Question

QUESTIONS 1. Identify 3 key strategic goals that Baramichai intend to achieve through the opening of the Tom Yum Restaurant 2. Support Baramichai in his

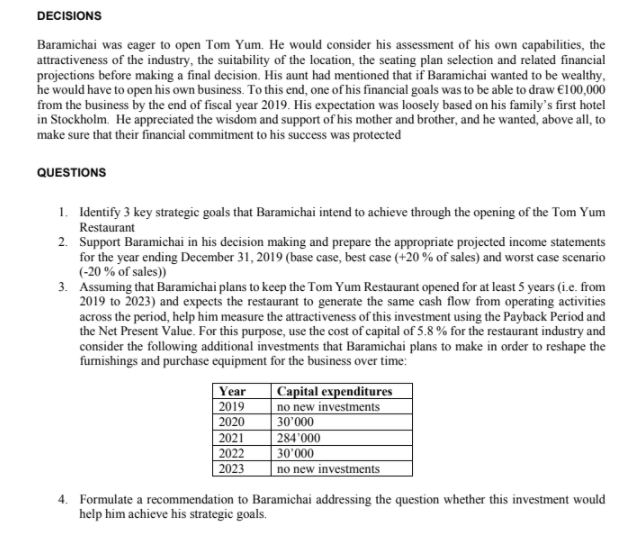

QUESTIONS 1. Identify 3 key strategic goals that Baramichai intend to achieve through the opening of the Tom Yum Restaurant 2. Support Baramichai in his decision making and prepare the appropriate projected income statements for the year ending December 31, 2019 (base case, best case (+20 % of sales) and worst case scenario (-20 % of sales)) 3. Assuming that Baramichai plans to keep the Tom Yum Restaurant opened for at least 5 years (i.e. from 2019 to 2023) and expects the restaurant to generate the same cash flow from operating activities across the period, help him measure the attractiveness of this investment using the Payback Period and the Net Present Value. For this purpose, use the cost of capital of 5.8 % for the restaurant industry and consider the following additional investments that Baramichai plans to make in order to reshape the furnishings and purchase equipment for the business over time: Year Capital expenditures 2019 no new investments 2020 30000 2021 284000 2022 30000 2023 no new investments

4. Formulate a recommendation to Baramichai addressing the question whether this investment would help him achieve his strategic goals.

If anyone can help please

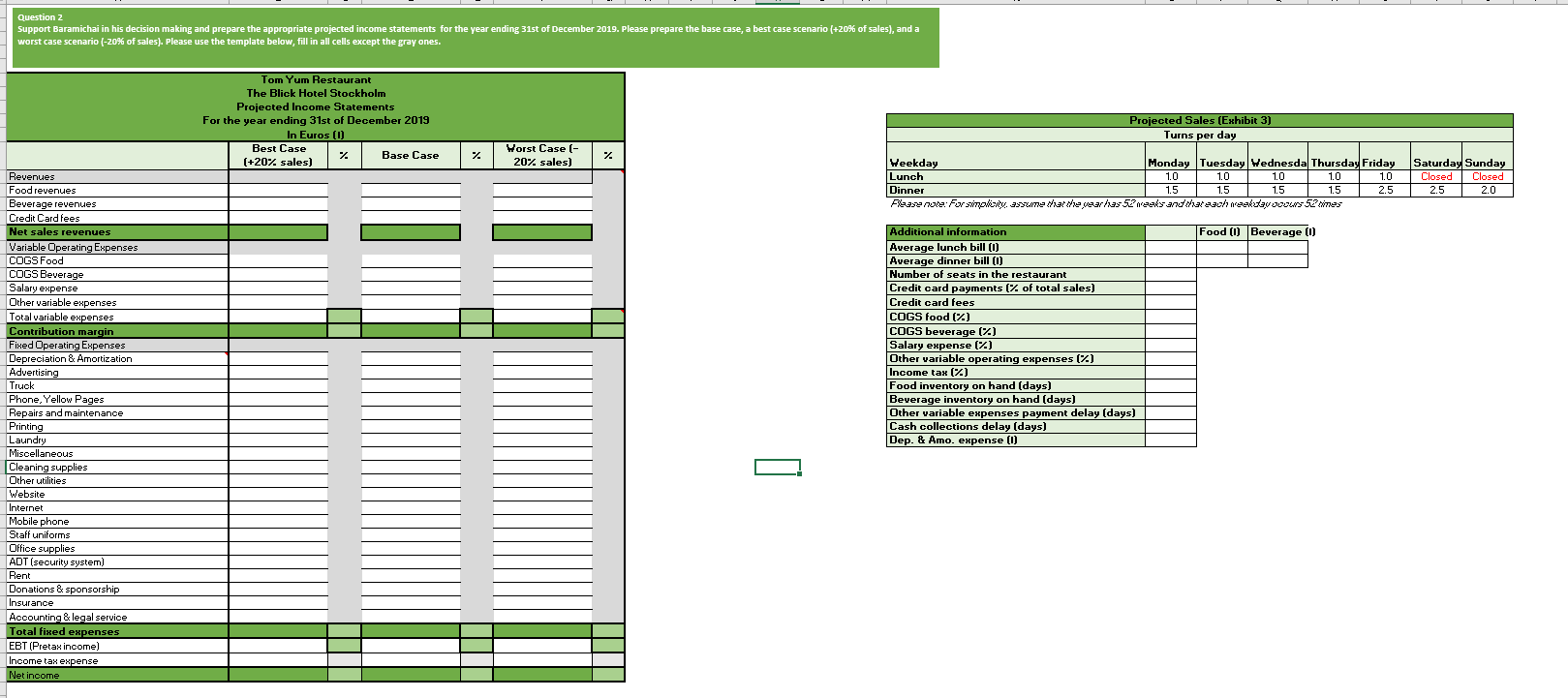

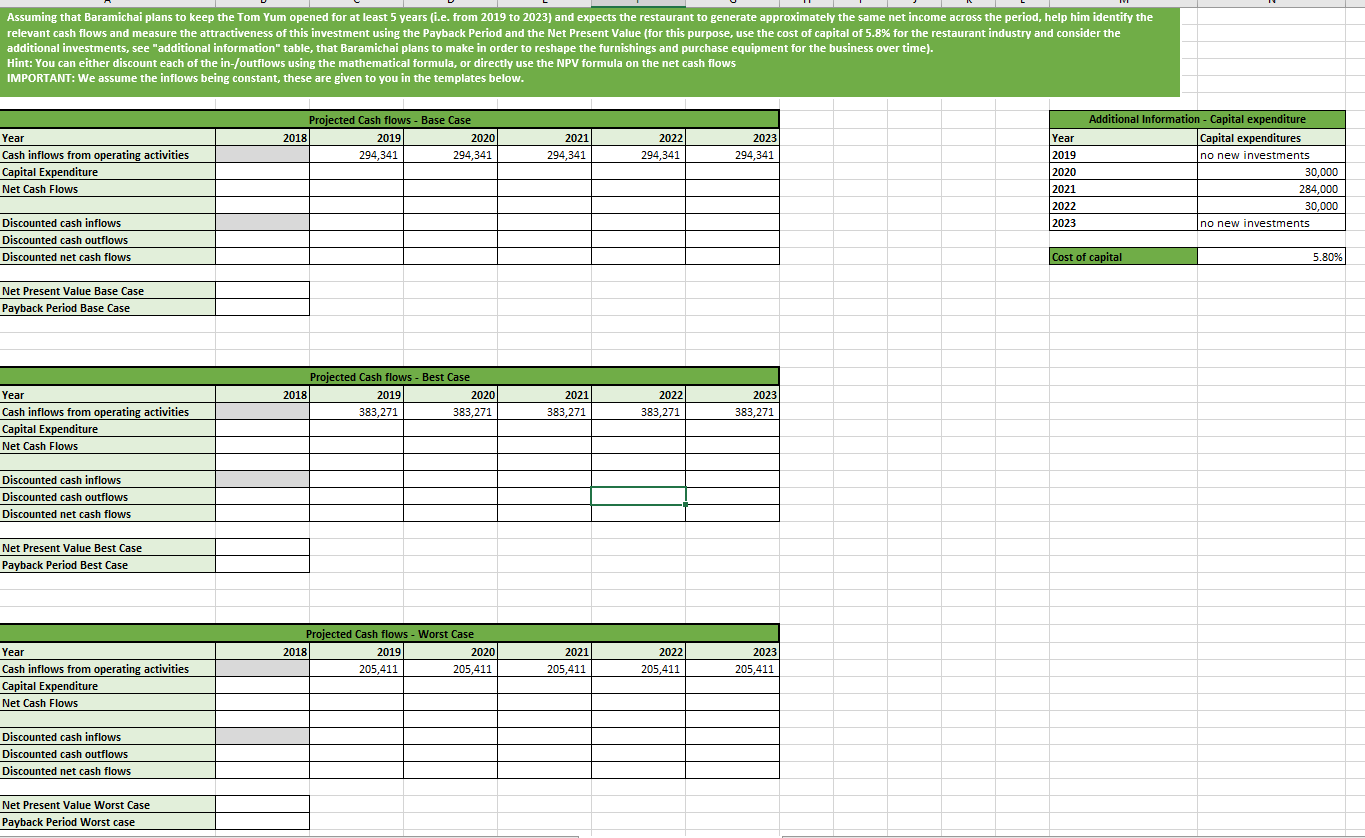

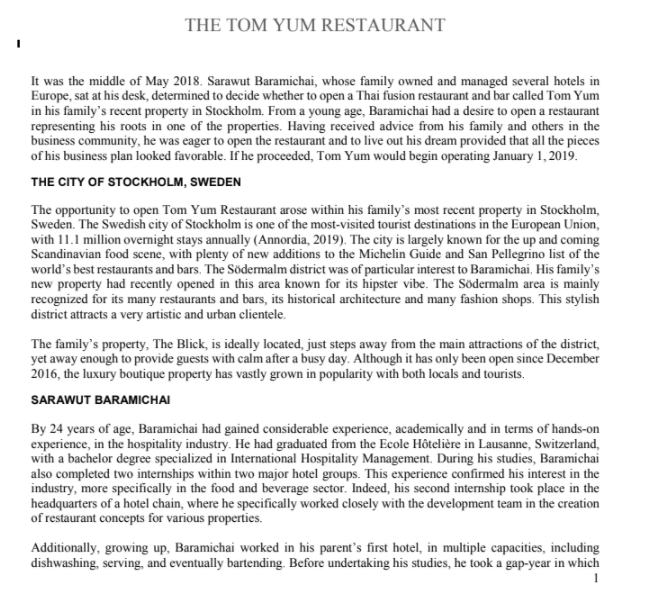

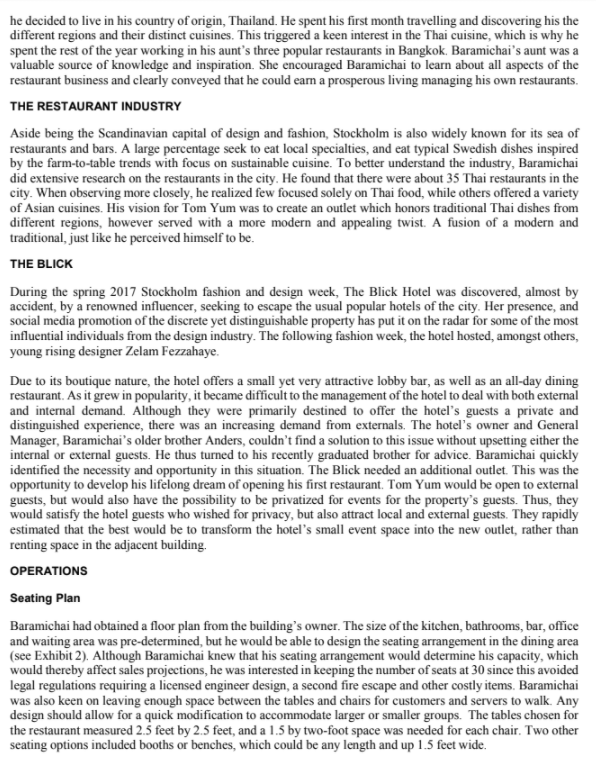

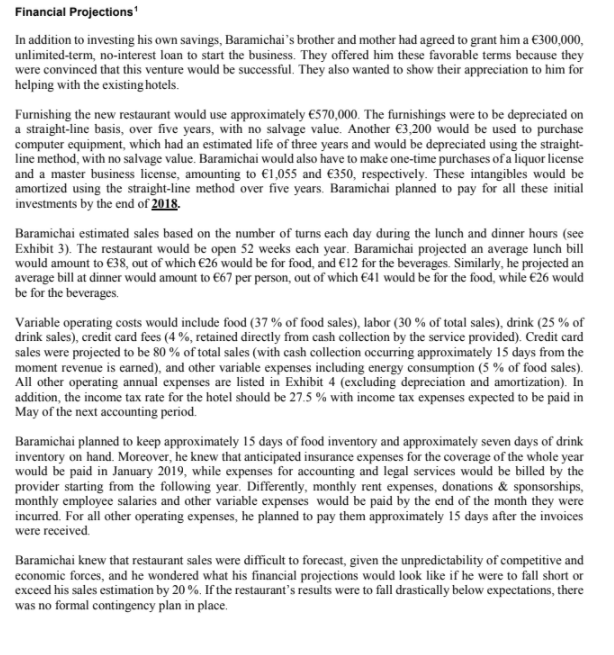

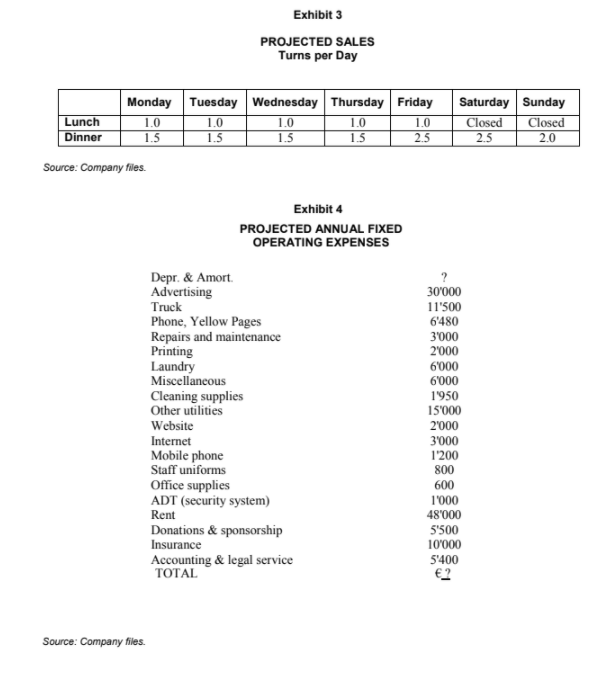

Question 2 Support Baramichai in his decision making and prepare the appropriate projected income statements for the year ending 31st of December 2019. Please prepare the base case, a best case scenario (+20% of sales), and a worst case scenario (-20% of sales). Please use the template below, fill in all cells except the gray ones. Tom Yum Restaurant The Blick Hotel Stockholm Projected Income Statements For the year ending 31st of December 2019 In Euros (1) Best Case (+20% sales) Base Case Projected Sales (Exhibit 3) Turns per day % Worst Case - 20% sales) z Weekday Monday Tuesday Wednesda Thursday Friday Lunch 1.0 1.0 10 1.0 1.0 Dinner 1.5 1.5 1.5 1.5 2.5 Agende: Fw singly assume thatever has 52 nesks and'Natachareekutywous 52mines Saturday Sunday Closed Closed 2.5 T 2.0 Food (1) Beverage (1) Revenues Food revenues Beverage revenues Credit Card fees Net sales revenues Variable Operating Expenses COGS Food COGS Beverage Salary expense Other variable expenses Total variable expenses Contribution margin Fixed Operating Expenses Depreciation & Amortization Advertising Truck Phone, Yellow Pages Repairs and maintenance Printing Laundry Miscellaneous Cleaning supplies Other utilities Website Internet Mobile phone Staff uniforms Office supplies ADT (security system) Rent Donations & sponsorship Insurance Accounting & legal service Total fixed expenses EBT (Pretax income) Income tax expense Net income Additional information Average lunch bill (1) Average dinner bill (0) Number of seats in the restaurant Credit card payments (% of total sales) Credit card fees COGS food (7) COGS beverage (7) Salary expense (%) Other variable operating expenses (%) Income tax (7) Food inventory on hand (days) Beverage inventory on hand (days) Other variable expenses payment delay (days) Cash collections delay (days) Dep. & Amo. expense (0) [] Assuming that Baramichai plans to keep the Tom Yum opened for at least 5 years (i.e. from 2019 to 2023) and expects the restaurant to generate approximately the same net income across the period, help him identify the relevant cash flows and measure the attractiveness of this investment using the Payback Period and the Net Present Value (for this purpose, use the cost of capital of 5.8% for the restaurant industry and consider the additional investments, see "additional information" table, that Baramichai plans to make in order to reshape the furnishings and purchase equipment for the business over time). Hint: You can either discount each of the in-/outflows using the mathematical formula, or directly use the NPV formula on the net cash flows IMPORTANT: We assume the inflows being constant, these are given to you in the templates below. Projected Cash flows - Base Case 2018 2019 2020 294,341 294,341 2021 294,341 2022 294,341 20231 294,341 Year Cash inflows from operating activities Capital Expenditure Net Cash Flows Year 2019 2020 2021 2022 2023 Additional Information - Capital expenditure Capital expenditures no new investments 30,000 284,000 30,000 no new investments Discounted cash inflows Discounted cash outflows Discounted net cash flows