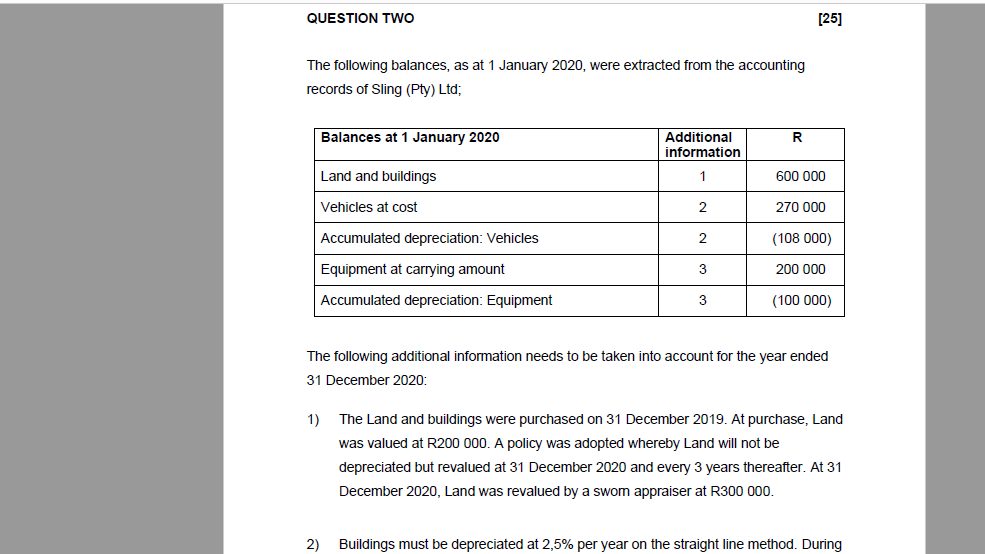

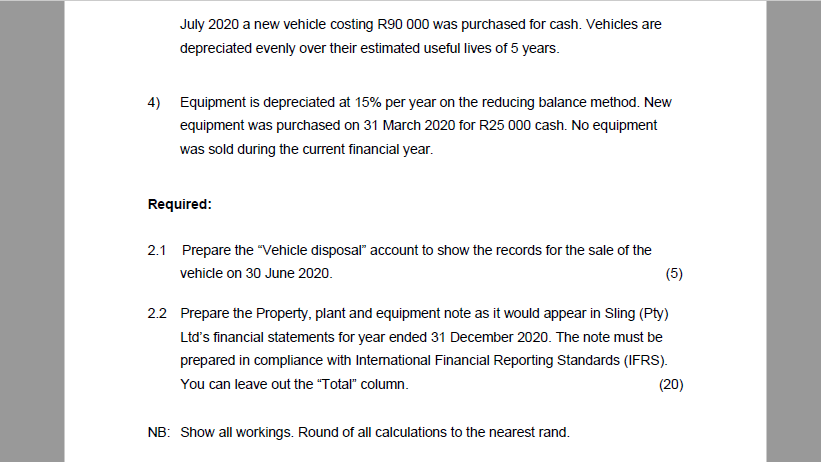

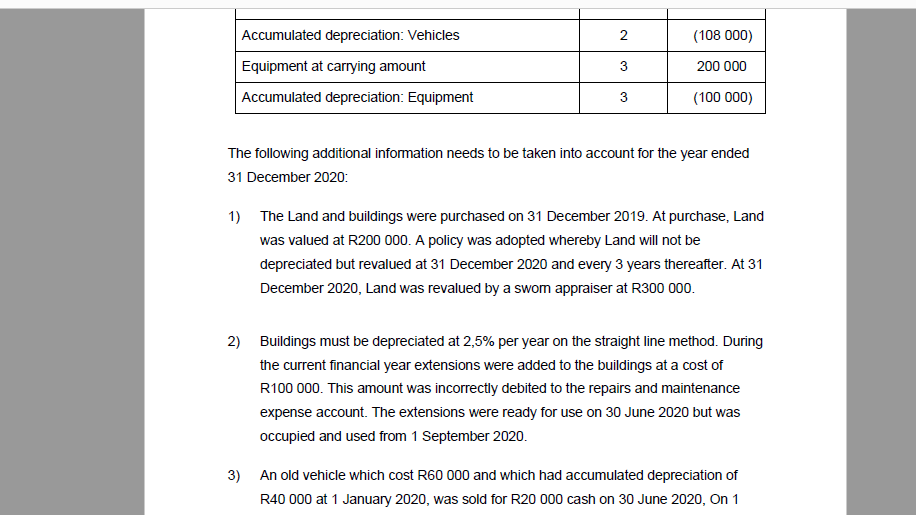

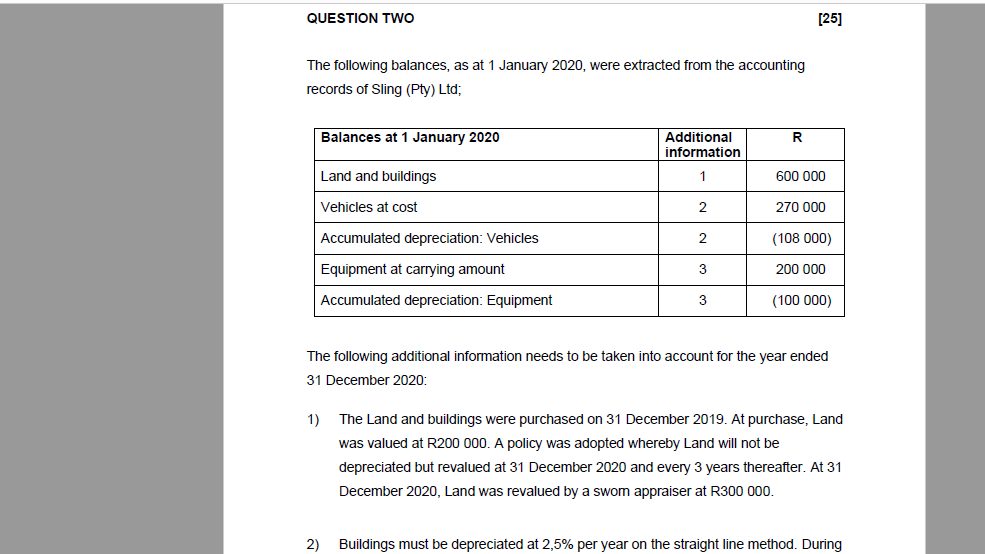

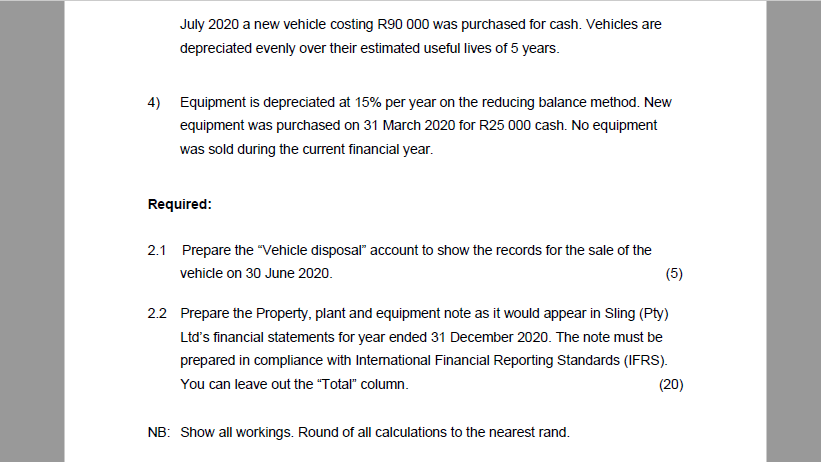

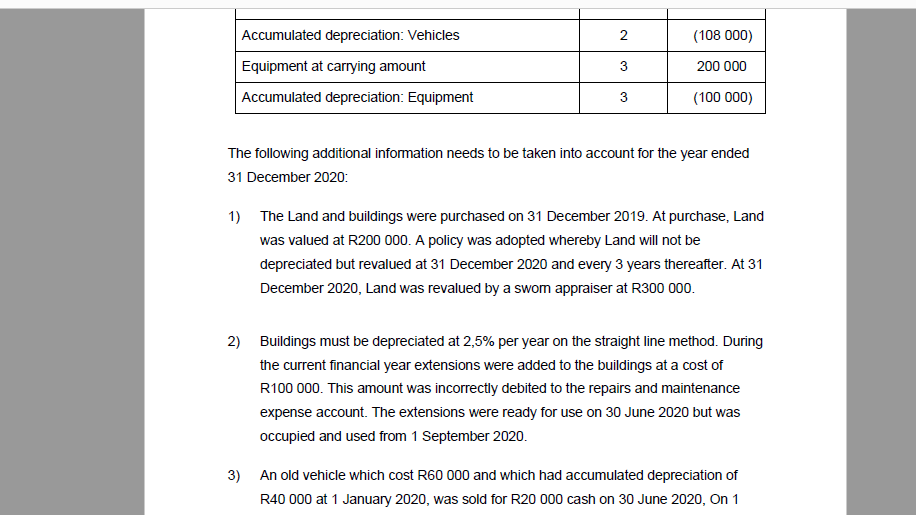

QUESTION TWO [25] The following balances, as at 1 January 2020, were extracted from the accounting records of Sling (Pty) Ltd; Balances at 1 January 2020 R Additional information Land and buildings 1 600 000 Vehicles at cost 2 270 000 2 (108 000) Accumulated depreciation: Vehicles Equipment at carrying amount 3 200 000 Accumulated depreciation: Equipment 3 (100 000) The following additional information needs to be taken into account for the year ended 31 December 2020: 1) The Land and buildings were purchased on 31 December 2019. At purchase, Land was valued at R200 000. A policy was adopted whereby Land will not be depreciated but revalued at 31 December 2020 and every 3 years thereafter. At 31 December 2020, Land was revalued by a swom appraiser at R300 000. 2) Buildings must be depreciated at 2,5% per year on the straight line method. During July 2020 a new vehicle costing R90 000 was purchased for cash. Vehicles are depreciated evenly over their estimated useful lives of 5 years. 4) Equipment is depreciated at 15% per year on the reducing balance method. New equipment was purchased on 31 March 2020 for R25 000 cash. No equipment was sold during the current financial year. Required: 2.1 Prepare the "Vehicle disposal account to show the records for the sale of the vehicle on 30 June 2020. (5) 2.2 Prepare the Property, plant and equipment note as it would appear in Sling (Pty) Ltd's financial statements for year ended 31 December 2020. The note must be prepared in compliance with International Financial Reporting Standards (IFRS). You can leave out the Total column. (20) NB: Show all workings. Round of all calculations