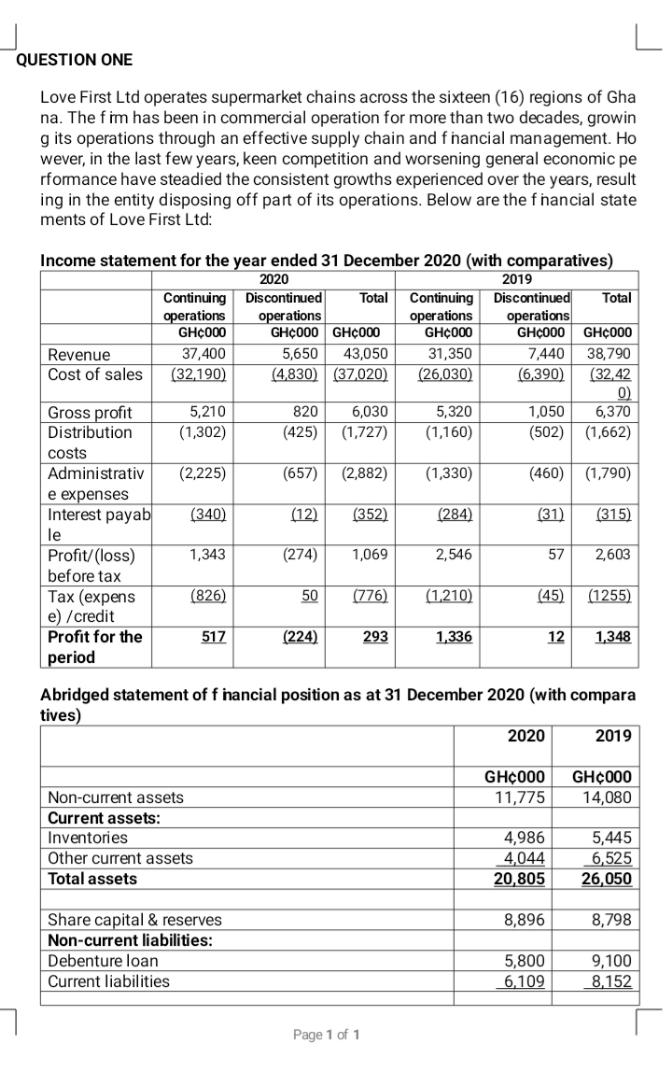

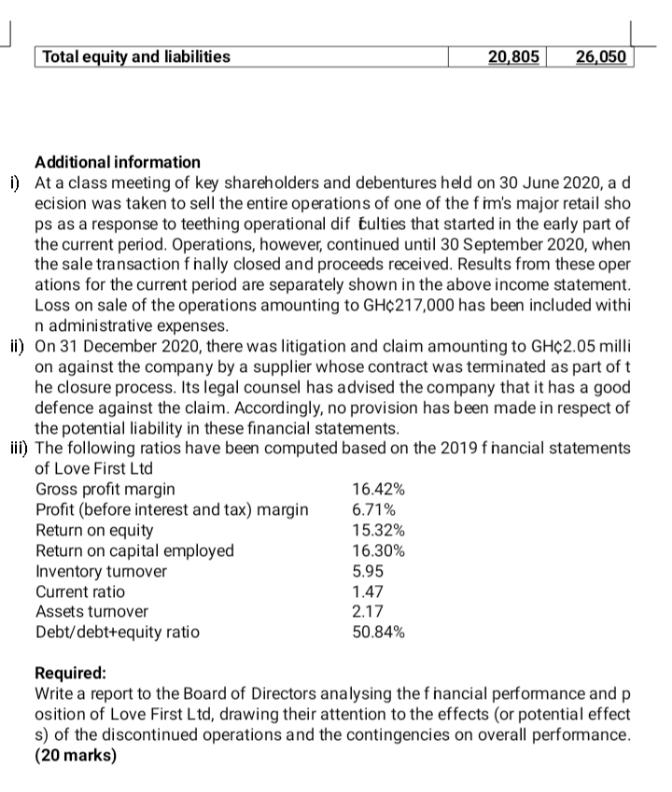

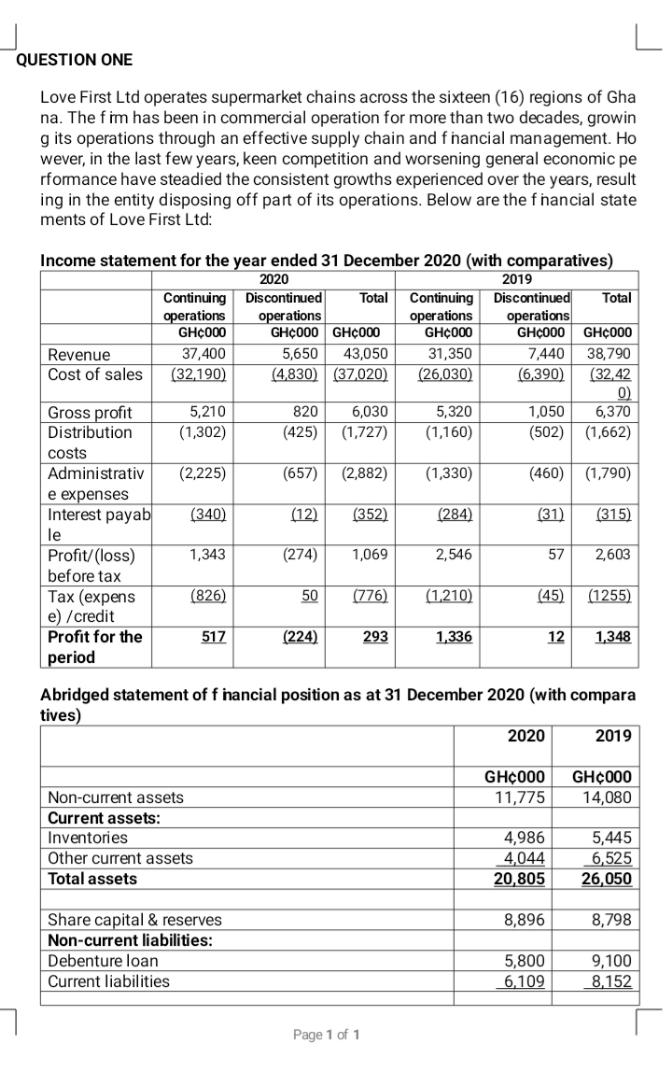

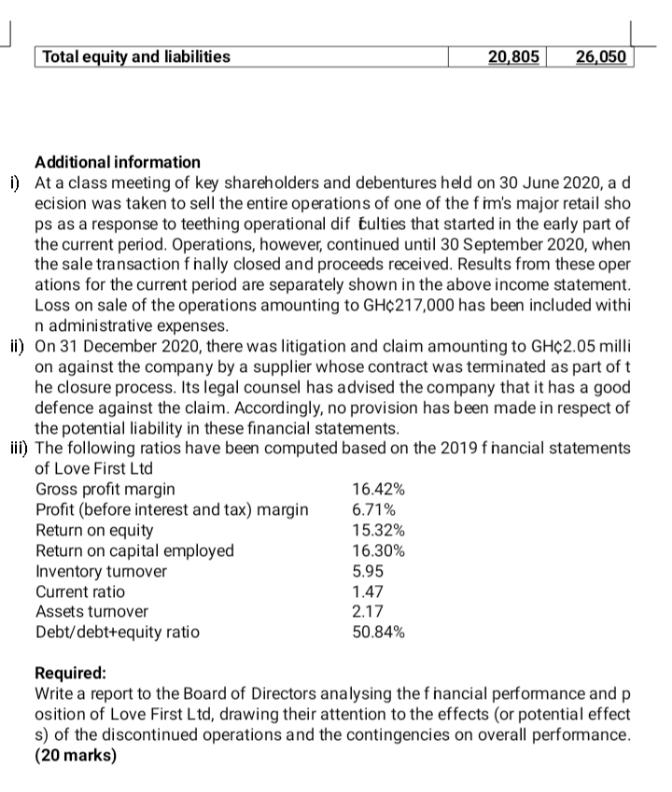

QUESTION ONE Love First Ltd operates supermarket chains across the sixteen (16) regions of Gha na. The fim has been in commercial operation for more than two decades, growin g its operations through an effective supply chain and financial management. Ho wever, in the last few years, keen competition and worsening general economic pe rformance have steadied the consistent growths experienced over the years, result ing in the entity disposing off part of its operations. Below are the financial state ments of Love First Ltd: Total Income statement for the year ended 31 December 2020 (with comparatives) 2020 2019 Continuing Discontinued Continuing Discontinued Total operations operations operations operations GH000 GH000 GHC000 GH000 GH_000 GH000 Revenue 37,400 5,650 43,050 31,350 7,440 38,790 Cost of sales (32,190) (4,830) (37,020) (26.030 (6 390) (32,42 0 Gross profit 5,210 820 6,030 5,320 1,050 6,370 Distribution (1,302) (425) (1,727) (1,160) (502) (1,662) costs Administrativ (2,225) (657) (2,882) (1,330) (460) (1,790) e expenses Interest payab (340) (12) (352) (284) (31) (315) le Profit/(loss) 1,343 (274) 1,069 2,546 57 2,603 before tax Tax (expens (826) 50 (776) (1210) (45) (1255) e) /credit Profit for the (224) 293 1.336 12 1,348 period 517 Abridged statement of financial position as at 31 December 2020 (with compara tives) 2020 2019 GH000 11,775 GH000 14,080 Non-current assets Current assets: Inventories Other current assets Total assets 4,986 4,044 20,805 5,445 6,525 26,050 8,896 8,798 Share capital & reserves Non-current liabilities: Debenture loan Current liabilities 5,800 6,109 9,100 8,152 Page 1 of 1 Total equity and liabilities 20,805 26,050 Additional information 1) At a class meeting of key shareholders and debentures held on 30 June 2020, a d ecision was taken to sell the entire operations of one of the fim's major retail sho ps as a response to teething operational dif tulties that started in the early part of the current period. Operations, however, continued until 30 September 2020, when the sale transaction f nally closed and