Answered step by step

Verified Expert Solution

Question

1 Approved Answer

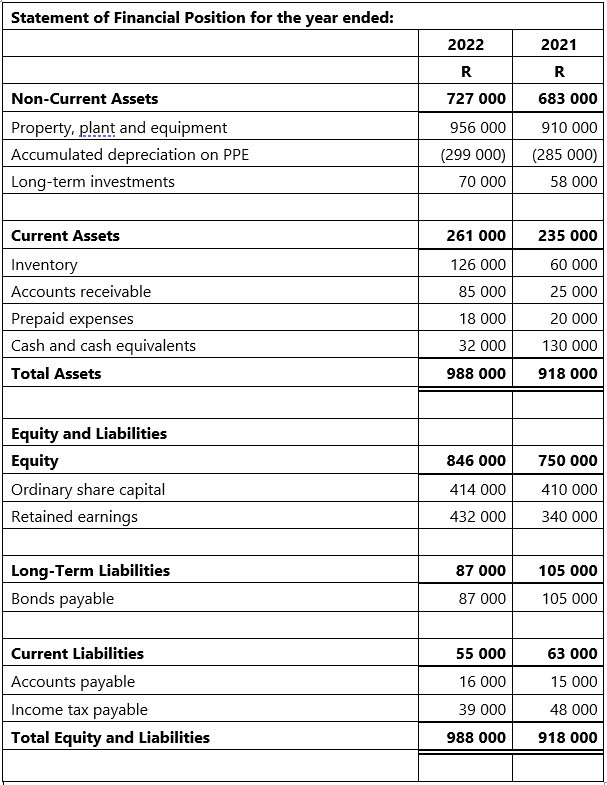

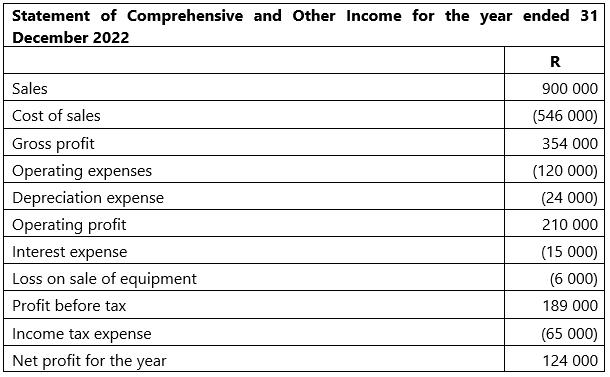

QUESTION TWO The following information shows the financial statements of Home Dcor Pty Ltd. Additional information: i) Sold equipment with a book value of R11

QUESTION TWO

The following information shows the financial statements of Home Dcor Pty Ltd.

Additional information:

i) Sold equipment with a book value of R11 000 (R21,000 cost R10,000 accumulated depreciation) for R5 000 cash.

ii) Purchased equipment for R67 000 cash.

iii) Declared and paid R32 000 in cash dividends.

Require:

Use the information provided to prepare the statement of cash flows using the indirect method. (25)

\begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Statement of Financial Position for the year ended: } \\ \hline & 2022 & 2021 \\ \hline & R & R \\ \hline Non-Current Assets & 727000 & 683000 \\ \hline Property, plant and equipment & 956000 & 910000 \\ \hline Accumulated depreciation on PPE & (299000) & (285000) \\ \hline Long-term investments & 70000 & 58000 \\ \hline Current Assets & 261000 & 235000 \\ \hline Inventory & 126000 & 60000 \\ \hline Accounts receivable & 85000 & 25000 \\ \hline Prepaid expenses & 18000 & 20000 \\ \hline Cash and cash equivalents & 32000 & 130000 \\ \hline Total Assets & 988000 & 918000 \\ \hline \multicolumn{3}{|l|}{ Equity and Liabilities } \\ \hline Equity & 846000 & 750000 \\ \hline Ordinary share capital & 414000 & 410000 \\ \hline Retained earnings & 432000 & 340000 \\ \hline Long-Term Liabilities & 87000 & 105000 \\ \hline Bonds payable & 87000 & 105000 \\ \hline Current Liabilities & 55000 & 63000 \\ \hline Accounts payable & 16000 & 15000 \\ \hline Income tax payable & 39000 & 48000 \\ \hline Total Equity and Liabilities & 988000 & 918000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{l} Statement of Comprehensive and Other Income for the year ended 31 \\ December 2022 \end{tabular}} \\ \hline & R \\ \hline Sales & 900000 \\ \hline Cost of sales & (546000) \\ \hline Gross profit & 354000 \\ \hline Operating expenses & (120000) \\ \hline Depreciation expense & (24000) \\ \hline Operating profit & 210000 \\ \hline Interest expense & (15000) \\ \hline Loss on sale of equipment & (6000) \\ \hline Profit before tax & 189000 \\ \hline Income tax expense & (65000) \\ \hline Net profit for the year & 124000 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ Statement of Financial Position for the year ended: } \\ \hline & 2022 & 2021 \\ \hline & R & R \\ \hline Non-Current Assets & 727000 & 683000 \\ \hline Property, plant and equipment & 956000 & 910000 \\ \hline Accumulated depreciation on PPE & (299000) & (285000) \\ \hline Long-term investments & 70000 & 58000 \\ \hline Current Assets & 261000 & 235000 \\ \hline Inventory & 126000 & 60000 \\ \hline Accounts receivable & 85000 & 25000 \\ \hline Prepaid expenses & 18000 & 20000 \\ \hline Cash and cash equivalents & 32000 & 130000 \\ \hline Total Assets & 988000 & 918000 \\ \hline \multicolumn{3}{|l|}{ Equity and Liabilities } \\ \hline Equity & 846000 & 750000 \\ \hline Ordinary share capital & 414000 & 410000 \\ \hline Retained earnings & 432000 & 340000 \\ \hline Long-Term Liabilities & 87000 & 105000 \\ \hline Bonds payable & 87000 & 105000 \\ \hline Current Liabilities & 55000 & 63000 \\ \hline Accounts payable & 16000 & 15000 \\ \hline Income tax payable & 39000 & 48000 \\ \hline Total Equity and Liabilities & 988000 & 918000 \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline \multicolumn{2}{|c|}{\begin{tabular}{l} Statement of Comprehensive and Other Income for the year ended 31 \\ December 2022 \end{tabular}} \\ \hline & R \\ \hline Sales & 900000 \\ \hline Cost of sales & (546000) \\ \hline Gross profit & 354000 \\ \hline Operating expenses & (120000) \\ \hline Depreciation expense & (24000) \\ \hline Operating profit & 210000 \\ \hline Interest expense & (15000) \\ \hline Loss on sale of equipment & (6000) \\ \hline Profit before tax & 189000 \\ \hline Income tax expense & (65000) \\ \hline Net profit for the year & 124000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started