Answered step by step

Verified Expert Solution

Question

1 Approved Answer

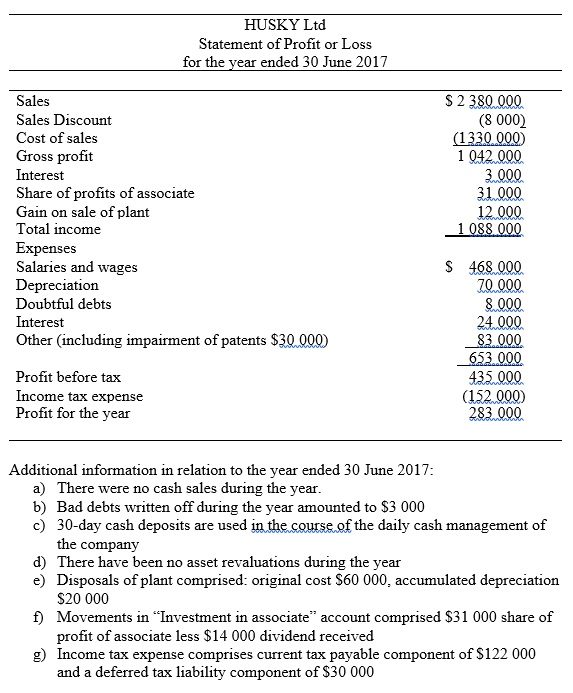

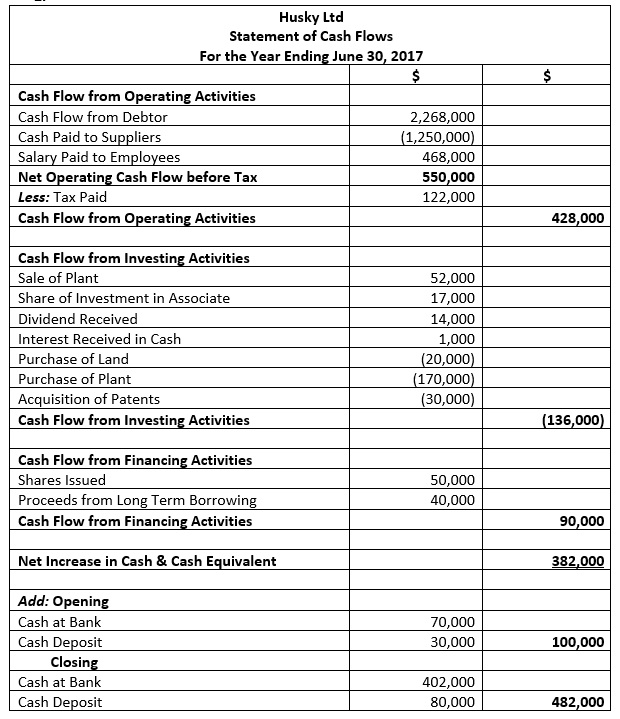

Question: Provide a reconciliation of net profit after tax with net cash provided by operating activities in accordance with AASB 1054? PART C (Total of

Question:

Provide a reconciliation of net profit after tax with net cash provided by operating activities in accordance with AASB 1054?

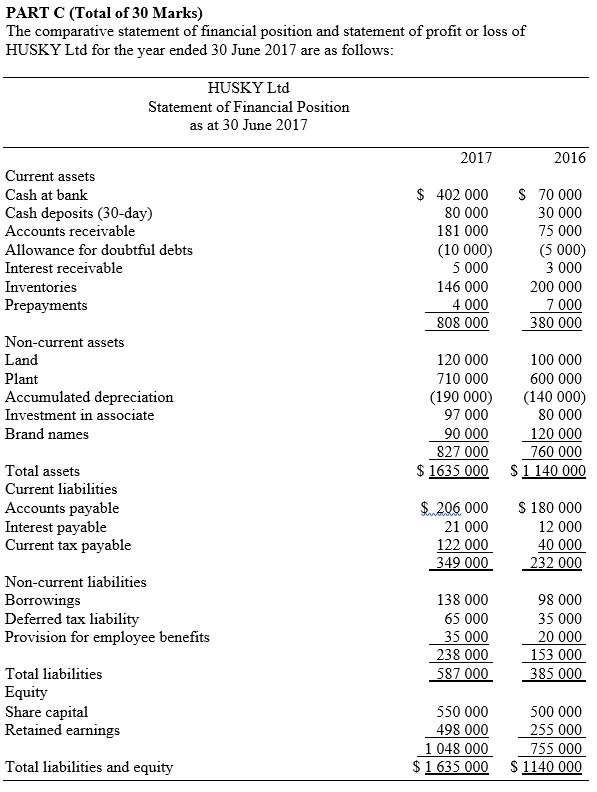

PART C (Total of 30 Marks) The comparative statement of financial position and statement of profit or loss of HUSKYLtd for the year ended 30 June 2017 are as follows: HUSKY Ltd Statement of Financial Position as at 30 June 2017 2017 2016 Current assets 402 000 70 000 Cash at bank deposits (30-da Cash 80 000 30 000 181 000 Accounts receivable 75 000 Allowance for doubtful debts (10 000) (5 000) Interest receivable 5 000 3 000 146 000 200 000 Inventories Prepayments 4 000 7000 808 000 380 000 Non-current assets 120 000 100 000 Land 710 000 600 000 Plant Accumulated depreciation (190 000) (140 000) 97 000 Investment in associate 80 000 Brand names 90 000 120 000 827 000 760 000 1635 000 1140 000 Total assets Current liabilities 206 000 180 000 Accounts payable Interest payable 21 000 12.000 Current tax payable 122 000 40 000 349 000 232 000 Non-current liabilities 138 000 Borrowings 98 000 Deferred tax liability 65 000 35 000 Provision for employee benefits 35 000 20 000 238 000 153 000 Total liabilities 587 000 385 000 Equity Share capital 550 000 500 000 Retained earnings 498 000 255 000 1 048 000 755 000 Total liabilities and equity 1633 000 S1140 000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started