Question: The cost of bank debt is generally lower than the cost of public high-yield bond. Explain why this may be the case.

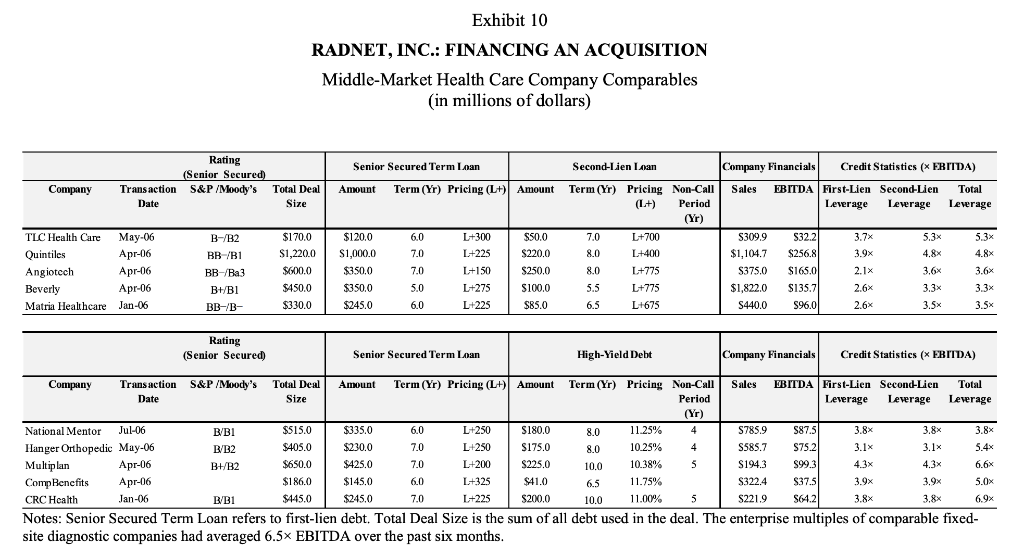

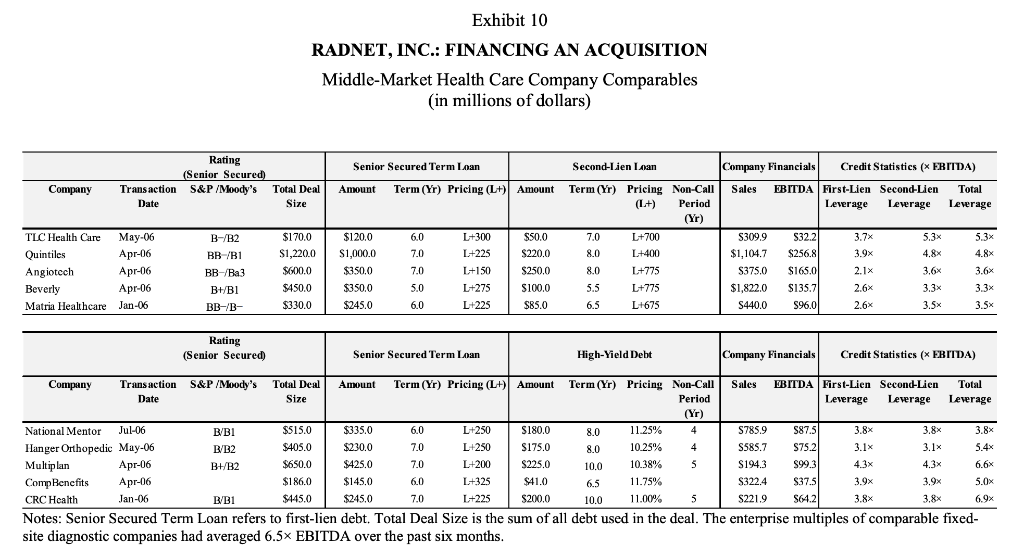

First tranche: Senior debt Because senior (or first-lien) debt holders were paid first in the event of bankruptcy, senior debt typically had the lowest interest cost. Commercial banks, the main providers of senior debt, evaluated both the creditworthiness of a given company and the existing market conditions before deciding what leverage ratio (usually based on a multiple of EBITDA) constituted a cutoff point for lending. In the first six months of 2006, leverage multiples for down the fairway senior secured (first-lien) debt for health care companies had ranged from 2.1x to 4.3x EBITDA, with spreads running from 150 bps to 350 bps over London Interbank Offered Rate (LIBOR) (Exhibit 10). Because of its lower interest cost, companies ordinarily attempted to max out the use of senior debt before resorting to other forms of financing. GE Capital would underwrite 100% of the senior debt and then try to syndicate the majority of that debt to other lenders. The acquirer of a public company usually insisted on a fully underwritten commitment to reduce the chances of the board accepting an offer that later failed due to lack of financing. In theory, if the syndication failed, GE Capital would be legally obligated to provide the required funding. In a typical failed syndication, however, the bank was entitled to increase the interest rate on the senior debt to compensate for a larger-than-expected hold amount. Stolper wanted to finance the acquisition to the greatest extent possible with senior debt, without risking a failed syndication and the prospect of higher interest payments. Second tranche: Public versus private debt Because of the size of the Radiologix acquisition, more than one type of debt financing would likely be needed. Here, Stolper's advisers differed in their recommendations about the second tranche of debt. The investment bankers at Jefferies urged RadNet to tap the public debt markets and raise HY bonds. They argued that the public HY market provided the most liquidity and therefore the best price. The team at GE Capital countered that private debt in the form of second-lien debt (SLD) should be used instead. SLD was a form of secured debt that had, since 2003, become popular in the market. Before 2003, less than $1 billion of SLD loans had been raised, but by 2005, the volume of SLD loans had risen to $16.3 billion and had already surpassed that mark by mid-2006. Depending on the quality of the collateral, in recent months, the spreads on SLD were running from around 400 bps to 800 bps over LIBOR (Exhibit 10). GE Capital feared a modest-size public offering would not attract sufficient investor attention in a market more accustomed to larger issuances by better-known