Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION TWO (2) Gordon's Wealth Growth Model was initially developed by Gordon and Shapiro in 1950 and later refined by Gordon in 1962 based on

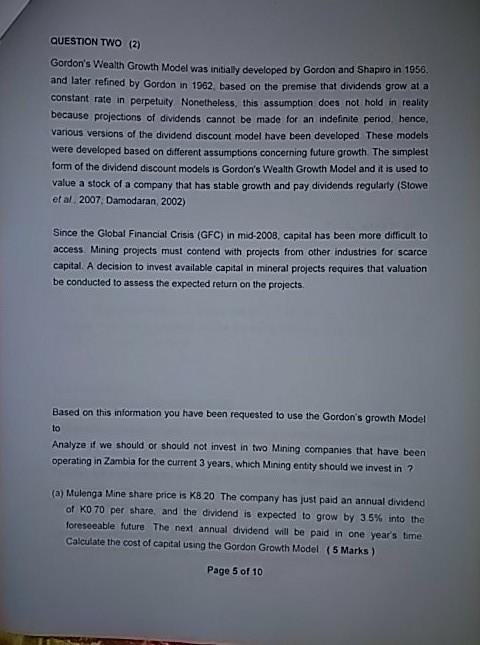

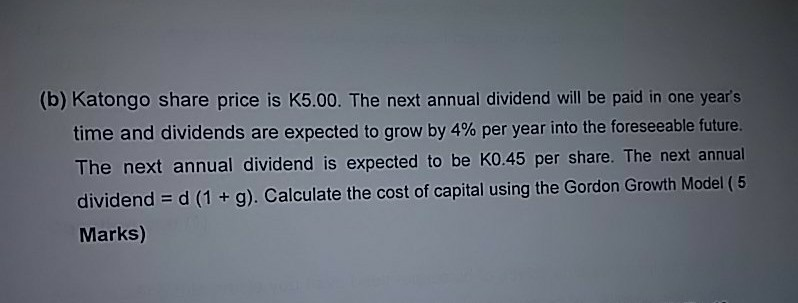

QUESTION TWO (2) Gordon's Wealth Growth Model was initially developed by Gordon and Shapiro in 1950 and later refined by Gordon in 1962 based on the premise that dividends grow at a constant rate in perpetuity Nonetheless, this assumption does not hold in reality because projections of dividends cannot be made for an indefinite period, hence, Various versions of the dividend discount model have been developed These models were developed based on different assumptions concerning future growth The simplest form of the dividend discount models is Gordon's Wealth Growth Model and it is used to value a stock of a company that has stable growth and pay dividends regularly (Slowe et al. 2007Damodaran, 2002) Since the Global Financial Crisis (GFC) in mid-2008, capital has been more difficult to access Mining projects must contend with projects from other industries for scarce capital. A decision to invest available capital in mineral projects requires that valuation be conducted to assess the expected return on the projects. Based on this information you have been requested to use the Gordon's growth Model Analyze if we should or should not invest in two Mining companies that have been operating in Zambia for the current 3 years, which Mining entity should we invest in ? (a) Mulenga Mine share price is K8 20 The company has just paid an annual dividend of KO 70 per share, and the dividend is expected to grow by 35% into the foreseeable future The next annual dividend will be paid in one year's time Calculate the cost of capital using the Gordon Growth Model 5 Marks) Page 5 of 10 (b) Katongo share price is K5.00. The next annual dividend will be paid in one year's time and dividends are expected to grow by 4% per year into the foreseeable future The next annual dividend is expected to be K0.45 per share. The next annual dividend = d (1 + g). Calculate the cost of capital using the Gordon Growth Model

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started