Cost of capital 5.80% Net Present Value Base Case Payback Period Base Case Projected Cash flows - Best Case 2018 2019 2020 383,271 383,271 2021) 383,271 2022 383,271 2023 383,271 Year Cash inflows from operating activities Capital Expenditure Net Cash Flows Discounted cash inflows Discounted cash outflows Discounted net cash flows Net Present Value Best Case Payback Period Best Case Projected Cash flows - Worst Case 2018 2019 2020 205,411 205,411 2022 2021 205,411 2023 205,411 205,411 Year Cash inflows from operating activities Capital Expenditure Net Cash Flows Discounted cash inflows Discounted cash outflows Discounted net cash flows Net Present Value Worst Case Payback Period Worst case DECISIONS Baramichai was eager to open Tom Yum. He would consider his assessment of his own capabilities, the attractiveness of the industry, the suitability of the location, the seating plan selection and related financial projections before making a final decision. His aunt had mentioned that if Baramichai wanted to be wealthy, he would have to open his own business. To this end, one of his financial goals was to be able to draw 100,000 from the business by the end of fiscal year 2019. His expectation was loosely based on his family's first hotel in Stockholm. He appreciated the wisdom and support of his mother and brother, and he wanted, above all, to make sure that their financial commitment to his success was protected QUESTIONS 1. Identify 3 key strategic goals that Baramichai intend to achieve through the opening of the Tom Yum Restaurant 2. Support Baramichai in his decision making and prepare the appropriate projected income statements for the year ending December 31, 2019 (base case, best case (+20 % of sales) and worst case scenario (-20% of sales)) 3. Assuming that Baramichai plans to keep the Tom Yum Restaurant opened for at least 5 years (.e. from 2019 to 2023) and expects the restaurant to generate the same cash flow from operating activities across the period, help him measure the attractiveness of this investment using the Payback Period and the Net Present Value. For this purpose, use the cost of capital of 5.8 % for the restaurant industry and consider the following additional investments that Baramichai plans to make in order to reshape the furnishings and purchase equipment for the business over time: Year Capital expenditures 2019 no new investments 2020 30 000 2021 284'000 2022 30'000 2023 no new investments 4. Formulate a recommendation to Baramichai addressing the question whether this investment would help him achieve his strategic goals. THE TOM YUM RESTAURANT It was the middle of May 2018. Sarawut Baramichai, whose family owned and managed several hotels in Europe, sat at his desk, determined to decide whether to open a Thai fusion restaurant and bar called Tom Yum in his family's recent property in Stockholm. From a young age, Baramichai had a desire to open a restaurant representing his roots in one of the properties. Having received advice from his family and others in the business community, he was eager to open the restaurant and to live out his dream provided that all the pieces of his business plan looked favorable. If he proceeded, Tom Yum would begin operating January 1, 2019. THE CITY OF STOCKHOLM, SWEDEN The opportunity to open Tom Yum Restaurant arose within his family's most recent property in Stockholm, Sweden. The Swedish city of Stockholm is one of the most-visited tourist destinations in the European Union, with 11.1 million overnight stays annually (Annordia, 2019). The city is largely known for the up and coming Scandinavian food scene, with plenty of new additions to the Michelin Guide and San Pellegrino list of the world's best restaurants and bars. The Sdermalm district was of particular interest to Baramichai. His family's new property had recently opened in this area known for its hipster vibe. The Sodermalm area is mainly recognized for its many restaurants and bars, its historical architecture and many fashion shops. This stylish district attracts a very artistic and urban clientele. The family's property, The Blick, is ideally located just steps away from the main attractions of the district, yet away enough to provide guests with calm after a busy day. Although it has only been open since December 2016, the luxury boutique property has vastly grown in popularity with both locals and tourists. SARAWUT BARAMICHAI By 24 years of age, Baramichai had gained considerable experience, academically and in terms of hands-on experience in the hospitality industry. He had graduated from the Ecole Htelire in Lausanne, Switzerland, with a bachelor degree specialized in International Hospitality Management. During his studies, Baramichai also