Answered step by step

Verified Expert Solution

Question

1 Approved Answer

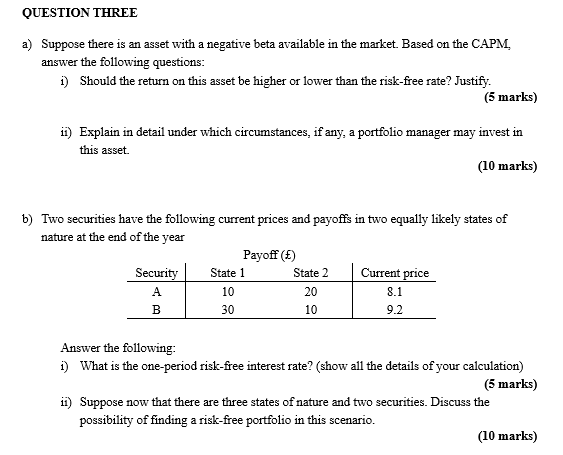

QUESTION THREE a) Suppose there is an asset with a negative beta available in the market. Based on the CAPM. answer the following questions: 1)

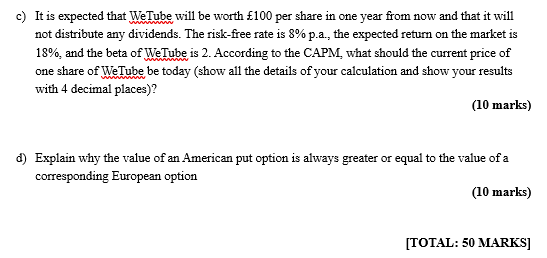

QUESTION THREE a) Suppose there is an asset with a negative beta available in the market. Based on the CAPM. answer the following questions: 1) Should the return on this asset be higher or lower than the risk-free rate? Justify. (5 marks) ii) Explain in detail under which circumstances, if any, a portfolio manager may invest in this asset. (10 marks) b) Two securities have the following current prices and payoffs in two equally likely states of nature at the end of the year Payoff (!) Security State 1 State 2 Current price 8.1 B 10 30 20 10 9.2 Answer the following: 1) What is the one-period risk-free interest rate? (show all the details of your calculation) (5 marks) ii) Suppose now that there are three states of nature and two securities. Discuss the possibility of finding a risk-free portfolio in this scenario. (10 marks) c) It is expected that WeTube will be worth 100 per share in one year from now and that it will not distribute any dividends. The risk-free rate is 8% p.a., the expected return on the market is 18%, and the beta of WeTube is 2. According to the CAPM what should the current price of one share of WeTube be today (show all the details of your calculation and show your results with 4 decimal places)? (10 marks) d) Explain why the value of an American put option is always greater or equal to the value of a corresponding European option (10 marks) [TOTAL: 50 MARKS]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started