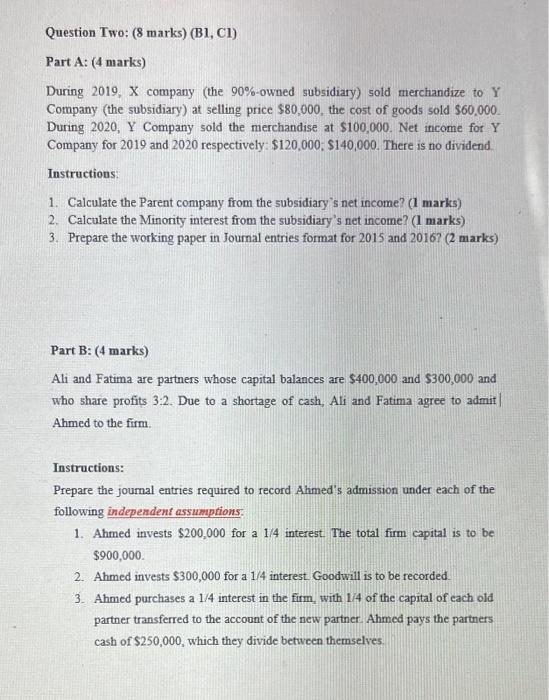

Question Two: (8 marks) (B1, C1) Part A: (4 marks) During 2019. X company (the 90%-owned subsidiary) sold merchandize to Y Company (the subsidiary) at selling price $80,000, the cost of goods sold $60,000 During 2020, Y Company sold the merchandise at $100,000. Net income for Y Company for 2019 and 2020 respectively: $120,000$140,000. There is no dividend Instructions 1. Calculate the Parent company from the subsidiary's net income? (1 marks) 2. Calculate the Minority interest from the subsidiary's net income? (1 marks) 3. Prepare the working paper in Journal entries format for 2015 and 20167 (2 marks) Part B: (4 marks) Ali and Fatima are partners whose capital balances are $400,000 and $300,000 and who share profits 3:2. Due to a shortage of cash. Ali and Fatima agree to admit Ahmed to the firm. Instructions: Prepare the journal entries required to record Ahmed's admission under each of the following independent assumptions 1. Ahmed invests $200,000 for a 1/4 interest. The total firm capital is to be $900,000 2. Ahmed invests $300,000 for a 1/4 interest Goodwill is to be recorded 3. Ahmed purchases a 1/4 interest in the firm, with 1/4 of the capital of each old partner transferred to the account of the new partner. Ahmed pays the partners cash of $250,000, which they divide between themselves. Question Two: (8 marks) (B1, C1) Part A: (4 marks) During 2019. X company (the 90%-owned subsidiary) sold merchandize to Y Company (the subsidiary) at selling price $80,000, the cost of goods sold $60,000 During 2020, Y Company sold the merchandise at $100,000. Net income for Y Company for 2019 and 2020 respectively: $120,000$140,000. There is no dividend Instructions 1. Calculate the Parent company from the subsidiary's net income? (1 marks) 2. Calculate the Minority interest from the subsidiary's net income? (1 marks) 3. Prepare the working paper in Journal entries format for 2015 and 20167 (2 marks) Part B: (4 marks) Ali and Fatima are partners whose capital balances are $400,000 and $300,000 and who share profits 3:2. Due to a shortage of cash. Ali and Fatima agree to admit Ahmed to the firm. Instructions: Prepare the journal entries required to record Ahmed's admission under each of the following independent assumptions 1. Ahmed invests $200,000 for a 1/4 interest. The total firm capital is to be $900,000 2. Ahmed invests $300,000 for a 1/4 interest Goodwill is to be recorded 3. Ahmed purchases a 1/4 interest in the firm, with 1/4 of the capital of each old partner transferred to the account of the new partner. Ahmed pays the partners cash of $250,000, which they divide between themselves