Answered step by step

Verified Expert Solution

Question

1 Approved Answer

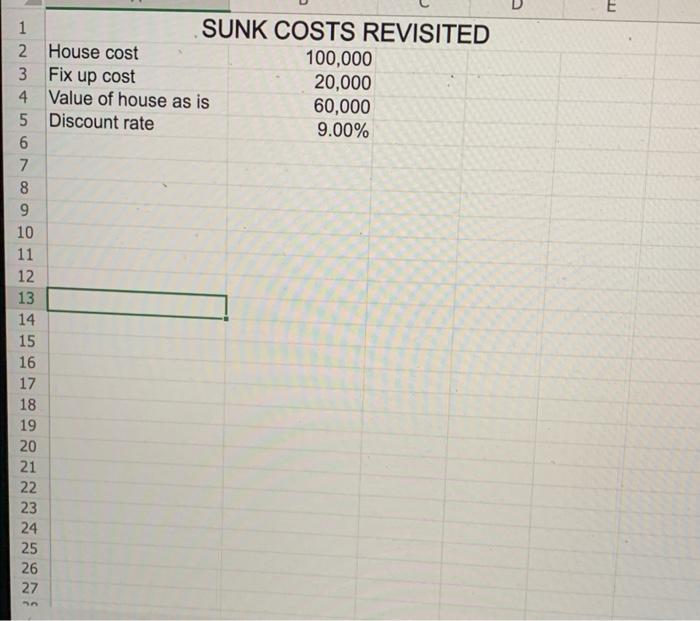

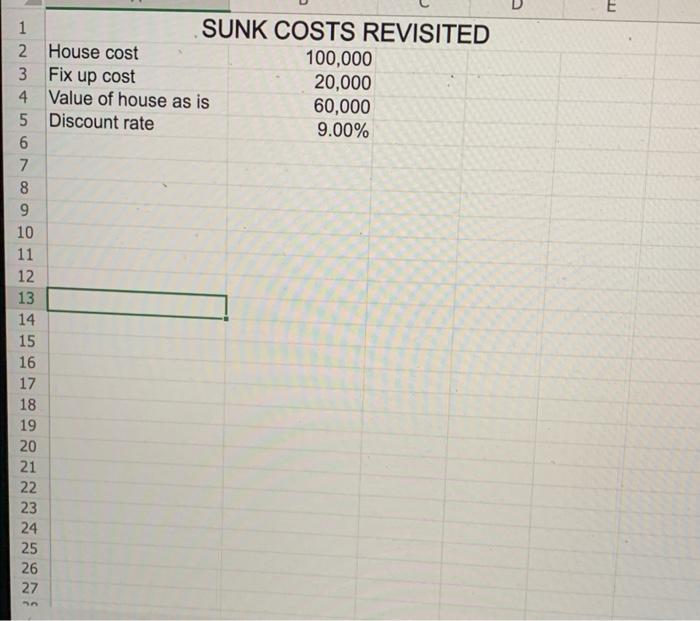

please do on excel and show functions please SUNK COSTS REVISITED begin{tabular}{llr} 2 & House cost & 100,000 3 & Fix up cost &

please do on excel and show functions please

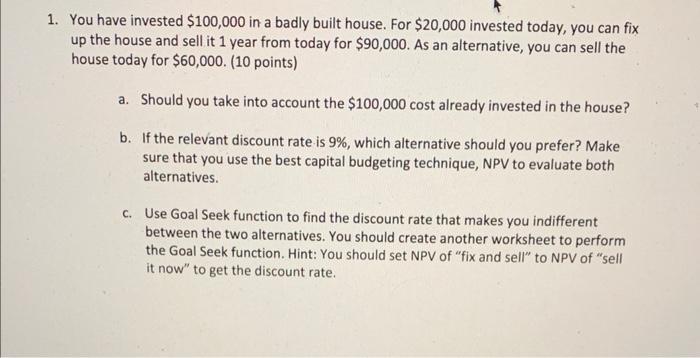

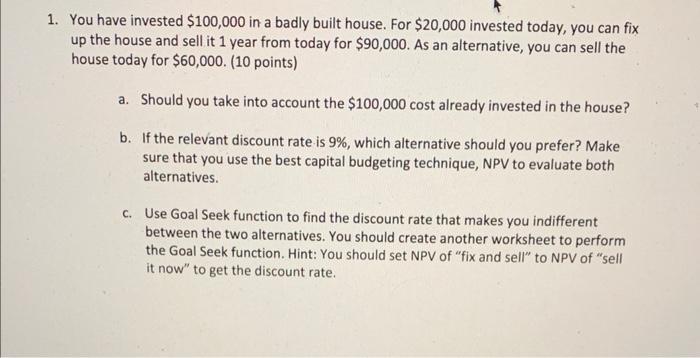

SUNK COSTS REVISITED \begin{tabular}{llr} 2 & House cost & 100,000 \\ 3 & Fix up cost & 20,000 \\ 4 & Value of house as is & 60,000 \\ 5 & Discount rate & 9.00% \\ \hline 6 & & \end{tabular} You have invested $100,000 in a badly built house. For $20,000 invested today, you can fix up the house and sell it 1 year from today for $90,000. As an alternative, you can sell the house today for $60,000. ( 10 points) a. Should you take into account the $100,000 cost already invested in the house? b. If the relevant discount rate is 9%, which alternative should you prefer? Make sure that you use the best capital budgeting technique, NPV to evaluate both alternatives. c. Use Goal Seek function to find the discount rate that makes you indifferent between the two alternatives. You should create another worksheet to perform the Goal Seek function. Hint: You should set NPV of "fix and sell" to NPV of "sell it now" to get the discount rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started