Answered step by step

Verified Expert Solution

Question

1 Approved Answer

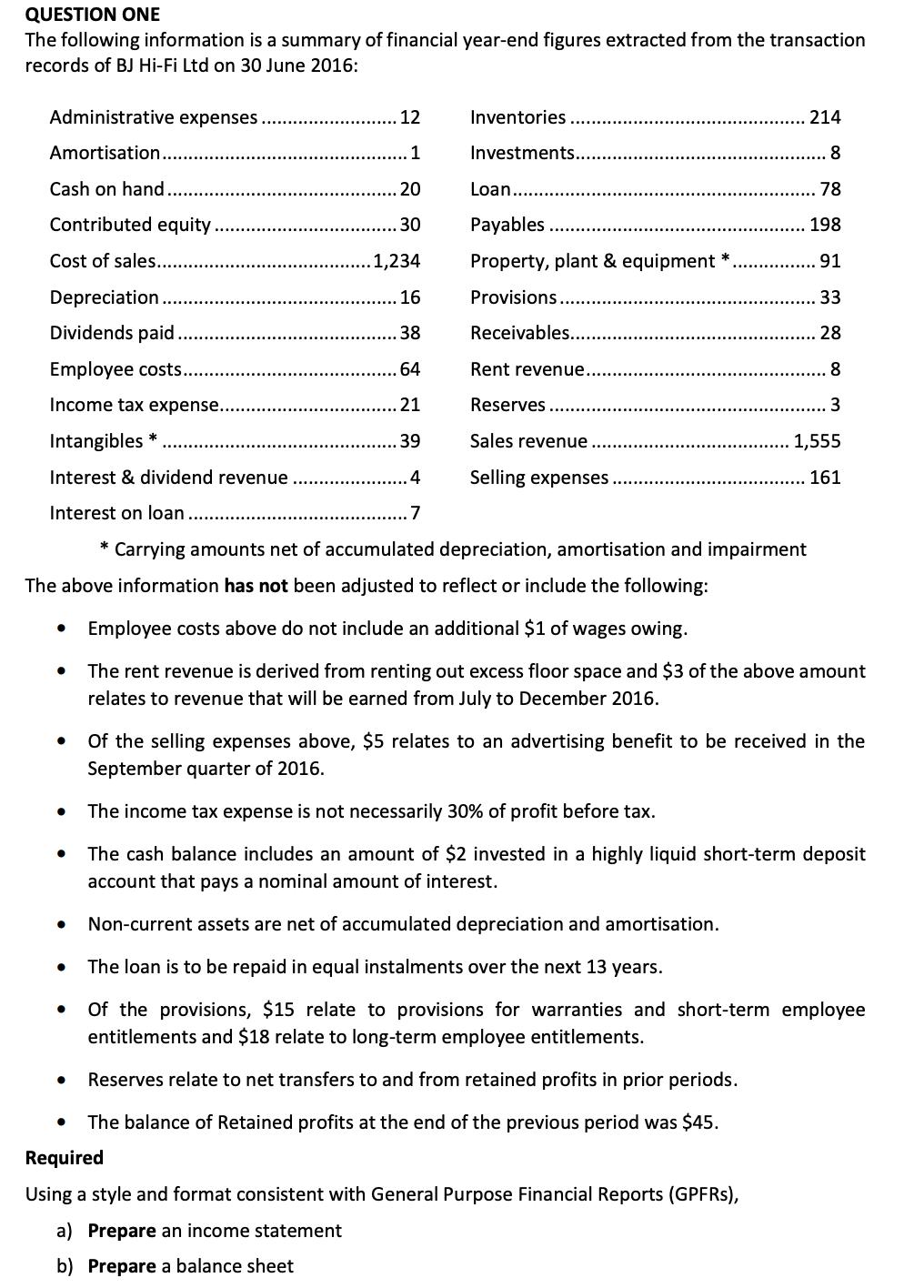

QUESTION ONE The following information is a summary of financial year-end figures extracted from the transaction records of BJ Hi-Fi Ltd on 30 June

