Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION Prepare relevant income tax return form (ITRF) of the above individual for year of assessment 2020. You have to decide on the suitable ITRF

QUESTION

Prepare relevant income tax return form (ITRF) of the above individual for year of assessment 2020. You have to decide on the suitable ITRF to submit, type of assessment and who will claim childrens relief.

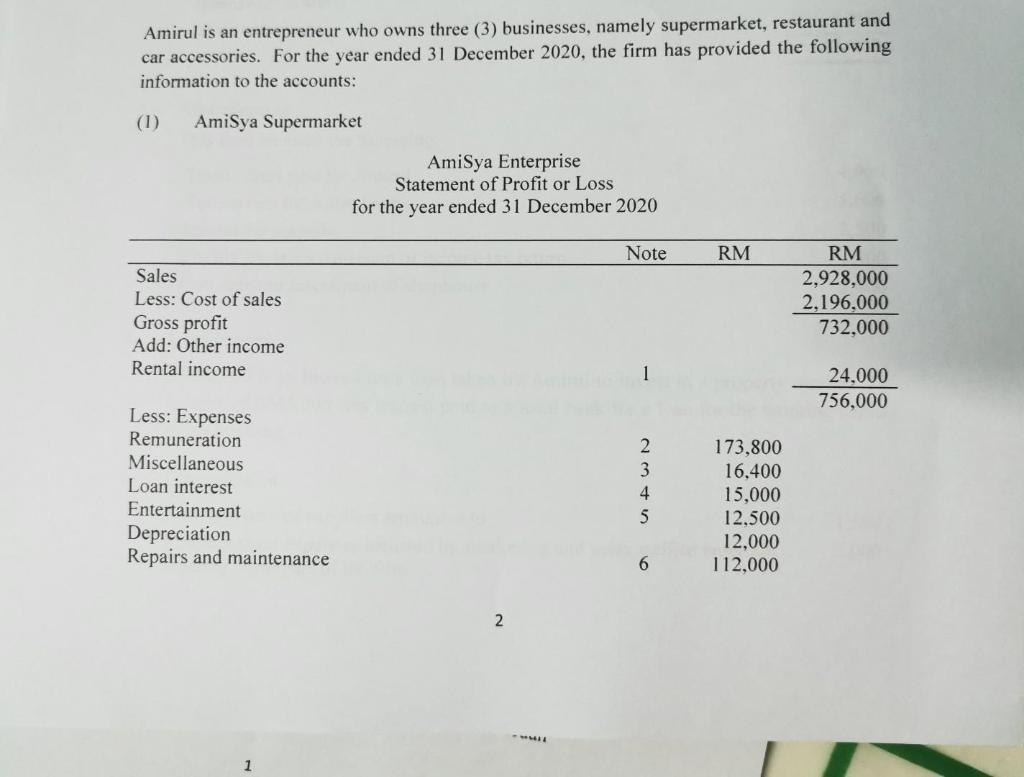

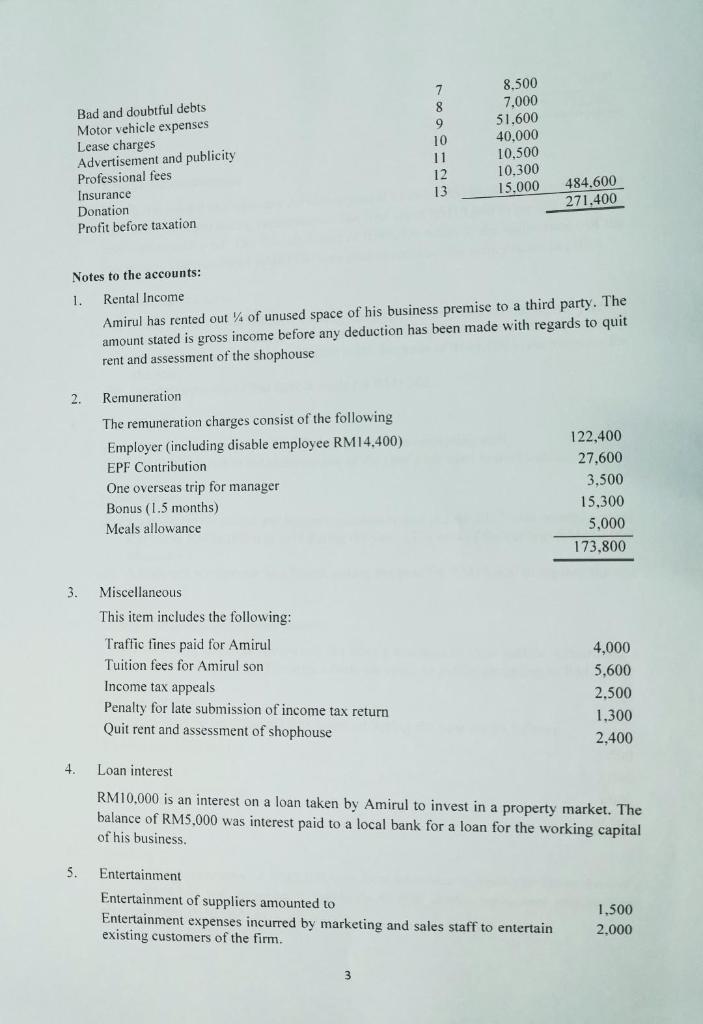

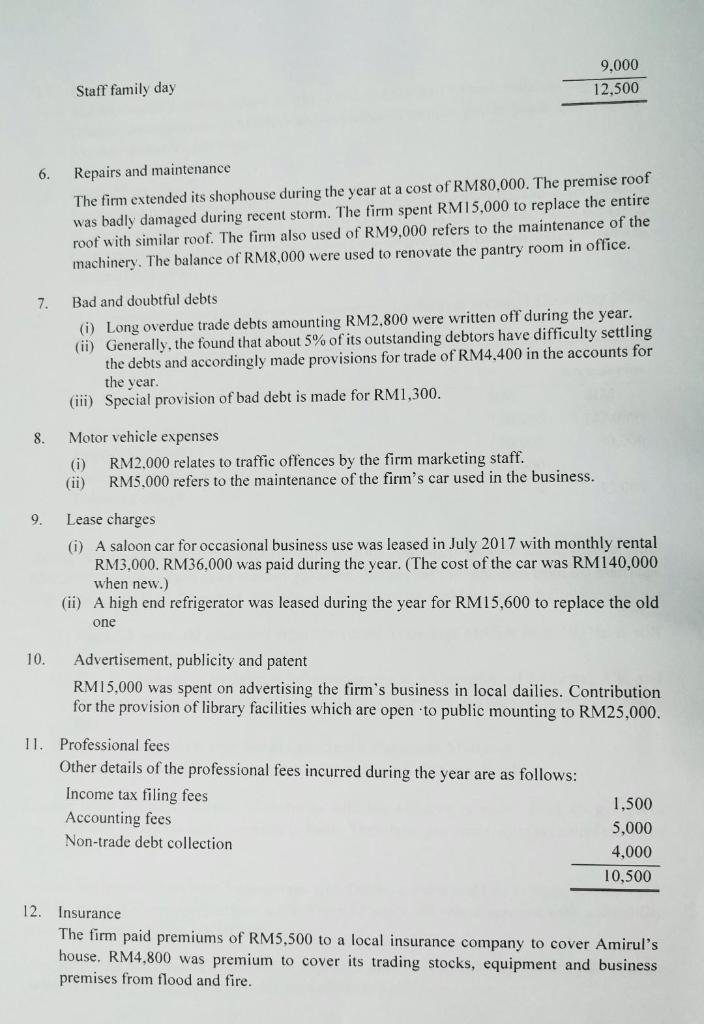

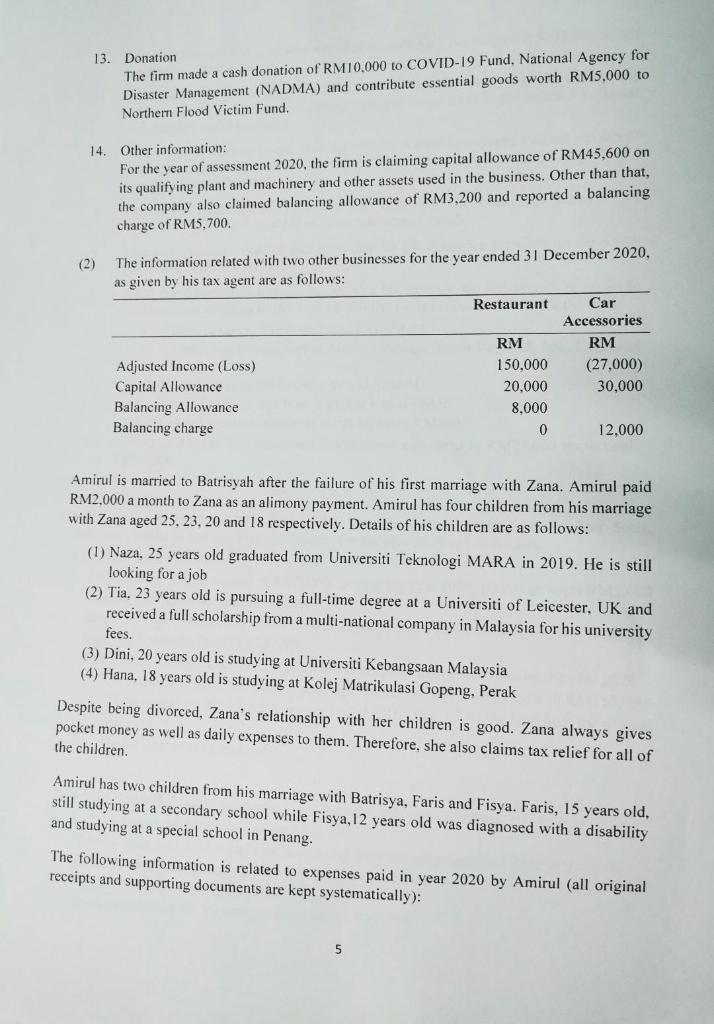

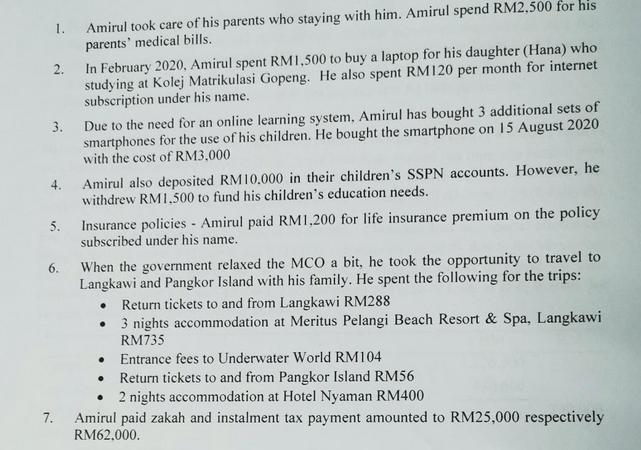

Amirul is an entrepreneur who owns three (3) businesses, namely supermarket, restaurant and car accessories. For the year ended 31 December 2020, the firm has provided the following information to the accounts: (1) AmiSya Supermarket AmiSya Enterprise Statement of Profit or Loss for the year ended 31 December 2020 Note RM Sales Less: Cost of sales Gross profit Add: Other income Rental income RM 2,928,000 2,196,000 732,000 1 24.000 756,000 Less: Expenses Remuneration Miscellaneous Loan interest Entertainment Depreciation Repairs and maintenance 2 3 4 173,800 16,400 15,000 12,500 12,000 112,000 6 2 Bad and doubtful debts Motor vehicle expenses Lease charges Advertisement and publicity Professional fees Insurance Donation Profit before taxation 7 8 9 10 11 12 13 8.500 7.000 51,600 40,000 10,500 10.300 15.000 484.600 271.400 Notes to the accounts: 1. Rental Income Amirul has rented out of unused space of his business premise to a third party. The amount stated is gross income before any deduction has been made with regards to quit rent and assessment of the shophouse 2 Remuneration The remuneration charges consist of the following Employer (including disable employee RM14.400) EPF Contribution One overseas trip for manager Bonus (1.5 months) Meals allowance 122,400 27,600 3,500 15.300 5,000 173,800 3. Miscellaneous This item includes the following: Traffic fines paid for Amirul Tuition fees for Amirul son Income tax appeals Penalty for late submission of income tax return Quit rent and assessment of shophouse 4,000 5,600 2.500 1,300 2.400 4 Loan interest RM10,000 is an interest on a loan taken by Amirul to invest in a property market. The balance of RM5,000 was interest paid to a local bank for a loan for the working capital of his business 5. Entertainment Entertainment of suppliers amounted to Entertainment expenses