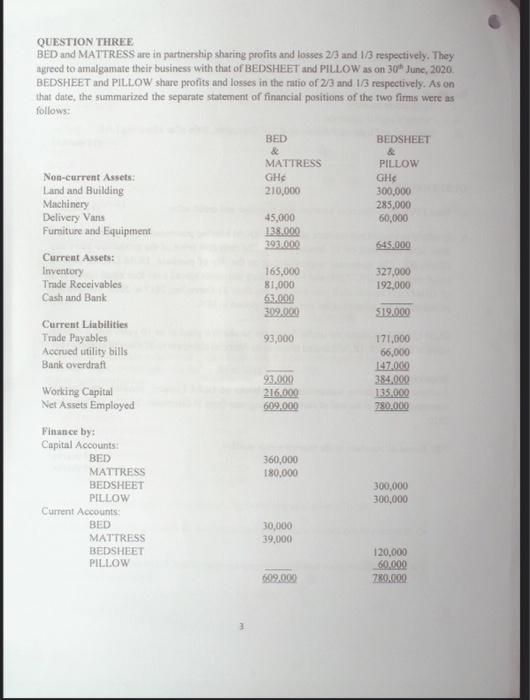

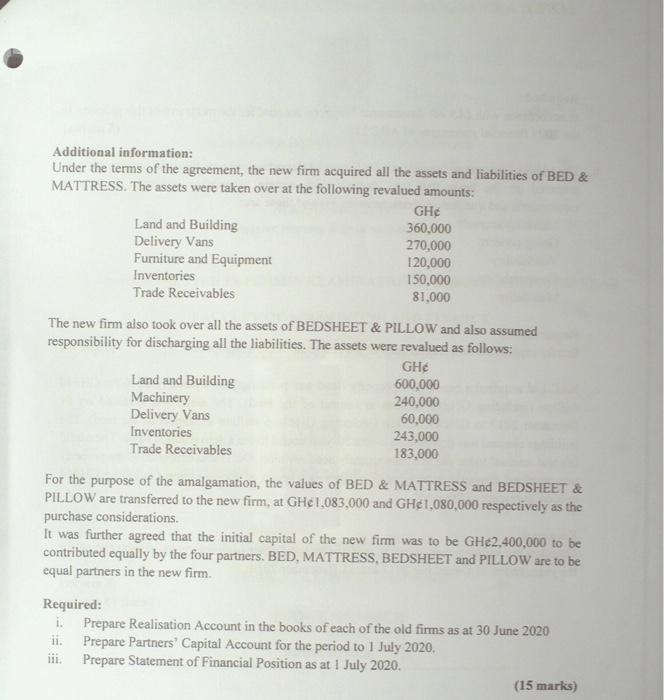

QUESTION THREE BED and MATTRESS are in partnership sharing profits and losses 2/3 and 1/3 respectively. They agreed to amalgamate their business with that of BEDSHEET and PILLOW as on 30" June, 2020. BEDSHEET and PILLOW share profits and losses in the ratio of 23 and 1/3 respectively. As on that date, the summarized the separate statement of financial positions of the two firms were as follows: BED & MATTRESS GHC 210,000 BEDSHEET & PILLOW GHE 300,000 285,000 60,000 45,000 138.000 393.000 645.000 327,000 192,000 165,000 81,000 63.000 309,000 519.000 93,000 Non-current Assets Land and Building Machinery Delivery Vans Fumiture and Equipment Current Assets: Inventory Trade Receivables Cash and Bank Current Liabilities Trade Payables Accrued utility bills Bank overdraft Working Capital Net Assets Employed Finance by: Capital Accounts: BED MATTRESS BEDSHEET PILLOW Current Accounts BED MATTRESS BEDSHEET PILLOW 171.000 66,000 147,000 384,000 135,000 780,000 93.000 216.000 609,000 360,000 180,000 300,000 300,000 30,000 39,000 120,000 60.000 780.000 509,000 Additional information: Under the terms of the agreement, the new firm acquired all the assets and liabilities of BED & MATTRESS. The assets were taken over at the following revalued amounts: GH Land and Building 360,000 Delivery Vans 270.000 Furniture and Equipment 120,000 Inventories 150,000 Trade Receivables 81,000 The new firm also took over all the assets of BEDSHEET & PILLOW and also assumed responsibility for discharging all the liabilities. The assets were revalued as follows: GH Land and Building 600,000 Machinery 240,000 Delivery Vans 60,000 Inventories 243,000 Trade Receivables 183,000 For the purpose of the amalgamation, the values of BED & MATTRESS and BEDSHEET & PILLOW are transferred to the new firm, at GH1,083,000 and GH1,080,000 respectively as the purchase considerations. It was further agreed that the initial capital of the new firm was to be GH2,400,000 to be contributed equally by the four partners. BED, MATTRESS, BEDSHEET and PILLOW are to be equal partners in the new firm. Required: i. Prepare Realisation Account in the books of each of the old firms as at 30 June 2020 ii. Prepare Partners' Capital Account for the period to 1 July 2020. Prepare Statement of Financial Position as at 1 July 2020. (15 marks)