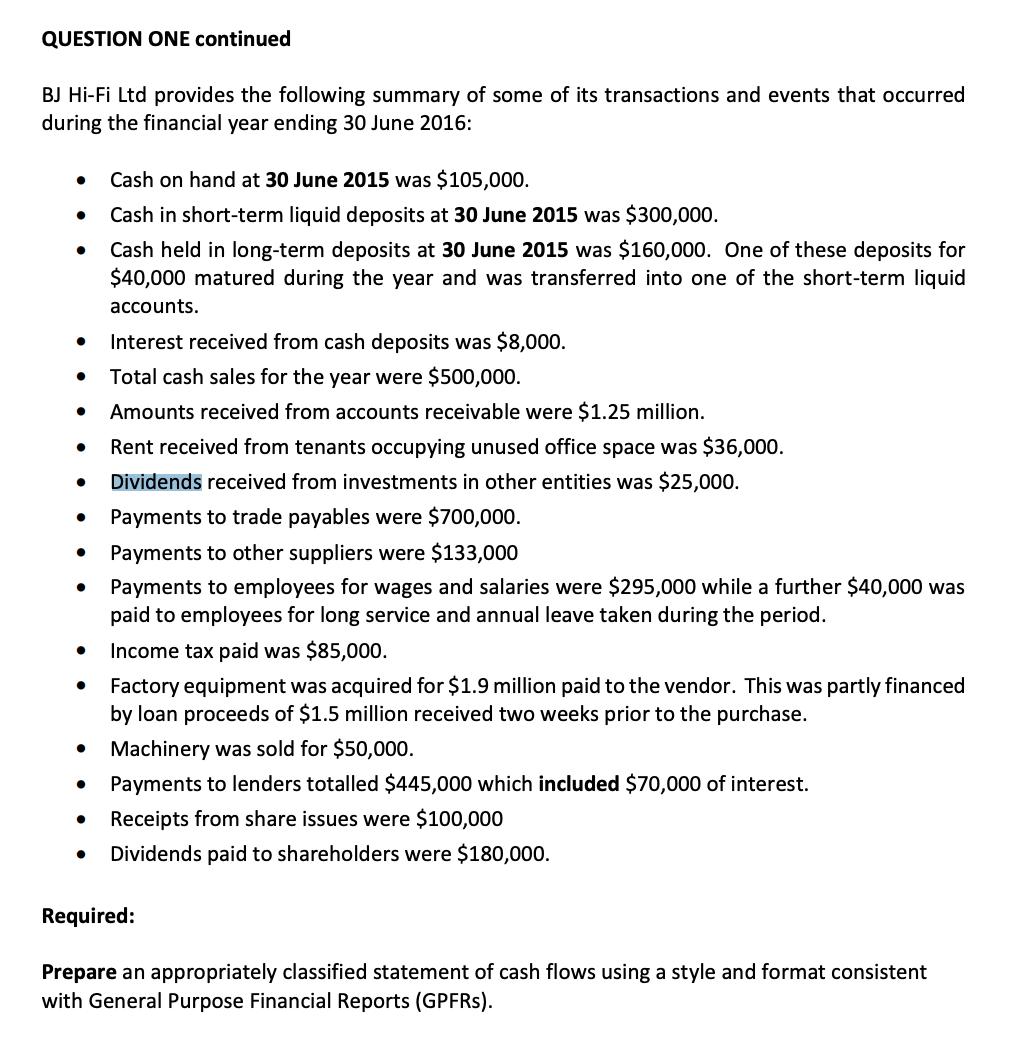

QUESTION ONE The following information is a summary of financial year-end figures extracted from the transaction records of BJ Hi-Fi Ltd on 30 June 2016: Administrative expenses 12 Inventories 214 Amortisation...... 1 Investments... 8 Cash on hand. 20 Loan....... 78 Contributed equity .30 Payables 198 Cost of sales. .1,234 Property, plant & equipment * 91 Depreciation 16 Provisions. 33 Dividends paid .38 Receivables.. 28 Employee costs. .64 Rent revenue.. 8 Income tax expense.. .21 Reserves 3 Intangibles * 39 Sales revenue 1,555 Interest & dividend revenue .4 Selling expenses. 161 Interest on loan .7 * Carrying amounts net of accumulated depreciation, amortisation and impairment The above information has not been adjusted to reflect or include the following: Employee costs above do not include an additional $1 of wages owing. The rent revenue is derived from renting out excess floor space and $3 of the above amount relates to revenue that will be earned from July to December 2016. Of the selling expenses above, $5 relates to an advertising benefit to be received in the September quarter of 2016. The income tax expense is not necessarily 30% of profit before tax. The cash balance includes an amount of $2 invested in a highly liquid short-term deposit account that pays a nominal amount of interest. Non-current assets are net of accumulated depreciation and amortisation. The loan is to be repaid in equal instalments over the next 13 years. Of the provisions, $15 relate to provisions for warranties and short-term employee entitlements and $18 relate to long-term employee entitlements. Reserves relate to net transfers to and from retained profits in prior periods. The balance of Retained profits at the end of the previous period was $45. Required Using a style and format consistent with General Purpose Financial Reports (GPFRS), a) Prepare an income statement b) Prepare a balance sheet QUESTION ONE continued BJ Hi-Fi Ltd provides the following summary of some of its transactions and events that occurred during the financial year ending 30 June 2016: Cash on hand at 30 June 2015 was $105,000. Cash in short-term liquid deposits at 30 June 2015 was $300,000. Cash held in long-term deposits at 30 June 2015 was $160,000. One of these deposits for $40,000 matured during the year and was transferred into one of the short-term liquid accounts. Interest received from cash deposits was $8,000. Total cash sales for the year were $500,000. Amounts received from accounts receivable were $1.25 million. Rent received from tenants occupying unused office space was $36,000. Dividends received from investments in other entities was $25,000. Payments to trade payables were $700,000. Payments to other suppliers were $133,000 Payments to employees for wages and salaries were $295,000 while a further $40,000 was paid to employees for long service and annual leave taken during the period. Income tax paid was $85,000. Factory equipment was acquired for $1.9 million paid to the vendor. This was partly financed by loan proceeds of $1.5 million received two weeks prior to the purchase. Machinery was sold for $50,000. Payments to lenders totalled $445,000 which included $70,000 of interest. Receipts from share issues were $100,000 Dividends paid to shareholders were $180,000. Required: Prepare an appropriately classified statement of cash flows using a style and format consistent with General Purpose Financial Reports (GPFRs).

Step by Step Solution

★★★★★

3.34 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Hello Student I ho...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started