incurred by marketing and sales staff to entertain existing customers of the firm. 1,500 2.000 9,000 12,500 Staff family day 6. Repairs and maintenance The firm extended its shophouse during the year at a cost of RM80,000. The premise roof was badly damaged during recent storm. The firm spent RM15,000 to replace the entire roof with similar roof. The firm also used of RM9,000 refers to the maintenance of the machinery. The balance of RM8,000 were used to renovate the pantry room in office. 7 Bad and doubtful debts (i) Long overdue trade debts amounting RM2.800 were written off during the year. (ii) Generally, the found that about 5% of its outstanding debtors have difficulty settling the debts and accordingly made provisions for trade of RM4.400 in the accounts for the year. (iii) Special provision of bad debt is made for RM1,300. 8. Motor vehicle expenses (i) RM2,000 rela to traffic offences by the firm marketing staff. (ii) RM5.000 refers to the maintenance of the firm's car used in the business. 9. Lease charges (i) A saloon car for occasional business use was leased in July 2017 with monthly rental RM3,000. RM36,000 was paid during the year. The cost of the car was RM140,000 when new.) (ii) A high end refrigerator was leased during the year for RM15,600 to replace the old one 10. Advertisement, publicity and patent RM15,000 was spent on advertising the firm's business in local dailies. Contribution for the provision of library facilities which are open to public mounting to RM25,000. 11. Professional fees Other details of the professional fees incurred during the year are as follows: Income tax filing fees Accounting fees Non-trade debt collection 1,500 5,000 4,000 10,500 12. Insurance The firm paid premiums of RM5,500 to a local insurance company to cover Amirul's house. RM4,800 was premium to cover its trading stocks, equipment and business premises from flood and fire. 13. Donation The firm made a cash donation of RM10,000 to COVID-19 Fund, National Agency for Disaster Management (NADMA) and contribute essential goods worth RM5,000 to Northern Flood Victim Fund. 14. Other information: For the year of assessment 2020, the firm is claiming capital allowance of RM45,600 on its qualifying plant and machinery and other assets used in the business. Other than that, the company also claimed balancing allowance of RM3,200 and reported a balancing charge of RM5,700. (2) The information related with two other businesses for the year ended 