Question

Question: Provide a Notes to accounts This considers the adequacy and effectiveness of the notes provided and includes consideration of Correctness and Completeness of disclosures

Question:

Provide a Notes to accounts This considers the adequacy and effectiveness of the notes provided and includes consideration of Correctness and Completeness of disclosures Correct application of all relevant accounting standards Appropriate identification and referencing of standards applied (eg. Standard and paragraph number) Only required disclosures being made Appropriate inclusion of notes where judgment required to be exercised Ability to make up information if not provided, or indicate information that needs to be included where this information is not available Logical sequence and links to statements to assist users

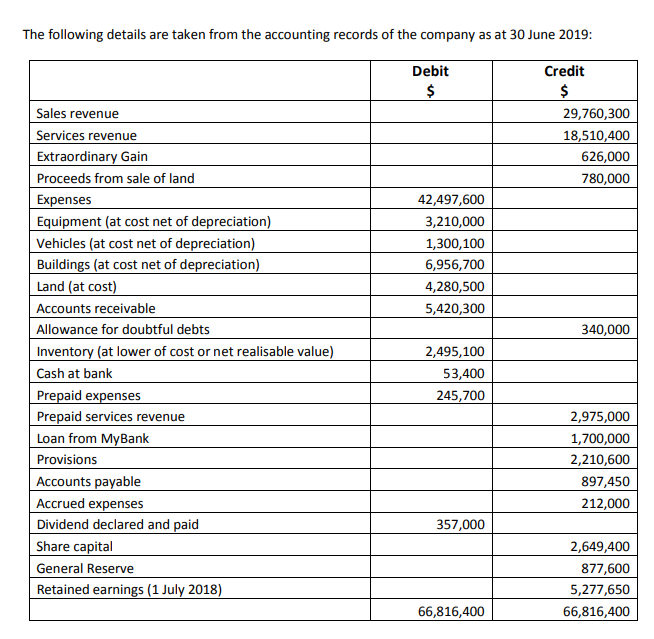

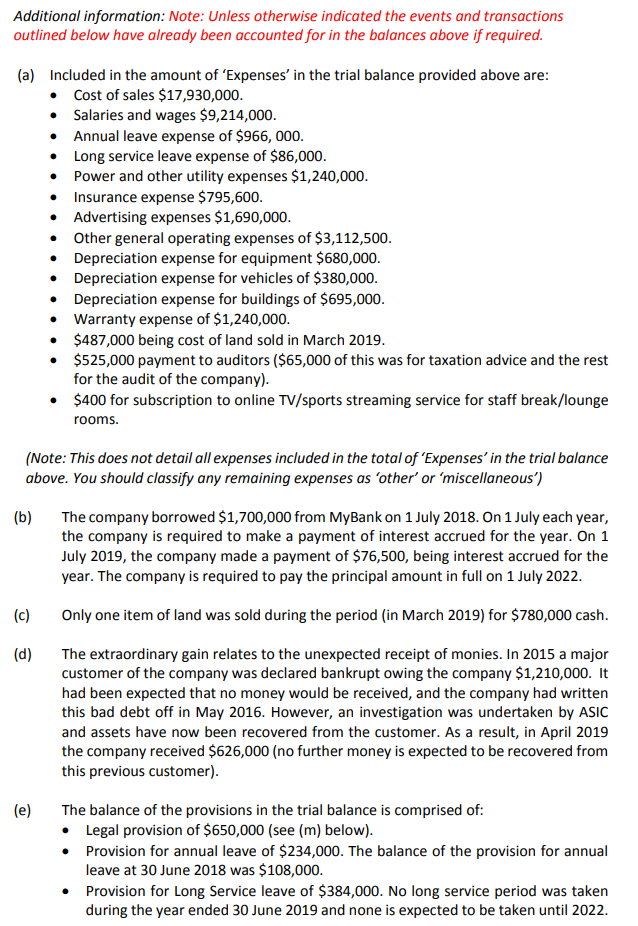

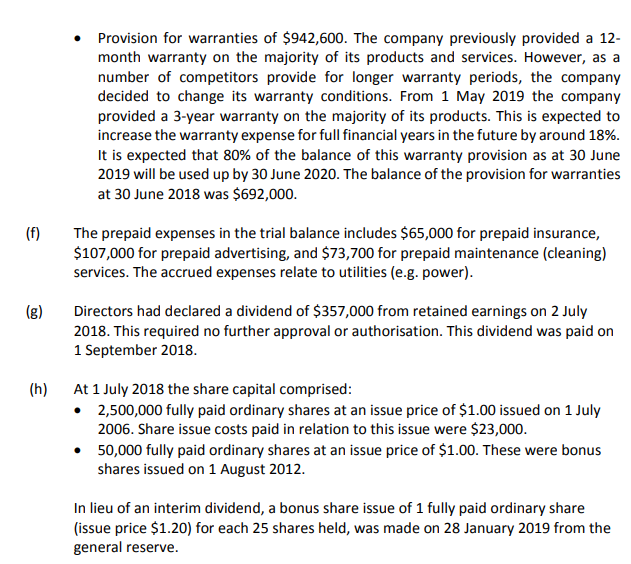

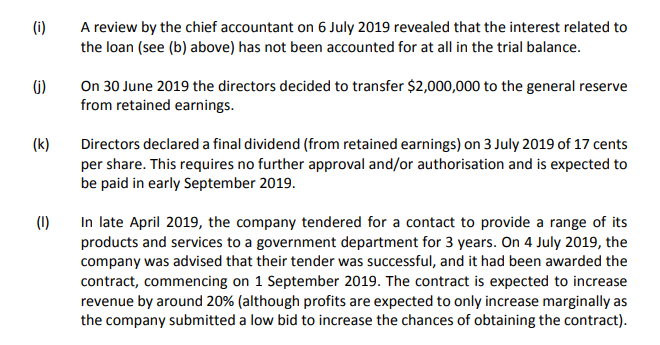

The following details are taken from the accounting records of the company as at 30 June 2019 Debit Credit Sales revenue 29,760,300 18,510,400 626,000 780,000 ervices revenue Extraordinary Gain Proceeds from sale of land Expenses Equipment (at cost net of depreciation Vehicles (at cost net of depreciation) Buildings (at cost net of depreciation) Land (at cost) Accounts receivable Allowance for doubtful debts Inventory (at lower of cost or net realisable value) Cash at bank Prepaid expenses Prepaid services revenue Loan from MyBank Provisions Accounts payable Accrued expenses Dividend declared and paid Share capital General Reserve Retained earnings (1 July 2018) 42,497,600 3,210,000 1,300,100 6,956,700 4,280,500 5,420,300 340,000 2,495,100 53,400 245,700 2,975,000 1,700,000 2,210,600 897,450 212,000 357,000 2,649,400 877,600 5,277,650 66,816,400 66,816,400 Additional information: Note: Unless otherwise indicated the events and transactions outlined below have already been accounted for in the balances above if required (a) Included in the amount of 'Expenses' in the trial balance provided above are . Cost of sales $17,930,000 .Salaries and wages $9,214,000 Annual leave expense of $966, 000 Long service leave expense of $86,000 . Power and other utility expenses $1,240,000 . Insurance expense $795,600 .Advertising expenses $1,690,000 . Other general operating expenses of $3,112,500 . Depreciation expense for equipment $680,000. . Depreciation expense for vehicles of $380,000 . Depreciation expense for buildings of $695,000 . Warranty expense of $1,240,000 . $487,000 being cost of land sold in March 2019 . $525,000 payment to auditors ($65,000 of this was for taxation advice and the rest for the audit of the company) $400 for subscription to online TV/sports streaming service for staff break/lounge rooms. . (Note: This does not detail all expenses included in the total of 'Expenses' in the trial balance above. You should classify any remaining expenses as 'other' or 'miscellaneous') (b) The company borrowed $1,700,000 from MyBank on 1 July 2018. On 1 July each year the company is required to make a payment of interest accrued for the year. On 1 July 2019, the company made a payment of $76,500, being interest accrued for the year. The company is required to pay the principal amount in full on 1 July 2022 (c) Only one item of land was sold during the period (in March 2019) for $780,000 cash (d) The extraordinary gain relates to the unexpected receipt of monies. In 2015 a major customer of the company was declared bankrupt owing the company $1,210,000. It had been expected that no money would be received, and the company had written this bad debt off in May 2016. However, an investigation was undertaken by ASIC and assets have now been recovered from the customer. As a result, in April 2019 the company received $626,000 (no further money is expected to be recovered from this previous customer) (e) The balance of the provisions in the trial balance is comprised of Legal provision