completed two internships within two major hotel groups. This experience confirmed his interest in the industry, more specifically in the food and beverage sector. Indeed, his second internship took place in the headquarters of a hotel chain, where he specifically worked closely with the development team in the creation of restaurant concepts for various properties. Additionally, growing up, Baramichai worked in his parent's first hotel, in multiple capacities, including dishwashing, serving, and eventually bartending. Before undertaking his studies, he took a gap-year in which 1 Question 2 Support Baramichai in his decision making and prepare the appropriate projected income statements for the year ending 31st of December 2019. Please prepare the base case, a best case scenario (+20% of sales), and a worst case scenario (-20% of sales). Please use the template below, fill in all cells except the gray ones. Tom Yum Restaurant The Blick Hotel Stockholm Projected Income Statements For the year ending 31st of December 2019 In Euros (1) Best Case (+20% sales) Base Case Projected Sales (Exhibit 3) Turns per day % Worst Case - 20% sales) z Weekday Monday Tuesday Wednesda Thursday Friday Lunch 1.0 1.0 10 1.0 1.0 Dinner 1.5 1.5 1.5 1.5 2.5 Agende: Fw singly assume thatever has 52 nesks and'Natachareekutywous 52mines Saturday Sunday Closed Closed 2.5 T 2.0 Food (1) Beverage (1) Revenues Food revenues Beverage revenues Credit Card fees Net sales revenues Variable Operating Expenses COGS Food COGS Beverage Salary expense Other variable expenses Total variable expenses Contribution margin Fixed Operating Expenses Depreciation & Amortization Advertising Truck Phone, Yellow Pages Repairs and maintenance Printing Laundry Miscellaneous Cleaning supplies Other utilities Website Internet Mobile phone Staff uniforms Office supplies ADT (security system) Rent Donations & sponsorship Insurance Accounting & legal service Total fixed expenses EBT (Pretax income) Income tax expense Net income Additional information Average lunch bill (1) Average dinner bill (0) Number of seats in the restaurant Credit card payments (% of total sales) Credit card fees COGS food (7) COGS beverage (7) Salary expense (%) Other variable operating expenses (%) Income tax (7) Food inventory on hand (days) Beverage inventory on hand (days) Other variable expenses payment delay (days) Cash collections delay (days) Dep. & Amo. expense (0) [] Financial Projections In addition to investing his own savings, Baramichai's brother and mother had agreed to grant him a 300,000, unlimited-term, no-interest loan to start the business. They offered him these favorable terms because they were convinced that this venture would be successful. They also wanted to show their appreciation to him for helping with the existing hotels. Furnishing the new restaurant would use approximately 570,000. The furnishings were to be depreciated on a straight-line basis, over five years, with no salvage value. Another 3,200 would be used to purchase computer equipment, which had an estimated life of three years and would be depreciated using the straight- line method, with no salvage value. Baramichai would also have to make one-time purchases of a liquor license and a master business license, amounting to 1,055 and 350, respectively. These intangibles would be amortized using the straight-line method over five years. Baramichai planned to pay for all these initial investments by the end of 2018. Baramichai estimated sales based on the number of turns each day during the lunch and dinner hours (see Exhibit 3). The restaurant would be open 52 weeks each year. Baramichai projected an average lunch bill would amount to 38, out of which 26 would be for food, and 12 for the beverages. Similarly, he projected an average bill at dinner would amount to 67 per person, out of which 41 would be for the food, while 26 would be for the beverages. Variable operating costs would include food (37% of food sales), labor (30 % of total sales), drink (25% of drink sales), credit card fees (4 %, retained directly from cash collection by the service provided). Credit card sales were projected to be 80 % of total sales (with cash collection occurring approximately 15 days from the moment revenue is earned), and other variable expenses including energy consumption (5 % of food sales). All other operating annual expenses are listed in Exhibit 4 (excluding depreciation and amortization). In addition, the income tax rate for the hotel should be 27.5 % with income tax expenses expected to be paid in May of the next accounting period. Baramichai planned to keep approximately 15 days of food inventory and approximately seven days of drink inventory on hand. Moreover, he knew