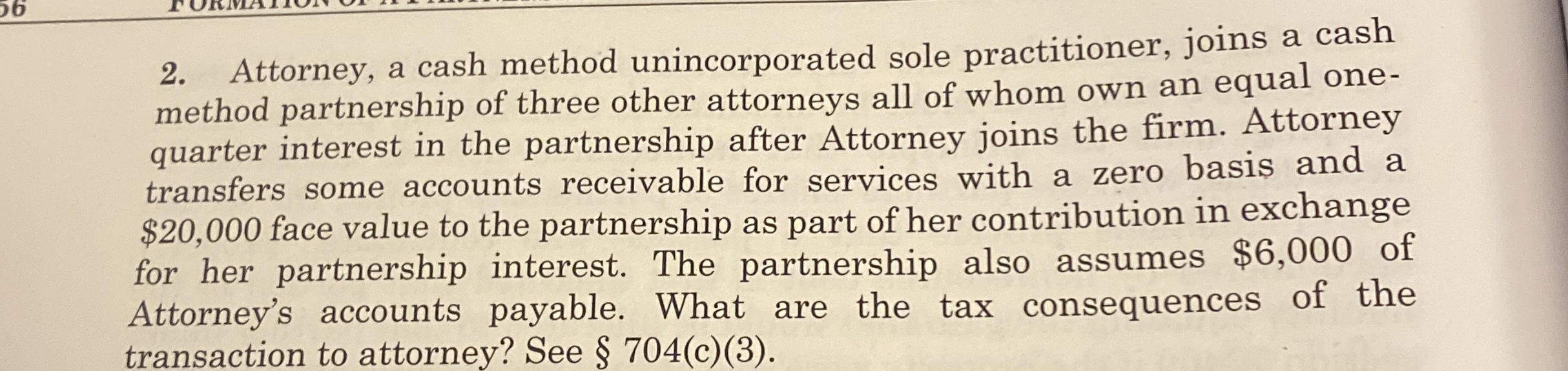

Attorney, a cash method unincorporated sole practitioner, joins a cash method partnership of three other attorneys all of whom own an equal onequarter interest in the partnership after Attorney joins the firm. Attorney transfers some accounts receivable for services with a zero basis and a $ face value to the partnership as part of her contribution in exchange for her partnership interest. The partnership also assumes $ of Attorney's accounts payable. What are the tax consequences of the transaction to attorney? See

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started