Answered step by step

Verified Expert Solution

Question

1 Approved Answer

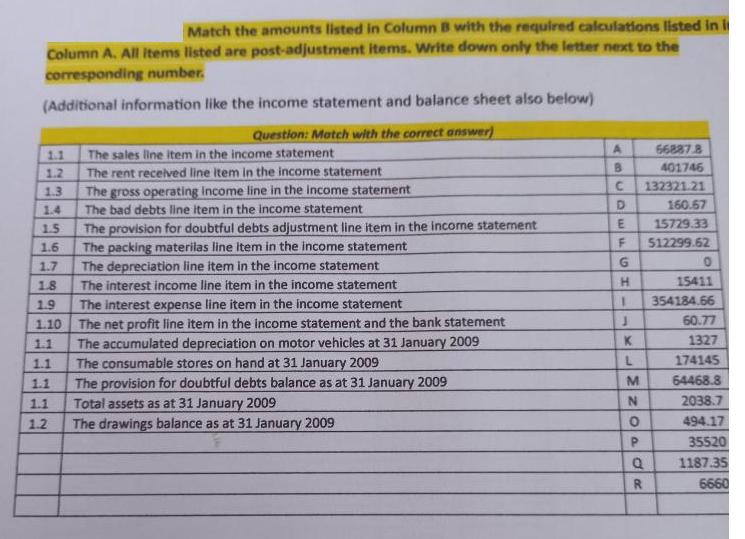

Match the amounts listed in Column B with the required calculations listed in i Column A. All items listed are post-adjustment items. Write down

