Answered step by step

Verified Expert Solution

Question

1 Approved Answer

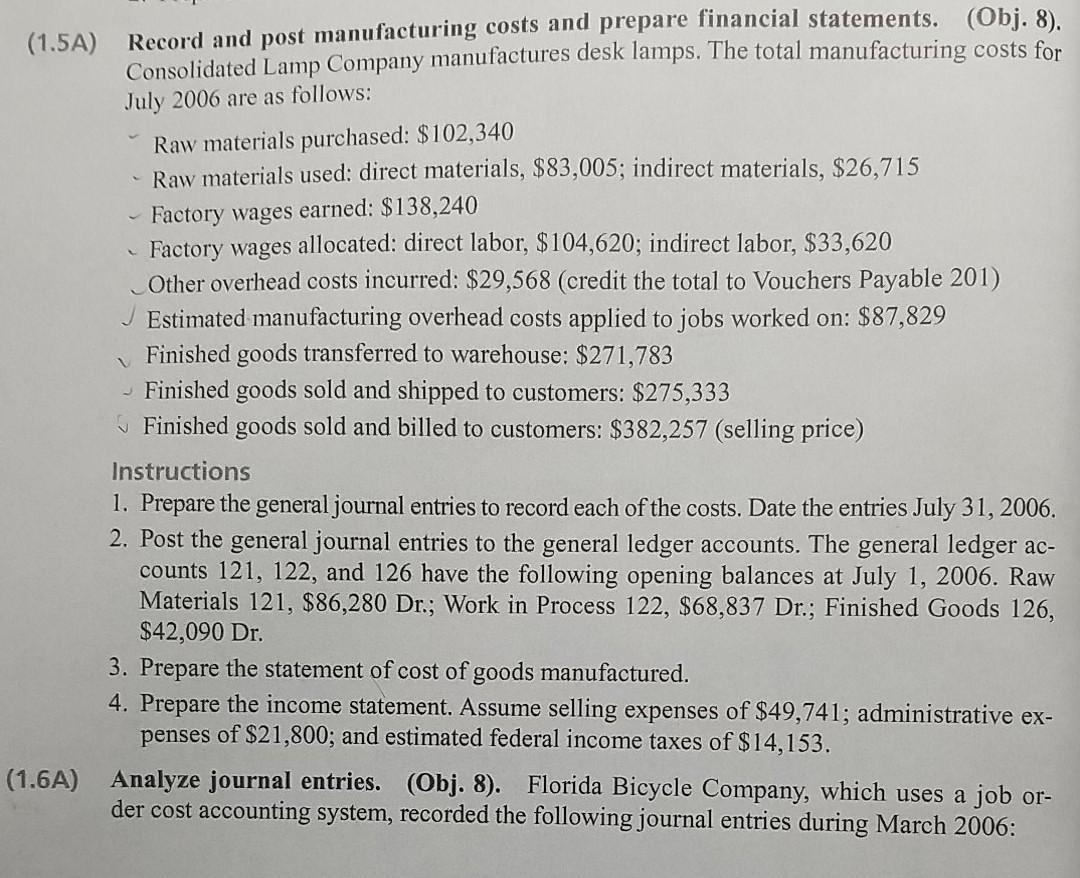

(1.5A) Record and post manufacturing costs and prepare financial statements. (Obj. 8). Consolidated Lamp Company manufactures desk lamps. The total manufacturing costs for July 2006

