Question: What advice can be given to Thakkar on his project idea?

Background:

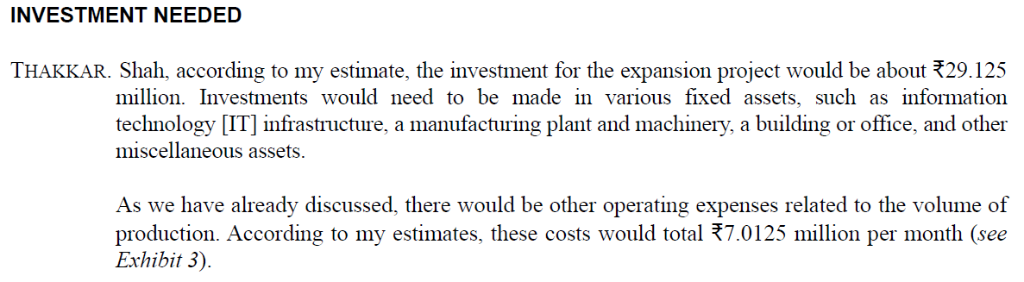

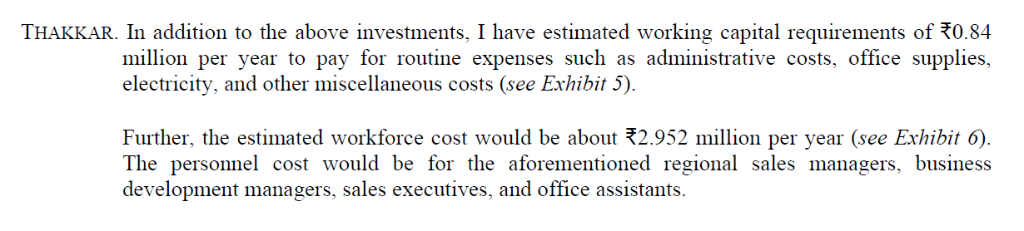

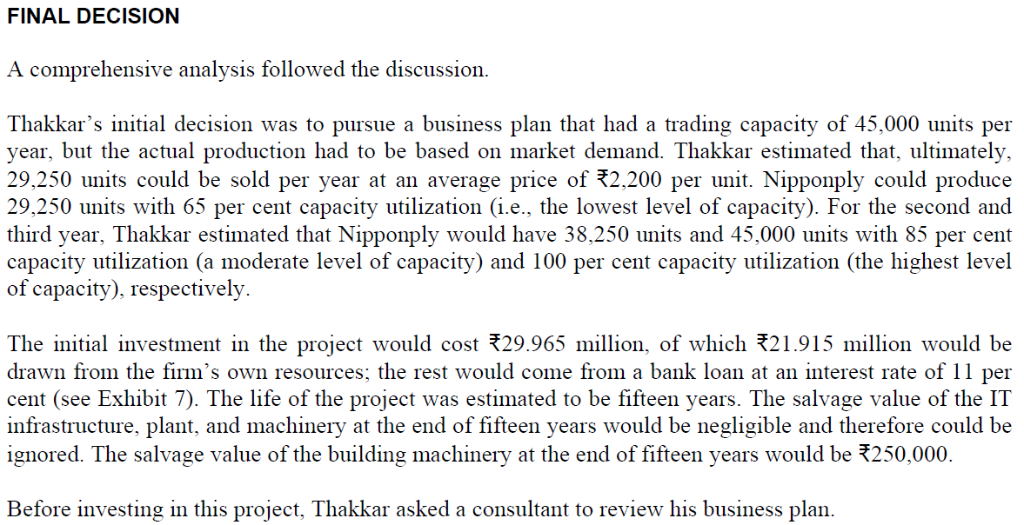

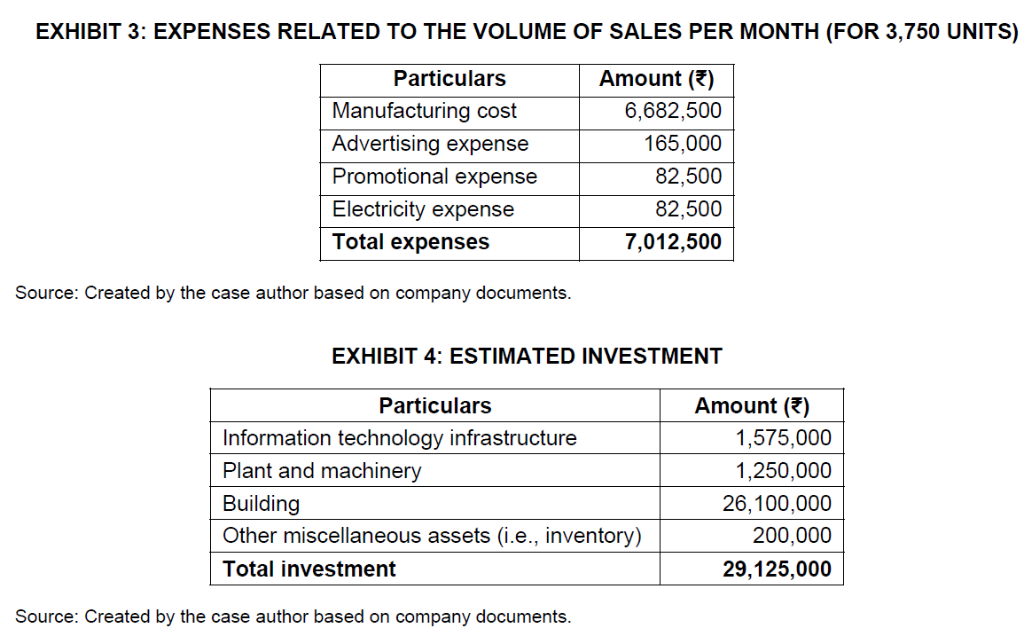

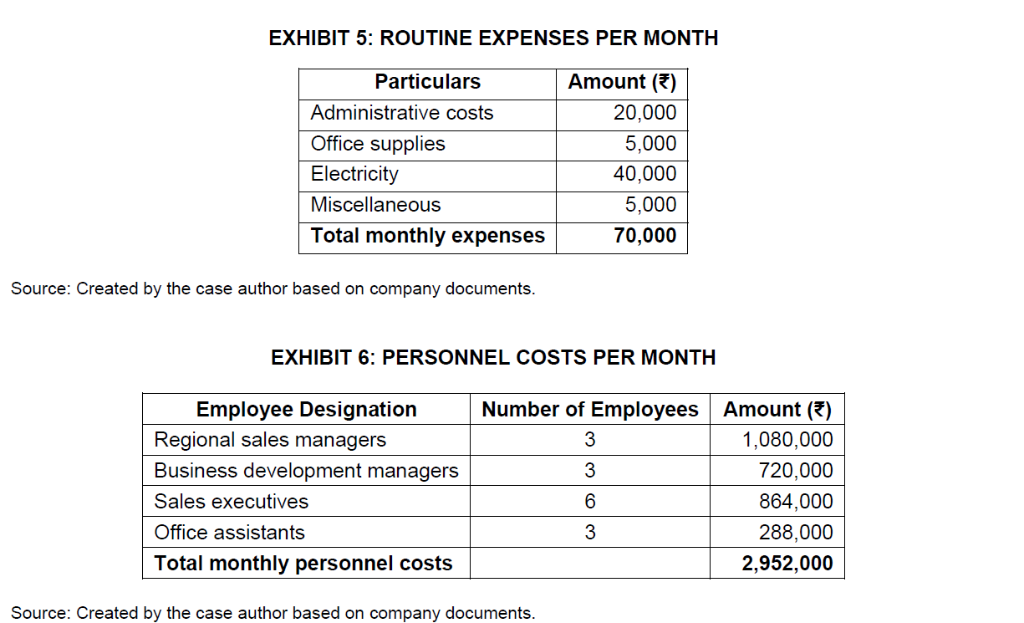

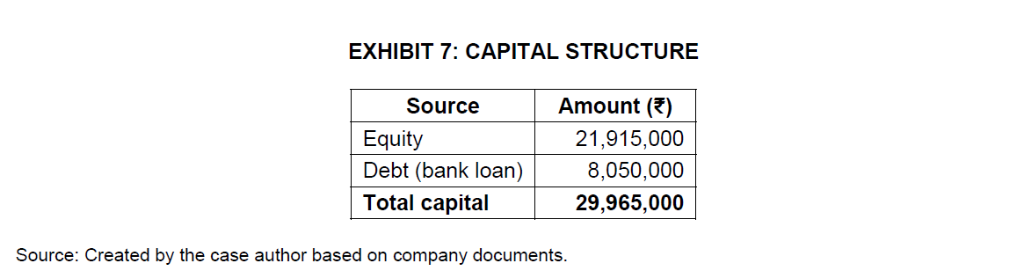

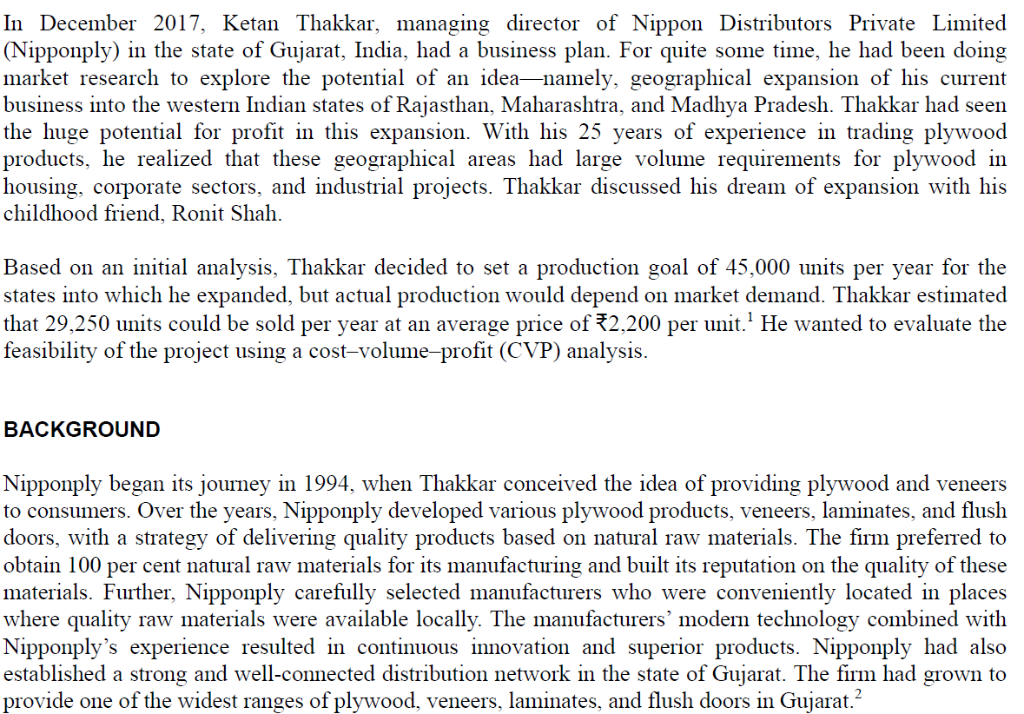

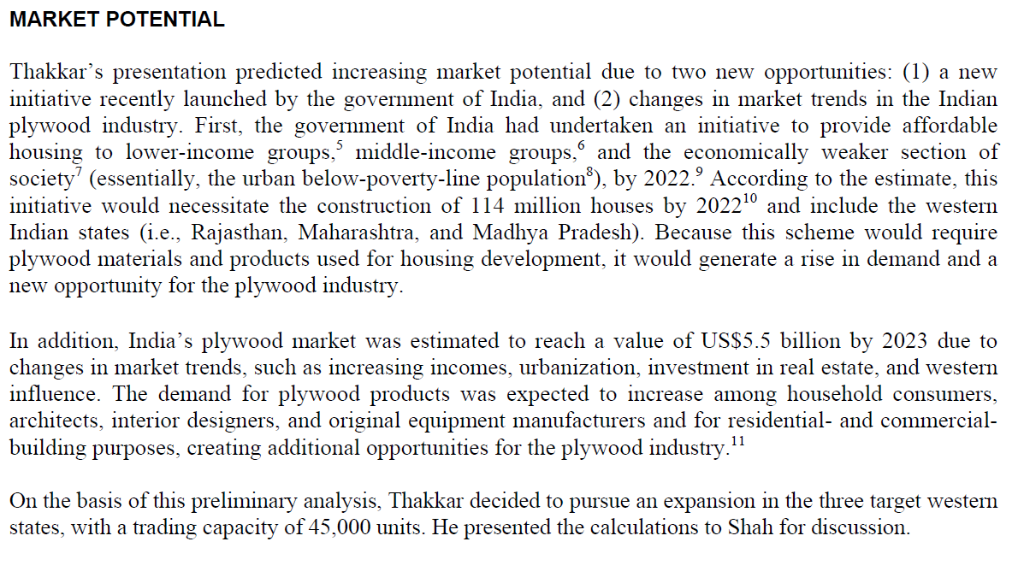

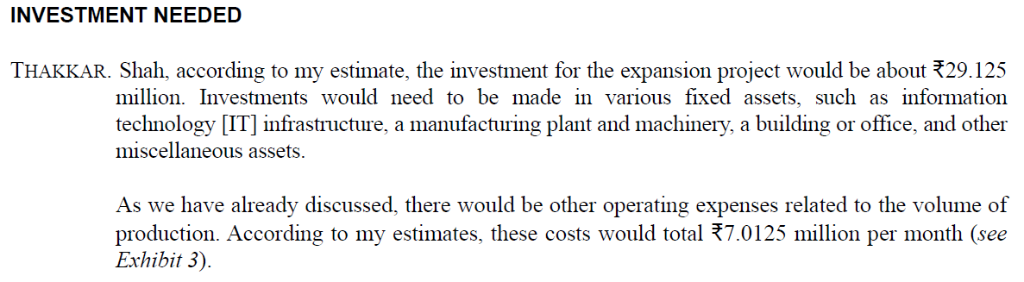

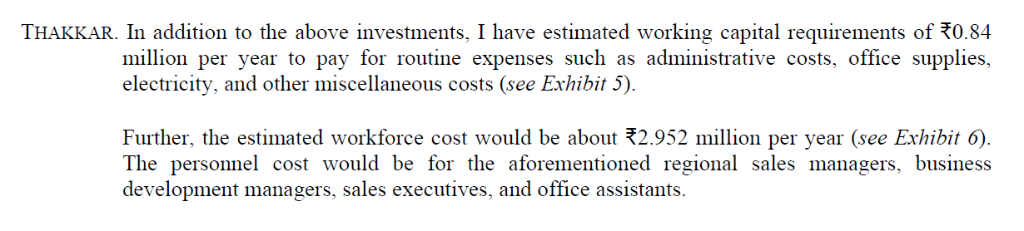

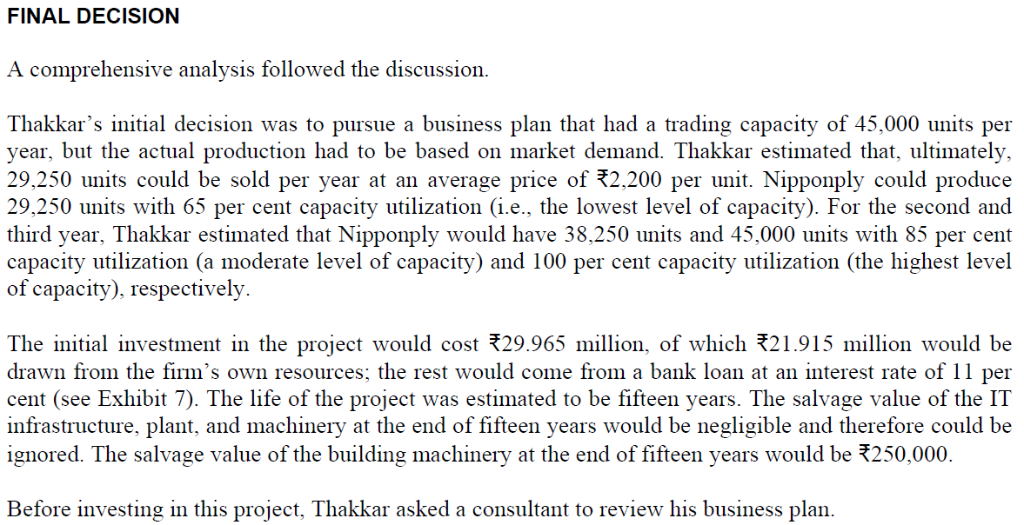

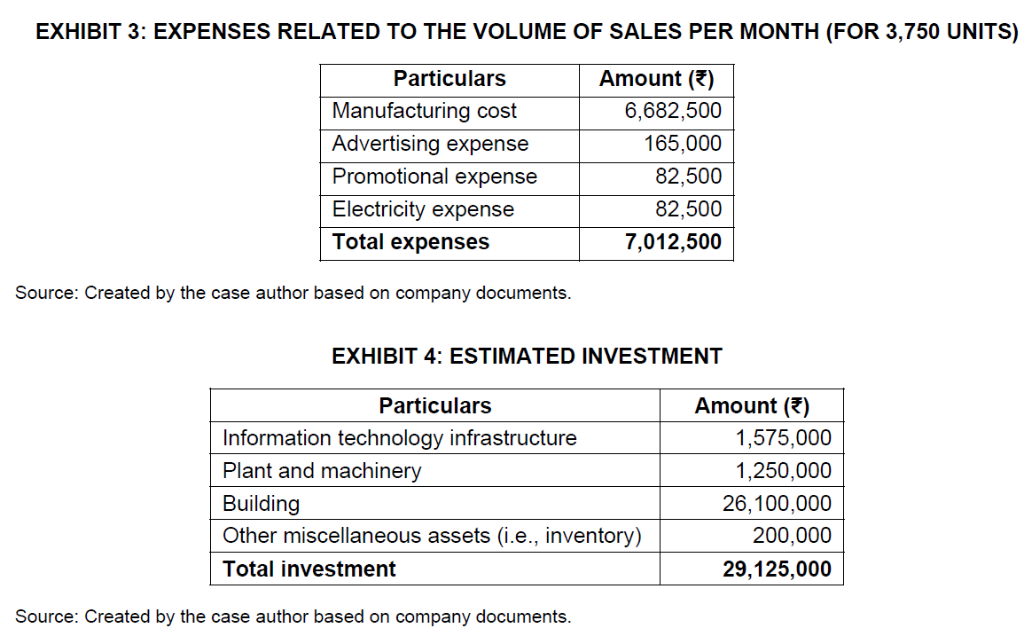

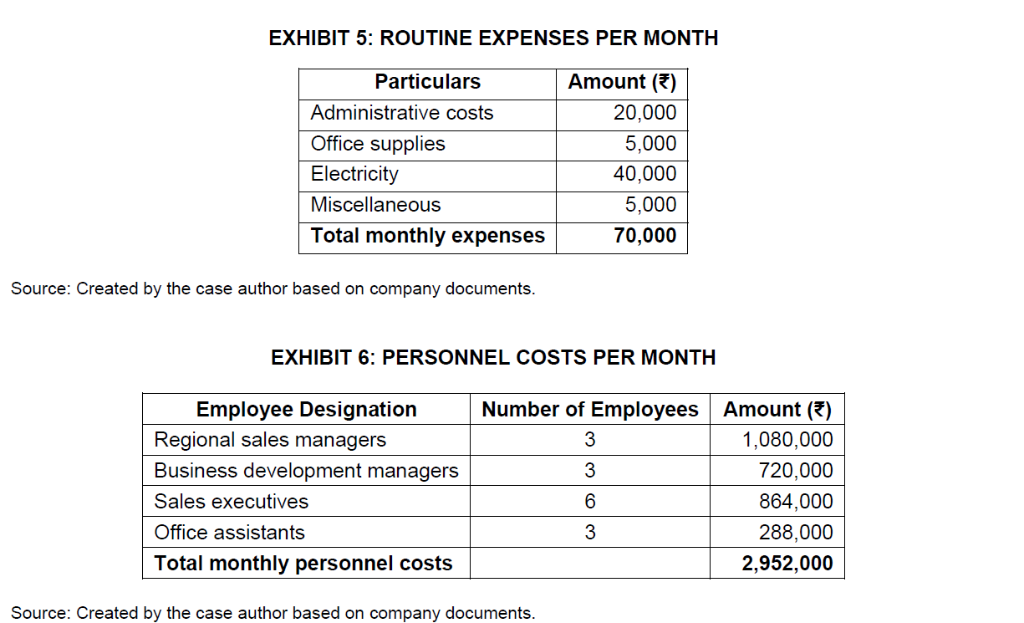

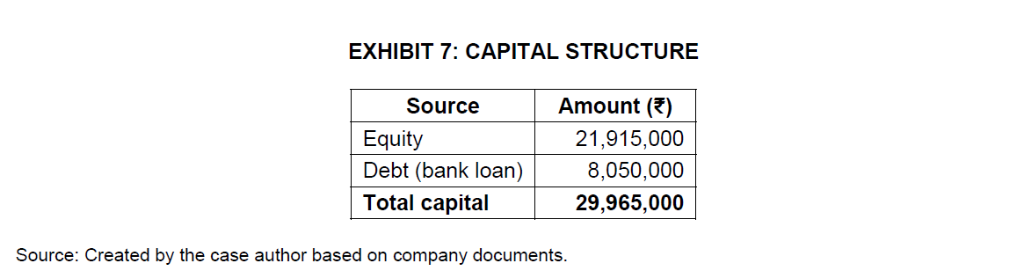

MARKET POTENTIAL Thakkar's presentation predicted increasing market potential due to two new opportunities: (1) a new initiative recently launched by the government of India, and (2) changes in market trends in the Indian plywood industry. First, the government of India had undertaken an initiative to provide affordable housing to lower-income groups,5 middle-income groups,6 and the economically weaker section of society" (essentially, the urban below-poverty-line population3), by 2022.9 According to the estimate, this initiative would necessitate the construction of 114 million houses by 202210 and include the western Indian states (i.e., Rajasthan, Maharashtra, and Madhya Pradesh). Because this scheme would