Answered step by step

Verified Expert Solution

Question

1 Approved Answer

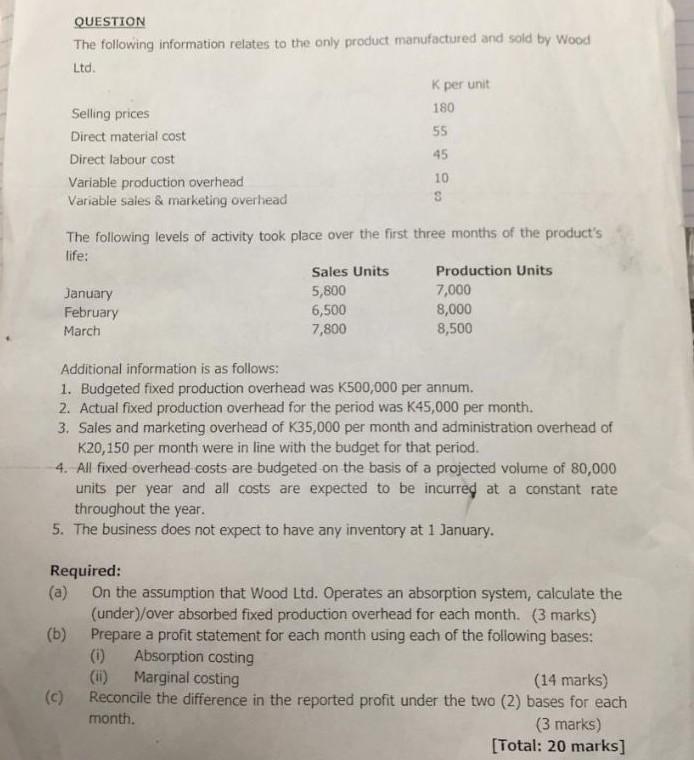

QUESTION The following information relates to the only product manufactured and sold by Wood Ltd. K per unit Selling prices 180 Direct material cost 55

QUESTION The following information relates to the only product manufactured and sold by Wood Ltd. K per unit Selling prices 180 Direct material cost 55 Direct labour cost 45 Variable production overhead 10 Variable sales & marketing overhead S The following levels of activity took place over the first three months of the product's life: Sales Units Production Units January 5,800 7,000 February 6,500 8,000 March 7,800 8,500 Additional information is as follows: 1. Budgeted fixed production overhead was K500,000 per annum. 2. Actual fixed production overhead for the period was K45,000 per month. 3. Sales and marketing overhead of K35,000 per month and administration overhead of K20,150 per month were in line with the budget for that period. 4. All fixed overhead costs are budgeted on the basis of a projected volume of 80,000 units per year and all costs are expected to be incurred at a constant rate throughout the year. 5. The business does not expect to have any inventory at 1 January. Required: (a) On the assumption that Wood Ltd. Operates an absorption system, calculate the (under)/over absorbed fixed production overhead for each month. (3 marks) (b) Prepare a profit statement for each month using each of the following bases: (1) Absorption costing (1) Marginal costing (14 marks) (c) Reconcile the difference in the reported profit under the two (2) bases for each month. (3 marks) [Total: 20 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started