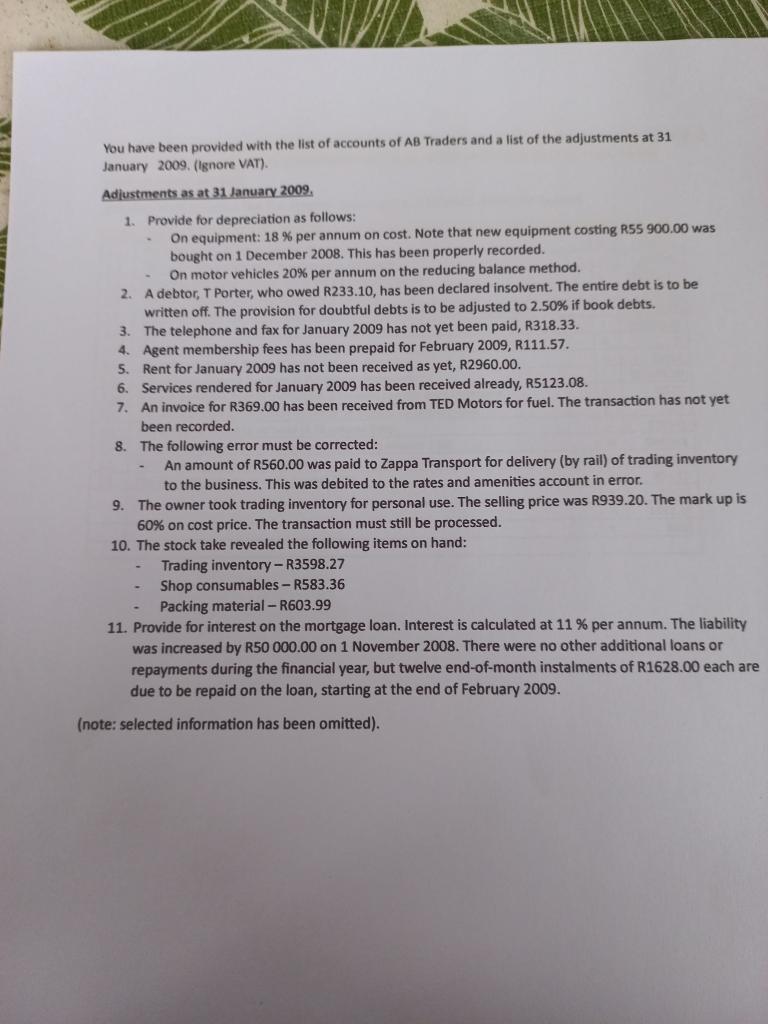

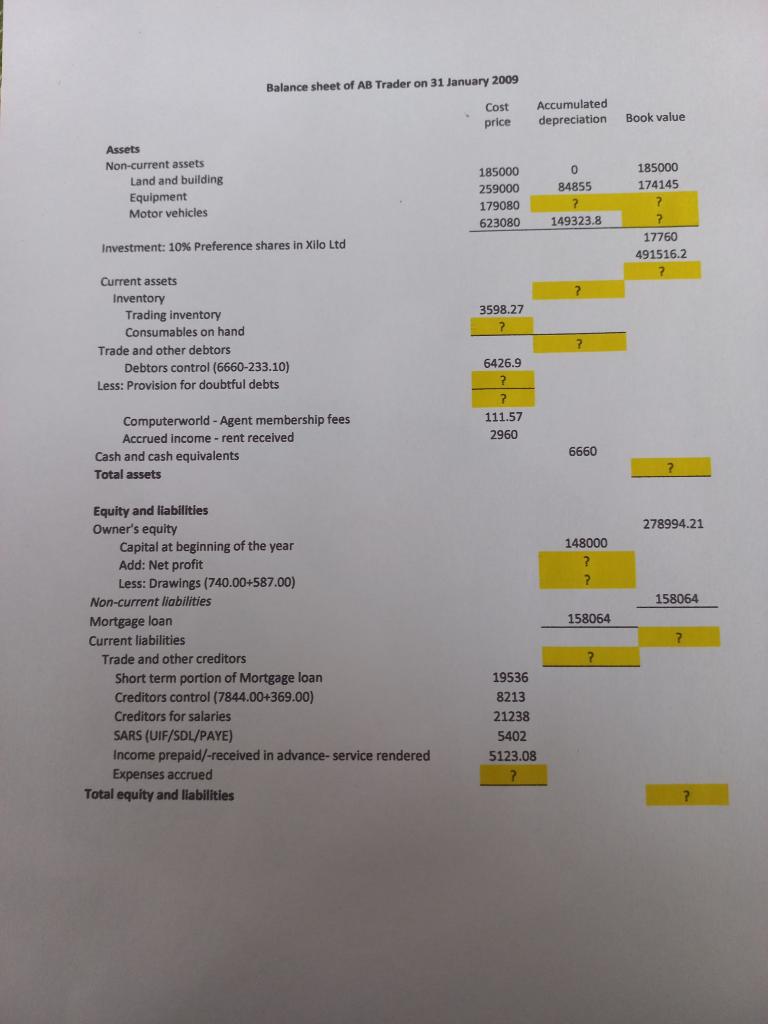

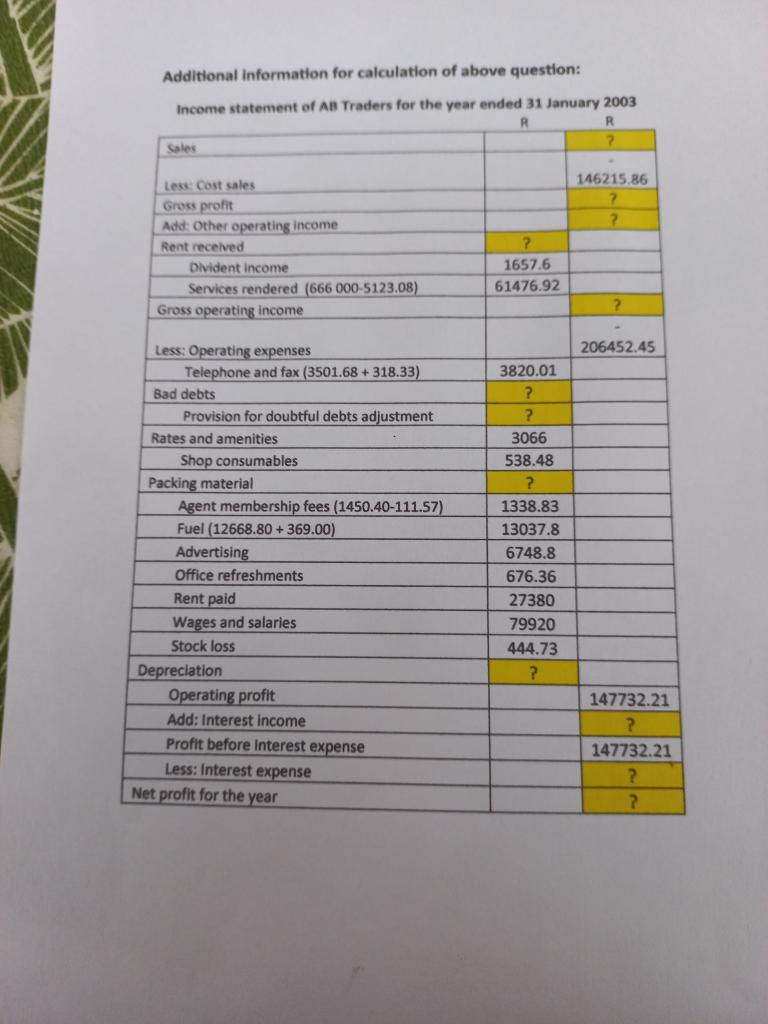

Match the amounts listed in Column B with the required calculations listed in i Column A. All items listed are post-adjustment items. Write down only the letter next to the corresponding number. (Additional information like the income statement and balance sheet also below) Question: Match with the correct answer) The sales line item in the income statement The rent received line item in the income statement 1.3 The gross operating income line in the income statement 1.4 The bad debts line item in the income statement 1.1 1.2 1.5 The provision for doubtful debts adjustment line item in the income statement The packing materilas line item in the income statement The depreciation line item in the income statement The interest income line item in the income statement The interest expense line item in the income statement The net profit line item in the income statement and the bank statement The accumulated depreciation on motor vehicles at 31 January 2009 The consumable stores on hand at 31 January 2009 The provision for doubtful debts balance as at 31 January 2009 Total assets as at 31 January 2009 The drawings balance as at 31 January 2009 LLLL 1.6 1.7 1.8 1.9 1.10 1.1 1.1 1.1 1.1 1.2 A 48 B C D E F H 1 J K L M N O P 66887.8 401746 132321.21 Q R 160.67 15729.33 512299.62 0 15411 354184.66 60.77 1327 174145 64468.8 2038.7 494.17 35520 1187.35 6660 You have been provided with the list of accounts of AB Traders and a list of the adjustments at 31 January 2009. (Ignore VAT). Adjustments as at 31 January 2009. 1. Provide for depreciation as follows: On equipment: 18 % per annum on cost. Note that new equipment costing R55 900.00 was bought on 1 December 2008. This has been properly recorded. On motor vehicles 20% per annum on the reducing balance method. 2. A debtor, T Porter, who owed R233.10, has been declared insolvent. The entire debt is to be written off. The provision for doubtful debts is to be adjusted to 2.50% if book debts. 3. The telephone and fax for January 2009 has not yet been paid, R318.33. 4. Agent membership fees has been prepaid for February 2009, R111.57. 5. Rent for January 2009 has not been received as yet, R2960.00. 6. Services rendered for January 2009 has been received already, R5123.08. 7. An invoice for R369.00 has been received from TED Motors for fuel. The transaction has not yet been recorded. 8. The following error must be corrected: An amount of R560.00 was paid to Zappa Transport for delivery (by rail) of trading inventory to the business. This was debited to the rates and amenities account in error. 