require plywood materials and products used for housing development, it would generate a rise in demand and a new opportunity for the plywood industry In addition India's plywood market was estimated to reach a value of US$5.5 billion by 2023 due to changes in market trends, such as increasing incomes, urbanization, investment in real estate, and westen influence. The demand for plywood products was expected to increase among household consumers, architects, interior designers, and original equipment manufacturers and for residential- and commercial building purposes, creating additional opportunities for the plywood industry.11 On the basis of this preliminary analysis, Thakkar decided to pursue an expansion in the three target western states, with a trading capacity of 45,000 units. He presented the calculations to Shah for discussion THAKKAR. In addition to the above investments, I have estimated working capital requirements of 0.84 million per year to pay for routine expenses such as administrative costs, office supplies, electricity, and other miscellaneous costs (see Exhibit 5) Further, the estimated workforce cost would be about2.952 million per year (see Exhibit 6). The personnel cost would be for the aforementioned regional sales managers, business development managers, sales executives, and office assistants. FINAL DECISION A comprehensive analysis followed the discussion. Thakkar's initial decision was to pursue a business plan that had a trading capacity of 45,000 units per year, but the actual production had to be based on market demand. Thakkar estimated that, ultimately 29.250 units could be sold per year at an average price of2.200 per unit. Nipponply could produce 29.250 units with 65 per cent capacity utilization (i.e., the lowest level of capacity). For the second and third year, Thakkar estimated that Nipponply would have 38,250 units and 45,000 units with 85 per cent capacity utilization (a moderate level of capacity) and 100 per cent capacity utilization (the highest level of capacity). respectively The initial investment in the project would cost 29.965 million, of which 21.915 million would be drawn from the firm's own resources; the rest would come from a bank loan at an interest rate of 11 per cent (see Exhibit 7). The life of the project was estimated to be fifteen years. The salvage value of the IT infrastructure, plant, and machinery at the end of fifteen years would be negligible and therefore could be ignored. The salvage value of the building machinery at the end of fifteen years would be 250.000. Before investing in this project, Thakkar asked a consultant to review his business plan EXHIBIT 3: EXPENSES RELATED To THE VOLUME OF SALES PER MONTH (FOR 3,750 UNITS) Particulars Manufacturing cost Advertising