Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION THREE a) Jennifer Connelly manages a KES200 million portfolio of government bonds. She expects the portfolio will return 3.20% over the next year. However,

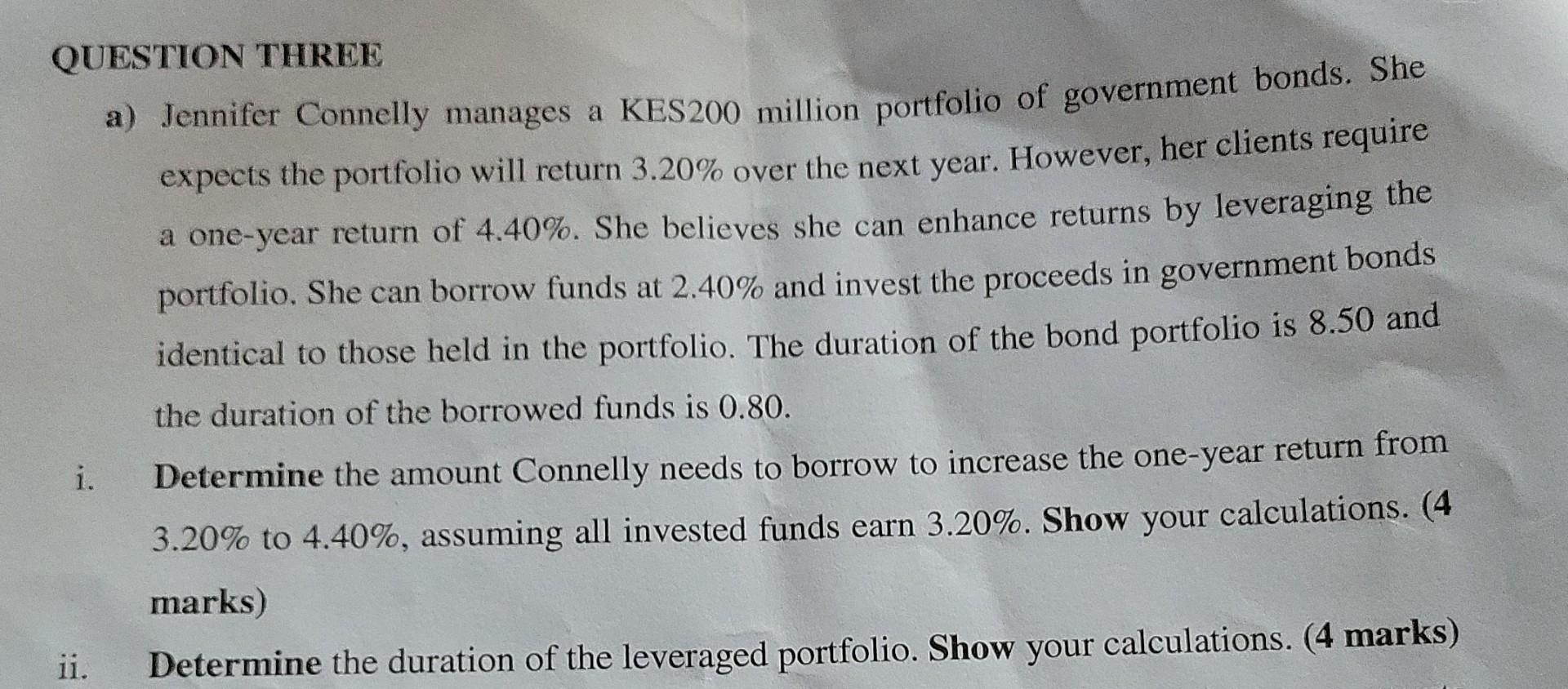

QUESTION THREE a) Jennifer Connelly manages a KES200 million portfolio of government bonds. She expects the portfolio will return 3.20% over the next year. However, her clients require a one-year return of 4.40%. She believes she can enhance returns by leveraging the portfolio. She can borrow funds at 2.40% and invest the proceeds in government bonds identical to those held in the portfolio. The duration of the bond portfolio is 8.50 and the duration of the borrowed funds is 0.80. Determine the amount Connelly needs to borrow to increase the one-year return from 3.20% to 4.40%, assuming all invested funds earn 3.20%. Show your calculations. (4 marks) ii. Determine the duration of the leveraged portfolio. Show your calculations. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started