31 December 2020, as given by his tax agent are as follows: Restaurant Car Accessories RM (27,000) 30,000 RM 150,000 20.000 8,000 0 Adjusted Income (Loss) Capital Allowance Balancing Allowance Balancing charge 12.000 Amirul is married to Batrisyah after the failure of his first marriage with Zana. Amirul paid RM2,000 a month to Zana as an alimony payment. Amirul has four children from his marriage with Zana aged 25.23, 20 and 18 respectively. Details of his children are as follows: (1) Naza. 25 years old graduated from Universiti Teknologi MARA in 2019. He is still looking for a job (2) Tia. 23 years old is pursuing a full-time degree at a Universiti of Leicester, UK and received a full scholarship from a multi-national company in Malaysia for his university fees. (3) Dini, 20 years old is studying at Universiti Kebangsaan Malaysia (4) Hana, 18 years old is studying at Kolej Matrikulasi Gopeng, Perak Despite being divorced, Zana's relationship with her children is good. Zana always gives pocket money as well as daily expenses to them. Therefore, she also claims tax relief for all of the children. Amirul has two children from his marriage with Batrisya, Faris and Fisya. Faris, 15 years old, still studying at a secondary school while Fisya, 12 years old was diagnosed with a disability and studying a special school in Penang. The following information is related to expenses paid in year 2020 by Amirul (all original receipts and supporting documents are kept systematically): 5 1. Amirul took care of his parents who staying with him. Amirul spend RM2,500 for his parents' medical bills. 2. In February 2020, Amirul spent RM1,500 to buy a laptop for his daughter (Hana) who studying at Kolej Matrikulasi Gopeng. He also spent RM120 per month for internet subscription under his name. 3. Due to the need for an online learning system, Amirul has bought 3 additional sets of smartphones for the use of his children. He bought the smartphone on 15 August 2020 with the cost of RM3,000 4. Amirul also deposited RM10,000 in their children's SSPN accounts. However, he withdrew RM1,500 to fund his children's education needs. 