to the nearest rand. 2 (108 000) Accumulated depreciation: Vehicles Equipment at carrying amount Accumulated depreciation: Equipment 3 200 000 3 (100 000) The following additional information needs to be taken into account for the year ended 31 December 2020: 1) The Land and buildings were purchased on 31 December 2019. At purchase, Land was valued at R200 000. A policy was adopted whereby Land will not be depreciated but revalued at 31 December 2020 and every 3 years thereafter. At 31 December 2020, Land was revalued by a swom appraiser at R300 000. 2) Buildings must be depreciated at 2,5% per year on the straight line method. During the current financial year extensions were added to the buildings at a cost of R100 000. This amount was incorrectly debited to the repairs and maintenance expense account. The extensions were ready for use on 30 June 2020 but was occupied and used from 1 September 2020. 3) An old vehicle which cost R60 000 and which had accumulated depreciation of R40 000 at 1 January 2020, was sold for R20 000 cash on 30 June 2020, On 1 QUESTION TWO [25] The following balances, as at 1 January 2020, were extracted from the accounting records of Sling (Pty) Ltd; Balances at 1 January 2020 R Additional information Land and buildings 1 600 000 Vehicles at cost 2 270 000 2 (108 000) Accumulated depreciation: Vehicles Equipment at carrying amount 3 200 000 Accumulated depreciation: Equipment 3 (100 000) The following additional information needs to be taken into account for the year ended 31 December 2020: 1) The Land and buildings were purchased on 31 December 2019. At purchase, Land was valued at R200 000. A policy was adopted whereby Land will not be depreciated but revalued at 31 December 2020 and every 3 years thereafter. At 31 December 2020, Land was revalued by a swom appraiser at R300 000. 