Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question2 CLO 3: Examine the different types of international financial markets; differentiate between spot and future markets; regional and international securities exchanges and their types

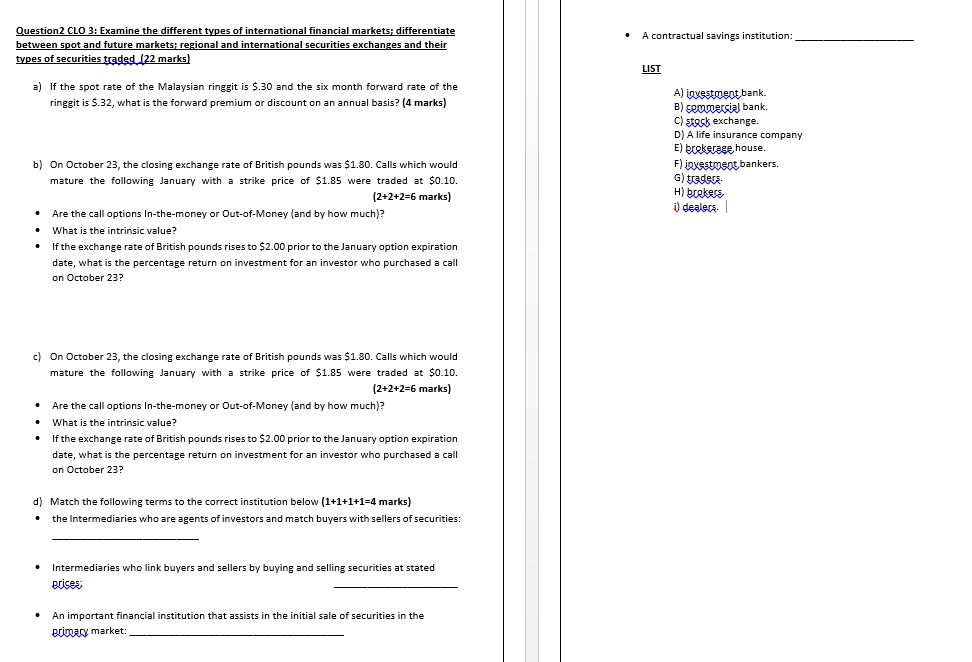

Question2 CLO 3: Examine the different types of international financial markets; differentiate between spot and future markets; regional and international securities exchanges and their types of securities tradeg.( 22 marks) a) If the spot rate of the Malaysian ringgit is $.30 and the six month forward rate of the ringgit is $.32, what is the forward premium or discount on an annual basis? (4 marks) b) On October 23 , the closing exchange rate of British pounds was $1.80. Calls which would mature the following January with a strike price of $1.85 were traded at $0.10. (2+2+2=6 marks) - Are the call options In-the-money or Out-of-Money (and by how much)? - What is the intrinsic value? - If the exchange rate of British pounds rises to $2.00 prior to the January option expiration c) On October 23, the closing exchange rate of British pounds was $1.80. Calls which would mature the following January with a strike price of $1.85 were traded at $0.10. (2+2+2=6marks) - Are the call options In-the-money or Out-of-Money (and by how much)? - What is the intrinsic value? - If the exchange rate of British pounds rises to $2.00 prior to the January option expiration date, what is the percentage return on investment for an investor who purchased a call on October 23 ? d) Match the following terms to the correct institution below (1+1+1+1=4 marks) - the Intermediaries who are agents of investors and match buyers with sellers of securities: - Intermediaries who link buyers and sellers by buying and selling securities at stated prices; - An important financial institution that assists in the initial sale of securities in the primacy market: Question2 CLO 3: Examine the different types of international financial markets; differentiate between spot and future markets; regional and international securities exchanges and their types of securities tradeg.( 22 marks) a) If the spot rate of the Malaysian ringgit is $.30 and the six month forward rate of the ringgit is $.32, what is the forward premium or discount on an annual basis? (4 marks) b) On October 23 , the closing exchange rate of British pounds was $1.80. Calls which would mature the following January with a strike price of $1.85 were traded at $0.10. (2+2+2=6 marks) - Are the call options In-the-money or Out-of-Money (and by how much)? - What is the intrinsic value? - If the exchange rate of British pounds rises to $2.00 prior to the January option expiration c) On October 23, the closing exchange rate of British pounds was $1.80. Calls which would mature the following January with a strike price of $1.85 were traded at $0.10. (2+2+2=6marks) - Are the call options In-the-money or Out-of-Money (and by how much)? - What is the intrinsic value? - If the exchange rate of British pounds rises to $2.00 prior to the January option expiration date, what is the percentage return on investment for an investor who purchased a call on October 23 ? d) Match the following terms to the correct institution below (1+1+1+1=4 marks) - the Intermediaries who are agents of investors and match buyers with sellers of securities: - Intermediaries who link buyers and sellers by buying and selling securities at stated prices; - An important financial institution that assists in the initial sale of securities in the primacy market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started