5. Insurance policies - Amirul paid RM1,200 for life insurance premium on the policy subscribed under his name. 6. When the government relaxed the MCO a bit, he took the opportunity to travel to Langkawi and Pangkor Island with his family. He spent the following for the trips: Return tickets to and from Langkawi RM288 3 nights accommodation at Meritus Pelangi Beach Resort & Spa, Langkawi RM735 Entrance fees to Underwater World RM104 Return tickets to and from Pangkor Island RM56 2 nights accommodation at Hotel Nyaman RM400 7. Amirul paid zakah and instalment tax payment amounted to RM25,000 respectively RM62,000. Amirul is an entrepreneur who owns three (3) businesses, namely supermarket, restaurant and car accessories. For the year ended 31 December 2020, the firm has provided the following information to the accounts: (1) AmiSya Supermarket AmiSya Enterprise Statement of Profit or Loss for the year ended 31 December 2020 Note RM Sales Less: Cost of sales Gross profit Add: Other income Rental income RM 2,928,000 2,196,000 732,000 1 24.000 756,000 Less: Expenses Remuneration Miscellaneous Loan interest Entertainment Depreciation Repairs and maintenance 2 3 4 173,800 16,400 15,000 12,500 12,000 112,000 6 2 Bad and doubtful debts Motor vehicle expenses Lease charges Advertisement and publicity Professional fees Insurance Donation Profit before taxation 7 8 9 10 11 12 13 8.500 7.000 51,600 40,000 10,500 10.300 15.000 484.600 271.400 Notes to the accounts: 1. Rental Income Amirul has rented out of unused space of his business premise to a third party. The amount stated is gross income before any deduction has been made with regards to quit rent and assessment of the shophouse 2 Remuneration The remuneration charges consist of the following Employer (including disable employee RM14.400) EPF Contribution One overseas trip for manager Bonus (1.5 months) Meals allowance 122,400 27,600 3,500 15.300 5,000 173,800 3. Miscellaneous This item includes the following: Traffic fines paid for Amirul Tuition fees for Amirul son Income tax appeals Penalty for late submission of income tax return Quit rent and assessment of shophouse 4,000 5,600 2.500 1,300 2.400 4 Loan interest RM10,000 is an interest on a loan taken by Amirul to invest in a property market. The balance of RM5,000 was interest paid to a local bank for a loan for the working capital of his business 5. Entertainment Entertainment of suppliers amounted to Entertainment expenses incurred by marketing and sales staff to entertain existing customers of the firm. 1,500 2.000 9,000 12,500 Staff family day 6. Repairs and maintenance The firm extended its shophouse during the year at a cost of RM80,000. The premise roof was badly damaged during recent storm. The firm spent RM15,000 to replace the entire roof with similar roof. The firm also used of RM9,000 refers to the maintenance of the machinery. The balance of RM8,000 were used to renovate the pantry room in office. 