Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Questions 1 to 3 please 1) You invest $50,000 now and receive S10,000 per year for 15 years starting at the end of the first

Questions 1 to 3 please

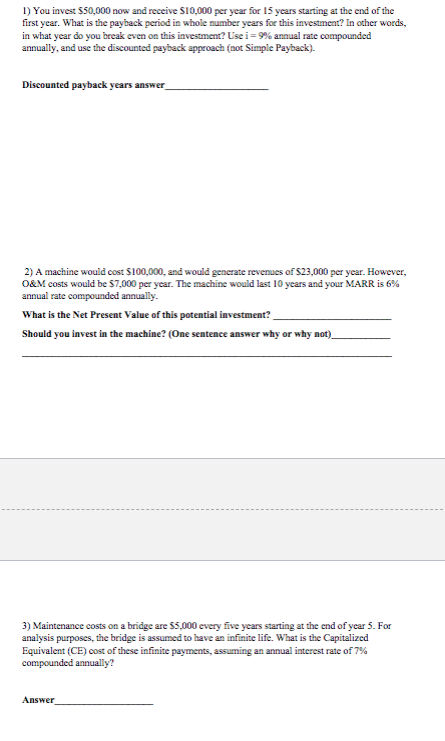

1) You invest $50,000 now and receive S10,000 per year for 15 years starting at the end of the first year. What is the payback period in whole number years for this investment? In other words in what year do you break even on this investment? Use i-9% annual rate compounded annually, and use the discounted payback approach (not Simple Payback). Discounted payback years answ er 2) A machine would cost $100,000, and would generate revenues of $23,000 per year. However, O&M costs would be $7,000 per year. The machine would last 10 years and your MARR is 6% annual rate compounded annually What is the Net Present Value of this potential investment Should you invest in the machine? (One sentence answer why or why not) 3) Maintenance costs on a bridge are $5,000 every five years starting at the end of year 5. For analysis purposes, the bridge is assumed to have an infinite life. What is the Capitalized Equivalent (CE) cost of these infinite payments, assuming an annual interest rate of 7% compounded annuallyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started