proceeds received. Results from these oper ations for the current period are separately shown in the above income statement. Loss on sale of the operations amounting to GHC217,000 has been included withi n administrative expenses. ii) On 31 December 2020, there was litigation and claim amounting to GHC2.05 milli on against the company by a supplier whose contract was terminated as part of t he closure process. Its legal counsel has advised the company that it has a good defence against the claim. Accordingly, no provision has been made in respect of the potential liability in these financial statements. iii) The following ratios have been computed based on the 2019 f nancial statements of Love First Ltd Gross profit margin 16.42% Profit (before interest and tax) margin 6.71% Return on equity 15.32% Return on capital employed 16.30% Inventory turnover 5.95 Current ratio 1.47 Assets tumover 2.17 Debt/debt+equity ratio 50.84% Required: Write a report to the Board of Directors analysing the fnancial performance and p osition of Love First Ltd, drawing their attention to the effects (or potential effect s) of the discontinued operations and the contingencies on overall performance. (20 marks) QUESTION ONE Love First Ltd operates supermarket chains across the sixteen (16) regions of Gha na. The fim has been in commercial operation for more than two decades, growin g its operations through an effective supply chain and financial management. Ho wever, in the last few years, keen competition and worsening general economic pe rformance have steadied the consistent growths experienced over the years, result ing in the entity disposing off part of its operations. Below are the financial state ments of Love First Ltd: Total Income statement for the year ended 31 December 2020 (with comparatives) 2020 2019 Continuing Discontinued Continuing Discontinued Total operations operations operations operations GH000 GH000 GHC000 GH000 GH_000 GH000 Revenue 37,400 5,650 43,050 31,350 7,440 38,790 Cost of sales (32,190) (4,830) (37,020) (26.030 (6 390) (32,42 0 Gross profit 5,210 820 6,030 5,320 1,050 6,370 Distribution (1,302) (425) (1,727) (1,160) (502) (1,662) costs Administrativ (2,225) (657) (2,882) (1,330) (460) (1,790) e