7 Bad and doubtful debts (i) Long overdue trade debts amounting RM2.800 were written off during the year. (ii) Generally, the found that about 5% of its outstanding debtors have difficulty settling the debts and accordingly made provisions for trade of RM4.400 in the accounts for the year. (iii) Special provision of bad debt is made for RM1,300. 8. Motor vehicle expenses (i) RM2,000 rela to traffic offences by the firm marketing staff. (ii) RM5.000 refers to the maintenance of the firm's car used in the business. 9. Lease charges (i) A saloon car for occasional business use was leased in July 2017 with monthly rental RM3,000. RM36,000 was paid during the year. The cost of the car was RM140,000 when new.) (ii) A high end refrigerator was leased during the year for RM15,600 to replace the old one 10. Advertisement, publicity and patent RM15,000 was spent on advertising the firm's business in local dailies. Contribution for the provision of library facilities which are open to public mounting to RM25,000. 11. Professional fees Other details of the professional fees incurred during the year are as follows: Income tax filing fees Accounting fees Non-trade debt collection 1,500 5,000 4,000 10,500 12. Insurance The firm paid premiums of RM5,500 to a local insurance company to cover Amirul's house. RM4,800 was premium to cover its trading stocks, equipment and business premises from flood and fire. 13. Donation The firm made a cash donation of RM10,000 to COVID-19 Fund, National Agency for Disaster Management (NADMA) and contribute essential goods worth RM5,000 to Northern Flood Victim Fund. 14. Other information: For the year of assessment 2020, the firm is claiming capital allowance of RM45,600 on its qualifying plant and machinery and other assets used in the business. Other than that, the company also claimed balancing allowance of RM3,200 and reported a balancing charge of RM5,700. (2) The information related with two other businesses for the year ended 31 December 2020, as given by his tax agent are as follows: Restaurant Car Accessories RM (27,000) 30,000 RM 150,000 20.000 8,000 0 Adjusted Income (Loss) Capital Allowance Balancing Allowance Balancing charge 12.000 Amirul is married to Batrisyah after the failure of his first marriage with Zana. Amirul paid RM2,000 a month to Zana as an