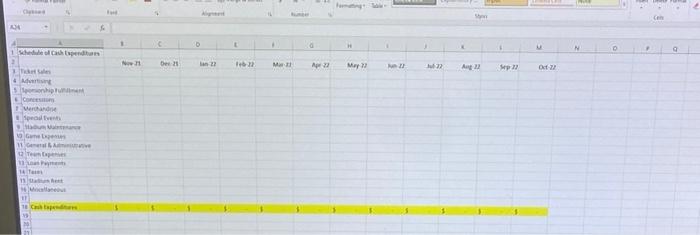

Questions 1. Using the accompanying Excel workbook and information provided in the case narrative, develop a schedule of cash receipts, a schedule of cash payments, and a cash budget that includes the line of credit borrowing and repayment provisions. Developing a Cash Budget 10 2. Describe the cash flow patterns revealed in the schedules of cash receipts and payments. How do the patterns of cash receipts differ from cash expenses? 3. What additional information should the Squares consider before accepting Sea Island Bank's offer of a line of credit? 4. What cash management techniques could the Squares use to mitigate the impact of months when expenses are higher than revenues? What recommendations would you give to the organization to make its cash flows less seasonal? 5. The City of Savannah has asked the Squares to contribute S1 million toward the cost of a new video board. The payment would be due in June. Based on the cash budget you have prepared, should the Squares pay cash or seek financing options to cover their share? 35 D F G H M N Schedule of Cash Receipts Nov 21 Dec. 21 lan 22 Feb-22 Mar 22 Apr 22 May 22 June 22 22 Aug 22 Oct 22 de Sales Aury Suites Cube Sponsorship min Con Merchandise 10 E 11 Speciales 12 13 Cash Recipts 15 04 1 C sche Cach pendan N New be 12 M Apr 22 May 22 Ant Sep Oct 22 M sonu Com 1 Merchandise pode Gune 11 It 11 18 D H canh BAN De Apr Mar 22 EVE Sep 27 Out 22 May 22 tun ny 1 w -al 50.000 000 3 000 50.000 SOOD RO 0.000 50.000 30,000 00006 OTO 50.000 0.000 30.000 50.000 500 000 ocor 000 Che Cathe cum 1001 15.000 001 KO DO es som 0001 15 10.00 DO TE w 5 oces 0.000 OK 0.000 10 The 5,000 Novo mencermin December 12 Questions 1. Using the accompanying Excel workbook and information provided in the case narrative, develop a schedule of cash receipts, a schedule of cash payments, and a cash budget that includes the line of credit borrowing and repayment provisions. Developing a Cash Budget 10 2. Describe the cash flow patterns revealed in the schedules of cash receipts and payments. How do the patterns of cash receipts differ from cash expenses? 3. What additional information should the Squares consider before accepting Sea Island Bank's offer of a line of credit? 4. What cash management techniques could the Squares use to mitigate the impact of months when expenses are higher than revenues? What recommendations would you give to the organization to make its cash flows less seasonal? 5. The City of Savannah has asked the Squares to contribute S1 million toward the cost of a new video board. The payment would be due in June. Based on the cash budget you have prepared, should the Squares pay cash or seek financing options to cover their share? 35 D F G H M N Schedule of Cash Receipts Nov 21 Dec. 21 lan 22 Feb-22 Mar 22 Apr 22 May 22 June 22 22 Aug 22 Oct 22 de Sales Aury Suites Cube Sponsorship min Con Merchandise 10 E 11 Speciales 12 13 Cash Recipts 15 04 1 C sche Cach pendan N New be 12 M Apr 22 May 22 Ant Sep Oct 22 M sonu Com 1 Merchandise pode Gune 11 It 11 18 D H canh BAN De Apr Mar 22 EVE Sep 27 Out 22 May 22 tun ny 1 w -al 50.000 000 3 000 50.000 SOOD RO 0.000 50.000 30,000 00006 OTO 50.000 0.000 30.000 50.000 500 000 ocor 000 Che Cathe cum 1001 15.000 001 KO DO es som 0001 15 10.00 DO TE w 5 oces 0.000 OK 0.000 10 The 5,000 Novo mencermin December 12