that anticipated insurance expenses for the coverage of the whole year would be paid in January 2019, while expenses for accounting and legal services would be billed by the provider starting from the following year. Differently, monthly rent expenses, donations & sponsorships, monthly employee salaries and other variable expenses would be paid by the end of the month they were incurred. For all other operating expenses, he planned to pay them approximately 15 days after the invoices were received Baramichai knew that restaurant sales were difficult to forecast, given the unpredictability of competitive and economic forces, and he wondered what his financial projections would look like if he were to fall short or exceed his sales estimation by 20 %. If the restaurant's results were to fall drastically below expectations, there was no formal contingency plan in place. Kocksgatan Urban Deli Nytorget I Sknegatan Exhibit 1 PROPOSED LOCATION Meatballs for the People Nook Blue Light Yokohama Axel Landquists Caf Pom & Flora park Caf String Tom Yum Restaurant Grandpa wannagatan Ai Ramen Folii Bondegatan Klippgatan Sknegatan Sknegatan Sofia kyrka Sknegatan Nytorget Ugglan Boule & Bar Renstiernas gata Sorter Pers grnd Nytorget ngata Sofiagatan KAJSAS I PARK kade traditioner Gotlandsgatan Shanti Classic Vitabe ryggartppan Ringvgen Exhibit 2 PROPOSED FLOOR PLAN 12 Front Entrance 149 N 194 Access to kitchen and bathrooms 16'2 he decided to live in his country of origin, Thailand. He spent his first month travelling and discovering his the different regions and their distinct cuisines. This triggered a keen interest in the Thai cuisine, which is why he spent the rest of the year working in his aunt's three popular restaurants in Bangkok. Baramichai's aunt was a valuable source of knowledge and inspiration. She encouraged Baramichai to learn about all aspects of the restaurant business and clearly conveyed that he could eam a prosperous living managing his own restaurants. THE RESTAURANT INDUSTRY Aside being the Scandinavian capital of design and fashion, Stockholm is also widely known for its sea of restaurants and bars. A large percentage seek to eat local specialties, and eat typical Swedish dishes inspired by the farm-to-table trends with focus on sustainable cuisine. To better understand the industry, Baramichai did extensive research on the restaurants in the city. He found that there were about 35 Thai restaurants in the city. When observing more closely, he realized few focused solely on Thai food, while others offered a variety of Asian cuisines. His vision for Tom Yum was to create an outlet which honors traditional Thai dishes from different regions, however served with a more modern and appealing twist. A fusion of a modern and traditional, just like he perceived himself to be. THE BLICK During the spring 2017 Stockholm fashion and design week, The Blick Hotel was discovered, almost by accident, by a renowned influencer, seeking to escape the usual popular hotels of the city. Her presence, and social media promotion of the discrete yet distinguishable property has put it on the radar for some of the most influential individuals from the design industry. The following fashion week, the hotel hosted, amongst others, young rising designer Zelam Fezzahaye. Due to its boutique nature, the hotel offers a small yet very attractive lobby bar, as well as an all-day dining restaurant. As it grew in popularity, it became difficult to the management of the hotel to deal with both external and internal demand. Although they were primarily destined to offer the hotel's guests a private and distinguished experience, there was an increasing demand from externals. The hotel's owner and General Manager, Baramichai's older brother Anders, couldn't find a solution to this issue without upsetting either the internal or external guests. He thus turned to his recently graduated brother for advice. Baramichai quickly identified the necessity and opportunity in this situation. The Blick needed an additional outlet. This was the opportunity to develop his lifelong dream of opening his first restaurant. Tom Yum would be open to external guests, but would also have the possibility to be privatized for events for the property's guests. Thus, they would satisfy the hotel guests who wished for privacy, but also attract local and external guests. They rapidly estimated that the best would be to transform the hotel's small event space into the new outlet, rather than renting space in the adjacent building, OPERATIONS Seating Plan Baramichai had obtained a floor plan from the building's owner. The size of the kitchen, bathrooms, bar, office and waiting area was pre-determined, but he would be able to design