alimony payment. Amirul has four children from his marriage with Zana aged 25.23, 20 and 18 respectively. Details of his children are as follows: (1) Naza. 25 years old graduated from Universiti Teknologi MARA in 2019. He is still looking for a job (2) Tia. 23 years old is pursuing a full-time degree at a Universiti of Leicester, UK and received a full scholarship from a multi-national company in Malaysia for his university fees. (3) Dini, 20 years old is studying at Universiti Kebangsaan Malaysia (4) Hana, 18 years old is studying at Kolej Matrikulasi Gopeng, Perak Despite being divorced, Zana's relationship with her children is good. Zana always gives pocket money as well as daily expenses to them. Therefore, she also claims tax relief for all of the children. Amirul has two children from his marriage with Batrisya, Faris and Fisya. Faris, 15 years old, still studying at a secondary school while Fisya, 12 years old was diagnosed with a disability and studying a special school in Penang. The following information is related to expenses paid in year 2020 by Amirul (all original receipts and supporting documents are kept systematically): 5 1. Amirul took care of his parents who staying with him. Amirul spend RM2,500 for his parents' medical bills. 2. In February 2020, Amirul spent RM1,500 to buy a laptop for his daughter (Hana) who studying at Kolej Matrikulasi Gopeng. He also spent RM120 per month for internet subscription under his name. 3. Due to the need for an online learning system, Amirul has bought 3 additional sets of smartphones for the use of his children. He bought the smartphone on 15 August 2020 with the cost of RM3,000 4. Amirul also deposited RM10,000 in their children's SSPN accounts. However, he withdrew RM1,500 to fund his children's education needs. 5. Insurance policies - Amirul paid RM1,200 for life insurance premium on the policy subscribed under his name. 6. When the government relaxed the MCO a bit, he took the opportunity to travel to Langkawi and Pangkor Island with his family. He spent the following for the trips: Return tickets to and from Langkawi RM288 3 nights accommodation at Meritus Pelangi Beach Resort & Spa, Langkawi RM735 Entrance fees to Underwater World RM104 Return tickets to and from Pangkor Island RM56 2 nights accommodation at Hotel Nyaman RM400 7. Amirul paid zakah and instalment tax payment amounted to RM25,000 respectively RM62,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started