companies. To support its claim, GE Capital noted that in recent years, the average HY issue had been roughly $300 million.' Because this would be a first-time public debt issue for RadNet, it risked the transaction failing due to a lack of investor interest. On the other hand, if RadNet needed to come back to the market again, GE Capital acknowledged that having an established investor base would be an advantage. Beyond pricing and availability, the public- versus private-debt decision subsumed several other important considerations. 8 SLD was secured by the same assets as bank debt but legally only had a second-priority lien on those assets. As a result, SLD was often "secured in name only and for all practical purposes was subordinated to bank debt. As a private instrument, a company did not have to register with the U.S. Securities and Exchange Commission to issue SLD, which saved time and costs. The average size of HY fixed-rate issues from 2000 to June 2006 by U.S. firms comes from the Thomson Reuters Security Data Corporation's Global New Issues Database. 9 Exhibit 10 RADNET, INC.: FINANCING AN ACQUISITION Middle-Market Health Care Company Comparables (in millions of dollars) Rating Senior Secured Term Loan Company (Senior Secured) S&P /Moody's Total Deal Size Transaction Date Amount Term (Yr) Pricing (L+) Amount TLC Health Care May-06 - Quintiles Apr-06 Angiotech Apr-06 Beverly Apr-06 Matria Healthcare Jan-06 6.0 7.0 B-/B2 BB-/B1 BB-/Ba3 BHB1 BB-B- $170.0 $1,220.0 $600.0 $450.0 $330.0 $120,0 $1,000,0 $350,0 L+300 L+225 L+150 L+275 SS0.0 $220,0 $250,0 $100,0 Second-Lien Loan Company Financials Credit Statistics (X EBITDA) Term (Yr) Pricing Non-Call Sales EBITDA First-Lien Second-Lien Total (L+) Period Leverage Leverage Leverage (Yr) 7.0 L+700 $309.9 $32.2 3.7x 5.3% 5.3x 8.0 L+400 $1,104.7 $256.8 3.9x 4.8% 4.8% 8.0 L+775 S375.0 $165.0 2.1 x 3.6% 3.6% 5.5 L+775 $1,822.0 S135.7 2.6x 3.3% 3.3% 6.5 L+675 S440.0 S96.0 2.6x 3.5x 3.5x 7.0 $350.0 $245.0 5.0 6.0 L+225 $85.0 Rating (Senior Secured) Senior Secured Term Loan High-Yield Debt Company Financials Credit Statistics (X EBITDA) Company Transaction S&P /Moody's Total Deal Amount Term (Yr) Pricing (L+) Amount Term (Yr) Pricing Non-Call Saules EBITDA First-Lien Second-Lien Total Date Size Period Leverage Leverage Leverage (Yr) National Mentor Jul-06 B/BI $S15.0 $335.0 6.0 L+250 S180,0 8.0 11.25% 4 S785.9 587. 3.8% 3.8% 3.8% Hanger Orthopedic May-06 B/B2 $405.0 $230,0 7.0 L+250 $175.0 8.0 10.25% 4 S585.7 S75.2 3.1x 3.1% 5.4x Multiplan Apr-06 B+/B2 $650.0 $425.0 7.0 L+200 $225,0 10.0 10.38% 5 S194.3 $99.3 4.3x 4.3x 6.6% Comp Benefits Apr-06 $186.0 $145.0 6.0 L+325 $41.0 6.5 11.75% S322.4 $37.5 3.9% 3.9x 5.OX CRC Health Jan-06 B/B1 $145.0 $245.0 7.0 L+225 $200.0 10.0 11.00% 5 5 S221.9 5612 3.8% 3.8% 6.9x Notes: Senior Secured Term Loan refers to first-lien debt. Total Deal Size is the sum of all debt used in the deal. The enterprise