expense Promotional expense Electricity expense Total expenses Amount () 6,682,500 165,000 82,500 82,500 7,012,500 Source: Created by the case author based on company documents EXHIBIT 4: ESTIMATED INVESTMENT Particulars Amount () Information technology infrastructure Plant and machinery Building Other miscellaneous assets (i.e., inventory) Total investment 1,575,000 1,250,000 26,100,000 200,000 29,125,000 Source: Created by the case author based on company documents EXHIBIT 5: ROUTINE EXPENSES PER MONTH Particulars Amount ( Administrative costs Office supplies Electricity Miscellaneous 20,000 5,000 40,000 5,000 70,000 Total monthly expenses Source: Created by the case author based on company documents EXHIBIT 6: PERSONNEL COSTS PER MONTH Number of Employees Amount (R) 1,080,000 720,000 864,000 288,000 2,952,000 Employee Designation Regional sales managers Business development managers Sales executives Office assistants Total monthly personnel costs Source: Created by the case author based on company documents MARKET POTENTIAL Thakkar's presentation predicted increasing market potential due to two new opportunities: (1) a new initiative recently launched by the government of India, and (2) changes in market trends in the Indian plywood industry. First, the government of India had undertaken an initiative to provide affordable housing to lower-income groups,5 middle-income groups,6 and the economically weaker section of society" (essentially, the urban below-poverty-line population3), by 2022.9 According to the estimate, this initiative would necessitate the construction of 114 million houses by 202210 and include the western Indian states (i.e., Rajasthan, Maharashtra, and Madhya Pradesh). Because this scheme would require plywood materials and products used for housing development, it would generate a rise in demand and a new opportunity for the plywood industry In addition India's plywood market was estimated to reach a value of US$5.5 billion by 2023 due to changes in market trends, such as increasing incomes, urbanization, investment in real estate, and westen influence. The demand for plywood products was expected to increase among household consumers, architects, interior designers, and original equipment manufacturers and for residential- and commercial building purposes, creating additional opportunities for the plywood industry.11 On the basis of this preliminary analysis, Thakkar decided to pursue an expansion in the three target western states, with a trading capacity of 45,000 units. He presented the calculations to Shah for discussion THAKKAR. In addition to the above investments, I have estimated working capital requirements of 0.84 million per year to pay for routine expenses such as administrative costs, office