the seating arrangement in the dining area (see Exhibit 2). Although Baramichai knew that his seating arrangement would determine his capacity, which would thereby affect sales projections, he was interested in keeping the number of seats at 30 since this avoided legal regulations requiring a licensed engineer design, a second fire escape and other costly items. Baramichai was also keen on leaving enough space between the tables and chairs for customers and servers to walk. Any design should allow for a quick modification to accommodate larger or smaller groups. The tables chosen for the restaurant measured 2.5 feet by 2.5 feet, and a 1.5 by two-foot space was needed for each chair. Two other seating options included booths or benches, which could be any length and up 1.5 feet wide. Question 2 Support Baramichai in his decision making and prepare the appropriate projected income statements for the year ending 31st of December 2019. Please prepare the base case, a best case scenario (+20% of sales), and a worst case scenario (-20% of sales). Please use the template below, fill in all cells except the gray ones. Tom Yum Restaurant The Blick Hotel Stockholm Projected Income Statements For the year ending 31st of December 2019 In Euros (1) Best Case (+20% sales) Base Case Projected Sales (Exhibit 3) Turns per day % Worst Case - 20% sales) z Weekday Monday Tuesday Wednesda Thursday Friday Lunch 1.0 1.0 10 1.0 1.0 Dinner 1.5 1.5 1.5 1.5 2.5 Agende: Fw singly assume thatever has 52 nesks and'Natachareekutywous 52mines Saturday Sunday Closed Closed 2.5 T 2.0 Food (1) Beverage (1) Revenues Food revenues Beverage revenues Credit Card fees Net sales revenues Variable Operating Expenses COGS Food COGS Beverage Salary expense Other variable expenses Total variable expenses Contribution margin Fixed Operating Expenses Depreciation & Amortization Advertising Truck Phone, Yellow Pages Repairs and maintenance Printing Laundry Miscellaneous Cleaning supplies Other utilities Website Internet Mobile phone Staff uniforms Office supplies ADT (security system) Rent Donations & sponsorship Insurance Accounting & legal service Total fixed expenses EBT (Pretax income) Income tax expense Net income Additional information Average lunch bill (1) Average dinner bill (0) Number of seats in the restaurant Credit card payments (% of total sales) Credit card fees COGS food (7) COGS beverage (7) Salary expense (%) Other variable operating expenses (%) Income tax (7) Food inventory on hand (days) Beverage inventory on hand (days) Other variable expenses payment delay (days) Cash collections delay (days) Dep. & Amo. expense (0) [] Assuming that Baramichai plans to keep the Tom Yum opened for at least 5 years (i.e. from 2019 to 2023) and expects the restaurant to generate approximately the same net income across the period, help him identify the relevant cash flows and measure the attractiveness of this investment using the Payback Period and the Net Present Value (for this purpose, use the cost of capital of 5.8% for the restaurant industry and consider the additional investments, see "additional information" table, that Baramichai plans to make in order to reshape the furnishings and purchase equipment for the business over time). Hint: You can either discount each of the in-/outflows using the mathematical formula, or directly use the NPV formula on the net cash flows IMPORTANT: We assume the inflows being constant, these are given to you in the templates below. Projected Cash flows - Base Case 2018 2019 2020 294,341 294,341 2021 294,341 2022 294,341 20231 294,341 Year Cash inflows from operating activities Capital Expenditure Net Cash Flows Year 2019 2020 2021 2022 2023 Additional Information - Capital expenditure Capital expenditures no new investments 30,000 284,000 30,000 no new investments Discounted cash inflows Discounted cash outflows Discounted net cash flows Cost of capital 5.80% Net Present Value Base Case Payback Period Base Case Projected Cash flows - Best Case 2018 2019 2020 383,271 383,271 2021) 383,271 2022 383,271 2023 383,271 Year Cash inflows from operating activities Capital Expenditure Net Cash Flows Discounted cash inflows Discounted cash outflows Discounted net cash flows Net Present Value Best Case Payback Period Best Case Projected Cash flows - Worst Case 2018 2019 2020 205,411 205,411 2022 2021 205,411 2023 205,411 205,411 Year Cash inflows from operating activities Capital Expenditure Net Cash Flows Discounted cash inflows Discounted cash outflows Discounted net cash flows Net Present Value Worst Case Payback Period Worst case DECISIONS Baramichai was eager to open Tom Yum. He would consider his assessment of his own capabilities, the attractiveness of the industry, the suitability