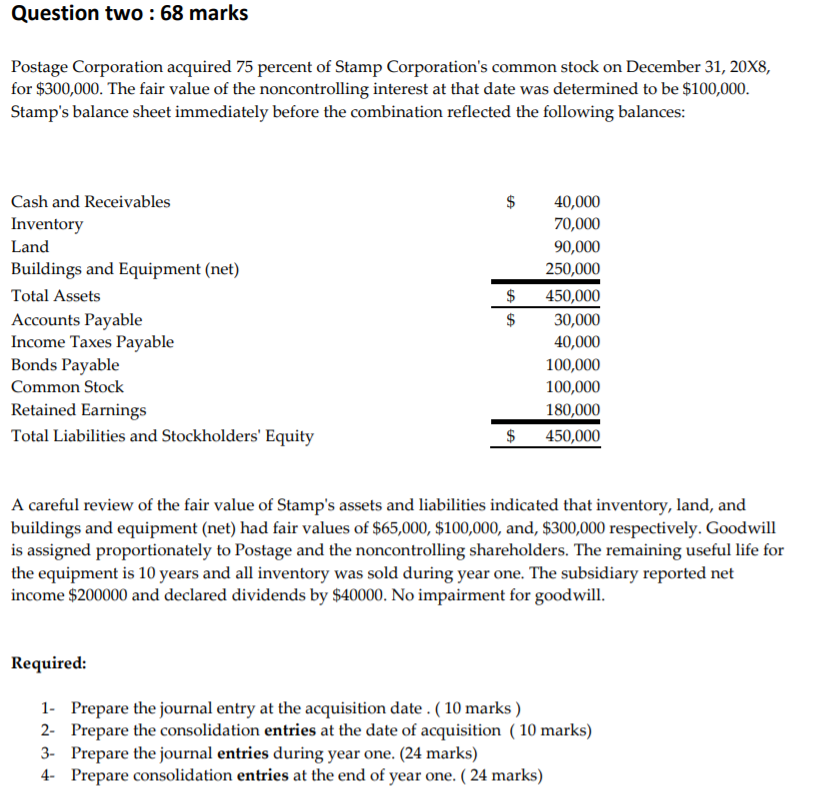

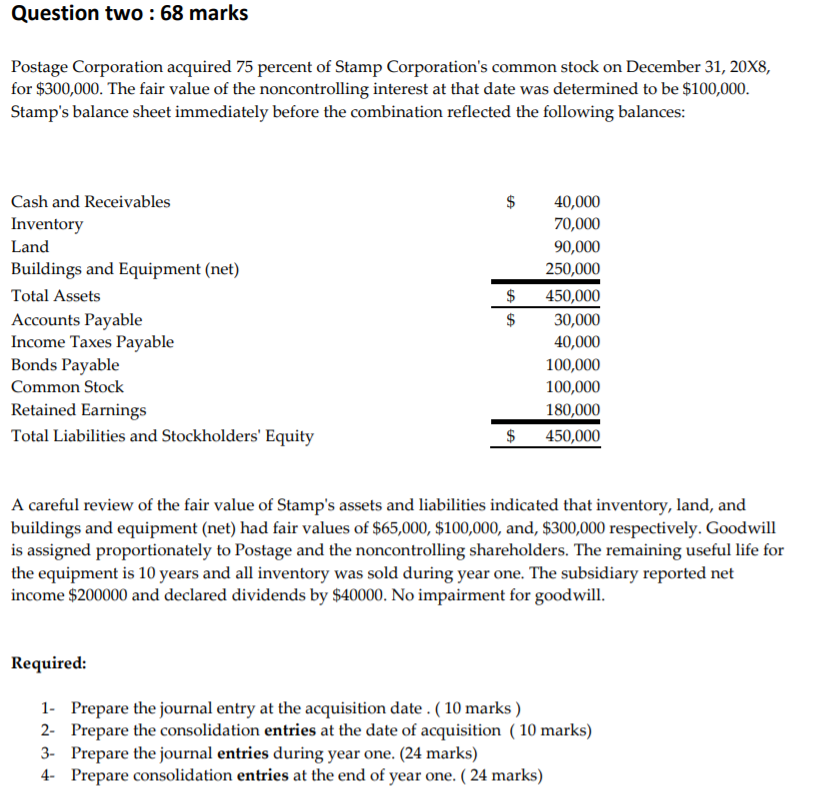

Question two : 68 marks Postage Corporation acquired 75 percent of Stamp Corporation's common stock on December 31, 20X8, for $300,000. The fair value of the noncontrolling interest at that date was determined to be $100,000. Stamp's balance sheet immediately before the combination reflected the following balances: $ Cash and Receivables Inventory Land Buildings and Equipment (net) Total Assets Accounts Payable Income Taxes Payable Bonds Payable Common Stock Retained Earnings Total Liabilities and Stockholders' Equity 40,000 70,000 90,000 250,000 450,000 $ 30,000 40,000 100,000 100,000 180,000 $ 450,000 A careful review of the fair value of Stamp's assets and liabilities indicated that inventory, land, and buildings and equipment (net) had fair values of $65,000, $100,000, and, $300,000 respectively. Goodwill is assigned proportionately to Postage and the noncontrolling shareholders. The remaining useful life for the equipment is 10 years and all inventory was sold during year one. The subsidiary reported net income $200000 and declared dividends by $40000. No impairment for goodwill. Required: 1. Prepare the journal entry at the acquisition date . (10 marks ) 2- Prepare the consolidation entries at the date of acquisition ( 10 marks) 3- Prepare the journal entries during year one. (24 marks) 4. Prepare consolidation entries at the end of year one. ( 24 marks) Question two : 68 marks Postage Corporation acquired 75 percent of Stamp Corporation's common stock on December 31, 20X8, for $300,000. The fair value of the noncontrolling interest at that date was determined to be $100,000. Stamp's balance sheet immediately before the combination reflected the following balances: $ Cash and Receivables Inventory Land Buildings and Equipment (net) Total Assets Accounts Payable Income Taxes Payable Bonds Payable Common Stock Retained Earnings Total Liabilities and Stockholders' Equity 40,000 70,000 90,000 250,000 450,000 $ 30,000 40,000 100,000 100,000 180,000 $ 450,000 A careful review of the fair value of Stamp's assets and liabilities indicated that inventory, land, and buildings and equipment (net) had fair values of $65,000, $100,000, and, $300,000 respectively. Goodwill is assigned proportionately to Postage and the noncontrolling shareholders. The remaining useful life for the equipment is 10 years and all inventory was sold during year one. The subsidiary reported net income $200000 and declared dividends by $40000. No impairment for goodwill. Required: 1. Prepare the journal entry at the acquisition date . (10 marks ) 2- Prepare the consolidation entries at the date of acquisition ( 10 marks) 3- Prepare the journal entries during year one. (24 marks) 4. Prepare consolidation entries at the end of year one. ( 24 marks)