Answered step by step

Verified Expert Solution

Question

1 Approved Answer

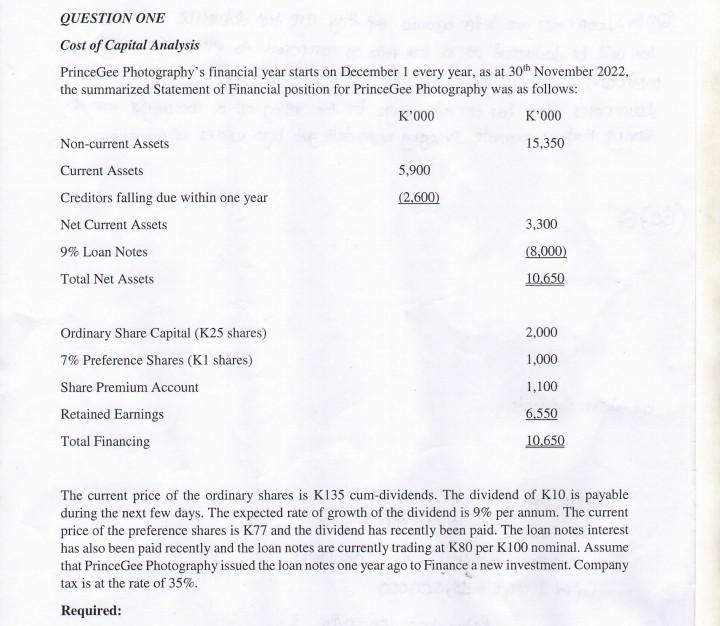

QUESTION ONE Cost of Capital Analysis PrinceGee Photography's financial year starts on December 1 every year, as at 30th November 2022, the summarized Statement of

QUESTION ONE Cost of Capital Analysis PrinceGee Photography's financial year starts on December 1 every year, as at 30th November 2022, the summarized Statement of Financial position for PrinceGee Photography was as follows: The current price of the ordinary shares is K135 cum-dividends. The dividend of K10 is payable during the next few days. The expected rate of growth of the dividend is 9% per annum. The current price of the preference shares is K 77 and the dividend has recently been paid. The loan notes interest has also been paid recently and the loan notes are currently trading at K80 per K100 nominal. Assume that PrinceGee Photography issued the loan notes one year ago to Finance a new investment. Company tax is at the rate of 35%. Required: i) Calculate the PrinceGee's weighted Average cost of capital (WACC), using the respective Book values as weighting factors. (10 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started