of $650,000 (see (m) below) Provision for annual leave of $234,000. The balance of the provision for annual leave at 30 June 2018 was $108,000 Provision for Long Service leave of $384,000. No long service period was taken during the year ended 30 June 2019 and none is expected to be taken until 2022 . . (i) A review by the chief accountant on 6 July 2019 revealed that the interest related to the loan (see (b) above) has not been accounted for at all in the trial balance. G) On 30 June 2019 the directors decided to transfer $2,000,000 to the general reserve from retained earnings. (k) Directors declared a final dividend (from retained earnings) on 3 July 2019 of 17 cents per share. This requires no further approval and/or authorisation and is expected to be paid in early September 2019. (U) In late April 2019, the company tendered for a contact to provide a range of its products and services to a government department for 3 years. On 4 July 2019, the company was advised that their tender was successful, and it had been awarded the contract, commencing on 1 September 2019. The contract is expected to increase revenue by around 20% although profits are expected to only increase marginally as the company submitted a low bid to increase the chances of obtaining the contract). Further, it is hoped that this may increase the possibility of entering into further contracts with government departments in the future. (m) On 10 July 2019, lawyers provided further information about a claim made against the company in January 2018. This case related to a customer suing the company for damages, claiming to have seriously injured themselves whilst using one of the company's products. The company's lawyers had previously advised that it was extremely likely that the company would be required to pay around $650,000 in damages. However further evidence has indicated that the claim is fraudulent (the customer has in the past tried to sue a number of other companies for the same medical condition) and it is now believed that that the company will not be liable for any damages. The matter is expected to be finalised in October 2019 (n) The company tax rate is 30%. Ignore tax-effect accounting. Tax expense should be based on 30% of the accounting profit before tax. No tax expense has yet been recorded You should assume that the company is a reporting entity and that the date the annual report (including the financial report) is authorised for issue is 28 August 2019. The following details are taken from the accounting records of the company as at 30 June 2019 Debit Credit Sales revenue 29,760,300 18,510,400 626,000 780,000 ervices revenue Extraordinary Gain Proceeds from sale of land Expenses Equipment (at cost net of depreciation Vehicles (at cost net of depreciation) Buildings (at cost net of depreciation) Land (at cost) Accounts receivable Allowance for doubtful debts Inventory (at lower of cost or net realisable value) Cash at bank Prepaid expenses Prepaid services revenue Loan from MyBank Provisions Accounts payable Accrued expenses Dividend declared and paid Share capital General Reserve Retained earnings (1 July 2018) 42,497,600 3,210,000 1,300,100 6,956,700 4,280,500 5,420,300 340,000 2,495,100 53,400 245,700 2,975,000 1,700,000 2,210,600 897,450 212,000 357,000 2,649,400 877,600 5,277,650 66,816,400 66,816,400 Additional information: Note: Unless otherwise indicated the events and transactions outlined below have already been accounted for in the balances above if required (a) Included in the amount of 'Expenses' in the trial balance provided above are . Cost of sales $17,930,000 .Salaries and wages $9,214,000 Annual leave expense of $966, 000 Long service leave expense of $86,000 . Power and other utility expenses $1,240,000 . Insurance expense $795,600 .Advertising expenses $1,690,000 . Other general operating expenses of $3,112,500 . Depreciation expense for equipment $680,000. . Depreciation expense for vehicles of $380,000 . Depreciation expense for buildings of $695,000 . Warranty expense of $1,240,000 . $487,000 being cost of land sold in March 2019 . $525,000 payment to auditors ($65,000 of this was for taxation advice and the rest for the audit of the company) $400 for subscription to online TV/sports streaming service for staff break/lounge rooms. . (Note: This does not detail all expenses included in the total of 'Expenses' in the trial balance above. You should classify any remaining expenses as 'other' or 'miscellaneous') (b) The company borrowed $1,700,000 from MyBank on 1 July 2018. On 1 July each year the company is required to make a payment of interest accrued for the year. On 1 July 2019, the company made a payment of $76,500, being interest accrued for the year. The company is required to pay the principal amount in full on 1 July 2022 (c) Only one item of land was sold during the period (in March 2019) for $780,000 cash (d) The extraordinary gain relates to the unexpected receipt of monies. In 2015 a major customer of the company was declared bankrupt owing the company $1,210,000. It had been expected that no money would be received, and the company had written this bad debt off in May 2016. However, an investigation was undertaken by ASIC and assets have now been recovered from the customer. As a result, in April 2019 the company received $626,000 (no further money is expected to be recovered from this previous customer) (e) The balance of the provisions in the trial balance is comprised of Legal provision of $650,000 (see (m) below) Provision for annual leave of $234,000. The balance of the provision for annual leave at 30 June 2018 was $108,000 Provision for Long Service leave of $384,000. No long service period was taken during the year ended 30 June 2019 and none is expected to be taken until 2022 . . (i) A review by the chief accountant on 6 July 2019 revealed that the interest related to the loan (see (b) above) has not been accounted for at all in the trial balance. G) On 30 June 2019 the directors decided to transfer $2,000,000 to the general reserve from retained earnings. (k) Directors declared a final dividend (from retained earnings) on 3 July 2019 of 17 cents per share. This requires no further approval and/or authorisation and is expected to be paid in early September 2019. (U) In late April 2019, the company tendered for a contact to provide a range of its products and services to a government department for 3 years. On 4 July 2019, the company was advised that their tender was successful, and it had been awarded the contract, commencing on 1 September 2019. The contract is expected to increase revenue by around 20% although profits are expected to only increase marginally as the company submitted a low bid to increase the chances of obtaining the contract). Further, it is hoped that this may increase the possibility of entering into further contracts with government departments in the future. (m) On 10 July 2019, lawyers provided further information about a claim made against the company in January 2018. This case related to a customer suing the company for damages, claiming to have seriously injured themselves whilst using one of the company's products. The company's lawyers had previously advised that it was extremely likely that the company would be required to pay around $650,000 in damages. However further evidence has indicated that the claim is fraudulent (the customer has in the past tried to sue a number of other companies for the same medical condition) and it is now believed that that the company will not be liable for any damages. The matter is expected to be finalised in October 2019 (n) The company tax rate is 30%. Ignore tax-effect accounting. Tax expense should be based on 30% of the accounting profit before tax. No tax expense has yet been recorded You should assume that the company is a reporting entity and that the date the annual report (including the financial report) is authorised for issue is 28 August 2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started