supplies, electricity, and other miscellaneous costs (see Exhibit 5) Further, the estimated workforce cost would be about2.952 million per year (see Exhibit 6). The personnel cost would be for the aforementioned regional sales managers, business development managers, sales executives, and office assistants. FINAL DECISION A comprehensive analysis followed the discussion. Thakkar's initial decision was to pursue a business plan that had a trading capacity of 45,000 units per year, but the actual production had to be based on market demand. Thakkar estimated that, ultimately 29.250 units could be sold per year at an average price of2.200 per unit. Nipponply could produce 29.250 units with 65 per cent capacity utilization (i.e., the lowest level of capacity). For the second and third year, Thakkar estimated that Nipponply would have 38,250 units and 45,000 units with 85 per cent capacity utilization (a moderate level of capacity) and 100 per cent capacity utilization (the highest level of capacity). respectively The initial investment in the project would cost 29.965 million, of which 21.915 million would be drawn from the firm's own resources; the rest would come from a bank loan at an interest rate of 11 per cent (see Exhibit 7). The life of the project was estimated to be fifteen years. The salvage value of the IT infrastructure, plant, and machinery at the end of fifteen years would be negligible and therefore could be ignored. The salvage value of the building machinery at the end of fifteen years would be 250.000. Before investing in this project, Thakkar asked a consultant to review his business plan EXHIBIT 3: EXPENSES RELATED To THE VOLUME OF SALES PER MONTH (FOR 3,750 UNITS) Particulars Manufacturing cost Advertising expense Promotional expense Electricity expense Total expenses Amount () 6,682,500 165,000 82,500 82,500 7,012,500 Source: Created by the case author based on company documents EXHIBIT 4: ESTIMATED INVESTMENT Particulars Amount () Information technology infrastructure Plant and machinery Building Other miscellaneous assets (i.e., inventory) Total investment 1,575,000 1,250,000 26,100,000 200,000 29,125,000 Source: Created by the case author based on company documents EXHIBIT 5: ROUTINE EXPENSES PER MONTH Particulars Amount ( Administrative costs Office supplies Electricity Miscellaneous 20,000 5,000 40,000 5,000 70,000 Total monthly expenses Source: Created by the case author based on company documents EXHIBIT 6: PERSONNEL COSTS PER MONTH Number of Employees Amount (R) 1,080,000 720,000 864,000 288,000 2,952,000 Employee Designation Regional sales managers Business development managers Sales executives Office assistants Total monthly personnel costs Source: Created by the case author based on company documents