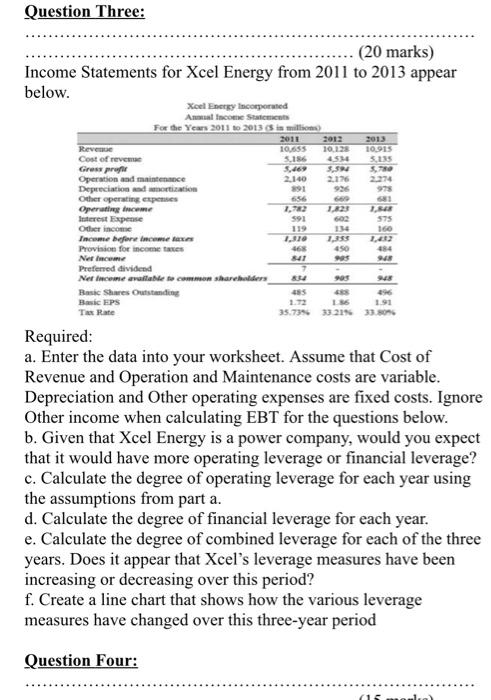

Question Three: (20 marks) Income Statements for Xcel Energy from 2011 to 2013 appear below. Xcel Energy Incorporated Amal Income State the Years 2011 to 2013 in millions) 2011 2012 2013 Reveme 10,655 10,28 1095 Cost of revene SLIS 451 5.US Gross profil 5.5 Operation and maintenance 2.140 2.176 Depreciation 291 Other operating experies 656 rathar tem 1.8 Interest Expense 591 575 Oder income 119 160 Income before income taxes 1.11 1,335 Provision for income taxes 468 450 484 Netice Preferred dividend 7 Net income available to common shareholders 905 Basic Shares Outstanding 485 Basic EPS 15 Tix Rate 35.73% 3321933.80 Required: NB a. Enter the data into your worksheet. Assume that Cost of Revenue and Operation and Maintenance costs are variable. Depreciation and Other operating expenses are fixed costs. Ignore Other income when calculating EBT for the questions below. b. Given that Xcel Energy is a power company, would you expect that it would have more operating leverage or financial leverage? c. Calculate the degree of operating leverage for each year using the assumptions from part a. d. Calculate the degree of financial leverage for each year. e. Calculate the degree of combined leverage for each of the three years. Does it appear that Xcel's leverage measures have been increasing or decreasing over this period? f. Create a line chart that shows how the various leverage measures have changed over this three-year period Question Four: (15) Income Sweets for Xeel Energy Droet 2011 2013 appear below PY 2018 2011 1 2) 11 AN Neem Nofemme Required Enter the dutime your worksheet Assume that Cest of Revenue and Operation and Maintenance costs are variable. Depreciation and other operating experts are fived costs. The Other income when calculating PBT for the questions Given that Xoel Energy is a power company, would you expect that it would have mere operating leverage or financial Revenge? Calculate the degree of operating leverage for each year using the septices from purta 4 Calede the degree of financial leverage for each year Calculate the degree of combined leverage for each of the these youn. Does it appear that Xcely leverage ewures have been increming or decrewing over this period! Create a line chart that shows how the leverage nurslave changed over this three-year period