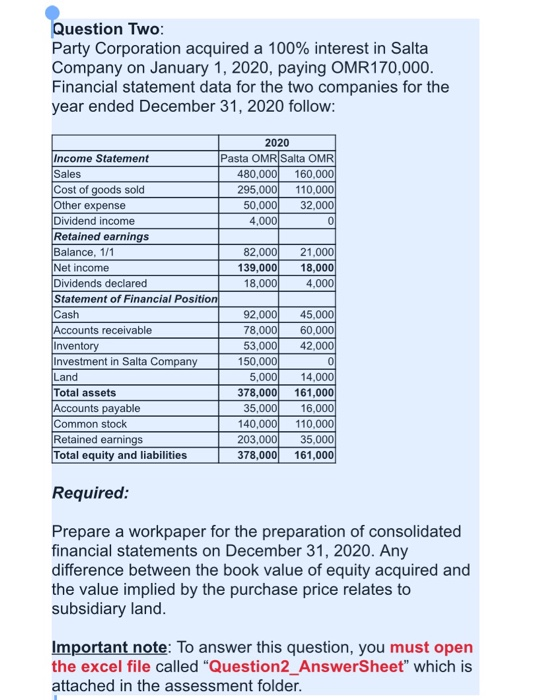

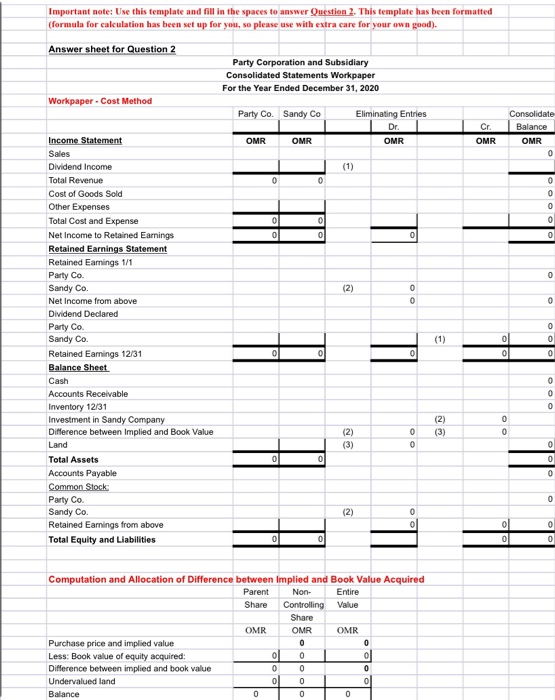

Question Two: Party Corporation acquired a 100% interest in Salta Company on January 1, 2020, paying OMR170,000. Financial statement data for the two companies for the year ended December 31, 2020 follow: 2020 Income Statement Pasta OMR Salta OMR Sales 480,000 160,000 Cost of goods sold 295,000 110,000 Other expense 50,000 32,000 Dividend income 4,000 0 Retained earnings Balance, 1/1 82,000 21,000 Net income 139,000 18,000 Dividends declared 18,000 4,000 Statement of Financial Position Cash 92,000 45,000 Accounts receivable 78,000 60,000 Inventory 53,000 42,000 Investment in Salta Company 150,000 0 Land 5,000 14,000 Total assets 378,000 161,000 Accounts payable 35,000 16,000 Common stock 140,000 110,000 Retained earnings 203,000 35,000 Total equity and liabilities 378,000 161,000 Required: Prepare a workpaper for the preparation of consolidated financial statements on December 31, 2020. Any difference between the book value of equity acquired and the value implied by the purchase price relates to subsidiary land. Important note: To answer this question, you must open the excel file called "Question2_AnswerSheet" which is attached in the assessment folder. Consolidate Balance OMR 0 0 0 0 0 O Important note: Use this template and fill in the spaces to answer Question 2. This template has been formatted (formula for calculation has been set up for you, so please use with extra care for your own good). Answer sheet for Question 2 Party Corporation and Subsidiary Consolidated Statements Workpaper For the Year Ended December 31, 2020 Workpaper. Cost Method Party Co. Sandy Co Eliminating Entries Dr. Cr Income Statement OMR OMR OMR OMR Sales Dividend Income (1) Total Revenue 0 0 Cost of Goods Sold Other Expenses Total Cost and Expense Net Income to Retained Earnings 0 Retained Earnings Statement Retained Earnings 1/1 Party Co. Sandy Co. (2) 0 Net Income from above 0 Dividend Declared Party Co. Sandy Co. (1) Retained Earnings 12/31 0 0 0 Balance Sheet Cash Accounts Receivable Inventory 12/31 Investment in Sandy Company (2) Difference between Implied and Book Value (2) 0 (3) Land (3) 0 Total Assets 0 Accounts Payable Common Stock Party Co Sandy Co. (2) 0 Retained Earnings from above 0 Total Equity and Liabilities 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 O 0 0 Computation and Allocation of Difference between Implied and Book Value Acquired Parent Non Entire Share Controlling Value Share OMR OMR OMR Purchase price and implied value 0 Less: Book value of equity acquired: 0 0 0 Difference between implied and book value 