9. The owner took trading inventory for personal use. The selling price was R939.20. The mark up is 60% on cost price. The transaction must still be processed. 10. The stock take revealed the following items on hand: Trading inventory-R3598.27 Shop consumables-R583.36 Packing material-R603.99 11. Provide for interest on the mortgage loan. Interest is calculated at 11 % per annum. The liability was increased by R50 000.00 on 1 November 2008. There were no other additional loans or repayments during the financial year, but twelve end-of-month instalments of R1628.00 each are due to be repaid on the loan, starting at the end of February 2009. (note: selected information has been omitted). Assets Non-current assets Land and building Equipment Motor vehicles Investment: 10% Preference shares in Xilo Ltd Current assets Inventory Trading inventory Consumables on hand Trade and other debtors Debtors control (6660-233.10) Less: Provision for doubtful debts Computerworld - Agent membership fees Accrued income- rent received Cash and cash equivalents Total assets Balance sheet of AB Trader on 31 January 2009 Cost price Equity and liabilities Owner's equity Capital at beginning of the year Add: Net profit Less: Drawings (740.00+587.00) Non-current liabilities Mortgage loan Current liabilities Trade and other creditors Short term portion of Mortgage loan Creditors control (7844.00+369.00) Creditors for salaries SARS (UIF/SDL/PAYE) Income prepaid/-received in advance-service rendered Expenses accrued Total equity and liabilities 185000 259000 179080 623080 3598.27 ? 6426.9 ? ? 111.57 2960 Accumulated depreciation 19536 8213 21238 5402 5123.08 ? 0 84855 149323.8 ? 6660 148000 ? ? 158064 ? Book value 185000 174145 ? ? 17760 491516.2 ? 278994.21 158064 7 ? Additional information for calculation of above question: Income statement of AB Traders for the year ended 31 January 2003 R R ? Sales Less: Cost sales Gross profit Add: Other operating income Rent received Divident income Services rendered (666 000-5123.08) Gross operating income Less: Operating expenses Telephone and fax (3501.68 +318.33) Bad debts Provision for doubtful debts adjustment Rates and amenities Shop consumables Packing material Agent membership fees (1450.40-111.57) Fuel (12668.80 + 369.00) Advertising Office refreshments Rent paid Wages and salaries Stock loss Depreciation Operating profit Add: Interest income Profit before interest expense Less: Interest expense Net profit for the year ? 1657.6 61476.92 3820.01 ? ? 3066 538.48 ? 1338.83 13037.8 6748.8 676.36 27380 79920 444.73 ? 146215.86 ? ? ? 206452.45 147732.21 ? 147732.21 ? ?

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Based on the given information the correct matching of calculations in Column A with the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started