Answered step by step

Verified Expert Solution

Question

1 Approved Answer

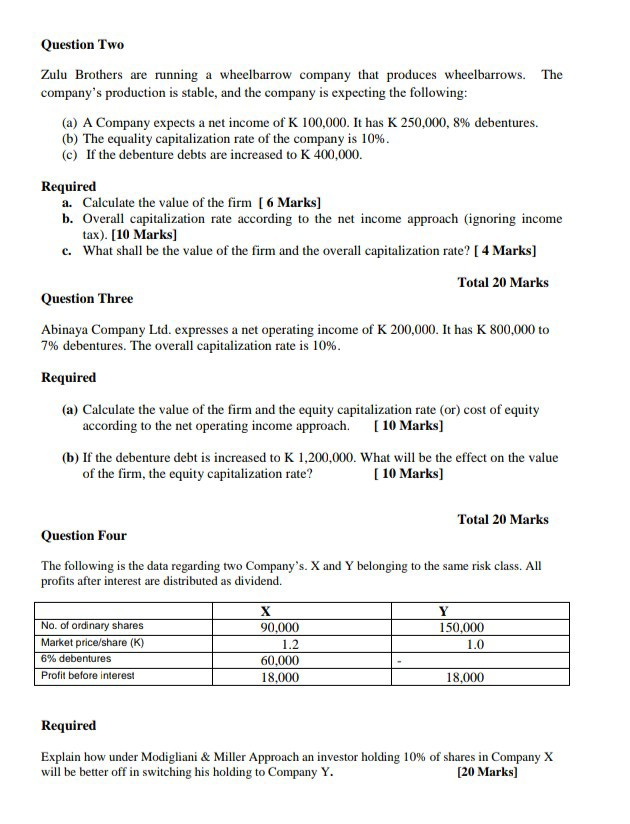

Question Two Zulu Brothers are running a wheelbarrow company that produces wheelbarrows. The company's production is stable, and the company is expecting the following: (a)

Question Two Zulu Brothers are running a wheelbarrow company that produces wheelbarrows. The company's production is stable, and the company is expecting the following: (a) A Company expects a net income of K 100,000. It has K 250,000, 8% debentures. (b) The equality capitalization rate of the company is 10% (c) If the debenture debts are increased to K 400,000. Required a. Calculate the value of the firm [ 6 Marks b. Overall capitalization rate according to the net income approach (ignoring income tax). [10 Marks c. What shall be the value of the firm and the overall capitalization rate? [ 4 Marks) Total 20 Marks Question Three Abinaya Company Ltd. expresses a net operating income of K 200,000. It has K 800,000 to 7% debentures. The overall capitalization rate is 10%. Required (a) Calculate the value of the firm and the equity capitalization rate (or) cost of equity according to the net operating income approach. [10 Marks] (b) If the debenture debt is increased to K 1,200,000. What will be the effect on the value of the firm, the equity capitalization rate? (10 Marks] Total 20 Marks Question Four The following is the data regarding two Company's. X and Y belonging to the same risk class. All profits after interest are distributed as dividend. 150,000 1.0 No. of ordinary shares Market price/share (K) 6% debentures Profit before interest 90.000 1.2 60.000 18.000 18.000 Required Explain how under Modigliani & Miller Approach an investor holding 10% of shares in Company X will be better off in switching his holding to Company Y. [20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started