of the location, the seating plan selection and related financial projections before making a final decision. His aunt had mentioned that if Baramichai wanted to be wealthy, he would have to open his own business. To this end, one of his financial goals was to be able to draw 100,000 from the business by the end of fiscal year 2019. His expectation was loosely based on his family's first hotel in Stockholm. He appreciated the wisdom and support of his mother and brother, and he wanted, above all, to make sure that their financial commitment to his success was protected QUESTIONS 1. Identify 3 key strategic goals that Baramichai intend to achieve through the opening of the Tom Yum Restaurant 2. Support Baramichai in his decision making and prepare the appropriate projected income statements for the year ending December 31, 2019 (base case, best case (+20 % of sales) and worst case scenario (-20% of sales)) 3. Assuming that Baramichai plans to keep the Tom Yum Restaurant opened for at least 5 years (.e. from 2019 to 2023) and expects the restaurant to generate the same cash flow from operating activities across the period, help him measure the attractiveness of this investment using the Payback Period and the Net Present Value. For this purpose, use the cost of capital of 5.8 % for the restaurant industry and consider the following additional investments that Baramichai plans to make in order to reshape the furnishings and purchase equipment for the business over time: Year Capital expenditures 2019 no new investments 2020 30 000 2021 284'000 2022 30'000 2023 no new investments 4. Formulate a recommendation to Baramichai addressing the question whether this investment would help him achieve his strategic goals. THE TOM YUM RESTAURANT It was the middle of May 2018. Sarawut Baramichai, whose family owned and managed several hotels in Europe, sat at his desk, determined to decide whether to open a Thai fusion restaurant and bar called Tom Yum in his family's recent property in Stockholm. From a young age, Baramichai had a desire to open a restaurant representing his roots in one of the properties. Having received advice from his family and others in the business community, he was eager to open the restaurant and to live out his dream provided that all the pieces of his business plan looked favorable. If he proceeded, Tom Yum would begin operating January 1, 2019. THE CITY OF STOCKHOLM, SWEDEN The opportunity to open Tom Yum Restaurant arose within his family's most recent property in Stockholm, Sweden. The Swedish city of Stockholm is one of the most-visited tourist destinations in the European Union, with 11.1 million overnight stays annually (Annordia, 2019). The city is largely known for the up and coming Scandinavian food scene, with plenty of new additions to the Michelin Guide and San Pellegrino list of the world's best restaurants and bars. The Sdermalm district was of particular interest to Baramichai. His family's new property had recently opened in this area known for its hipster vibe. The Sodermalm area is mainly recognized for its many restaurants and bars, its historical architecture and many fashion shops. This stylish district attracts a very artistic and urban clientele. The family's property, The Blick, is ideally located just steps away from the main attractions of the district, yet away enough to provide guests with calm after a busy day. Although it has only been open since December 2016, the luxury boutique property has vastly grown in popularity with both locals and tourists. SARAWUT BARAMICHAI By 24 years of age, Baramichai had gained considerable experience, academically and in terms of hands-on experience in the hospitality industry. He had graduated from the Ecole Htelire in Lausanne, Switzerland, with a bachelor degree specialized in International Hospitality Management. During his studies, Baramichai also completed two internships within two major hotel groups. This experience confirmed his interest in the industry, more specifically in the food and beverage sector. Indeed, his second internship took place in the headquarters of a hotel chain, where he specifically worked closely with the development team in the creation of restaurant concepts for various properties. Additionally, growing up, Baramichai worked in his parent's first hotel, in multiple capacities, including dishwashing, serving, and eventually bartending. Before undertaking his studies, he took a gap-year in which 1 Question 2 Support Baramichai in his decision making and prepare the appropriate projected income statements for the year ending 31st of December 2019. Please prepare the base case, a best case scenario (+20% of sales), and a worst case scenario (-20% of sales). Please