2) Buildings must be depreciated at 2,5% per year on the straight line method. During July 2020 a new vehicle costing R90 000 was purchased for cash. Vehicles are depreciated evenly over their estimated useful lives of 5 years. 4) Equipment is depreciated at 15% per year on the reducing balance method. New equipment was purchased on 31 March 2020 for R25 000 cash. No equipment was sold during the current financial year. Required: 2.1 Prepare the "Vehicle disposal account to show the records for the sale of the vehicle on 30 June 2020. (5) 2.2 Prepare the Property, plant and equipment note as it would appear in Sling (Pty) Ltd's financial statements for year ended 31 December 2020. The note must be prepared in compliance with International Financial Reporting Standards (IFRS). You can leave out the Total column. (20) NB: Show all workings. Round of all calculations to the nearest rand. 2 (108 000) Accumulated depreciation: Vehicles Equipment at carrying amount Accumulated depreciation: Equipment 3 200 000 3 (100 000) The following additional information needs to be taken into account for the year ended 31 December 2020: 1) The Land and buildings were purchased on 31 December 2019. At purchase, Land was valued at R200 000. A policy was adopted whereby Land will not be depreciated but revalued at 31 December 2020 and every 3 years thereafter. At 31 December 2020, Land was revalued by a swom appraiser at R300 000. 2) Buildings must be depreciated at 2,5% per year on the straight line method. During the current financial year extensions were added to the buildings at a cost of R100 000. This amount was incorrectly debited to the repairs and maintenance expense account. The extensions were ready for use on 30 June 2020 but was occupied and used from 1 September 2020. 3) An old vehicle which cost R60 000 and which had accumulated depreciation of R40 000 at 1 January 2020, was sold for R20 000 cash on 30 June 2020, On 1