0 0 Undervalued land 0 0 0 Balance 0 0 0 0 Question Two: Party Corporation acquired a 100% interest in Salta Company on January 1, 2020, paying OMR170,000. Financial statement data for the two companies for the year ended December 31, 2020 follow: 2020 Income Statement Pasta OMR Salta OMR Sales 480,000 160,000 Cost of goods sold 295,000 110,000 Other expense 50,000 32,000 Dividend income 4,000 0 Retained earnings Balance, 1/1 82,000 21,000 Net income 139,000 18,000 Dividends declared 18,000 4,000 Statement of Financial Position Cash 92,000 45,000 Accounts receivable 78,000 60,000 Inventory 53,000 42,000 Investment in Salta Company 150,000 0 Land 5,000 14,000 Total assets 378,000 161,000 Accounts payable 35,000 16,000 Common stock 140,000 110,000 Retained earnings 203,000 35,000 Total equity and liabilities 378,000 161,000 Required: Prepare a workpaper for the preparation of consolidated financial statements on December 31, 2020. Any difference between the book value of equity acquired and the value implied by the purchase price relates to subsidiary land. Important note: To answer this question, you must open the excel file called "Question2_AnswerSheet" which is attached in the assessment folder. Consolidate Balance OMR 0 0 0 0 0 O Important note: Use this template and fill in the spaces to answer Question 2. This template has been formatted (formula for calculation has been set up for you, so please use with extra care for your own good). Answer sheet for Question 2 Party Corporation and Subsidiary Consolidated Statements Workpaper For the Year Ended December 31, 2020 Workpaper. Cost Method Party Co. Sandy Co Eliminating Entries Dr. Cr Income Statement OMR OMR OMR OMR Sales Dividend Income (1) Total Revenue 0 0 Cost of Goods Sold Other Expenses Total Cost and Expense Net Income to Retained Earnings 0 Retained Earnings Statement Retained Earnings 1/1 Party Co. Sandy Co. (2) 0 Net Income from above 0 Dividend Declared Party Co. Sandy Co. (1) Retained Earnings 12/31 0 0 0 Balance Sheet Cash Accounts Receivable Inventory 12/31 Investment in Sandy Company (2) Difference between Implied and Book Value (2) 0 (3) Land (3) 0 Total Assets 0 Accounts Payable Common Stock Party Co Sandy Co. (2) 0 Retained Earnings from above 0 Total Equity and Liabilities 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 O 0 0 Computation and Allocation of Difference between Implied and Book Value Acquired Parent Non Entire Share Controlling Value Share OMR OMR OMR Purchase price and implied value 0 Less: Book value of equity acquired: 0 0 0 Difference between implied and book value 0 0 Undervalued land 0 0 0 Balance 0 0 0 0