multiples of comparable fixed- site diagnostic companies had averaged 6.5x EBITDA over the past six months. First tranche: Senior debt Because senior (or first-lien) debt holders were paid first in the event of bankruptcy, senior debt typically had the lowest interest cost. Commercial banks, the main providers of senior debt, evaluated both the creditworthiness of a given company and the existing market conditions before deciding what leverage ratio (usually based on a multiple of EBITDA) constituted a cutoff point for lending. In the first six months of 2006, leverage multiples for down the fairway senior secured (first-lien) debt for health care companies had ranged from 2.1x to 4.3x EBITDA, with spreads running from 150 bps to 350 bps over London Interbank Offered Rate (LIBOR) (Exhibit 10). Because of its lower interest cost, companies ordinarily attempted to max out the use of senior debt before resorting to other forms of financing. GE Capital would underwrite 100% of the senior debt and then try to syndicate the majority of that debt to other lenders. The acquirer of a public company usually insisted on a fully underwritten commitment to reduce the chances of the board accepting an offer that later failed due to lack of financing. In theory, if the syndication failed, GE Capital would be legally obligated to provide the required funding. In a typical failed syndication, however, the bank was entitled to increase the interest rate on the senior debt to compensate for a larger-than-expected hold amount. Stolper wanted to finance the acquisition to the greatest extent possible with senior debt, without risking a failed syndication and the prospect of higher interest payments. Second tranche: Public versus private debt Because of the size of the Radiologix acquisition, more than one type of debt financing would likely be needed. Here, Stolper's advisers differed in their recommendations about the second tranche of debt. The investment bankers at Jefferies urged RadNet to tap the public debt markets and raise HY bonds. They argued that the public HY market provided the most liquidity and therefore the best price. The team at GE Capital countered that private debt in the form of second-lien debt (SLD) should be used instead. SLD was a form of secured debt that had, since 2003, become popular in the market. Before 2003, less than $1 billion of SLD loans had been raised, but by 2005, the volume of SLD loans had risen to $16.3 billion and had already surpassed that mark by mid-2006. Depending on the quality of the collateral, in recent months, the spreads on SLD were running from around 400 bps to 800 bps over LIBOR (Exhibit 10). GE Capital feared a modest-size public offering would not attract sufficient investor attention in a market more accustomed to larger issuances by better-known companies. To support its claim, GE Capital noted that in recent years, the average HY issue had been roughly $300 million.' Because this would be a first-time public debt issue for RadNet, it risked the transaction failing due to a lack of investor interest. On the other hand, if RadNet needed to come back to the market again, GE Capital acknowledged that having an established investor base would be an advantage. Beyond pricing and availability, the public- versus private-debt decision subsumed several other important considerations. 