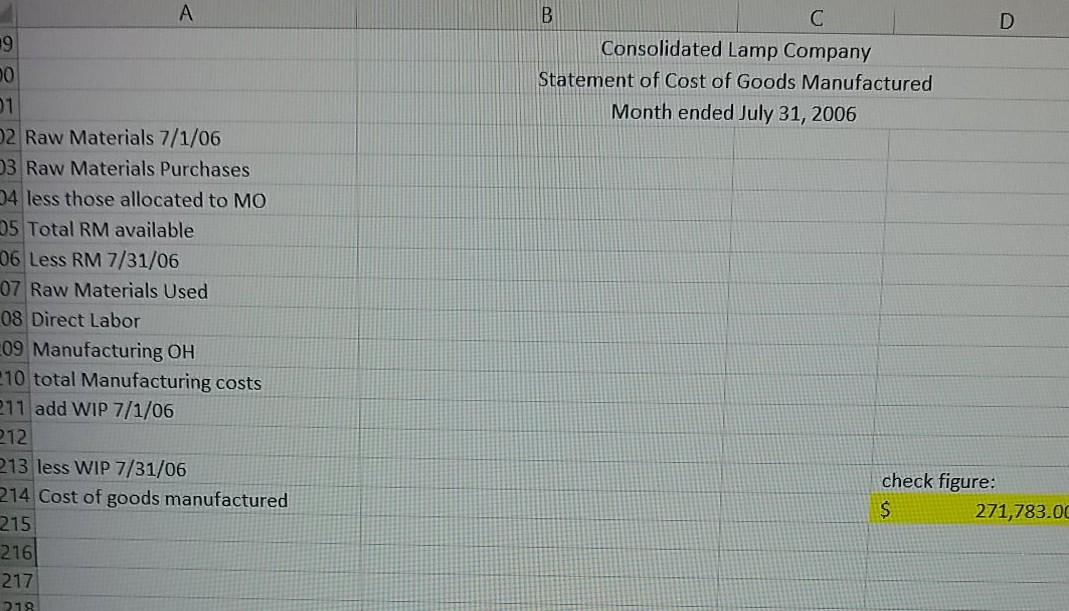

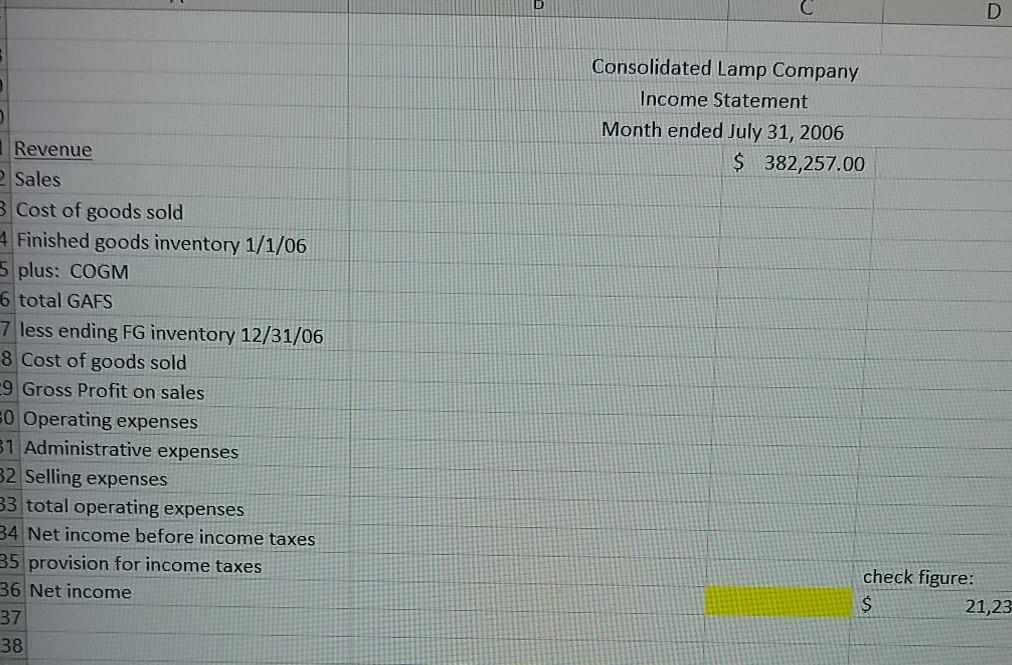

(1.5A) Record and post manufacturing costs and prepare financial statements. (Obj. 8). Consolidated Lamp Company manufactures desk lamps. The total manufacturing costs for July 2006 are as follows: Raw materials purchased: $102,340 - Raw materials used: direct materials, $83,005; indirect materials, $26,715 Factory wages earned: $138,240 Factory wages allocated: direct labor, $104,620; indirect labor, $33,620 Other overhead costs incurred: $29,568 (credit the total to Vouchers Payable 201) Estimated manufacturing overhead costs applied to jobs worked on: $87,829 Finished goods transferred to warehouse: $271,783 Finished goods sold and shipped to customers: $275,333 Finished goods sold and billed to customers: $382,257 (selling price) Instructions 1. Prepare the general journal entries to record each of the costs. Date the entries July 31, 2006. 2. Post the general journal entries to the general ledger accounts. The general ledger ac- counts 121, 122, and 126 have the following opening balances at July 1, 2006. Raw Materials 121, $86,280 Dr.; Work in Process 122, $68,837 Dr.; Finished Goods 126, $42,090 Dr. 3. Prepare the statement of cost of goods manufactured. 4. Prepare the income statement. Assume selling expenses of $49,741; administrative ex- penses of $21,800; and estimated federal income taxes of $14,153. (1.6A) Analyze journal entries. (Obj. 8). Florida Bicycle Company, which uses a job or- der cost accounting system, recorded the following journal entries during March 2006: D 19 B Consolidated Lamp Company Statement of Cost of Goods Manufactured Month ended July 31, 2006 00 51 02 Raw Materials 7/1/06 3 Raw Materials Purchases 24 less those allocated to MO 05 Total RM available 06 Less RM 7/31/06 07 Raw Materials Used 08 Direct Labor 09 Manufacturing OH 10 total Manufacturing costs 211 add WIP 7/1/06 212 213 less WIP 7/31/06 214 Cost of goods manufactured 215 216 217 218 check figure: $ 271,783.00 D Consolidated Lamp Company Income Statement Month ended July 31, 2006 $ 382,257.00 Revenue Sales Cost of goods sold 4 Finished goods inventory 1/1/06 5 plus: COGM 6 total GAFS 7 less ending FG inventory 12/31/06 8 Cost of goods sold -9 Gross Profit on sales 50 Operating expenses 31 Administrative expenses 32 Selling expenses 33 total operating expenses 34 Net income before income taxes 35 provision for income taxes 36 Net income 37 38 check figure: $ 21,23

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started