expenses Interest payab (340) (12) (352) (284) (31) (315) le Profit/(loss) 1,343 (274) 1,069 2,546 57 2,603 before tax Tax (expens (826) 50 (776) (1210) (45) (1255) e) /credit Profit for the (224) 293 1.336 12 1,348 period 517 Abridged statement of financial position as at 31 December 2020 (with compara tives) 2020 2019 GH000 11,775 GH000 14,080 Non-current assets Current assets: Inventories Other current assets Total assets 4,986 4,044 20,805 5,445 6,525 26,050 8,896 8,798 Share capital & reserves Non-current liabilities: Debenture loan Current liabilities 5,800 6,109 9,100 8,152 Page 1 of 1 Total equity and liabilities 20,805 26,050 Additional information 1) At a class meeting of key shareholders and debentures held on 30 June 2020, a d ecision was taken to sell the entire operations of one of the fim's major retail sho ps as a response to teething operational dif tulties that started in the early part of the current period. Operations, however, continued until 30 September 2020, when the sale transaction f nally closed and proceeds received. Results from these oper ations for the current period are separately shown in the above income statement. Loss on sale of the operations amounting to GHC217,000 has been included withi n administrative expenses. ii) On 31 December 2020, there was litigation and claim amounting to GHC2.05 milli on against the company by a supplier whose contract was terminated as part of t he closure process. Its legal counsel has advised the company that it has a good defence against the claim. Accordingly, no provision has been made in respect of the potential liability in these financial statements. iii) The following ratios have been computed based on the 2019 f nancial statements of Love First Ltd Gross profit margin 16.42% Profit (before interest and tax) margin 6.71% Return on equity 15.32% Return on capital employed 16.30% Inventory turnover 5.95 Current ratio 1.47 Assets tumover 2.17 Debt/debt+equity ratio 50.84% Required: Write a report to the Board of Directors analysing the fnancial performance and p osition of Love First Ltd, drawing their attention to the effects (or potential effect s) of the discontinued operations and the contingencies on overall performance. (20 marks)