8 SLD was secured by the same assets as bank debt but legally only had a second-priority lien on those assets. As a result, SLD was often "secured in name only and for all practical purposes was subordinated to bank debt. As a private instrument, a company did not have to register with the U.S. Securities and Exchange Commission to issue SLD, which saved time and costs. The average size of HY fixed-rate issues from 2000 to June 2006 by U.S. firms comes from the Thomson Reuters Security Data Corporation's Global New Issues Database. 9 Exhibit 10 RADNET, INC.: FINANCING AN ACQUISITION Middle-Market Health Care Company Comparables (in millions of dollars) Rating Senior Secured Term Loan Company (Senior Secured) S&P /Moody's Total Deal Size Transaction Date Amount Term (Yr) Pricing (L+) Amount TLC Health Care May-06 - Quintiles Apr-06 Angiotech Apr-06 Beverly Apr-06 Matria Healthcare Jan-06 6.0 7.0 B-/B2 BB-/B1 BB-/Ba3 BHB1 BB-B- $170.0 $1,220.0 $600.0 $450.0 $330.0 $120,0 $1,000,0 $350,0 L+300 L+225 L+150 L+275 SS0.0 $220,0 $250,0 $100,0 Second-Lien Loan Company Financials Credit Statistics (X EBITDA) Term (Yr) Pricing Non-Call Sales EBITDA First-Lien Second-Lien Total (L+) Period Leverage Leverage Leverage (Yr) 7.0 L+700 $309.9 $32.2 3.7x 5.3% 5.3x 8.0 L+400 $1,104.7 $256.8 3.9x 4.8% 4.8% 8.0 L+775 S375.0 $165.0 2.1 x 3.6% 3.6% 5.5 L+775 $1,822.0 S135.7 2.6x 3.3% 3.3% 6.5 L+675 S440.0 S96.0 2.6x 3.5x 3.5x 7.0 $350.0 $245.0 5.0 6.0 L+225 $85.0 Rating (Senior Secured) Senior Secured Term Loan High-Yield Debt Company Financials Credit Statistics (X EBITDA) Company Transaction S&P /Moody's Total Deal Amount Term (Yr) Pricing (L+) Amount Term (Yr) Pricing Non-Call Saules EBITDA First-Lien Second-Lien Total Date Size Period Leverage Leverage Leverage (Yr) National Mentor Jul-06 B/BI $S15.0 $335.0 6.0 L+250 S180,0 8.0 11.25% 4 S785.9 587. 3.8% 3.8% 3.8% Hanger Orthopedic May-06 B/B2 $405.0 $230,0 7.0 L+250 $175.0 8.0 10.25% 4 S585.7 S75.2 3.1x 3.1% 5.4x Multiplan Apr-06 B+/B2 $650.0 $425.0 7.0 L+200 $225,0 10.0 10.38% 5 S194.3 $99.3 4.3x 4.3x 6.6% Comp Benefits Apr-06 $186.0 $145.0 6.0 L+325 $41.0 6.5 11.75% S322.4 $37.5 3.9% 3.9x 5.OX CRC Health Jan-06 B/B1 $145.0 $245.0 7.0 L+225 $200.0 10.0 11.00% 5 5 S221.9 5612 3.8% 3.8% 6.9x Notes: Senior Secured Term Loan refers to first-lien debt. Total Deal Size is the sum of all debt used in the deal. The enterprise multiples of comparable fixed- site diagnostic companies had averaged 6.5x EBITDA over the past six months