use the template below, fill in all cells except the gray ones. Tom Yum Restaurant The Blick Hotel Stockholm Projected Income Statements For the year ending 31st of December 2019 In Euros (1) Best Case (+20% sales) Base Case Projected Sales (Exhibit 3) Turns per day % Worst Case - 20% sales) z Weekday Monday Tuesday Wednesda Thursday Friday Lunch 1.0 1.0 10 1.0 1.0 Dinner 1.5 1.5 1.5 1.5 2.5 Agende: Fw singly assume thatever has 52 nesks and'Natachareekutywous 52mines Saturday Sunday Closed Closed 2.5 T 2.0 Food (1) Beverage (1) Revenues Food revenues Beverage revenues Credit Card fees Net sales revenues Variable Operating Expenses COGS Food COGS Beverage Salary expense Other variable expenses Total variable expenses Contribution margin Fixed Operating Expenses Depreciation & Amortization Advertising Truck Phone, Yellow Pages Repairs and maintenance Printing Laundry Miscellaneous Cleaning supplies Other utilities Website Internet Mobile phone Staff uniforms Office supplies ADT (security system) Rent Donations & sponsorship Insurance Accounting & legal service Total fixed expenses EBT (Pretax income) Income tax expense Net income Additional information Average lunch bill (1) Average dinner bill (0) Number of seats in the restaurant Credit card payments (% of total sales) Credit card fees COGS food (7) COGS beverage (7) Salary expense (%) Other variable operating expenses (%) Income tax (7) Food inventory on hand (days) Beverage inventory on hand (days) Other variable expenses payment delay (days) Cash collections delay (days) Dep. & Amo. expense (0) [] Financial Projections In addition to investing his own savings, Baramichai's brother and mother had agreed to grant him a 300,000, unlimited-term, no-interest loan to start the business. They offered him these favorable terms because they were convinced that this venture would be successful. They also wanted to show their appreciation to him for helping with the existing hotels. Furnishing the new restaurant would use approximately 570,000. The furnishings were to be depreciated on a straight-line basis, over five years, with no salvage value. Another 3,200 would be used to purchase computer equipment, which had an estimated life of three years and would be depreciated using the straight- line method, with no salvage value. Baramichai would also have to make one-time purchases of a liquor license and a master business license, amounting to 1,055 and 350, respectively. These intangibles would be amortized using the straight-line method over five years. Baramichai planned to pay for all these initial investments by the end of 2018. Baramichai estimated sales based on the number of turns each day during the lunch and dinner hours (see Exhibit 3). The restaurant would be open 52 weeks each year. Baramichai projected an average lunch bill would amount to 38, out of which 26 would be for food, and 12 for the beverages. Similarly, he projected an average bill at dinner would amount to 67 per person, out of which 41 would be for the food, while 26 would be for the beverages. Variable operating costs would include food (37% of food sales), labor (30 % of total sales), drink (25% of drink sales), credit card fees (4 %, retained directly from cash collection by the service provided). Credit card sales were projected to be 80 % of total sales (with cash collection occurring approximately 15 days from the moment revenue is earned), and other variable expenses including energy consumption (5 % of food sales). All other operating annual expenses are listed in Exhibit 4 (excluding depreciation and amortization). In addition, the income tax rate for the hotel should be 27.5 % with income tax expenses expected to be paid in May of the next accounting period. Baramichai planned to keep approximately 15 days of food inventory and approximately seven days of drink inventory on hand. Moreover, he knew that anticipated insurance expenses for the coverage of the whole year would be paid in January 2019, while expenses for accounting and legal services would be billed by the provider starting from the following year. Differently, monthly rent expenses, donations & sponsorships, monthly employee salaries and other variable expenses would be paid by the end of the month they were incurred. For all other operating expenses, he planned to pay them approximately 15 days after the invoices were received Baramichai knew that restaurant sales were difficult to forecast, given the unpredictability of competitive and economic forces, and he wondered what his financial projections would look like if he were to fall short or exceed his sales estimation by 20 %. If the restaurant's results were to fall drastically below expectations, there was no formal