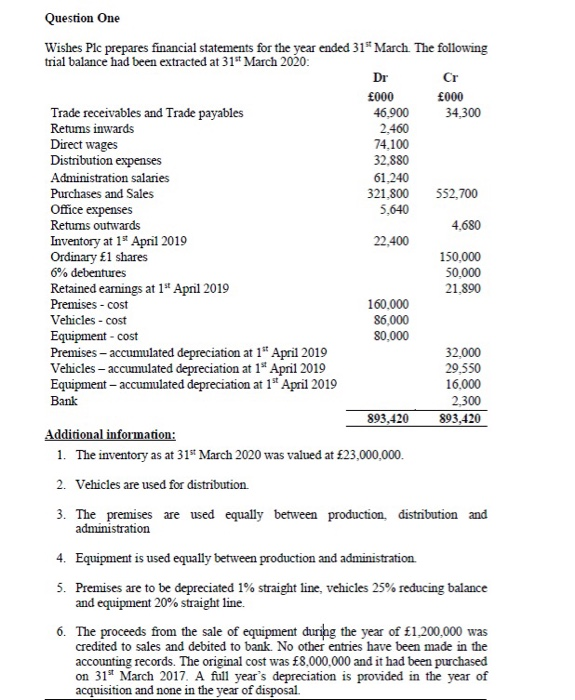

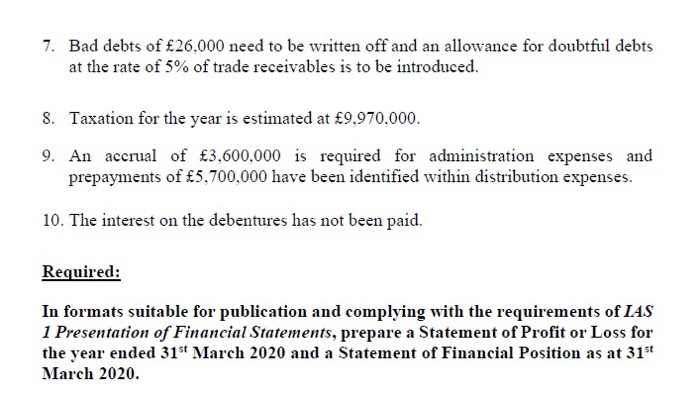

Question One Wishes Plc prepares financial statements for the year ended 31" March The following trial balance had been extracted at 31" March 2020: Dr Cr 000 000 Trade receivables and Trade payables 46,900 34,300 Retums inwards 2.460 Direct wages 74.100 Distribution expenses 32,880 Administration salaries 61,240 Purchases and Sales 321,800 552,700 Office expenses 5.640 Returns outwards 4,680 Inventory at 1 April 2019 22,400 Ordinary 1 shares 150,000 6% debentures 50,000 Retained earnings at 1st April 2019 21.890 Premises - cost 160,000 Vehicles - cost 86,000 Equipment -cost 80,000 Premises - accumulated depreciation at 1" April 2019 32.000 Vehicles - accumulated depreciation at 1* April 2019 29.550 Equipment - accumulated depreciation at 1" April 2019 16,000 Bank 2,300 893,420 893,420 Additional information: 1. The inventory as at 31 March 2020 was valued at 23,000,000 2. Vehicles are used for distribution 3. The premises administration are used equally between production, distribution and 4. Equipment is used equally between production and administration 5. Premises are to be depreciated 1% straight line, vehicles 25% reducing balance and equipment 20% straight line. 6. The proceeds from the sale of equipment during the year of 1,200,000 was credited to sales and debited to bank No other entries have been made in the accounting records. The original cost was 8,000,000 and it had been purchased on 31" March 2017. A full year's depreciation is provided in the year of acquisition and none in the year of disposal 7. Bad debts of 26,000 need to be written off and an allowance for doubtful debts at the rate of 5% of trade receivables is to be introduced. 8. Taxation for the year is estimated at 9.970,000. 9. An accrual of 3,600,000 is required for administration expenses and prepayments of 5,700.000 have been identified within distribution expenses. 10. The interest on the debentures has not been paid. Required: In formats suitable for publication and complying with the requirements of IAS 1 Presentation of Financial Statements, prepare a Statement of Profit or Loss for the year ended 31st March 2020 and a Statement of Financial Position as at 315 March 2020