contingency plan in place. Kocksgatan Urban Deli Nytorget I Sknegatan Exhibit 1 PROPOSED LOCATION Meatballs for the People Nook Blue Light Yokohama Axel Landquists Caf Pom & Flora park Caf String Tom Yum Restaurant Grandpa wannagatan Ai Ramen Folii Bondegatan Klippgatan Sknegatan Sknegatan Sofia kyrka Sknegatan Nytorget Ugglan Boule & Bar Renstiernas gata Sorter Pers grnd Nytorget ngata Sofiagatan KAJSAS I PARK kade traditioner Gotlandsgatan Shanti Classic Vitabe ryggartppan Ringvgen Exhibit 2 PROPOSED FLOOR PLAN 12 Front Entrance 149 N 194 Access to kitchen and bathrooms 16'2 he decided to live in his country of origin, Thailand. He spent his first month travelling and discovering his the different regions and their distinct cuisines. This triggered a keen interest in the Thai cuisine, which is why he spent the rest of the year working in his aunt's three popular restaurants in Bangkok. Baramichai's aunt was a valuable source of knowledge and inspiration. She encouraged Baramichai to learn about all aspects of the restaurant business and clearly conveyed that he could eam a prosperous living managing his own restaurants. THE RESTAURANT INDUSTRY Aside being the Scandinavian capital of design and fashion, Stockholm is also widely known for its sea of restaurants and bars. A large percentage seek to eat local specialties, and eat typical Swedish dishes inspired by the farm-to-table trends with focus on sustainable cuisine. To better understand the industry, Baramichai did extensive research on the restaurants in the city. He found that there were about 35 Thai restaurants in the city. When observing more closely, he realized few focused solely on Thai food, while others offered a variety of Asian cuisines. His vision for Tom Yum was to create an outlet which honors traditional Thai dishes from different regions, however served with a more modern and appealing twist. A fusion of a modern and traditional, just like he perceived himself to be. THE BLICK During the spring 2017 Stockholm fashion and design week, The Blick Hotel was discovered, almost by accident, by a renowned influencer, seeking to escape the usual popular hotels of the city. Her presence, and social media promotion of the discrete yet distinguishable property has put it on the radar for some of the most influential individuals from the design industry. The following fashion week, the hotel hosted, amongst others, young rising designer Zelam Fezzahaye. Due to its boutique nature, the hotel offers a small yet very attractive lobby bar, as well as an all-day dining restaurant. As it grew in popularity, it became difficult to the management of the hotel to deal with both external and internal demand. Although they were primarily destined to offer the hotel's guests a private and distinguished experience, there was an increasing demand from externals. The hotel's owner and General Manager, Baramichai's older brother Anders, couldn't find a solution to this issue without upsetting either the internal or external guests. He thus turned to his recently graduated brother for advice. Baramichai quickly identified the necessity and opportunity in this situation. The Blick needed an additional outlet. This was the opportunity to develop his lifelong dream of opening his first restaurant. Tom Yum would be open to external guests, but would also have the possibility to be privatized for events for the property's guests. Thus, they would satisfy the hotel guests who wished for privacy, but also attract local and external guests. They rapidly estimated that the best would be to transform the hotel's small event space into the new outlet, rather than renting space in the adjacent building, OPERATIONS Seating Plan Baramichai had obtained a floor plan from the building's owner. The size of the kitchen, bathrooms, bar, office and waiting area was pre-determined, but he would be able to design the seating arrangement in the dining area (see Exhibit 2). Although Baramichai knew that his seating arrangement would determine his capacity, which would thereby affect sales projections, he was interested in keeping the number of seats at 30 since this avoided legal regulations requiring a licensed engineer design, a second fire escape and other costly items. Baramichai was also keen on leaving enough space between the tables and chairs for customers and servers to walk. Any design should allow for a quick modification to accommodate larger or smaller groups. The tables chosen for the restaurant measured 2.5 feet by 2.5 feet, and a 1.5 by two-foot space was needed for each chair. Two other seating options included booths or benches, which could be any length and up 1.5 feet wideStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started